Fill a Valid Business Credit Application Form

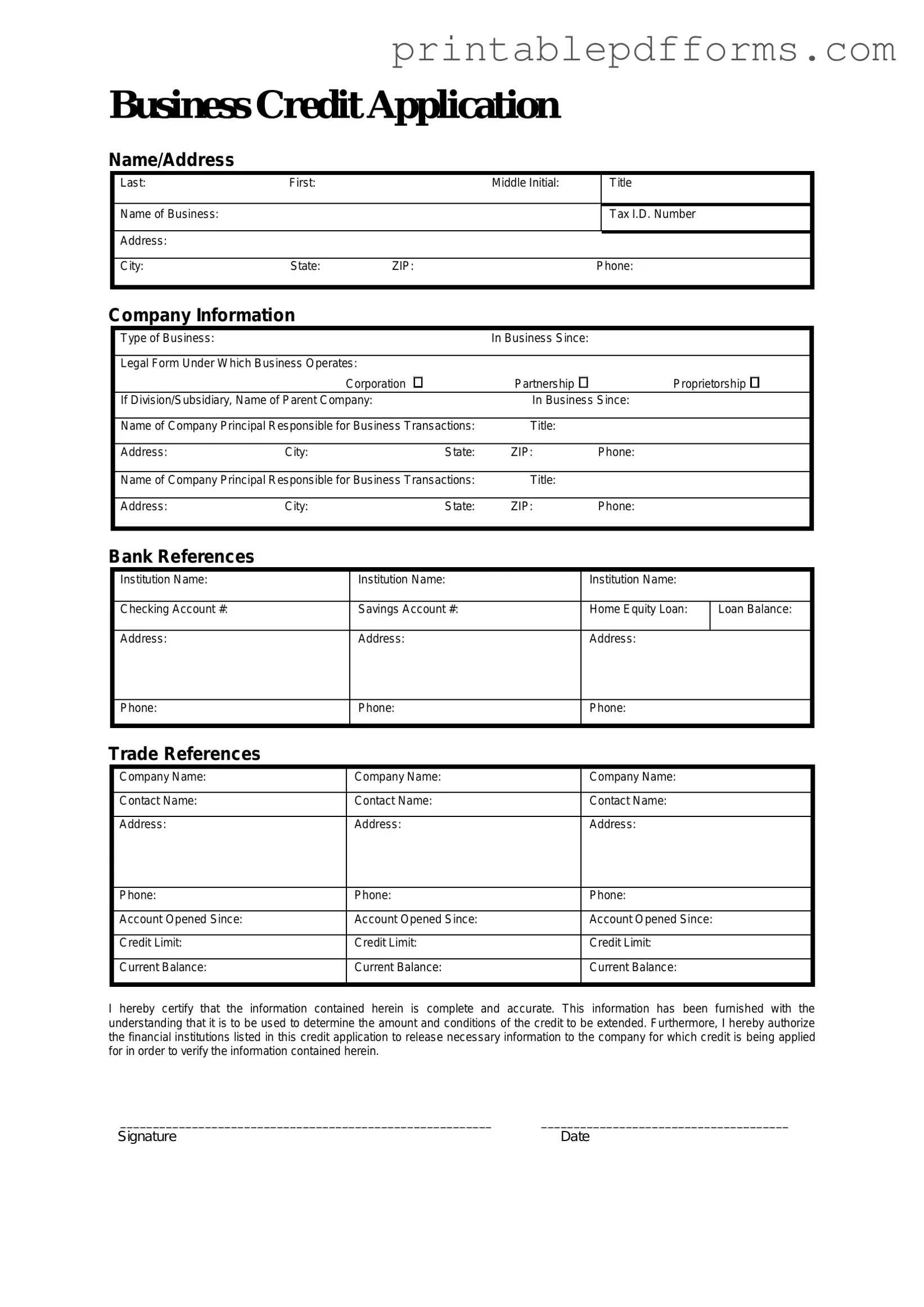

The Business Credit Application form serves as a critical tool for companies seeking to establish credit with suppliers or lenders. This document typically requires essential information about the business, including its legal name, address, and contact details. Additionally, it often asks for the business structure, such as whether it is a corporation, partnership, or sole proprietorship. Financial information, including annual revenue and bank references, is usually requested to assess the creditworthiness of the applicant. Furthermore, the form may include sections for personal guarantees from business owners, which can provide additional security for lenders. Completing this form accurately is vital, as it can influence the terms of credit extended and the overall financial relationship between the business and its creditors.

Additional PDF Templates

Erc Forms - Prepare for client queries based on findings from this property assessment.

Understanding the importance of having a proper Living Will is crucial for those who want to ensure their medical wishes are honored. This document serves as a declaration of one’s healthcare preferences and provides peace of mind. For more information, you can refer to a practical guide on the Living Will process available at navigating Ohio's Living Will requirements.

Profits or Loss From Business - You’ll need to provide information about the start date of your business on the form.

Similar forms

-

The Loan Application form is similar to the Business Credit Application form in that both require detailed financial information about the applicant. This includes income, expenses, and credit history. The purpose of each document is to assess the applicant's ability to repay borrowed funds.

- Articles of Incorporation: For establishing a corporation in Washington, utilize the comprehensive Articles of Incorporation form to ensure all required details are accurately documented.

-

The Vendor Credit Application form shares similarities with the Business Credit Application form as both are used to establish credit with suppliers. Each form typically requests information regarding the business's financial stability and creditworthiness.

-

The Business Partnership Agreement can be compared to the Business Credit Application form, as both documents outline the terms of financial responsibilities. While the partnership agreement focuses on the relationship between partners, the credit application assesses the financial standing of the business as a whole.

-

The Personal Guarantee Form is akin to the Business Credit Application form in that both may require personal financial details. This document is often used to secure business credit by holding the individual accountable for the business's debts.

-

The Financial Statement is another document that resembles the Business Credit Application form. Both require a comprehensive overview of the business's financial health, including assets, liabilities, and income, to help lenders evaluate the risk involved in extending credit.

Document Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used by businesses to apply for credit from suppliers or lenders. |

| Information Required | Typically, the form requires details such as business name, address, tax identification number, and financial information. |

| Signatures | Authorized representatives of the business must sign the application to validate the information provided. |

| Credit Evaluation | Creditors use the information to assess the creditworthiness of the business before granting credit. |

| State-Specific Forms | Some states may have specific requirements or forms based on local laws governing business credit. |

| Governing Laws | For example, California law (California Commercial Code) may govern certain aspects of business credit applications. |

| Confidentiality | Information provided in the application is typically kept confidential and used solely for credit evaluation. |

| Approval Process | The approval process can vary in length, depending on the lender's policies and the complexity of the application. |

Crucial Questions on This Form

What is the Business Credit Application form?

The Business Credit Application form is a document that businesses complete to request credit from a supplier or lender. This form collects essential information about the business, including financial details, ownership structure, and credit history, to help the lender assess the risk of extending credit.

Who should fill out the Business Credit Application form?

The form should be filled out by the owner or an authorized representative of the business seeking credit. This ensures that the information provided is accurate and that the person completing the form has the authority to make financial decisions on behalf of the business.

What information is required on the application?

The application typically requires the following information:

- Business name and address

- Type of business entity (e.g., LLC, corporation, sole proprietorship)

- Tax identification number

- Financial statements or income information

- Bank references

- Trade references

- Owner's personal information, including social security number

How long does it take to process the application?

The processing time can vary based on the lender's policies and the completeness of the application. Generally, it takes anywhere from a few days to a couple of weeks. Applicants are encouraged to provide all required information to expedite the process.

What happens after I submit the application?

After submission, the lender will review the application. They may contact you for additional information or clarification. Once the review is complete, you will receive a decision regarding your credit request, which may include approval, denial, or a request for more information.

Is there a fee associated with the application?

Some lenders may charge a fee for processing the Business Credit Application. It's important to check with the specific lender to understand any associated costs before submitting the form.

Can I apply for credit if my business is new?

Yes, new businesses can apply for credit. However, they may face stricter scrutiny due to a lack of established credit history. Providing a solid business plan, personal credit history, and any relevant financial projections can help strengthen your application.

What if my application is denied?

If your application is denied, the lender is required to provide a reason for the decision. You can ask for feedback and consider addressing any issues before reapplying. Additionally, exploring other lenders or credit options may be beneficial.

Can I update my application after submission?

Once submitted, it may be challenging to make changes to your application. If you realize there is an error or need to provide additional information, contact the lender immediately. They can advise you on the best course of action.

Documents used along the form

When applying for business credit, several forms and documents often accompany the Business Credit Application form. Each of these documents plays a crucial role in providing lenders with a comprehensive understanding of the applicant's financial situation and business operations.

- Personal Guarantee: This document ensures that the business owner agrees to be personally responsible for the debt if the business fails to repay it. It adds an extra layer of security for lenders.

- Business Financial Statements: These include balance sheets, income statements, and cash flow statements. They provide a snapshot of the business's financial health and help lenders assess creditworthiness.

- Tax Returns: Typically, lenders request the last two to three years of business tax returns. These documents verify income and can reveal the financial stability of the business.

- Prenuptial Agreement Form: Couples in Ohio can use this legal document to establish the ownership and division of their current and future assets and debts, ensuring clarity and security in financial matters. For more information, visit All Ohio Forms.

- Bank Statements: Recent bank statements may be required to demonstrate cash flow and the ability to manage funds. Lenders use this information to evaluate the business's financial habits.

- Business Plan: A detailed business plan outlines the company's goals, strategies, and financial projections. It helps lenders understand the business's potential for growth and profitability.

- Trade References: This document lists other businesses that the applicant has worked with, providing insight into the applicant's payment history and reliability.

Gathering these documents can streamline the application process and improve the chances of obtaining credit. Providing complete and accurate information demonstrates professionalism and helps build trust with potential lenders.

Misconceptions

-

Misconception 1: The Business Credit Application is only for large companies.

This is not true. Small businesses can and should use the Business Credit Application. It helps establish creditworthiness, regardless of company size. Many lenders offer credit options tailored specifically for small enterprises.

-

Misconception 2: Completing the application guarantees approval.

While submitting a Business Credit Application is a crucial step, it does not guarantee that credit will be granted. Lenders evaluate various factors, including credit history and financial stability, before making a decision.

-

Misconception 3: The application process is overly complicated.

Many people believe that the process is daunting. In reality, most applications are straightforward and require basic information about the business, such as financials and ownership structure. With proper preparation, it can be completed efficiently.

-

Misconception 4: Only established businesses can apply.

This is a common misunderstanding. Startups and new businesses can also apply for credit. However, they may need to provide additional documentation, such as a business plan or projections, to demonstrate their potential for success.