California Articles of Incorporation Document

The California Articles of Incorporation form is a crucial document for anyone looking to start a corporation in the state. This form establishes the existence of a corporation and outlines essential details about its structure and purpose. Key components include the corporation's name, which must be unique and comply with state regulations. Additionally, the form requires the designation of a registered agent, responsible for receiving legal documents on behalf of the corporation. The purpose of the corporation must also be stated, providing clarity on its intended business activities. Furthermore, the Articles of Incorporation may include information about the corporation’s stock structure, detailing the types and number of shares that can be issued. Completing this form accurately is vital, as it lays the foundation for the corporation's legal status and operations within California. Understanding each section of the form helps ensure that all necessary information is provided, paving the way for a smooth incorporation process.

Discover More Articles of Incorporation Forms for Different States

Registration Certificate - It’s important to understand the implications of each section of the Articles.

How Much Is an Llc in Texas - Nonprofit corporations will draft Articles that meet different requirements.

New York Department of State Business Search - Consider consulting a professional for complex structures.

Understanding your paycheck is crucial for managing your finances effectively, and the ADP Pay Stub form serves as a key resource in achieving this clarity. This document details your earnings, deductions, and net pay for each pay period, allowing you to see how taxes and benefits impact your total compensation. For those ready to manage their payroll information effectively, consider filling out the Adp Pay Stub form to streamline this process.

Ohio Secretary of State Llc Filing - Completing the Articles of Incorporation may involve paying a filing fee.

Similar forms

- Bylaws: Bylaws outline the internal rules and procedures for managing a corporation. They govern the day-to-day operations and detail the responsibilities of directors and officers, similar to how the Articles of Incorporation establish the corporation's existence and structure.

- Operating Agreement: An operating agreement serves a similar purpose for limited liability companies (LLCs). It defines the management structure and operational guidelines, akin to how Articles of Incorporation define the framework for a corporation.

- Automotive Bill of Sale: Essential for vehicle transactions, the Automotive Bill of Sale documents the sale or transfer of a vehicle, safeguarding both buyer and seller interests.

- Certificate of Formation: This document is often required for LLCs and serves a similar function to the Articles of Incorporation. Both documents officially establish a business entity with the state and provide essential information about the organization.

- Business License: A business license grants permission to operate within a specific jurisdiction. While the Articles of Incorporation create the entity, a business license allows it to conduct business legally, highlighting the regulatory framework necessary for operation.

Document Example

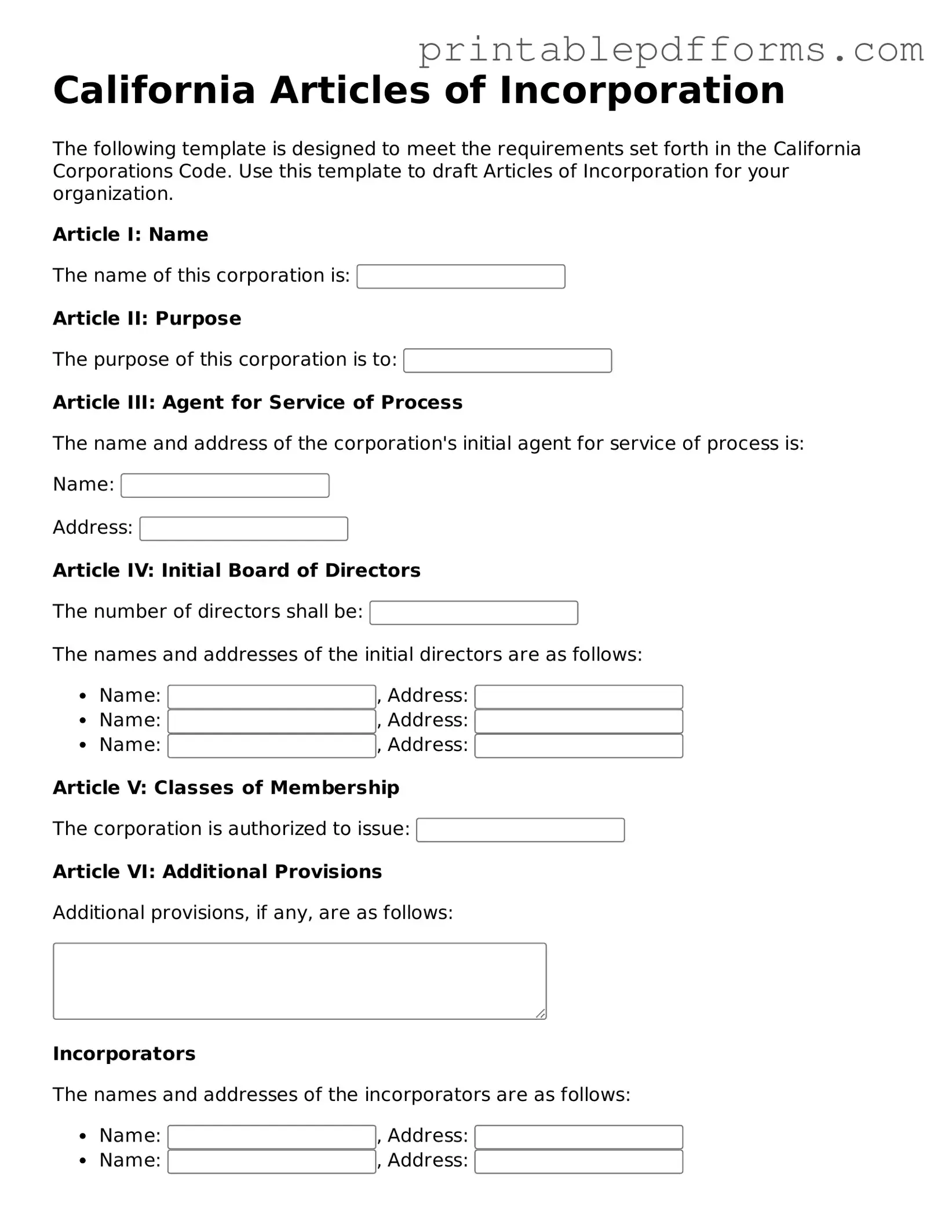

California Articles of Incorporation

The following template is designed to meet the requirements set forth in the California Corporations Code. Use this template to draft Articles of Incorporation for your organization.

Article I: Name

The name of this corporation is:

Article II: Purpose

The purpose of this corporation is to:

Article III: Agent for Service of Process

The name and address of the corporation's initial agent for service of process is:

Name:

Address:

Article IV: Initial Board of Directors

The number of directors shall be:

The names and addresses of the initial directors are as follows:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article V: Classes of Membership

The corporation is authorized to issue:

Article VI: Additional Provisions

Additional provisions, if any, are as follows:

Incorporators

The names and addresses of the incorporators are as follows:

- Name: , Address:

- Name: , Address:

Execution

We, the undersigned, hereby declare that we are the incorporators of the corporation and that the information provided herein is true and correct.

Incorporator Signature:

Date:

Incorporator Signature:

Date:

PDF Form Specs

| Fact Name | Details |

|---|---|

| Governing Law | California Corporations Code Sections 200-211 |

| Purpose | The Articles of Incorporation establish the existence of a corporation in California. |

| Required Information | The form must include the corporation's name, purpose, and agent for service of process. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation to the Secretary of State. |

| Duration | The corporation can exist perpetually unless a specific duration is stated in the Articles. |

| Nonprofit Option | California allows for the incorporation of nonprofit organizations through this form. |

| Amendments | Changes to the Articles can be made by filing an amendment with the Secretary of State. |

| Initial Directors | The form may specify the names and addresses of the initial directors of the corporation. |

| Online Filing | California allows for the online submission of the Articles of Incorporation for convenience. |

Crucial Questions on This Form

What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in California. They outline essential details about the corporation, including its name, purpose, and structure. Filing these articles with the California Secretary of State is the first step in forming a corporation.

Who needs to file Articles of Incorporation?

Any individual or group looking to create a corporation in California must file Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, non-profit organizations, and professional corporations.

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require the following information:

- The name of the corporation.

- The purpose of the corporation.

- The address of the corporation's initial registered office.

- The name and address of the initial agent for service of process.

- The number of shares the corporation is authorized to issue.

How do I file the Articles of Incorporation?

To file the Articles of Incorporation in California, you can complete the form online or download it from the California Secretary of State's website. After filling it out, submit the form along with the required filing fee either online or by mail. Ensure that all information is accurate to avoid delays.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies based on the type of corporation you are forming. As of October 2023, the fee for a standard for-profit corporation is typically around $100. However, additional fees may apply depending on your specific circumstances or if you choose expedited processing.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Generally, it takes about 15 business days for the California Secretary of State to process Articles of Incorporation. If you need faster service, you may opt for expedited processing, which can significantly reduce the wait time.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are processed and approved, your corporation is officially formed. You will receive a stamped copy of the Articles back from the Secretary of State. This document serves as proof of your corporation's existence and may be required for opening bank accounts or obtaining business licenses.

Can I amend my Articles of Incorporation later?

Yes, you can amend your Articles of Incorporation if changes are needed. This process involves filing an amendment form with the California Secretary of State and paying any applicable fees. Common reasons for amendments include changes to the corporation's name, purpose, or share structure.

Do I need a lawyer to file Articles of Incorporation?

While it's not required to hire a lawyer to file Articles of Incorporation, many people choose to do so for guidance. An attorney can help ensure that your documents are completed correctly and that you comply with all state regulations. However, if you feel comfortable navigating the process on your own, you can file without legal assistance.

Are there ongoing requirements after filing Articles of Incorporation?

Yes, after filing your Articles of Incorporation, your corporation must meet ongoing requirements. This includes holding annual meetings, keeping minutes of those meetings, and filing periodic reports with the state. Staying compliant with these requirements helps maintain your corporation's good standing.

Documents used along the form

When forming a corporation in California, several documents accompany the Articles of Incorporation. Each document serves a specific purpose in the incorporation process and ensures compliance with state regulations. Below is a list of commonly used forms and documents.

- Bylaws: This document outlines the internal rules and procedures for the corporation's operations. It covers topics such as the roles of directors and officers, meeting protocols, and voting procedures.

- Bill of Sale: To document property transfers effectively, ensure you utilize the detailed bill of sale form guidelines for legal protection and clarity.

- Statement of Information: Required within 90 days of filing the Articles of Incorporation, this form provides the state with updated information about the corporation, including its address, officers, and agent for service of process.

- Employer Identification Number (EIN): Obtained from the IRS, this number is necessary for tax purposes and is required for opening a corporate bank account and hiring employees.

- Initial Board of Directors Meeting Minutes: These minutes document the first meeting of the board of directors, including key decisions made, such as the appointment of officers and adoption of bylaws.

- Stock Certificates: If the corporation issues stock, these certificates serve as proof of ownership for shareholders and must comply with state regulations.

- Business License: Depending on the nature of the business and its location, obtaining a business license may be necessary to operate legally in the city or county.

- Fictitious Business Name Statement: If the corporation plans to operate under a name different from its legal name, this statement must be filed with the county clerk.

- Shareholder Agreements: This document outlines the rights and responsibilities of shareholders, including how shares can be transferred and how disputes will be resolved.

- Registered Agent Consent Form: This form confirms that the designated registered agent agrees to serve in this capacity and is available during business hours to receive legal documents.

These documents are essential for establishing a corporation in California and maintaining compliance with state laws. Properly preparing and filing each document will help ensure a smooth incorporation process.

Misconceptions

Understanding the California Articles of Incorporation form is crucial for anyone looking to start a corporation in the state. However, several misconceptions can lead to confusion. Here are ten common misunderstandings:

- All corporations must file Articles of Incorporation. Many believe that only certain types of businesses need to file. In reality, any corporation, regardless of its purpose, must complete this form.

- Filing Articles of Incorporation guarantees legal protection. While this form is necessary for incorporation, it does not automatically shield owners from liability. Additional steps are required to ensure personal asset protection.

- Articles of Incorporation are the same as a business license. These are distinct documents. The Articles establish the corporation's existence, while a business license permits operations within a specific jurisdiction.

- You can file Articles of Incorporation at any time. There are specific times when filing is most beneficial. For example, filing at the beginning of the fiscal year can have tax advantages.

- Only lawyers can file Articles of Incorporation. While legal assistance can be helpful, anyone can complete and submit the form as long as they follow the instructions accurately.

- Once filed, Articles of Incorporation cannot be changed. This is not true. Amendments can be made if circumstances change, but the process requires additional filings.

- Articles of Incorporation are only for for-profit businesses. Nonprofit organizations also need to file Articles of Incorporation to be legally recognized in California.

- Filing fees are the same for all corporations. Fees can vary based on the type of corporation and additional services requested, such as expedited processing.

- All information in the Articles of Incorporation is confidential. In fact, much of the information is public record and can be accessed by anyone.

- Once incorporated, you do not need to worry about compliance. Incorporation does not eliminate the need for ongoing compliance with state and federal regulations. Regular filings and maintenance are essential.

By addressing these misconceptions, individuals can better navigate the process of incorporating a business in California and ensure compliance with all necessary regulations.