Fill a Valid Broker Price Opinion Form

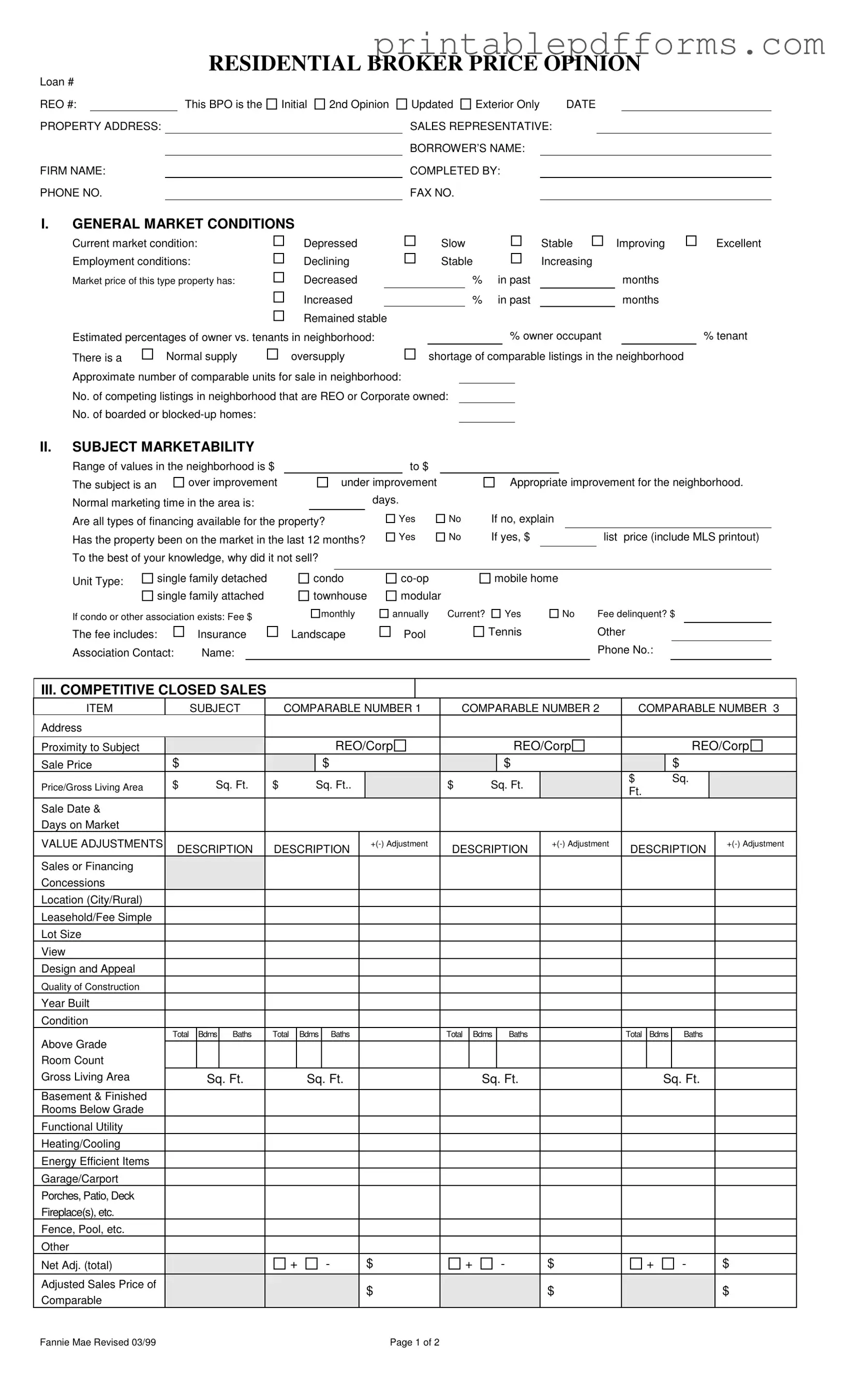

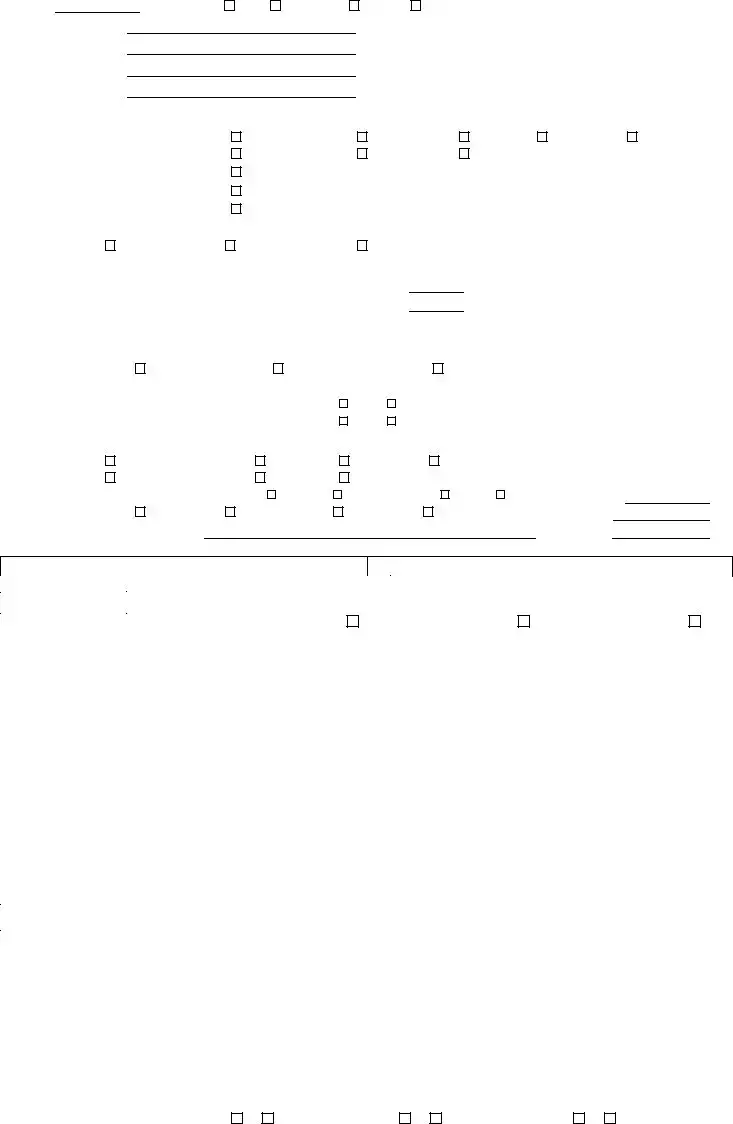

The Broker Price Opinion (BPO) form is a critical tool used in real estate to assess property value based on current market conditions. It encompasses several key components, beginning with general market conditions that evaluate employment trends and the supply of comparable properties in the neighborhood. This section allows for an understanding of whether the market is stable, improving, or declining. The form also delves into the subject property's marketability, detailing its condition and the types of financing available. It includes a comparative analysis of closed sales, listing the subject property alongside comparable properties to determine value adjustments based on various factors such as location, size, and condition. Additionally, the BPO outlines a marketing strategy and necessary repairs to enhance the property's appeal. Finally, it concludes with a suggested market value and any pertinent comments regarding the property’s unique characteristics or concerns. This comprehensive approach ensures that stakeholders receive a well-rounded view of the property's worth and market position.

Additional PDF Templates

Dr Excuse for School - This note helps support a culture of health awareness in workplaces and schools.

The Ohio Motor Vehicle Bill of Sale form is a critical document that records the essential details of the sale of a vehicle between two parties in Ohio. It serves as a proof of transaction and establishes the transfer of ownership from the seller to the buyer. To ensure that you have the correct documentation, you can visit All Ohio Forms, where you can find the necessary forms and further information on this important process.

Credit Application Template for Business - Your insights will aid in determining your eligibility for credit facilities.

Similar forms

-

Comparative Market Analysis (CMA): Similar to a Broker Price Opinion, a CMA evaluates property values by comparing similar properties that have recently sold. It provides a detailed analysis of market trends and property features to assist sellers and buyers in determining fair market value.

-

Appraisal Report: An appraisal report is a formal assessment of a property's value conducted by a licensed appraiser. Like a Broker Price Opinion, it considers comparable sales but is typically more detailed and follows strict regulatory guidelines.

-

Real Estate Listing Agreement: This document outlines the terms under which a property will be marketed for sale. While it does not assess value directly, it often references market conditions similar to those in a Broker Price Opinion.

-

Property Condition Report: This report details the physical condition of a property, including necessary repairs. It shares similarities with the BPO in assessing marketability based on the property's condition.

-

Market Analysis Report: This report provides insights into local real estate trends and pricing. It is akin to a Broker Price Opinion in that it analyzes market conditions to help determine property values.

-

Investment Property Analysis: This document evaluates potential returns on real estate investments. It resembles a Broker Price Opinion by considering property value and market conditions to assess investment viability.

-

Foreclosure Valuation Report: Used primarily in foreclosure situations, this report assesses the value of a property under distress. It is similar to a BPO in its focus on current market conditions and comparable sales.

-

Sales Comparison Approach Report: This report methodically compares a property to similar properties that have sold recently. It shares the same foundational principles as a Broker Price Opinion in determining value based on comparable sales.

-

Lease Analysis Report: This document evaluates the terms and conditions of a lease agreement. While it does not directly appraise property value, it often considers market conditions similar to those found in a Broker Price Opinion.

- Articles of Incorporation: Essential for establishing a corporation in New York, this form includes critical information such as the corporation's name and purpose. For more details, visit https://nypdfforms.com/articles-of-incorporation-form.

-

Property Tax Assessment: This assessment determines the value of a property for tax purposes. It is comparable to a Broker Price Opinion in that it evaluates property value based on market conditions and comparable properties.

Document Example

RESIDENTIAL BROKER PRICE OPINION

Loan #

REO #:This BPO is the

PROPERTY ADDRESS:

FIRM NAME:

PHONE NO.

Initial

2nd Opinion

Updated Exterior Only |

DATE |

|||

SALES REPRESENTATIVE: |

|

|

|

|

BORROWER’S NAME: |

|

|

|

|

COMPLETED BY: |

|

|

|

|

FAX NO. |

|

|

|

|

I.GENERAL MARKET CONDITIONS

Current market condition: |

Depressed |

Slow |

|

Stable |

Improving |

||

Employment conditions: |

Declining |

Stable |

|

Increasing |

|

||

Market price of this type property has: |

Decreased |

|

|

% |

in past |

|

months |

|

Increased |

|

|

% |

in past |

|

months |

|

Remained stable |

|

|

|

|

|

|

Estimated percentages of owner vs. tenants in neighborhood: |

|

|

% owner occupant |

|

|||

There is a |

Normal supply |

oversupply |

shortage of comparable listings in the neighborhood |

||||

Approximate number of comparable units for sale in neighborhood: |

|

|

|

|

|

||

No. of competing listings in neighborhood that are REO or Corporate owned:

No. of boarded or

Excellent

% tenant

II.SUBJECT MARKETABILITY

Range of values in the neighborhood is $ |

|

|

|

|

|

to $ |

|

|

|

|

|

|

|

|

The subject is an |

over improvement |

|

|

under improvement |

|

Appropriate improvement for the neighborhood. |

||||||||

Normal marketing time in the area is: |

|

|

|

|

days. |

|

|

|

|

|

|

|||

Are all types of financing available for the property? |

Yes |

No |

If no, explain |

|

|

|

||||||||

Has the property been on the market in the last 12 months? |

Yes |

No |

If yes, $ |

|

|

list price (include MLS printout) |

||||||||

To the best of your knowledge, why did it not sell? |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||||

Unit Type: |

single family detached |

|

condo |

|

mobile home |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

single family attached |

|

townhouse |

modular |

|

|

|

|

|

|

||||

If condo or other association exists: Fee $

monthly

annually Current?

Yes

No |

Fee delinquent? $ |

The fee includes:

Association Contact:

Insurance

Name:

Landscape

Pool

Tennis |

Other |

|

Phone No.: |

III. COMPETITIVE CLOSED SALES

ITEM |

|

|

SUBJECT |

|

COMPARABLE NUMBER 1 |

|

COMPARABLE NUMBER 2 |

|

COMPARABLE NUMBER 3 |

|||||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

||||||||

Sale Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|||

Price/Gross Living Area |

$ |

|

Sq. Ft. |

$ |

|

Sq. Ft.. |

|

|

$ |

|

|

Sq. Ft. |

|

|

$ |

|

|

|

Sq. |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

Ft. |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Sale Date & |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

|

DESCRIPTION |

|

|

DESCRIPTION |

|

DESCRIPTION |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

Bdms |

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|

Total |

|

Bdms |

|

Baths |

|

|

Total |

Bdms |

Baths |

|

|

|

||||||

Above Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

Sq. Ft. |

|

|

Sq. Ft. |

|

|

|

|

|

|

Sq. Ft. |

|

|

|

|

|

Sq. Ft. |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Adj. (total) |

|

|

|

|

|

+ |

- |

|

|

$ |

|

+ |

- |

|

$ |

|

+ |

|

|

- |

|

$ |

|

|||||||||

Adjusted Sales Price of |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

$ |

|

Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fannie Mae Revised 03/99 |

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 of 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REO# |

Loan # |

IV. MARKETING STRATEGY

Minimal Lender Required Repairs |

V. REPAIRS

Occupancy Status: Occupied

Repaired Most Likely Buyer:

Vacant

Unknown

Unknown

Owner occupant

Investor

Investor

Itemize ALL repairs needed to bring property from its present “as is” condition to average marketable condition for the neighborhood. Check those repairs you recommend that we perform for most successful marketing of the property.

$

$

$

$

$

$

$

$

$

$

|

|

|

|

GRAND TOTAL FOR ALL REPAIRS $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VI. COMPETITIVE LISTINGS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

ITEM |

|

|

SUBJECT |

COMPARABLE NUMBER 1 |

COMPARABLE NUMBER. 2 |

COMPARABLE NUMBER. 3 |

|||||||||||||||||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proximity to Subject |

|

|

|

|

|

REO/Corp |

|

|

|

|

|

REO/Corp |

|

|

REO/Corp |

||||||||||||

List Price |

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

||

Price/Gross Living Area |

$ |

|

Sq.Ft. |

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

|

$ |

Sq.Ft. |

|

|

||||||||||

Data and/or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Verification Sources |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUE ADJUSTMENTS |

|

DESCRIPTION |

DESCRIPTION |

|

+ |

DESCRIPTION |

|

DESCRIPTION |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales or Financing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concessions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days on Market and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date on Market |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location (City/Rural) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasehold/Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lot Size |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

View |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Design and Appeal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quality of Construction |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Built |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Above Grade |

Total |

Bdms |

Baths |

Total |

Bdms |

Baths |

|

|

|

Total |

Bdms |

|

Baths |

|

Total |

Bdms |

|

Baths |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Room Count |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Living Area |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Sq. Ft. |

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|

Sq. Ft. |

|

|

|||||||||||||

Basement & Finished |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rooms Below Grade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Functional Utility |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heating/Cooling |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Efficient Items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Garage/Carport |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Porches, Patio, Deck |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fireplace(s), etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fence, Pool, etc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net Adj. (total) |

|

|

|

|

+ |

- |

|

|

|

$ |

|

|

+ |

- |

- |

|

$ |

|

|

+ |

- |

|

$ |

|

|

||

Adjusted Sales Price |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

of Comparable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

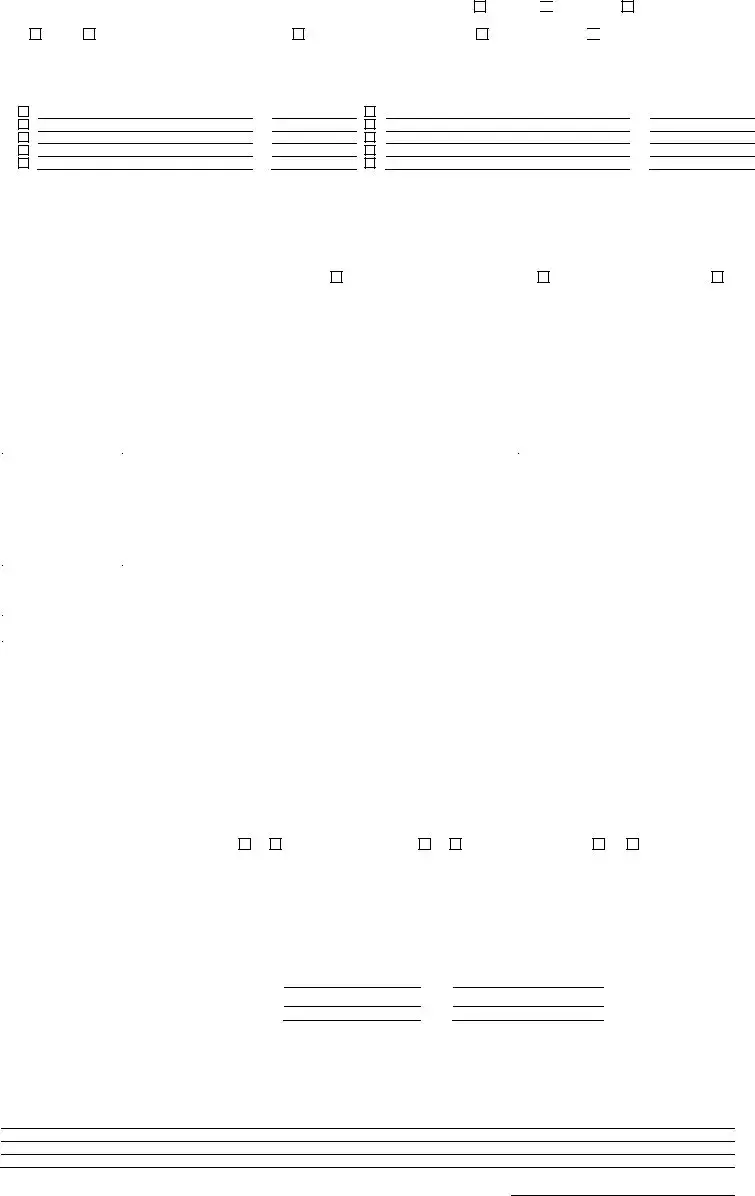

VI. THE MARKET VALUE (The value must fall within the indicated value of the Competitive Closed Sales).

Market Value |

Suggested List Price |

AS IS REPAIRED

30 Quick Sale Value

Last Sale of Subject, Price |

Date |

COMMENTS (Include specific positives/negatives, special concerns, encroachments, easements, water rights, environmental concerns, flood zones, etc. Attach addendum if additional space is needed.)

Signature: |

|

Date: |

Fannie Mae Revised 03/99 |

Page 2 of 2 |

CMS Publishing Company 1 800 |

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used to estimate the market value of a property, often for lenders or investors. |

| Market Conditions | The form assesses general market conditions, including employment status and the supply of comparable listings in the neighborhood. |

| Marketability Assessment | It evaluates the subject property's marketability, including the range of values and types of financing available. |

| Competitive Sales Analysis | The BPO includes a section for comparing the subject property with similar properties that have recently sold. |

| Repair Recommendations | The form allows for itemization of necessary repairs to bring the property to an average marketable condition. |

| State-Specific Requirements | In some states, specific regulations govern the use of BPOs, including licensing requirements for brokers. For example, California requires that BPOs be performed by licensed real estate professionals under California Business and Professions Code Section 11320. |

Crucial Questions on This Form

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion (BPO) is an assessment of a property's value, typically prepared by a licensed real estate broker or agent. This document provides an estimate of the market value based on various factors, including current market conditions, comparable sales, and the property's specific characteristics. BPOs are often used by lenders, investors, and financial institutions to determine the value of a property for purposes such as sales, refinancing, or foreclosures.

What information is typically included in a BPO form?

A BPO form generally includes several sections that cover important aspects of the property and its market context. Key components of the form include:

- General market conditions, such as employment trends and supply-demand dynamics.

- Details about the subject property's marketability, including its condition and financing options.

- Comparative analysis with closed sales and active listings in the area.

- Recommendations for repairs and marketing strategies.

By compiling this information, the BPO provides a comprehensive view of the property's potential value.

How does a BPO differ from a formal appraisal?

While both a BPO and a formal appraisal aim to determine a property's value, they differ in several key aspects. A BPO is generally less formal and may not require a physical inspection of the property. It is often based on the broker's knowledge of the local market and comparable properties. In contrast, an appraisal is a more detailed and regulated process, typically conducted by a licensed appraiser who follows specific guidelines and standards. Appraisals often carry more weight in legal and financial contexts due to their rigorous nature.

Who typically requests a Broker Price Opinion?

Various parties may request a Broker Price Opinion, including:

- Mortgage lenders seeking to assess the value of properties before approving loans.

- Investors looking to understand the market value of potential investment properties.

- Real estate agents needing to provide clients with insights on property pricing.

- Financial institutions managing foreclosures or short sales.

Each of these stakeholders benefits from the insights provided in a BPO to make informed decisions regarding property transactions.

Documents used along the form

The Broker Price Opinion (BPO) form is a crucial document used by real estate professionals to estimate the value of a property. However, it is often accompanied by several other forms and documents that provide additional context and information. Below is a list of some of these commonly used documents, each serving a specific purpose in the real estate evaluation process.

- Comparative Market Analysis (CMA): This document analyzes similar properties in the area that have recently sold, are currently on the market, or were taken off the market. It helps establish a competitive price by comparing features, location, and selling prices.

- Listing Agreement: This contract outlines the terms between the property owner and the real estate agent. It details the agent's responsibilities, the duration of the listing, and the commission structure, ensuring clarity in the sale process.

- Property Condition Report: This report assesses the physical state of the property. It includes details about necessary repairs, maintenance issues, and overall condition, which can significantly impact the property's value.

- Georgia Tractor Bill of Sale: This vital document records the transfer of ownership of a tractor in Georgia, detailing buyer, seller, and tractor information. For more information, visit georgiapdf.com/tractor-bill-of-sale/.

- Appraisal Report: Conducted by a licensed appraiser, this document provides an unbiased estimate of a property's value based on various factors, including location, condition, and recent sales of comparable properties.

- Seller's Disclosure Statement: This document requires the seller to disclose known issues or defects with the property. It protects buyers by ensuring they are aware of any potential problems before making a purchase.

- Market Analysis Report: Similar to a CMA, this report provides a broader view of market trends, economic factors, and demographic data that can influence property values in a specific area.

- Title Report: This document outlines the legal ownership of the property and any liens or encumbrances that may exist. It is essential for ensuring that the property can be sold free of legal issues.

Each of these documents plays a vital role in the real estate transaction process. Together, they provide a comprehensive view of the property's value, condition, and marketability, helping buyers, sellers, and agents make informed decisions. Understanding these forms can enhance the overall experience and facilitate smoother transactions in the real estate market.

Misconceptions

Understanding the Broker Price Opinion (BPO) form can be tricky. Many people hold misconceptions about its purpose and use. Here are ten common misunderstandings:

- A BPO is the same as an appraisal. A BPO is not an official appraisal. It provides an estimate of a property's value based on market conditions and comparable sales, but it lacks the formal certification of an appraisal.

- Only real estate agents can complete a BPO. While real estate agents often fill out BPOs, other qualified professionals, like brokers, can also complete them, depending on state regulations.

- A BPO guarantees a sale price. A BPO is merely an opinion of value. It does not guarantee that the property will sell for that amount.

- The BPO form is always the same. Different lenders and organizations may have unique BPO forms, each with specific requirements and sections.

- A BPO is only used for foreclosures. While BPOs are commonly used in foreclosure situations, they can also be utilized for regular sales, short sales, and investment properties.

- The BPO process is quick and simple. While filling out a BPO can be straightforward, gathering accurate data and analyzing market conditions can take time and effort.

- All BPOs are created equal. The quality of a BPO can vary significantly based on the experience and knowledge of the person completing it.

- A BPO reflects the current market only. A BPO takes into account historical data and trends, not just current market conditions.

- A BPO is only for residential properties. BPOs can be used for various property types, including commercial and industrial properties.

- A BPO is always accurate. While BPOs aim to provide a reasonable estimate, they are subjective and can be influenced by the biases of the person preparing the report.

By clarifying these misconceptions, you can better understand the role of a Broker Price Opinion in real estate transactions.