Blank Articles of Incorporation Form

The Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the United States. This form serves as the foundation for your business, detailing essential information such as the corporation's name, its purpose, and the address of its principal office. Additionally, it outlines the number of shares the corporation is authorized to issue, which is vital for understanding ownership structure and potential investment opportunities. The form also requires the names and addresses of the initial directors, providing a clear picture of who will be responsible for guiding the corporation in its early stages. Furthermore, it may include provisions for the management structure and the duration of the corporation, ensuring that all parties involved have a clear understanding of the business's operational framework. Completing the Articles of Incorporation accurately is essential, as it not only facilitates the legal formation of the corporation but also helps in complying with state regulations and securing necessary licenses. By addressing these key components, the Articles of Incorporation form lays the groundwork for a successful business venture.

State-specific Guidelines for Articles of Incorporation Forms

Other Templates:

Dog Contract - It serves as a reminder of the responsibilities associated with pet ownership.

Fedex Adult Signature Required - Safeguarding your shipment through a Release Authorization form is essential.

When planning for future health care needs, individuals in Ohio should consider the importance of a Medical Power of Attorney, a document that empowers a trusted person to make medical decisions on their behalf in case they are unable to express their will. This ensures that their health care preferences are followed, particularly during emergencies. To learn more about the necessary paperwork, residents can refer to resources like All Ohio Forms, which provide the necessary forms and guidance in this vital area of health care planning.

Waiver Liability Form - The waiver can cover various types of risks and liabilities associated with activities.

Similar forms

-

Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. They govern how meetings are conducted, how decisions are made, and the roles of officers and directors, much like the Articles of Incorporation establish the corporation's structure and purpose.

-

Operating Agreement: For LLCs, the operating agreement serves a similar purpose to the Articles of Incorporation. It details the management structure and operating procedures of the LLC, ensuring that members understand their rights and responsibilities.

-

Certificate of Formation: This document is often used interchangeably with Articles of Incorporation in certain states. It formally establishes a corporation or LLC and includes basic information such as the name, address, and purpose, similar to the Articles.

-

Partnership Agreement: This document outlines the terms of a partnership, including each partner's contributions and responsibilities. Like the Articles of Incorporation, it sets the foundation for how the entity will operate and defines the roles of each member.

-

Shareholder Agreement: This agreement governs the relationship between shareholders and the corporation. It includes provisions on share transfers, voting rights, and management, paralleling the foundational role of the Articles of Incorporation in defining the corporation’s structure.

- Quitclaim Deed Form: For property ownership transfers without title guarantees, refer to our valuable Quitclaim Deed template resources to streamline the process.

-

Business License: While not a formation document, a business license is essential for operating legally. It provides the necessary permissions to conduct business, similar to how Articles of Incorporation grant the authority to exist as a corporation.

Document Example

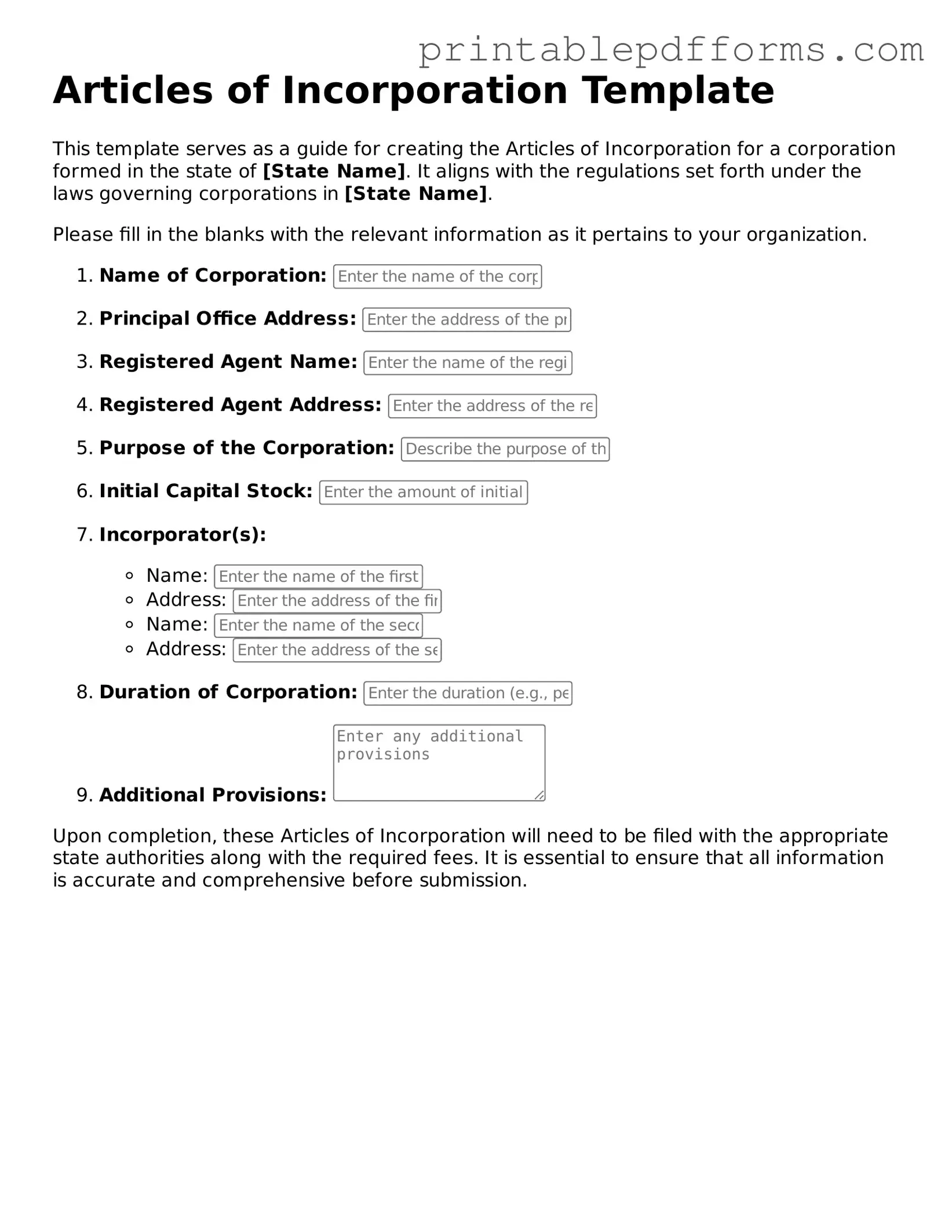

Articles of Incorporation Template

This template serves as a guide for creating the Articles of Incorporation for a corporation formed in the state of [State Name]. It aligns with the regulations set forth under the laws governing corporations in [State Name].

Please fill in the blanks with the relevant information as it pertains to your organization.

Upon completion, these Articles of Incorporation will need to be filed with the appropriate state authorities along with the required fees. It is essential to ensure that all information is accurate and comprehensive before submission.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | The Articles of Incorporation is a legal document that establishes a corporation in the United States. |

| Purpose | This document outlines the corporation's basic information, including its name, purpose, and structure. |

| State-Specific Forms | Each state has its own specific form for Articles of Incorporation, which must be filed with the appropriate state agency. |

| Governing Laws | The governing laws for Articles of Incorporation vary by state, typically found in the state's business corporation act. |

| Filing Fees | Most states require a filing fee when submitting the Articles of Incorporation, which can vary significantly. |

| Approval Process | After submission, the state reviews the Articles of Incorporation for compliance before granting approval. |

| Importance of Accuracy | Accurate information in the Articles of Incorporation is crucial, as errors can lead to delays or rejection of the application. |

Crucial Questions on This Form

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the eyes of the state. They serve as the foundation for your business entity, outlining essential information such as the corporation's name, purpose, registered agent, and the number of shares it is authorized to issue. By filing these articles with the appropriate state authority, you formally create your corporation and gain certain legal protections and benefits.

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is crucial for several reasons:

- Legal Recognition: It grants your business legal status, allowing you to operate as a separate entity from its owners.

- Liability Protection: Incorporating limits your personal liability for business debts and obligations, protecting your personal assets.

- Tax Benefits: Corporations may enjoy certain tax advantages that are not available to sole proprietorships or partnerships.

- Credibility: Having an incorporated status can enhance your business's credibility with customers, suppliers, and potential investors.

What information do I need to include in the Articles of Incorporation?

When preparing your Articles of Incorporation, you'll need to provide specific information, which typically includes:

- Corporation Name: Choose a unique name that complies with your state’s naming requirements.

- Business Purpose: Clearly state the purpose of your corporation, which can be general or specific.

- Registered Agent: Designate a registered agent who will receive legal documents on behalf of the corporation.

- Share Structure: Specify the number of shares your corporation is authorized to issue and their par value, if applicable.

- Incorporators: List the names and addresses of the individuals responsible for filing the Articles.

How do I file the Articles of Incorporation?

Filing your Articles of Incorporation typically involves the following steps:

- Prepare the Document: Fill out the Articles of Incorporation form with the required information.

- Review State Requirements: Check your state’s specific filing requirements, as they can vary.

- Submit the Form: File the completed form with the appropriate state agency, usually the Secretary of State.

- Pay the Filing Fee: Include the necessary filing fee, which varies by state.

How long does it take to get my Articles of Incorporation approved?

The approval time for Articles of Incorporation can vary depending on the state and the volume of filings they are processing. Generally, you can expect:

- Same-Day Processing: Some states offer expedited services for an additional fee, allowing for same-day approval.

- Standard Processing: In most cases, approval can take anywhere from a few days to a few weeks.

- Check Status: You can often check the status of your filing online through the state’s business portal.

Documents used along the form

When forming a corporation, several documents complement the Articles of Incorporation. Each of these forms plays a vital role in establishing and maintaining a corporation's legal status. Below is a list of common documents that are often used alongside the Articles of Incorporation.

- Bylaws: These are the internal rules that govern the management of the corporation. Bylaws outline the responsibilities of directors, the process for holding meetings, and how decisions are made.

- Initial Report: Some states require an initial report to be filed shortly after incorporation. This document provides essential information about the corporation, including its address and the names of its officers.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS for tax purposes. It is necessary for opening a business bank account and filing taxes.

- Bill of Sale: This legal document serves as a receipt for the transfer of personal property ownership and can be found at freebusinessforms.org/, ensuring all necessary details are accurately recorded.

- Operating Agreement: Although more common in LLCs, some corporations may choose to draft an operating agreement. This document outlines the management structure and operational procedures of the corporation.

- Stock Certificates: These are physical or electronic documents that represent ownership in the corporation. They are issued to shareholders and indicate the number of shares owned.

- Meeting Minutes: Corporations must keep records of meetings held by the board of directors and shareholders. Meeting minutes document decisions made and actions taken during these meetings.

- State Filings: Depending on the state, additional filings may be required, such as annual reports or franchise tax filings, to maintain good standing.

- Business Licenses: Various local and state licenses may be required to legally operate the business. These licenses vary based on the industry and location.

- Shareholder Agreements: This document outlines the rights and obligations of shareholders, including how shares can be sold or transferred and how disputes will be resolved.

Each of these documents contributes to the successful establishment and operation of a corporation. Ensuring that all necessary forms are completed and filed properly is crucial for legal compliance and smooth business operations.

Misconceptions

The Articles of Incorporation is a crucial document for anyone looking to establish a corporation. However, several misconceptions surround this form. Let’s clarify these misunderstandings.

- Misconception 1: Articles of Incorporation are only necessary for large businesses.

- Misconception 2: Filing Articles of Incorporation guarantees business success.

- Misconception 3: The Articles of Incorporation are the same in every state.

- Misconception 4: Once filed, Articles of Incorporation cannot be changed.

- Misconception 5: Articles of Incorporation are only for for-profit corporations.

- Misconception 6: The Articles of Incorporation are the only document needed to start a business.

This is not true. Any business, regardless of size, must file Articles of Incorporation to legally establish itself as a corporation. This document provides essential information about the company and its structure.

While filing is a critical step in forming a corporation, it does not ensure success. Many factors, such as market demand, management, and financial planning, contribute to a business's overall performance.

Each state has its own requirements and format for Articles of Incorporation. Therefore, it’s essential to check the specific regulations in the state where the business will be incorporated.

This is incorrect. Amendments can be made to the Articles of Incorporation if changes occur in the business structure or other key information. However, this process may require additional filings and fees.

Many people believe this to be true, but it’s not. Nonprofit organizations also need to file Articles of Incorporation to gain legal recognition and protect their members from personal liability.

While they are essential, they are not the only requirement. Other documents, such as bylaws, licenses, and permits, may also be necessary depending on the type of business and its location.