Blank Business Purchase and Sale Agreement Form

When buying or selling a business, having a solid agreement in place is crucial for a smooth transaction. A Business Purchase and Sale Agreement outlines the terms and conditions of the sale, ensuring both parties understand their rights and responsibilities. This document typically includes key details such as the purchase price, payment terms, and a description of the business being sold. It also addresses important aspects like the transfer of assets, liabilities, and any existing contracts. By clearly defining the scope of the sale, the agreement helps prevent misunderstandings and disputes down the line. Additionally, it often includes provisions for contingencies, such as financing or due diligence, which can protect both the buyer and seller during the process. Understanding this form is essential for anyone involved in a business transaction, as it lays the groundwork for a successful sale.

Other Templates:

Affidavit Letter of Support Sample - A well-crafted affidavit can significantly strengthen an I-751 petition.

In navigating the complexities of investment opportunities, it is essential to understand the role of an Investment Letter of Intent (LOI), as this document can clarify the intentions of both the investor and the recipient of funds. For more insights and templates regarding these documents, visit legalformspdf.com, where you can find valuable resources to assist in the investment process.

Schedule of Availability Template - Let us know if you are open to different job roles based on availability.

Employee Advance Agreement - Get a head start on your earnings through this form.

Similar forms

- Asset Purchase Agreement: This document outlines the terms for purchasing specific assets of a business rather than the entire company. It details what is included in the sale, such as equipment, inventory, and intellectual property.

- Stock Purchase Agreement: Similar to the Business Purchase and Sale Agreement, this document focuses on the sale of a company's stock. It specifies the number of shares being sold, the price per share, and any conditions that must be met prior to the sale.

- Letter of Intent: This preliminary document expresses the intent to enter into a formal agreement. It outlines key terms and conditions, providing a framework for negotiations before a full agreement is drafted.

- Non-Disclosure Agreement (NDA): Before discussions about a business sale, parties often sign an NDA to protect sensitive information. This agreement ensures that proprietary data shared during negotiations remains confidential.

- Due Diligence Checklist: This document is used to gather information about the business being sold. It lists all necessary documents and data that the buyer needs to review before finalizing the purchase.

ATV Bill of Sale: This form is essential for documenting the sale and transfer of ownership of an all-terrain vehicle in New York. It ensures compliance with state regulations and includes important details about both parties involved in the transaction, making it a vital step in the buying process. For more information, visit nypdfforms.com/atv-bill-of-sale-form.

- Closing Statement: At the end of a business sale, a closing statement summarizes the financial details of the transaction. It includes the final purchase price, adjustments, and any fees associated with the sale.

- Bill of Sale: This document serves as proof of the transfer of ownership. It details the items sold, the parties involved, and is often required for legal purposes to finalize the sale.

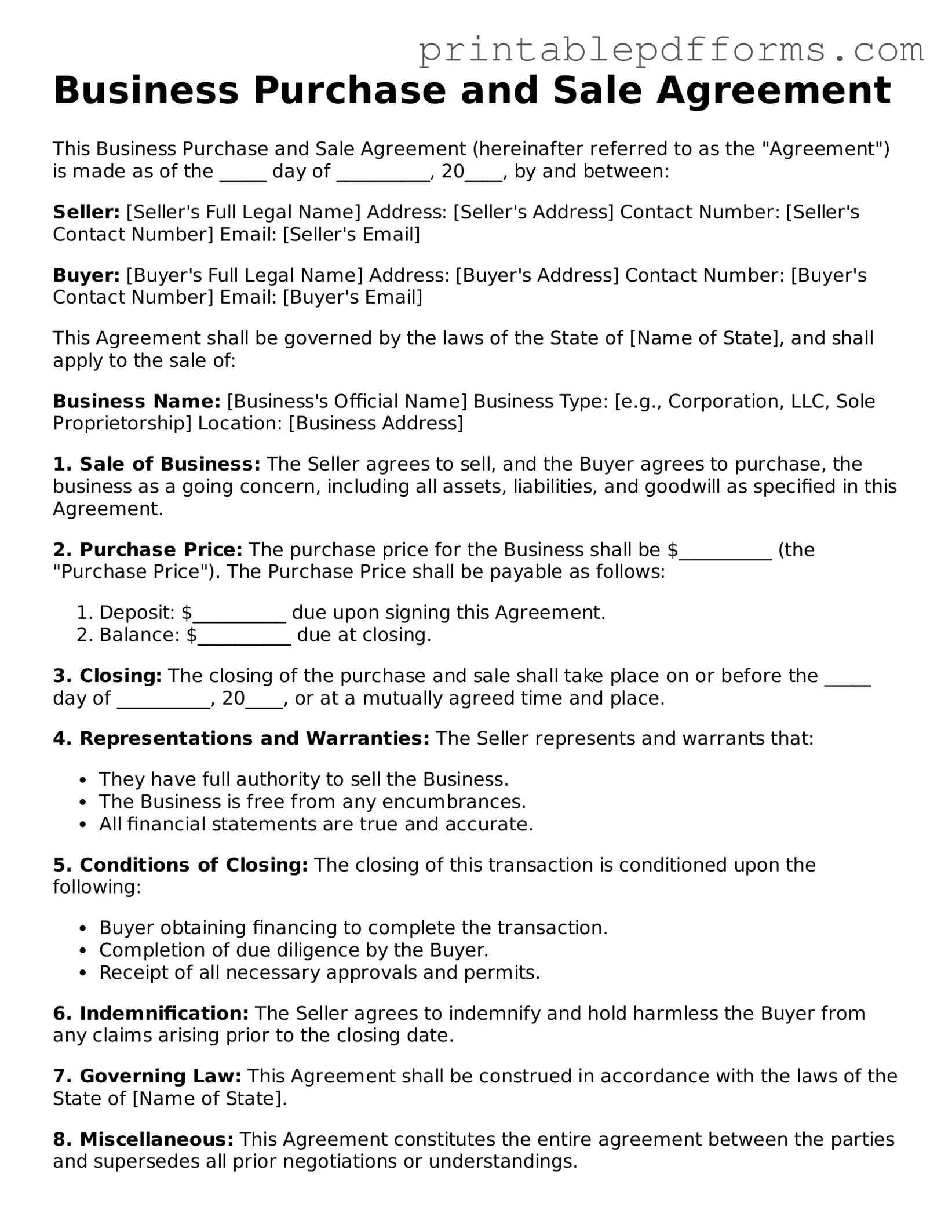

Document Example

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement (hereinafter referred to as the "Agreement") is made as of the _____ day of __________, 20____, by and between:

Seller: [Seller's Full Legal Name] Address: [Seller's Address] Contact Number: [Seller's Contact Number] Email: [Seller's Email]

Buyer: [Buyer's Full Legal Name] Address: [Buyer's Address] Contact Number: [Buyer's Contact Number] Email: [Buyer's Email]

This Agreement shall be governed by the laws of the State of [Name of State], and shall apply to the sale of:

Business Name: [Business's Official Name] Business Type: [e.g., Corporation, LLC, Sole Proprietorship] Location: [Business Address]

1. Sale of Business: The Seller agrees to sell, and the Buyer agrees to purchase, the business as a going concern, including all assets, liabilities, and goodwill as specified in this Agreement.

2. Purchase Price: The purchase price for the Business shall be $__________ (the "Purchase Price"). The Purchase Price shall be payable as follows:

- Deposit: $__________ due upon signing this Agreement.

- Balance: $__________ due at closing.

3. Closing: The closing of the purchase and sale shall take place on or before the _____ day of __________, 20____, or at a mutually agreed time and place.

4. Representations and Warranties: The Seller represents and warrants that:

- They have full authority to sell the Business.

- The Business is free from any encumbrances.

- All financial statements are true and accurate.

5. Conditions of Closing: The closing of this transaction is conditioned upon the following:

- Buyer obtaining financing to complete the transaction.

- Completion of due diligence by the Buyer.

- Receipt of all necessary approvals and permits.

6. Indemnification: The Seller agrees to indemnify and hold harmless the Buyer from any claims arising prior to the closing date.

7. Governing Law: This Agreement shall be construed in accordance with the laws of the State of [Name of State].

8. Miscellaneous: This Agreement constitutes the entire agreement between the parties and supersedes all prior negotiations or understandings.

IN WITNESS WHEREOF, the parties hereto have executed this Business Purchase and Sale Agreement as of the date first above written.

________________________ Signature of Seller Date: _______________

________________________ Signature of Buyer Date: _______________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement outlines the terms and conditions under which a business is sold. |

| Key Components | This agreement typically includes details such as purchase price, payment terms, and representations and warranties. |

| Governing Law | The agreement is governed by the laws of the state where the business operates, which can vary significantly from state to state. |

| Importance of Due Diligence | Both buyers and sellers should conduct due diligence to ensure all information is accurate before finalizing the agreement. |

| Legal Assistance | It is advisable for both parties to seek legal advice to navigate complexities and protect their interests. |

Crucial Questions on This Form

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy a business from another party. This agreement serves to protect both the buyer and the seller by clearly defining their rights and obligations throughout the transaction process.

Why is a Business Purchase and Sale Agreement important?

This agreement is crucial for several reasons:

- It establishes the purchase price and payment terms.

- It details the assets and liabilities being transferred.

- It outlines any contingencies that must be met before the sale is finalized.

- It provides a framework for resolving disputes that may arise during the transaction.

What key elements should be included in the agreement?

A comprehensive Business Purchase and Sale Agreement should include the following key elements:

- Parties Involved: Clearly identify the buyer and seller.

- Description of the Business: Provide a detailed description of the business being sold.

- Purchase Price: Specify the total purchase price and payment structure.

- Assets and Liabilities: List the assets being transferred and any liabilities the buyer will assume.

- Conditions Precedent: Outline any conditions that must be satisfied before closing.

- Confidentiality Clause: Include terms to protect sensitive information.

How does the negotiation process work?

Negotiation typically begins with both parties discussing their expectations and concerns. The seller may present an initial offer, which the buyer can accept, reject, or counter. This back-and-forth continues until both parties reach a mutually agreeable set of terms. It is advisable to document all discussions and agreements to ensure clarity.

What happens after the agreement is signed?

Once both parties sign the agreement, the next steps include:

- Conducting due diligence to verify the information provided.

- Finalizing financing arrangements, if necessary.

- Preparing for the transfer of ownership, including any required licenses or permits.

- Closing the sale, which involves the actual transfer of funds and assets.

Can the agreement be modified after signing?

Yes, the Business Purchase and Sale Agreement can be modified after signing, but both parties must agree to any changes. Modifications should be documented in writing and signed by both parties to ensure enforceability. It is important to approach any amendments carefully to maintain clarity and avoid misunderstandings.

Documents used along the form

When engaging in a business transaction, particularly the purchase or sale of a business, several key documents accompany the Business Purchase and Sale Agreement. Each of these documents serves a specific purpose and helps to ensure that the transaction proceeds smoothly and legally. Below is a list of commonly used forms and documents that are often utilized alongside the Business Purchase and Sale Agreement.

- Letter of Intent (LOI): This document outlines the preliminary understanding between the buyer and seller. It serves as a roadmap for negotiations and typically includes key terms such as price, payment structure, and timelines.

- Due Diligence Checklist: This list helps buyers systematically evaluate the business they are considering purchasing. It includes various aspects such as financial records, legal compliance, and operational procedures that need to be reviewed.

- Confidentiality Agreement (NDA): Before sharing sensitive information, both parties often sign this agreement to protect confidential business information. It ensures that proprietary details remain secure throughout the negotiation process.

- General Bill of Sale: A crucial form that serves as a receipt for the transfer of ownership of personal property. For templates and examples, you can visit freebusinessforms.org.

- Asset Purchase Agreement: If the sale involves specific assets rather than the entire business entity, this agreement details which assets are being sold, their value, and any liabilities that may be transferred.

- Bill of Sale: This document serves as proof of the transfer of ownership of the business or its assets. It outlines what is being sold and confirms that the buyer has paid for the transaction.

- Closing Statement: At the conclusion of the transaction, this statement summarizes the financial details of the sale. It includes the final purchase price, adjustments, and any other financial considerations agreed upon by both parties.

Understanding these documents is crucial for anyone involved in buying or selling a business. Each serves a vital role in protecting the interests of both parties and ensuring that the transaction is conducted in a clear and legally sound manner.

Misconceptions

Understanding the Business Purchase and Sale Agreement is essential for anyone involved in buying or selling a business. However, several misconceptions can lead to confusion. Here are ten common misconceptions explained:

- It is a standard form that requires no customization. Each business transaction is unique, and the agreement should reflect the specific terms and conditions of the sale.

- Only lawyers can prepare this agreement. While legal advice is beneficial, many individuals can prepare the agreement with the right information and understanding.

- The agreement is only necessary for large transactions. Regardless of the size of the business, having a formal agreement protects both parties involved.

- Once signed, the agreement cannot be changed. Parties can negotiate changes before closing, and amendments can be made if both agree.

- It only covers the sale price. The agreement includes various terms, such as payment methods, warranties, and contingencies.

- It is not legally binding. A properly executed agreement is legally enforceable, provided it meets state requirements.

- Only sellers need to understand the agreement. Buyers must also comprehend the terms to ensure they are making an informed decision.

- Verbal agreements are sufficient. Written agreements are crucial for clarity and legal protection, as verbal agreements can lead to misunderstandings.

- The agreement does not need to be reviewed by a professional. Having a professional review can help identify potential issues and ensure compliance with laws.

- It is a one-time document with no future implications. The agreement can have lasting effects, influencing future business operations and relationships.

By addressing these misconceptions, individuals can approach the Business Purchase and Sale Agreement with a clearer understanding, ensuring a smoother transaction process.