Fill a Valid Advance Beneficiary Notice of Non-coverage Form

The Advance Beneficiary Notice of Non-coverage, often referred to as ABN, plays a crucial role in the healthcare landscape, particularly for Medicare beneficiaries. This form is designed to inform patients when a service or item may not be covered by Medicare. By receiving an ABN, individuals gain clarity about their potential financial responsibilities before undergoing certain medical procedures or tests. It serves as a proactive communication tool, allowing patients to make informed decisions about their care. Additionally, the ABN outlines the reasons why a service might not be covered, helping patients understand the criteria used by Medicare. This transparency is essential, as it empowers beneficiaries to weigh their options and consider whether to proceed with the service or seek alternatives. Ultimately, the ABN is about ensuring that patients have the information they need to navigate their healthcare choices effectively.

Additional PDF Templates

Employee Change of Status Form - Used to indicate promotions, demotions, or transfers within the company.

The USCIS I-864 form, also known as the Affidavit of Support, is a crucial document used in the immigration process. It serves to demonstrate that a sponsor can financially support a family member seeking permanent residency in the United States. Additionally, resources such as https://freebusinessforms.org can provide further guidance on completing this important form. By signing this form, the sponsor commits to ensuring that the immigrant will not rely on government assistance.

Ucc 308 - In its essence, the UCC 1-308 serves as both protection and proclamation for the affiant.

Similar forms

- Medicare Summary Notice (MSN): This document provides a summary of services billed to Medicare, showing what was covered and what was not. Like the Advance Beneficiary Notice, it helps beneficiaries understand their financial responsibilities.

- Notice of Medicare Non-Coverage (NOMNC): This notice is given to beneficiaries when a service is about to be discontinued. It informs them of their rights and options, similar to how the Advance Beneficiary Notice informs them about non-coverage.

- Medicare Enrollment Form: This form allows individuals to enroll in Medicare. It is similar in that it requires clear communication about benefits and coverage, just like the Advance Beneficiary Notice does.

- Explanation of Benefits (EOB): An EOB outlines what services were provided, what was covered, and what the patient owes. It shares a similar purpose of transparency regarding costs and coverage.

- Prior Authorization Request: This document is required for certain services to ensure they will be covered. It parallels the Advance Beneficiary Notice by addressing coverage decisions before services are rendered.

- Appeal Rights Notification: This informs beneficiaries of their right to appeal a coverage decision. Like the Advance Beneficiary Notice, it emphasizes the importance of understanding one's rights regarding coverage.

- Patient Responsibility Notice: This document clarifies what costs the patient is responsible for after services. It serves a similar function by ensuring patients are aware of their financial obligations.

- Claim Denial Letter: When a claim is denied, this letter explains the reasons for denial. It is akin to the Advance Beneficiary Notice, which also communicates decisions about coverage.

- Prenuptial Agreement Form: This legal document helps establish asset ownership and debt division for couples in Ohio before marriage, ensuring clarity and security in financial matters. For further details, refer to All Ohio Forms.

- Service Agreement: This outlines the terms of service between the provider and the patient. It is similar in that it ensures both parties understand what to expect regarding coverage and costs.

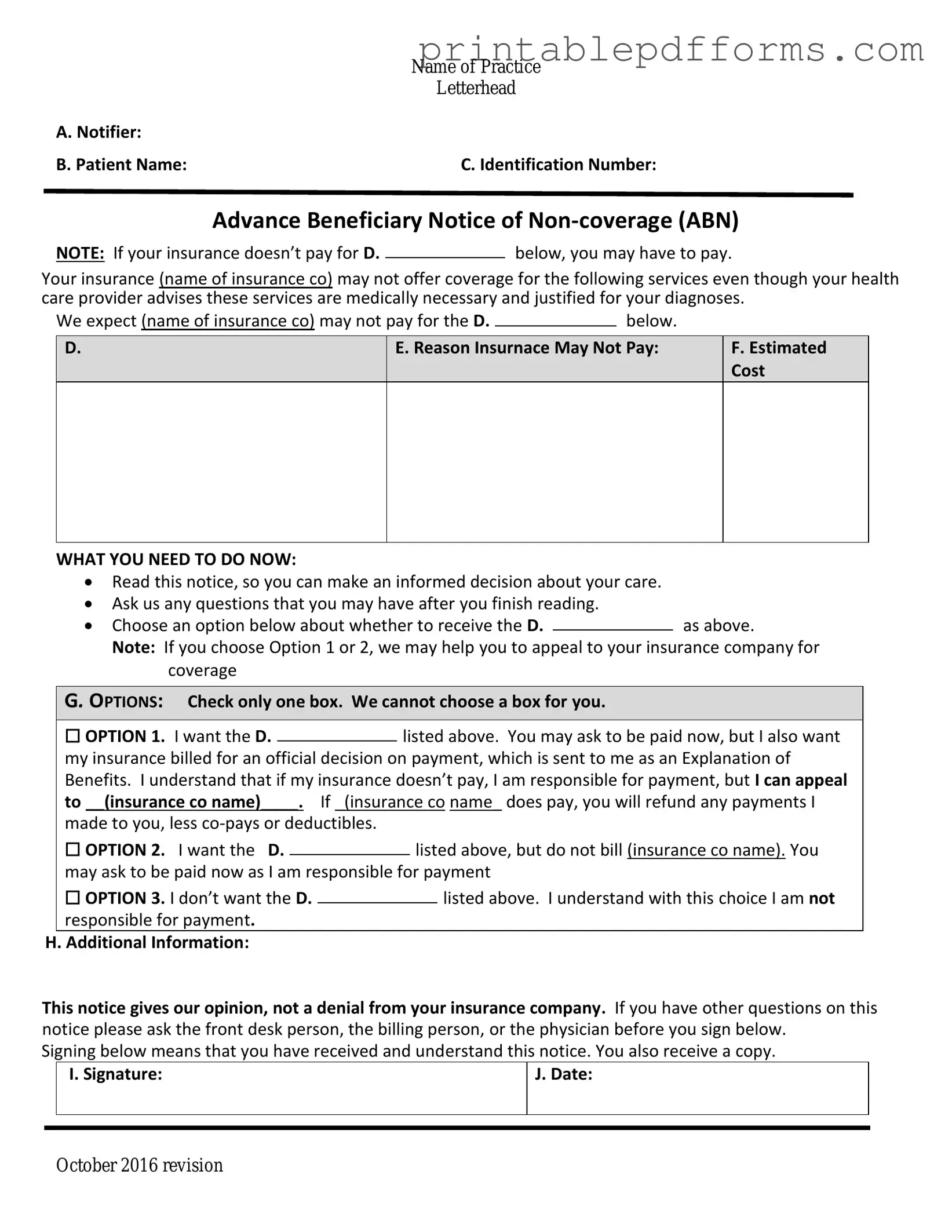

Document Example

|

Name of Practice |

|

Letterhead |

A. Notifier: |

|

B. Patient Name: |

C. Identification Number: |

Advance Beneficiary Notice of

NOTE: If your insurance doesn’t pay for D.below, you may have to pay.

Your insurance (name of insurance co) may not offer coverage for the following services even though your health care provider advises these services are medically necessary and justified for your diagnoses.

We expect (name of insurance co) may not pay for the D. |

|

below. |

|

D.

E. Reason Insurnace May Not Pay:

F.Estimated Cost

WHAT YOU NEED TO DO NOW:

Read this notice, so you can make an informed decision about your care.

Ask us any questions that you may have after you finish reading.

Choose an option below about whether to receive the D.as above.

Note: If you choose Option 1 or 2, we may help you to appeal to your insurance company for coverage

G. OPTIONS: Check only one box. We cannot choose a box for you.

|

☐ OPTION 1. I want the D. |

|

listed above. You may ask to be paid now, but I also want |

||||

|

|

||||||

|

my insurance billed for an official decision on payment, which is sent to me as an Explanation of |

||||||

|

Benefits. I understand that if my insurance doesn’t pay, I am responsible for payment, but I can appeal |

||||||

|

to __(insurance co name)____. If _(insurance co name_ does pay, you will refund any payments I |

||||||

|

made to you, less |

|

|

|

|||

|

☐ OPTION 2. I want the D. |

|

|

listed above, but do not bill (insurance co name). You |

|||

|

|

|

|||||

|

may ask to be paid now as I am responsible for payment |

||||||

|

☐ OPTION 3. I don’t want the D. |

|

|

|

listed above. I understand with this choice I am not |

||

|

|

|

|

||||

|

responsible for payment. |

|

|

|

|||

H. Additional Information: |

|

|

|

||||

This notice gives our opinion, not a denial from your insurance company. If you have other questions on this notice please ask the front desk person, the billing person, or the physician before you sign below.

Signing below means that you have received and understand this notice. You also receive a copy.

|

I. Signature: |

J. Date: |

|

|

|

|

|

|

October 2016 revision

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Advance Beneficiary Notice of Non-coverage (ABN) informs patients that Medicare may not cover a service or item. |

| When to Use | Providers must issue an ABN when they believe Medicare will deny payment for a service or item. |

| Patient Rights | Patients have the right to refuse services after receiving an ABN and can appeal Medicare's decision. |

| Format | The ABN must be completed in writing and signed by the patient or their representative. |

| State-Specific Forms | Some states may have additional requirements or specific forms. Check local laws for compliance. |

| Validity | An ABN is valid only if it is properly filled out and delivered to the patient prior to the service. |

| Governing Law | The ABN is governed by federal law under Medicare regulations, specifically 42 CFR § 411.20. |

Crucial Questions on This Form

What is the Advance Beneficiary Notice of Non-coverage (ABN)?

The Advance Beneficiary Notice of Non-coverage, commonly referred to as the ABN, is a form that healthcare providers use to inform Medicare beneficiaries that a particular service or item may not be covered by Medicare. It is designed to help beneficiaries understand their financial responsibility if they choose to receive the service or item despite the potential lack of coverage.

When should I receive an ABN?

You should receive an ABN when your healthcare provider believes that Medicare may not pay for a specific service or item. This typically occurs before the service is provided. The provider is required to give you the ABN in situations where they anticipate that Medicare will deny payment based on medical necessity or other reasons.

What should I do if I receive an ABN?

If you receive an ABN, you have a few options:

- Review the information on the form carefully.

- Decide whether you want to proceed with the service or item knowing that you may be responsible for the cost.

- Discuss any questions or concerns with your healthcare provider.

It is important to understand that signing the ABN does not guarantee payment; it simply acknowledges that you are aware of the potential costs involved.

What happens if I do not sign the ABN?

If you choose not to sign the ABN, your provider may decide not to provide the service or item. In some cases, if the service is provided without an ABN, Medicare may deny coverage, leaving you responsible for the full cost. Therefore, it is advisable to communicate with your provider about your decision.

Can I appeal a Medicare denial after signing the ABN?

Yes, you can appeal a Medicare denial even after signing the ABN. If Medicare denies payment for the service or item, you have the right to file an appeal. The ABN serves as a notice that you were informed about the potential lack of coverage, but it does not affect your ability to contest the denial.

Is the ABN required for all services?

No, the ABN is not required for all services. It is specifically used for services that a provider believes may not be covered by Medicare. Some services are always covered, and in those cases, an ABN would not be necessary. Your healthcare provider will determine whether an ABN is appropriate based on the specific circumstances of your care.

Documents used along the form

The Advance Beneficiary Notice of Non-coverage (ABN) form is a crucial document in the healthcare system, particularly for Medicare beneficiaries. It informs patients when a service may not be covered by Medicare, allowing them to make informed decisions about their care. Alongside the ABN, several other forms and documents are commonly used to ensure clarity and compliance in the billing and coverage process. Below is a list of these documents, each serving a specific purpose.

- Medicare Claim Form (CMS-1500): This form is used by healthcare providers to bill Medicare for services rendered to patients. It contains details about the patient, the provider, and the services provided.

- Notice of Medicare Non-Coverage (NOMNC): This notice informs patients when a service or item is ending, and it explains their rights regarding continued care and coverage.

- Medicare Summary Notice (MSN): This document is sent to beneficiaries every three months. It summarizes the services received, the amounts billed, and what Medicare paid.

- Advanced Beneficiary Notice of Non-Coverage (ABN) for Home Health Services: Similar to the standard ABN, this version specifically addresses home health services that may not be covered.

- Patient Authorization Form: This form allows healthcare providers to obtain permission from patients to share their medical information with third parties, such as insurance companies.

- Assignment of Benefits Form: This document allows patients to assign their Medicare benefits directly to their healthcare provider, facilitating payment for services rendered.

- Patient Responsibility Statement: This statement outlines the patient's financial responsibility for services not covered by Medicare or other insurance plans.

- Appeal Form: Patients can use this form to appeal a Medicare decision regarding coverage or payment for services they believe should be covered.

- Eligibility Verification Form: This form helps providers confirm a patient’s Medicare eligibility before services are provided, reducing the risk of unexpected charges.

- Minnesota Trailer Bill of Sale Form: This essential document verifies the sale and transfer of ownership of a trailer in Minnesota. It's crucial for ensuring that both parties are protected during the transaction. For those looking to finalize the sale of a trailer, you're encouraged to fill out the document in pdf.

- Consent for Treatment Form: This document ensures that patients understand and agree to the treatment plan proposed by their healthcare provider.

Understanding these documents is essential for both patients and healthcare providers. Each form plays a vital role in the healthcare process, ensuring that patients receive the care they need while also clarifying their rights and responsibilities regarding coverage and payment. Proper use of these documents can prevent misunderstandings and promote transparency in the healthcare system.

Misconceptions

The Advance Beneficiary Notice of Non-coverage (ABN) form can be a source of confusion for many. Here are seven common misconceptions about this important document, along with clarifications to help you understand it better.

- The ABN is only for Medicare patients. Many believe that the ABN is exclusive to Medicare beneficiaries. In reality, it can be used in other health insurance scenarios as well, but it is most commonly associated with Medicare services.

- Receiving an ABN means that the service will not be covered. Some people think that if they receive an ABN, the service is automatically denied coverage. This is not true. The ABN informs you that the provider believes the service may not be covered, but it doesn't guarantee that it won't be.

- Signing an ABN means you agree to pay for the service. A common misconception is that signing the ABN obligates you to pay for the service. While it does indicate you understand the potential for non-coverage, it does not force you to accept the charges.

- The ABN must be signed before every service. Some individuals think that an ABN is required for every single service. However, it is only necessary when a provider believes that a specific service may not be covered by Medicare.

- You cannot appeal a decision if you signed an ABN. Many believe that signing an ABN waives their right to appeal a coverage decision. This is incorrect. You still have the right to appeal if you believe the service should be covered.

- The ABN is the same as a waiver of liability. Some may confuse the ABN with a waiver of liability. While both documents deal with coverage issues, they serve different purposes. The ABN informs you about potential non-coverage, whereas a waiver of liability is used when a provider wants to protect themselves from liability for providing a service.

- All providers must give an ABN. Lastly, not all healthcare providers are required to issue an ABN. Only those who accept Medicare and believe that a service may not be covered need to provide this notice.

Understanding these misconceptions can help you navigate your healthcare options more effectively. If you have questions about an ABN, don't hesitate to ask your healthcare provider for clarification.