California Deed Document

In California, the deed form serves as a critical legal instrument for transferring property ownership. This document outlines essential details, including the names of the grantor (the seller) and grantee (the buyer), the legal description of the property, and the consideration, or payment, involved in the transaction. It also specifies any conditions or restrictions that may apply to the property. Ensuring accuracy in these details is paramount, as errors can lead to disputes or complications in the future. Additionally, the deed must be signed by the grantor and notarized to be valid. Once executed, it is typically recorded with the county recorder's office, providing public notice of the ownership transfer. Understanding the nuances of the California deed form is essential for both buyers and sellers to facilitate a smooth real estate transaction and protect their legal rights.

Discover More Deed Forms for Different States

Texas Deed Forms - Creating a Deed can protect your interests in property dealings.

Nys Deed Form - They may be recorded at the county recorder's office to provide public notice of ownership.

The Ohio Payoff Form is an essential tool for those navigating the complexities of state debts, enabling realtors and title companies to efficiently request necessary payoff information. By ensuring that consent is obtained from the relevant parties, this form facilitates the release of information concerning certified debts and liens, which is crucial for the transparent execution of property transactions. For comprehensive guidelines and resources, you can visit All Ohio Forms, which offers further details on this process and its importance in debt resolution.

How Long Does It Take to Record a Deed in Florida - A deed may include a clause for escrow, particularly in complex transactions.

Similar forms

The Deed form shares similarities with several other important legal documents. Each serves a unique purpose but often contains comparable elements. Here are five documents that are similar to the Deed form:

- Title Transfer Document: This document facilitates the transfer of ownership of property from one party to another, much like a Deed. Both documents must be executed and recorded to be legally binding.

- Lease Agreement: A lease agreement outlines the terms under which one party can use another party's property. Similar to a Deed, it requires signatures and specifies rights and obligations.

- Mortgage Agreement: This document secures a loan with the property as collateral. Like a Deed, it must be recorded and includes details about ownership and rights.

- Power of Attorney: This document grants one person the authority to act on behalf of another. It is similar to a Deed in that it must be signed and can affect property rights.

- WC-240 Form: Essential for informing employees about job offers that accommodate their health conditions, this form ensures compliance with state regulations and can be further explored at georgiapdf.com/wc-240-georgia.

- Trust Agreement: A trust agreement establishes a fiduciary relationship for managing assets. It shares similarities with a Deed in terms of outlining the management and transfer of property rights.

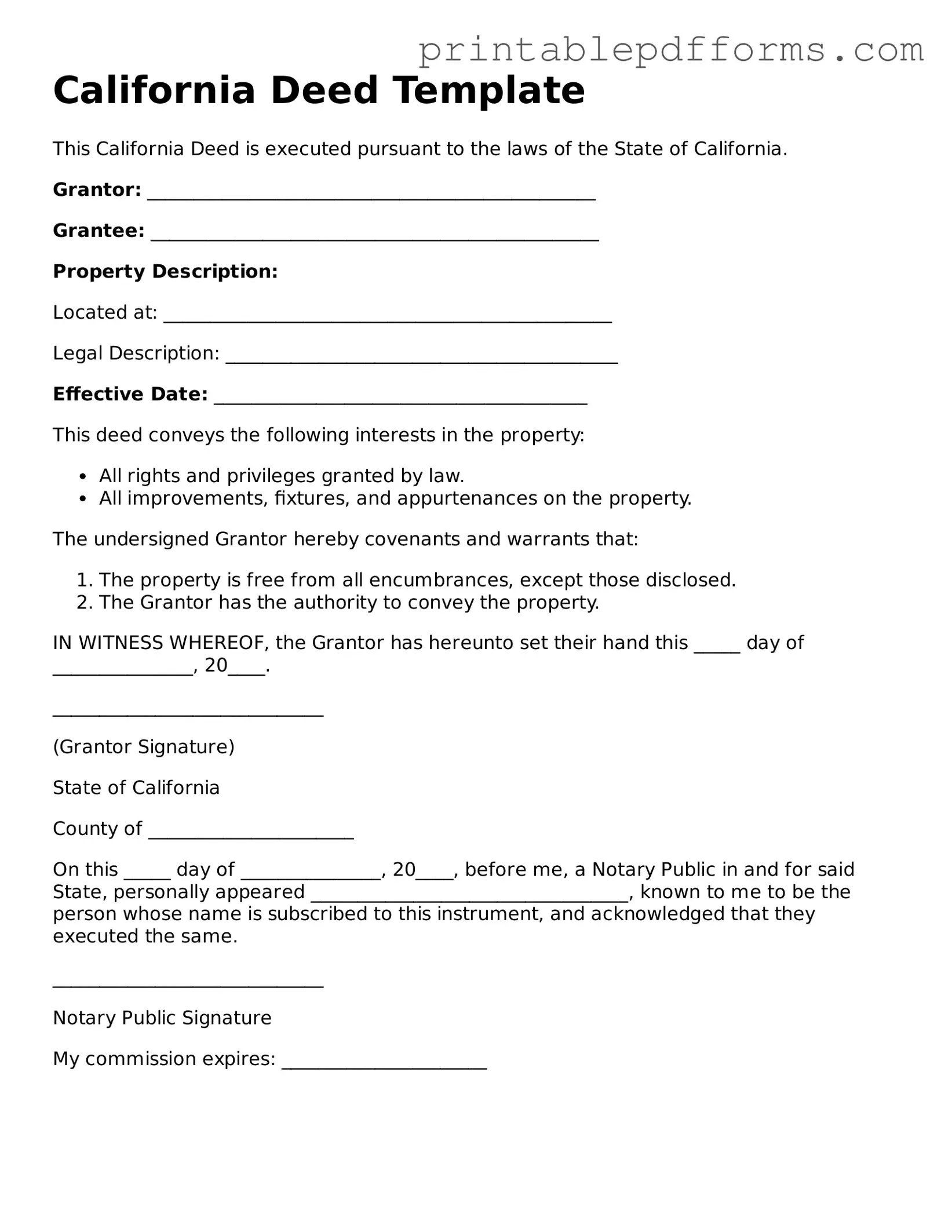

Document Example

California Deed Template

This California Deed is executed pursuant to the laws of the State of California.

Grantor: ________________________________________________

Grantee: ________________________________________________

Property Description:

Located at: ________________________________________________

Legal Description: __________________________________________

Effective Date: ________________________________________

This deed conveys the following interests in the property:

- All rights and privileges granted by law.

- All improvements, fixtures, and appurtenances on the property.

The undersigned Grantor hereby covenants and warrants that:

- The property is free from all encumbrances, except those disclosed.

- The Grantor has the authority to convey the property.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this _____ day of _______________, 20____.

_____________________________

(Grantor Signature)

State of California

County of ______________________

On this _____ day of _______________, 20____, before me, a Notary Public in and for said State, personally appeared __________________________________, known to me to be the person whose name is subscribed to this instrument, and acknowledged that they executed the same.

_____________________________

Notary Public Signature

My commission expires: ______________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A California Deed is a legal document used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Grant Deed, Quitclaim Deed, and Warranty Deed, each serving different purposes in property transfer. |

| Governing Law | The California Civil Code governs the creation and execution of deeds in the state. |

| Recording Requirement | To provide public notice, the deed must be recorded with the county recorder's office where the property is located. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Consideration | While consideration (payment) is often required, a deed can still be valid even if no money changes hands. |

Crucial Questions on This Form

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property in California. It serves as proof of the transfer and is recorded with the county recorder's office to make it official. There are different types of deeds, including grant deeds and quitclaim deeds, each serving specific purposes.

Who needs a California Deed form?

Anyone transferring ownership of real property in California needs a deed form. This includes individuals selling their homes, gifting property, or transferring property into a trust. It's essential for both the seller and buyer to ensure the deed is completed correctly to avoid future disputes.

What information is required on a California Deed form?

A California Deed form typically requires the following information:

- The names of the grantor (seller) and grantee (buyer).

- A legal description of the property being transferred.

- The date of the transfer.

- The consideration (amount paid for the property, if applicable).

- The signature of the grantor.

How do I complete a California Deed form?

To complete a California Deed form, follow these steps:

- Obtain the correct deed form for your transaction type.

- Fill in the required information accurately.

- Have the grantor sign the document in front of a notary public.

- Record the deed with the county recorder's office.

Do I need a lawyer to prepare a California Deed form?

While it's not legally required to hire a lawyer, consulting one is advisable, especially for complex transactions. A legal professional can ensure that the deed is completed correctly and complies with California laws, minimizing the risk of issues later on.

What is the difference between a grant deed and a quitclaim deed?

A grant deed provides certain guarantees about the property, including that the seller has the right to sell it and that it is free from undisclosed encumbrances. A quitclaim deed, on the other hand, transfers whatever interest the seller has in the property without any guarantees. This makes grant deeds more secure for buyers.

How much does it cost to record a California Deed form?

The cost to record a California Deed form varies by county. Generally, fees can range from $10 to $50. It's wise to check with your local county recorder's office for specific pricing and any additional requirements.

Can I change a California Deed form after it has been recorded?

Once a California Deed form is recorded, it cannot be changed. If you need to correct an error or modify ownership, you may need to create a new deed or use a legal process such as a court order. Always consult a legal professional for guidance in these situations.

How long does it take to process a recorded California Deed form?

Processing times for recorded California Deed forms can vary by county. Typically, it takes a few days to a couple of weeks for the county recorder's office to process and return the recorded deed. You can usually check the status by contacting the office directly.

Documents used along the form

When dealing with property transactions in California, several forms and documents often accompany the California Deed form. Each of these documents plays a crucial role in ensuring a smooth transfer of ownership and compliance with state regulations.

- Grant Deed: This document transfers ownership of real estate and provides certain guarantees about the property. It ensures that the seller has not sold the property to anyone else and that there are no undisclosed liens.

- Quitclaim Deed: This form allows a person to transfer their interest in a property without making any guarantees about the title. It is often used between family members or in divorce settlements.

- Title Insurance Policy: This policy protects the buyer from any future claims against the property’s title. It ensures that the buyer has clear ownership and can defend against any disputes.

- Preliminary Change of Ownership Report: This form is required by the county assessor’s office when a property changes hands. It helps assess the property’s value for tax purposes.

- Divorce Settlement Agreement: This document details the terms of divorce, including asset division and support obligations, streamlining the legal process for both parties, and can be found in All Washington Forms.

- Property Transfer Disclosure Statement: Sellers must provide this document to inform buyers about the condition of the property and any known issues. It promotes transparency in the transaction.

- Affidavit of Death: If the property is being transferred due to the death of an owner, this document verifies the death and the rightful heirs to the property.

- Escrow Instructions: These are detailed guidelines that outline how the transaction should be handled by the escrow company. They ensure that all parties understand their responsibilities.

- Loan Documents: If financing is involved, various loan documents will be necessary. These outline the terms of the mortgage and the obligations of the borrower.

Understanding these accompanying documents can help you navigate the property transfer process more effectively. Each plays a vital role in protecting your interests and ensuring compliance with California laws.

Misconceptions

Understanding the California Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions about the California Deed form, along with clarifications.

-

All deeds are the same.

Different types of deeds serve various purposes. For example, a grant deed offers different protections than a quitclaim deed.

-

A deed must be notarized to be valid.

While notarization is recommended, certain deeds may still be valid without it, depending on specific circumstances.

-

Once a deed is recorded, it cannot be changed.

While the original deed remains unchanged, property owners can create new deeds to amend or clarify ownership.

-

Only an attorney can prepare a deed.

While legal assistance is beneficial, individuals can prepare their own deeds if they understand the necessary requirements.

-

All deeds need to be filed with the county.

Recording a deed is not mandatory but is highly advisable to protect ownership rights against future claims.

-

Deeds are only for transferring ownership.

Deeds can also be used to clarify interests, such as adding or removing a co-owner.

-

Once signed, a deed is effective immediately.

A deed becomes effective only when it is delivered to the grantee, not merely upon signing.

-

All property transfers require a deed.

Some transfers, such as those between spouses or through inheritance, may not require a formal deed.

-

Deeds are only relevant during a sale.

Deeds play a crucial role in various situations, including gifting property or transferring assets into a trust.

-

There is only one type of California Deed form.

California has multiple deed forms, including grant deeds, quitclaim deeds, and warranty deeds, each serving different needs.

Clarifying these misconceptions can help individuals navigate property transactions with greater confidence and understanding. Always consider seeking professional advice for specific situations.