Blank Business Bill of Sale Form

When it comes to transferring ownership of a business, clarity and documentation are paramount. A Business Bill of Sale form serves as a crucial legal instrument that outlines the terms of the sale, ensuring that both the seller and the buyer understand their rights and responsibilities. This form typically includes essential details such as the names and addresses of the parties involved, a description of the business being sold, and the agreed-upon purchase price. Additionally, it may specify any included assets, such as equipment, inventory, or intellectual property, which are vital for the new owner to operate effectively. Furthermore, the form often contains warranties and representations made by the seller, affirming the legitimacy of the business and its assets. By utilizing a Business Bill of Sale, both parties can mitigate potential disputes and establish a clear record of the transaction, making it an indispensable tool in the business transfer process.

Popular Business Bill of Sale Documents:

General Bill of Sale Pdf - An ideal record for any informal or private sales arrangement.

In addition to its role as a receipt, the Colorado Bill of Sale form can also be easily accessed for various items through resources such as Colorado PDF Forms, ensuring that both buyers and sellers have the necessary documentation to complete their transactions smoothly.

Online Bill of Sale - A Motorcycle Bill of Sale can help streamline the process for filing a title transfer with the DMV.

Similar forms

- Sales Agreement: This document outlines the terms of a sale between a buyer and seller. Like a Business Bill of Sale, it confirms the transfer of ownership and can include details about the payment and delivery.

- Purchase Agreement: Similar to a sales agreement, this document specifies the conditions under which a buyer agrees to purchase a business or its assets. It also details payment terms and timelines.

- Asset Purchase Agreement: This document is used when a buyer purchases specific assets of a business rather than the entire business. It includes information about what is being sold and the agreed price.

Georgia Bill of Sale: A Georgia PDF Forms serves as a legal document that records the transfer of ownership for various items. It is essential for documenting transactions and safeguarding the interests of both parties involved.

- Lease Agreement: This document outlines the terms under which one party agrees to rent property from another. It can be similar in that it transfers rights to use a business property for a specified time.

- Transfer of Ownership Form: This form officially records the transfer of ownership of a business or its assets. It serves as proof of the change in ownership, much like a Business Bill of Sale.

- Promissory Note: This document is a written promise to pay a specified amount of money to a lender. It can accompany a Business Bill of Sale if financing is involved in the sale.

- Operating Agreement: For LLCs, this document outlines the management structure and operating procedures. It can be similar in that it helps clarify ownership and responsibilities after a sale.

- Non-Disclosure Agreement (NDA): This document protects confidential information shared during the sale process. While it doesn’t transfer ownership, it is often used alongside a Business Bill of Sale to safeguard sensitive business information.

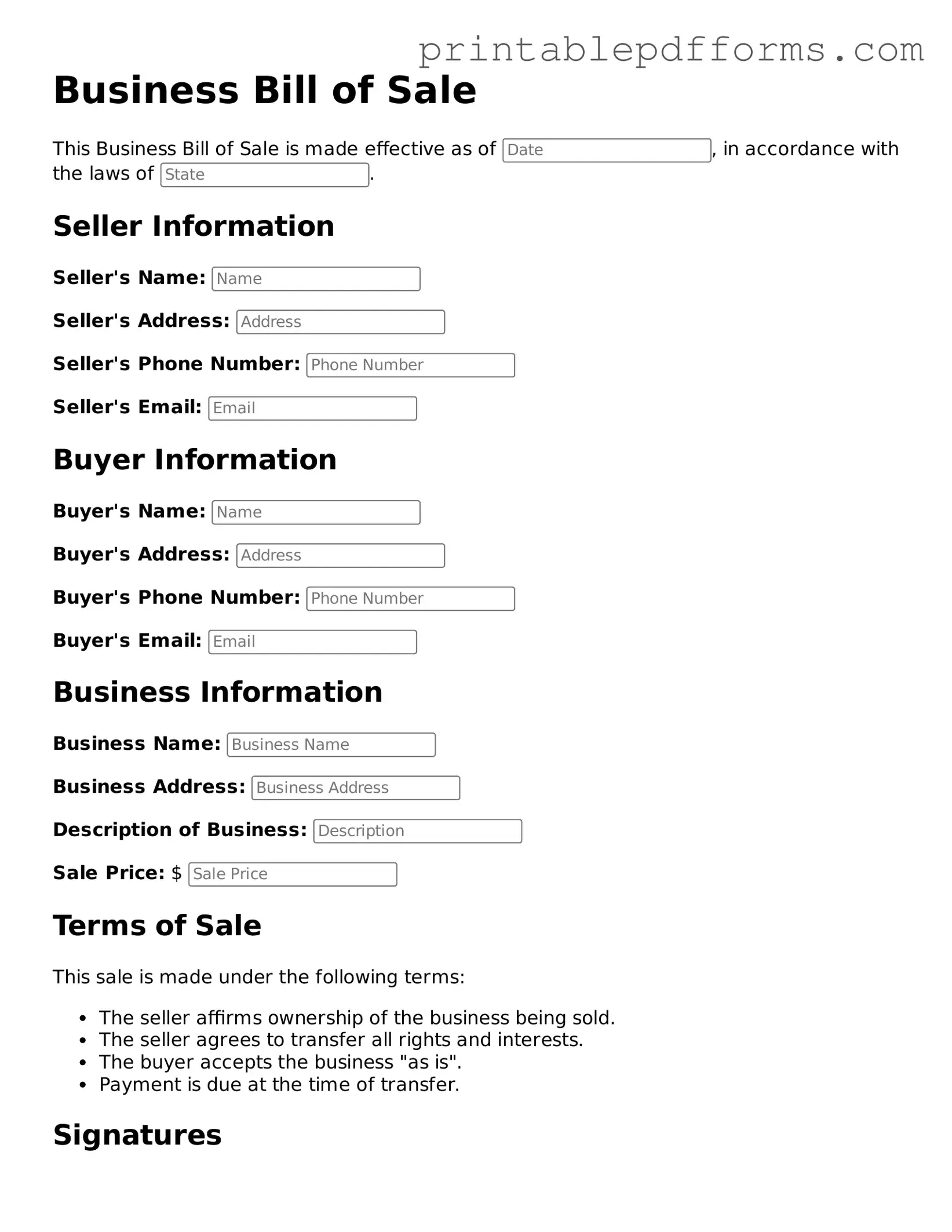

Document Example

Business Bill of Sale

This Business Bill of Sale is made effective as of , in accordance with the laws of .

Seller Information

Seller's Name:

Seller's Address:

Seller's Phone Number:

Seller's Email:

Buyer Information

Buyer's Name:

Buyer's Address:

Buyer's Phone Number:

Buyer's Email:

Business Information

Business Name:

Business Address:

Description of Business:

Sale Price: $

Terms of Sale

This sale is made under the following terms:

- The seller affirms ownership of the business being sold.

- The seller agrees to transfer all rights and interests.

- The buyer accepts the business "as is".

- Payment is due at the time of transfer.

Signatures

By signing below, both parties agree to the terms set forth in this Business Bill of Sale.

- Seller's Signature: _______________________________ Date: ____________

- Buyer's Signature: _______________________________ Date: ____________

This document serves as a formal record of the transaction and is intended to protect both parties.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. |

| Purpose | This form serves to provide proof of the transaction and details the terms of the sale, ensuring both parties are protected. |

| Parties Involved | The document typically involves a seller (the current owner) and a buyer (the new owner) of the business or its assets. |

| Governing Law | The governing law may vary by state; for example, in California, the Uniform Commercial Code (UCC) applies to the sale of business assets. |

| Components | A standard Business Bill of Sale includes details like the purchase price, description of assets, and any warranties or representations made. |

| Signatures | Both the buyer and seller must sign the document to validate the transfer of ownership and ensure legal enforceability. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed Bill of Sale for their records, as it may be needed for tax purposes or future disputes. |

| State-Specific Variations | Some states may have specific requirements for the Bill of Sale, such as notarization or additional disclosures, depending on local laws. |

Crucial Questions on This Form

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. This document serves as proof of the transaction and outlines the details of what is being sold, including equipment, inventory, and any intangible assets like goodwill.

Why do I need a Business Bill of Sale?

This document is essential for several reasons:

- It provides legal protection for both the buyer and the seller.

- It clearly outlines the terms of the sale, reducing the potential for disputes.

- It can be required by financial institutions for loan applications or other financing needs.

What should be included in a Business Bill of Sale?

A comprehensive Business Bill of Sale should include the following elements:

- The names and addresses of both the buyer and seller.

- A detailed description of the business or assets being sold.

- The sale price and payment terms.

- The date of the transaction.

- Any warranties or representations made by the seller.

Is a Business Bill of Sale legally binding?

Yes, a properly executed Business Bill of Sale is legally binding. Once both parties sign the document, it creates an enforceable agreement. However, it's important to ensure that all terms are clear and agreed upon to avoid any misunderstandings.

Do I need to have the Business Bill of Sale notarized?

While notarization is not always required, it can add an extra layer of security and authenticity to the document. Having the Bill of Sale notarized can be especially beneficial if the transaction involves a significant amount of money or if either party anticipates potential disputes.

Can I use a Business Bill of Sale for different types of businesses?

Yes, a Business Bill of Sale can be used for various types of businesses, whether you are selling a sole proprietorship, a partnership, or a corporation. The key is to ensure that the document accurately reflects the specific assets and terms of the sale relevant to the type of business being transferred.

How do I fill out a Business Bill of Sale?

Filling out a Business Bill of Sale involves providing accurate information about the transaction. Follow these steps:

- Enter the names and addresses of both parties.

- Describe the business or assets being sold in detail.

- Specify the total sale price and any payment arrangements.

- Include the date of the transaction.

- Have both parties sign the document, and consider notarizing it.

What happens if I don't use a Business Bill of Sale?

Not using a Business Bill of Sale can lead to complications. Without this document, there may be no official record of the transaction, making it difficult to prove ownership or resolve disputes. Additionally, you may face challenges in securing financing or fulfilling tax obligations related to the sale.

Where can I obtain a Business Bill of Sale template?

Business Bill of Sale templates can be found online through various legal websites, government resources, or legal document services. Ensure that the template you choose is appropriate for your specific situation and complies with your state’s laws.

Documents used along the form

A Business Bill of Sale is an essential document that facilitates the transfer of ownership for a business. However, several other forms and documents often accompany it to ensure a smooth transaction. Below is a list of commonly used documents that can help clarify the terms of the sale and protect both parties involved.

- Purchase Agreement: This document outlines the terms and conditions of the sale, including the purchase price, payment terms, and any contingencies that must be met before the sale is finalized.

- Asset List: A detailed inventory of the assets being sold, such as equipment, inventory, and intellectual property, helps both parties understand what is included in the sale.

- Non-Disclosure Agreement (NDA): This agreement protects sensitive information shared during the negotiation process, ensuring that both parties keep confidential details private.

- Liability Waiver: This document releases the seller from future liabilities related to the business, protecting them from claims that may arise after the sale.

- Financial Statements: Recent financial statements provide insight into the business’s performance, helping the buyer make an informed decision about the purchase.

- Tax Documents: Relevant tax documents, such as tax returns and sales tax permits, are important for understanding the business’s financial obligations and ensuring compliance.

- Employee Agreements: If the business has employees, agreements detailing their employment terms and conditions may need to be reviewed or transferred to the new owner.

- Ohio Bill of Sale Form: To ensure proper documentation during personal property transfers, consult our essential Ohio bill of sale form guide for accurate completion and compliance.

- Transfer of Licenses and Permits: This document outlines the process for transferring any necessary licenses or permits required to operate the business legally.

Utilizing these documents alongside the Business Bill of Sale can help ensure a more transparent and efficient transaction. Each document plays a role in protecting the interests of both the buyer and the seller, ultimately contributing to a successful business transfer.

Misconceptions

- Misconception 1: A Business Bill of Sale is only necessary for large transactions.

- Misconception 2: The form is only for selling a business in its entirety.

- Misconception 3: A verbal agreement is sufficient without a written Bill of Sale.

- Misconception 4: Only the seller needs to sign the Bill of Sale.

- Misconception 5: The form is not needed if the transaction occurs between family members.

This is not true. A Business Bill of Sale is important for any transfer of business assets, regardless of the size of the transaction. It serves as proof of ownership and can help prevent disputes in the future.

Many believe that a Business Bill of Sale is only applicable when selling an entire business. In reality, it can be used for individual assets, such as equipment or inventory, making it versatile for various transactions.

While verbal agreements can be legally binding, they often lead to misunderstandings. A written Business Bill of Sale provides clear documentation of the terms, protecting both parties involved.

Some people think that only the seller’s signature is required. However, it is essential for both the seller and the buyer to sign the document. This ensures that both parties acknowledge the terms of the sale.

Even when family members are involved, a Business Bill of Sale is still important. It helps clarify the transaction and can prevent potential disputes or misunderstandings in the future.