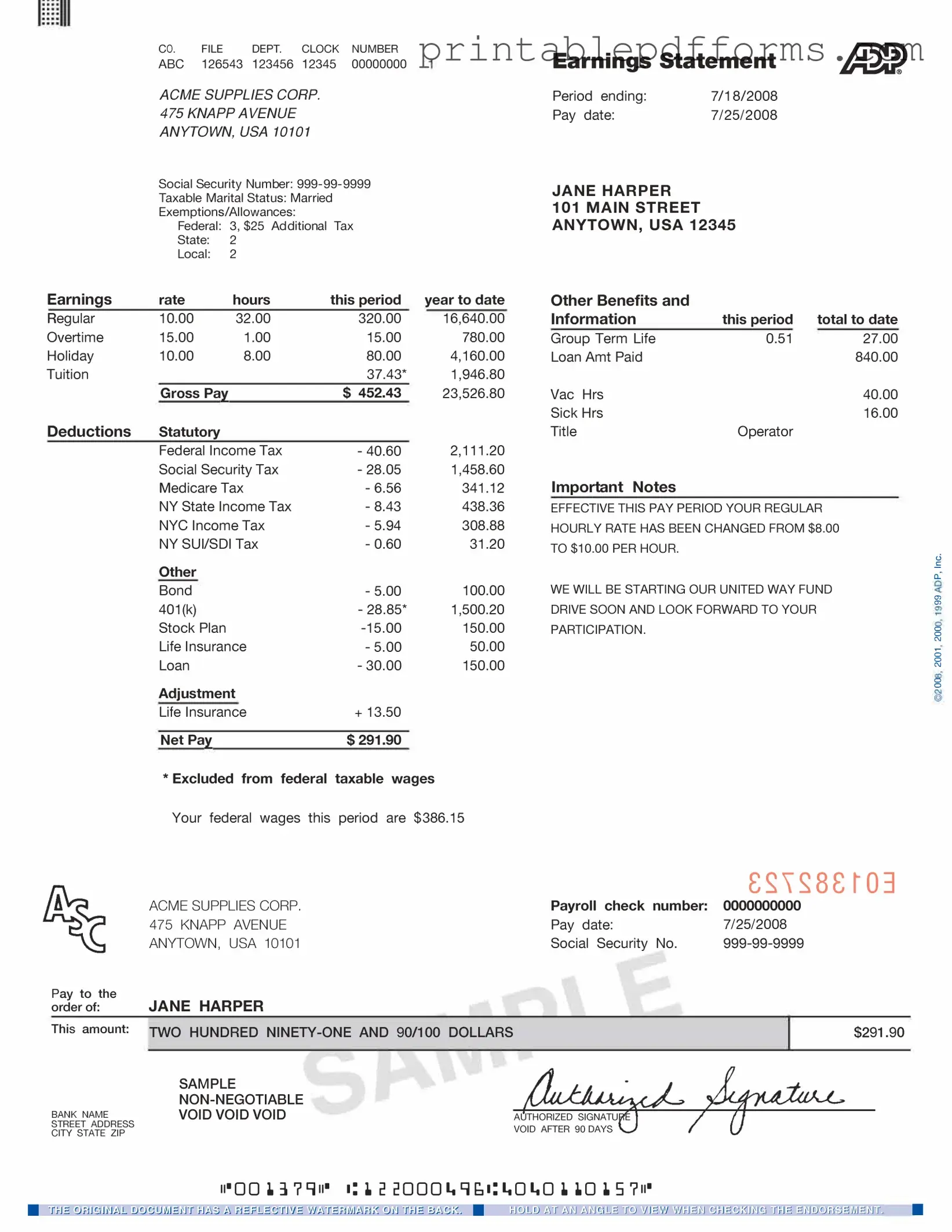

Fill a Valid Adp Pay Stub Form

The ADP Pay Stub form is an essential document for employees, providing a clear breakdown of earnings and deductions for each pay period. It offers a detailed view of gross pay, which includes regular wages and any additional compensation such as overtime or bonuses. Taxes withheld, including federal, state, and local taxes, are also clearly outlined, allowing employees to understand their net pay—the amount they take home after all deductions. Additionally, the form may include information about benefits contributions, retirement plan deductions, and other withholdings that can impact take-home pay. Understanding this form is crucial for employees to manage their finances effectively and ensure that their compensation aligns with their expectations. By reviewing their pay stubs regularly, employees can catch any discrepancies early and address them with their employer, ensuring transparency and accuracy in their payroll process.

Additional PDF Templates

Simple Job Application Form - Sections devoted to references and past experience.

Direction to Pay - Owner specifies the payment amount directly to the shop.

To understand the significance of an Employment Verification form in diverse situations, consider its application when securing loans or rentals. This document often becomes a crucial part of the assessment process. For more information, you can explore resources like the comprehensive Employment Verification guide available here.

How to Design a Crest - A visual celebration of a family's journey across time and space.

Similar forms

The ADP Pay Stub form is an important document for employees, as it provides detailed information about their earnings and deductions. Several other documents share similarities with the ADP Pay Stub form. Here are four of them:

- W-2 Form: This tax form summarizes an employee's annual wages and the taxes withheld from their paycheck. Like the ADP Pay Stub, it includes information about gross income, net income, and various deductions, but it covers an entire year rather than a single pay period.

- Paycheck: A physical or electronic check issued to an employee for their work. The paycheck displays the same information as a pay stub, including gross pay, deductions, and net pay. However, it serves as the actual payment rather than just a summary.

- Direct Deposit Receipt: This document confirms that an employee's paycheck has been deposited directly into their bank account. It typically includes similar information to a pay stub, such as gross pay and deductions, but it focuses on the transaction rather than providing a detailed breakdown.

- Last Will and Testament: Create peace of mind for your family with a comprehensive Last Will and Testament document that clearly outlines your wishes for asset distribution.

- Payroll Summary Report: This report is generated by payroll software and provides an overview of all employees' earnings and deductions for a specific period. While it includes aggregate data for multiple employees, it mirrors the detailed breakdown found in individual pay stubs.

Document Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of ADP Pay Stub | The ADP Pay Stub serves as an official record of an employee's earnings, deductions, and net pay for a specific pay period. |

| Components | Each pay stub typically includes details such as gross pay, taxes withheld, benefits deductions, and year-to-date totals. |

| Accessing the Pay Stub | Employees can access their pay stubs online through the ADP portal or receive them via email, depending on employer preferences. |

| State-Specific Requirements | Some states have specific laws governing pay stubs. For example, California requires employers to provide itemized statements of wages and deductions. |

| Importance for Employees | Pay stubs are crucial for employees to understand their earnings and ensure that deductions are accurate, aiding in personal financial planning. |

| Tax Reporting | ADP Pay Stubs can be used as documentation for tax purposes, helping employees accurately report their income during tax season. |

| Dispute Resolution | In case of discrepancies in pay, employees can refer to their pay stubs to address issues with their employer or payroll department. |

Crucial Questions on This Form

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll services company, that outlines an employee's earnings for a specific pay period. It details gross pay, deductions, and net pay, allowing employees to understand how their earnings are calculated.

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP portal. To do this, follow these steps:

- Visit the ADP website.

- Log in using your credentials.

- Navigate to the “Pay” section to find your pay stubs.

If you are unable to access your account, contact your HR department for assistance.

What information is included on an ADP Pay Stub?

An ADP Pay Stub typically includes the following information:

- Employee name and identification number

- Pay period dates

- Gross earnings

- Deductions (taxes, retirement contributions, etc.)

- Net pay

This information helps employees track their earnings and deductions accurately.

How often are ADP Pay Stubs issued?

ADP Pay Stubs are usually issued on a regular payroll schedule determined by your employer. This can be weekly, bi-weekly, or monthly. Check with your HR department for the specific schedule used by your organization.

Can I get a paper copy of my ADP Pay Stub?

Yes, many employers provide the option to receive paper copies of pay stubs. If you prefer a paper version, contact your HR department to request this option. However, most employees access their pay stubs electronically for convenience.

What should I do if I notice an error on my pay stub?

If you find an error on your pay stub, such as incorrect hours worked or deductions, it is important to address it promptly. Follow these steps:

- Review your pay stub carefully to confirm the error.

- Gather any supporting documentation, such as time sheets or pay agreements.

- Contact your HR department or payroll administrator to report the issue.

They can help investigate and correct any discrepancies.

Is my ADP Pay Stub secure?

ADP takes security seriously. The online portal uses encryption and other security measures to protect your personal and financial information. Always ensure you log in from a secure device and avoid sharing your login credentials with anyone.

What if I forget my ADP login credentials?

If you forget your login credentials, you can reset your password through the ADP portal. Look for the “Forgot Password” link on the login page. Follow the prompts to verify your identity and create a new password. If you encounter issues, reach out to your HR department for assistance.

Can I access my past pay stubs?

Yes, you can typically access past pay stubs through the ADP portal. Most employers keep several months of pay stubs available online. If you need a pay stub from a longer period ago, contact your HR department, as they may be able to provide you with a copy.

Documents used along the form

When managing payroll and employee compensation, several forms and documents often accompany the ADP Pay Stub. Each of these plays a vital role in ensuring accurate record-keeping and compliance with employment laws. Understanding these documents can help both employers and employees navigate the complexities of payroll management.

- W-2 Form: This form summarizes an employee's annual wages and the taxes withheld. Employers must provide this to employees by January 31 each year for tax filing purposes.

- Motor Vehicle Bill of Sale: This essential document captures the details of vehicle transactions, ensuring all legal requirements are met. For more information and to get a template, visit Top Document Templates.

- W-4 Form: Employees fill out this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from paychecks.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank accounts, streamlining the payment process.

- Time Sheets: Employees use time sheets to record their hours worked. These records help employers calculate pay accurately and ensure compliance with labor laws.

- Employee Handbook: This handbook outlines company policies, procedures, and benefits. It serves as a guide for employees regarding workplace expectations and entitlements.

- Payroll Summary Report: This report provides an overview of payroll expenses for a specific period. It helps employers analyze labor costs and budget effectively.

- Paycheck Stubs for Previous Periods: These stubs provide historical pay information. Employees may need them for loan applications or tax purposes, ensuring they have a complete financial picture.

Understanding these documents in conjunction with the ADP Pay Stub can enhance transparency and foster better communication between employers and employees. Keeping these records organized is essential for efficient payroll management and compliance with legal obligations.

Misconceptions

Understanding the ADP Pay Stub form can be challenging, and several misconceptions often arise. Here are seven common misunderstandings about this important document:

-

All deductions are automatically calculated.

Many people believe that all deductions on their pay stub are automatically calculated without any input. In reality, while some deductions are standard, others may vary based on individual choices, such as retirement contributions or health insurance plans.

-

The pay stub shows gross pay only.

Some individuals think that the pay stub only reflects gross pay, which is the total earnings before any deductions. However, the pay stub also details net pay, which is the amount employees actually receive after all deductions.

-

Pay stubs are only for full-time employees.

There is a misconception that only full-time employees receive pay stubs. In fact, part-time and temporary workers also receive pay stubs detailing their earnings and deductions.

-

All states have the same pay stub requirements.

Many people assume that pay stub requirements are uniform across the United States. However, different states have varying laws regarding what information must be included on a pay stub.

-

Pay stubs are not important for tax purposes.

Some individuals may underestimate the importance of pay stubs when it comes to taxes. In truth, pay stubs provide essential information needed for filing taxes, including total earnings and withheld taxes.

-

You can’t access past pay stubs.

There is a belief that once a pay period is over, accessing past pay stubs becomes impossible. Most employers provide a way to access previous pay stubs, either through an online portal or upon request.

-

Pay stubs are only for tracking income.

While tracking income is a primary function of pay stubs, they also serve to inform employees about their deductions, tax withholdings, and contributions to benefits, making them a comprehensive financial document.