Fill a Valid Auto Insurance Card Form

The Auto Insurance Card is a crucial document for every vehicle owner, serving as proof of insurance coverage and a vital resource during unforeseen circumstances. This card typically includes essential information such as the insurance company’s name, policy number, and the effective and expiration dates of the coverage. Additionally, it lists the vehicle's year, make, model, and the unique Vehicle Identification Number (VIN), ensuring that the specific vehicle is easily identifiable. The issuing agency or company is also noted, providing clarity on where the insurance is sourced. Importantly, the card carries a directive that it must be kept in the insured vehicle and presented upon demand, particularly in the event of an accident. In such situations, drivers are advised to report the incident to their insurance agent or company immediately and gather necessary details, including the names and addresses of all parties involved, as well as their respective insurance information. Furthermore, the card features an artificial watermark, which can be viewed by tilting the document at an angle, adding a layer of security to this important identification tool. Understanding the components and requirements of the Auto Insurance Card is essential for all drivers, as it not only ensures compliance with legal obligations but also facilitates smoother interactions during emergencies.

Additional PDF Templates

Broker Price Opinion Template - The detailed adjustments help refine the estimated value of the subject property.

To complete the sale process effectively, it is advisable to gather all necessary information regarding the trailer and then print the document for your records. This step will ensure that you adhere to the legal requirements stipulated by the state, providing a smooth transaction for both parties involved.

Request Tax Transcript - All information contained in this form is sensitive and requires secure handling.

Similar forms

The Auto Insurance Card form serves as a crucial document for vehicle owners. It provides essential information about insurance coverage and vehicle details. Several other documents share similarities with the Auto Insurance Card in terms of purpose and content. Below are seven such documents:

- Vehicle Registration Document: This document includes the vehicle's make, model, and identification number, similar to the Auto Insurance Card. It also serves as proof of ownership and is required to be kept in the vehicle.

- Proof of Insurance Certificate: Like the Auto Insurance Card, this certificate verifies that the vehicle is insured. It contains the insurance company’s name, policy number, and effective dates.

- Accident Report Form: This form is used to document details of an accident, including driver and witness information. It parallels the Auto Insurance Card’s instruction to collect such information post-accident.

- Title Document: The title proves ownership of the vehicle and includes details like the vehicle identification number. This is akin to the information provided on the Auto Insurance Card.

- Inspection Certificate: This document confirms that a vehicle has passed safety and emissions inspections. It is often kept in the vehicle, similar to the Auto Insurance Card.

- Rental Car Agreement: When renting a vehicle, this agreement includes insurance details and vehicle information. It serves a similar purpose in providing proof of coverage.

Living Will Form: For those preparing for future healthcare decisions, our essential Living Will guidelines assist in expressing your medical treatment preferences clearly.

- Liability Waiver Form: This form may be required in various situations, such as events or activities involving vehicles. It outlines insurance coverage and liabilities, much like the Auto Insurance Card.

Each of these documents plays a vital role in vehicle ownership and operation. Keeping them accessible is essential for compliance and safety on the road.

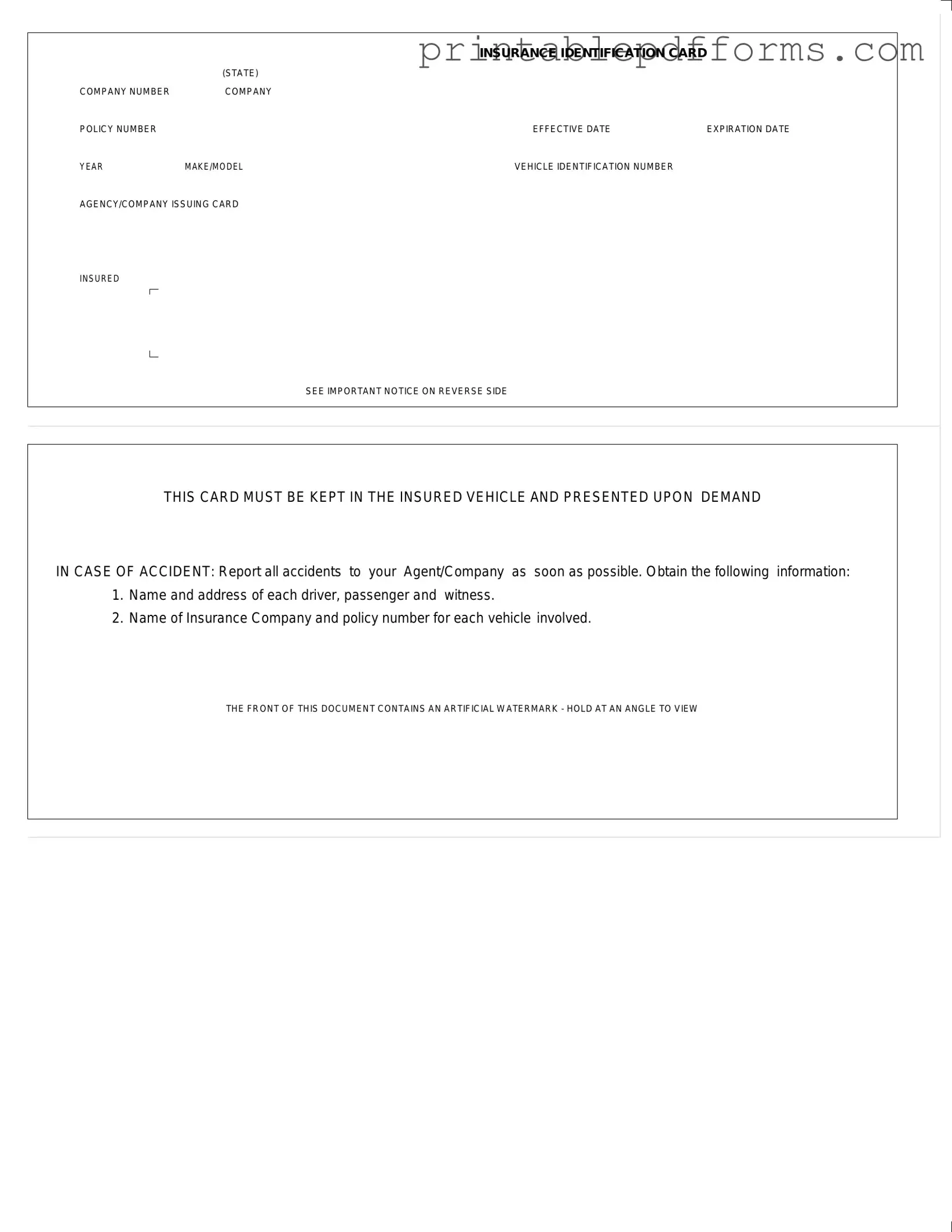

Document Example

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for the vehicle listed on the card. |

| Legal Requirement | Most states require drivers to carry an insurance card in their vehicle at all times, as mandated by state laws. |

| Information Included | The card typically includes essential details such as the insurance company name, policy number, effective dates, and vehicle information. |

| Accident Protocol | In the event of an accident, the cardholder must present the card and report the incident to their insurance agent as soon as possible. |

| Watermark Feature | The front of the card contains an artificial watermark, which can be viewed by holding the card at an angle, adding a layer of security. |

Crucial Questions on This Form

What is the purpose of the Auto Insurance Card?

The Auto Insurance Card serves as proof of insurance coverage for your vehicle. It is required by law in most states and must be kept in the insured vehicle at all times. You must present it upon demand in case of an accident or traffic stop.

What information is included on the Auto Insurance Card?

The Auto Insurance Card contains several key pieces of information, including:

- Insurance identification card (state)

- Company number

- Company policy number

- Effective date of the policy

- Expiration date of the policy

- Year, make, and model of the vehicle

- Vehicle identification number (VIN)

- Agency or company issuing the card

Where should I keep my Auto Insurance Card?

Your Auto Insurance Card must be kept in the insured vehicle at all times. This ensures that you can easily present it if requested by law enforcement or in the event of an accident.

What should I do if I lose my Auto Insurance Card?

If you lose your Auto Insurance Card, contact your insurance agent or company immediately. They can issue a replacement card and provide you with the necessary documentation to prove your coverage until the new card arrives.

What steps should I take after an accident?

After an accident, it is crucial to report the incident to your insurance agent or company as soon as possible. Gather the following information:

- Name and address of each driver involved

- Name and address of passengers and witnesses

- Name of the insurance company and policy number for each vehicle involved

Is there a watermark on the Auto Insurance Card?

Yes, the front of the Auto Insurance Card contains an artificial watermark. To view it, hold the card at an angle. This feature helps to prevent fraud and ensures the authenticity of the document.

What happens if my insurance policy expires?

If your insurance policy expires, you must obtain a new Auto Insurance Card reflecting the updated coverage. Driving without valid insurance can result in legal penalties and fines.

Can I use a digital version of my Auto Insurance Card?

What should I do if my vehicle information changes?

If you change vehicles or update any vehicle information, contact your insurance provider to update your policy. A new Auto Insurance Card will be issued to reflect the changes.

How can I verify that my Auto Insurance Card is valid?

You can verify the validity of your Auto Insurance Card by contacting your insurance company. They can confirm your coverage status and provide any additional information you may need.

What is the significance of the effective and expiration dates?

The effective date indicates when your insurance coverage begins, while the expiration date shows when the coverage ends. It is essential to ensure that your policy remains active and that you renew it before the expiration date.

Documents used along the form

The Auto Insurance Card is an essential document for vehicle owners, serving as proof of insurance coverage. Alongside this card, several other forms and documents are commonly used in conjunction with auto insurance. Understanding these documents can help ensure that drivers are prepared in the event of an accident or insurance claim.

- Insurance Policy Document: This document outlines the terms and conditions of the insurance coverage. It includes details such as coverage limits, deductibles, and the specific protections offered by the policy.

- Claims Form: In the event of an accident, this form is used to report the incident to the insurance company. It typically requires information about the accident, including details of the parties involved and any damages incurred.

- Bill of Sale: This document is crucial for transferring ownership of personal property, ensuring both parties have proof of the transaction. For additional resources, visit https://freebusinessforms.org.

- Proof of Financial Responsibility: Some states require drivers to carry proof of financial responsibility, which can be satisfied by the auto insurance card or a similar document. This proof demonstrates that the driver can cover costs associated with accidents or damages.

- Vehicle Registration: This document verifies that the vehicle is registered with the state. It includes information such as the vehicle identification number (VIN), make, model, and the owner's details.

- Accident Report Form: After an accident, drivers may be required to fill out an accident report form. This document is usually submitted to law enforcement and may be necessary for insurance claims as well.

Being familiar with these documents can aid vehicle owners in navigating the complexities of auto insurance and ensure they are adequately prepared for any situation that may arise on the road.

Misconceptions

Misconceptions about the Auto Insurance Card can lead to confusion and potential legal issues. Here are seven common misunderstandings:

- It is optional to carry the card in the vehicle. Many believe that having the card is not necessary. However, it must be kept in the insured vehicle and presented upon demand during an accident.

- All information on the card is irrelevant after an accident. Some think that once an accident occurs, the card's details no longer matter. In reality, the information is crucial for reporting the incident and ensuring proper claims processing.

- The card is only needed for police encounters. While it is essential during traffic stops, the card is also necessary for exchanging information with other parties involved in an accident.

- The expiration date is not important. Many underestimate the significance of the expiration date. An expired card may lead to complications with insurance coverage and legal penalties.

- All auto insurance cards look the same. Each card may vary by state and insurance company. Recognizing your specific card is important for ensuring you have the correct coverage details.

- The watermark on the card is just for decoration. The watermark serves a purpose. It helps prevent fraud and ensures that the card is legitimate.

- Accident information collection is optional. Some individuals believe they can skip gathering information after an accident. However, it is essential to collect names, addresses, and insurance details of all parties involved for accurate reporting.

Understanding these misconceptions can help you navigate your responsibilities as a driver and ensure compliance with state laws.