California Deed in Lieu of Foreclosure Document

In California, homeowners facing financial difficulties may consider the Deed in Lieu of Foreclosure as a viable alternative to the lengthy and often stressful foreclosure process. This legal document allows a homeowner to voluntarily transfer the ownership of their property back to the lender, effectively settling the mortgage debt without the need for foreclosure proceedings. By signing this form, the homeowner relinquishes their rights to the property, while the lender agrees to accept the deed in exchange for releasing the homeowner from the mortgage obligation. This arrangement can benefit both parties; the homeowner can avoid the negative impact of foreclosure on their credit score, and the lender can expedite the process of reclaiming the property. Additionally, a Deed in Lieu of Foreclosure may help homeowners avoid the costs associated with foreclosure, such as legal fees and property maintenance. Understanding the requirements and implications of this form is essential for anyone considering this option, as it involves specific conditions and potential consequences that must be carefully evaluated.

Discover More Deed in Lieu of Foreclosure Forms for Different States

Foreclosure Vs Deed in Lieu - The process may involve negotiations over any potential liabilities or claims.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - Completion of the Deed in Lieu form begins a formal transition of property ownership.

Filling out the Ohio Living Will form is an essential process for ensuring that your medical preferences are documented and honored. By completing this legal document, individuals can communicate their desires regarding medical treatment and end-of-life care. For more resources on this process, you can visit All Ohio Forms to find the appropriate templates and guidance.

Deed in Lieu of Foreclosure Texas - Homeowners must ensure they are making an informed choice before pursuing this route.

Deed in Lieu of Foreclosure Sample - This form signals the end of the borrower’s responsibility for the mortgage note.

Similar forms

The Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. Several other documents share similarities with this form, primarily in their purpose of addressing property ownership and debt obligations. Here are five such documents:

- Short Sale Agreement: This document involves the sale of a property for less than the amount owed on the mortgage. Like a Deed in Lieu of Foreclosure, it allows the homeowner to avoid foreclosure, but it requires a buyer and often involves a real estate transaction.

- Trailer Bill of Sale: The Bill of Sale for Trailers is crucial for documenting the ownership transfer of a trailer, safeguarding both the buyer and seller by ensuring a clear record of the transaction.

- Mortgage Modification Agreement: This document modifies the terms of an existing mortgage to make payments more manageable for the homeowner. While it does not transfer ownership, it serves a similar purpose by helping the homeowner retain their property and avoid foreclosure.

- Forbearance Agreement: In this document, a lender agrees to temporarily suspend or reduce mortgage payments. This arrangement allows homeowners to catch up on their payments without losing their property, similar to the Deed in Lieu of Foreclosure, which seeks to prevent foreclosure altogether.

- Repayment Plan: This agreement outlines a plan for a borrower to repay missed mortgage payments over time. Like the Deed in Lieu of Foreclosure, it aims to keep the homeowner in their home while addressing outstanding debts.

- Bankruptcy Filing: Filing for bankruptcy can provide relief from foreclosure by temporarily halting the process. While it is a more complex legal procedure, it shares the goal of protecting the homeowner from losing their property due to unpaid debts.

Document Example

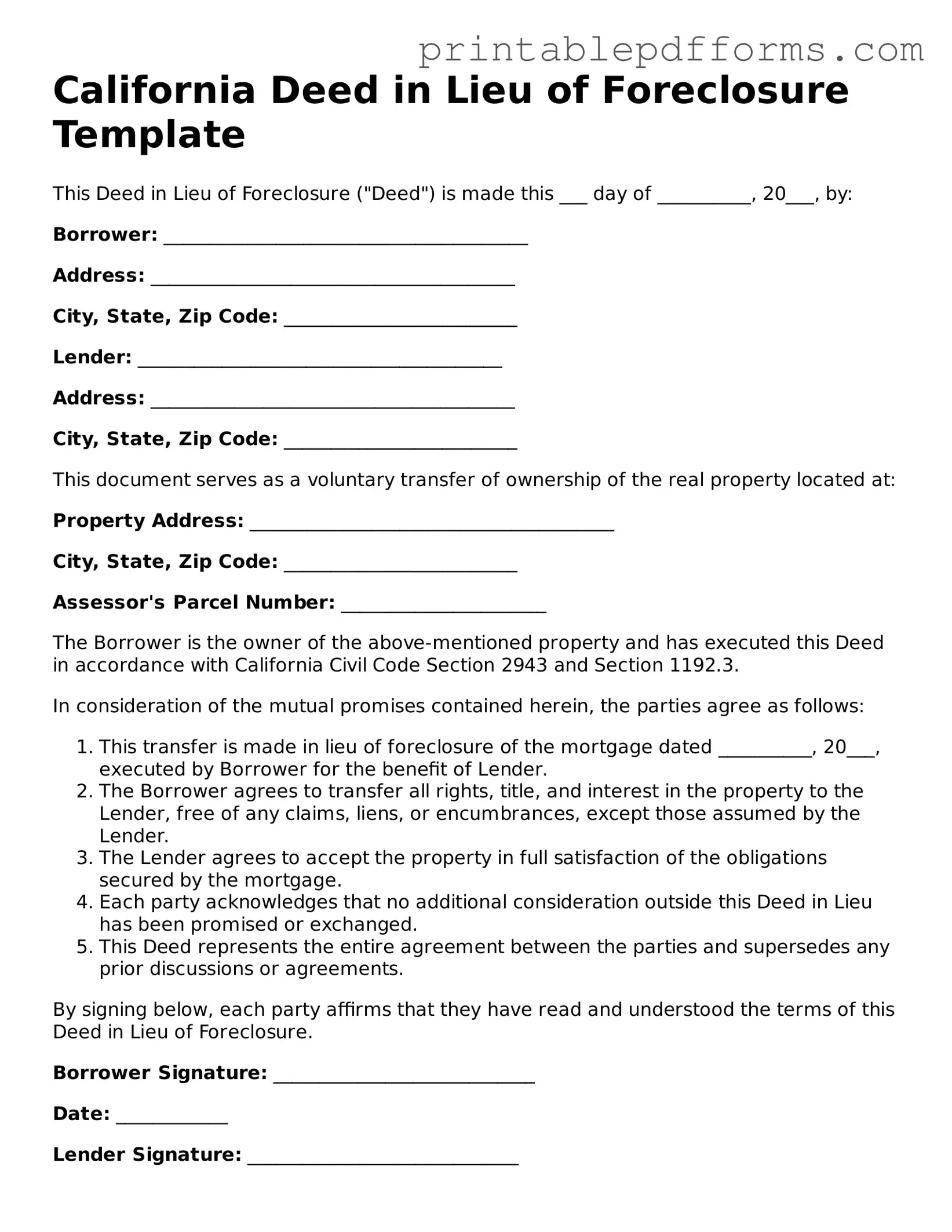

California Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made this ___ day of __________, 20___, by:

Borrower: _______________________________________

Address: _______________________________________

City, State, Zip Code: _________________________

Lender: _______________________________________

Address: _______________________________________

City, State, Zip Code: _________________________

This document serves as a voluntary transfer of ownership of the real property located at:

Property Address: _______________________________________

City, State, Zip Code: _________________________

Assessor's Parcel Number: ______________________

The Borrower is the owner of the above-mentioned property and has executed this Deed in accordance with California Civil Code Section 2943 and Section 1192.3.

In consideration of the mutual promises contained herein, the parties agree as follows:

- This transfer is made in lieu of foreclosure of the mortgage dated __________, 20___, executed by Borrower for the benefit of Lender.

- The Borrower agrees to transfer all rights, title, and interest in the property to the Lender, free of any claims, liens, or encumbrances, except those assumed by the Lender.

- The Lender agrees to accept the property in full satisfaction of the obligations secured by the mortgage.

- Each party acknowledges that no additional consideration outside this Deed in Lieu has been promised or exchanged.

- This Deed represents the entire agreement between the parties and supersedes any prior discussions or agreements.

By signing below, each party affirms that they have read and understood the terms of this Deed in Lieu of Foreclosure.

Borrower Signature: ____________________________

Date: ____________

Lender Signature: _____________________________

Date: ____________

This Deed shall be recorded in the County Recorder's Office of ______________ County, California.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | This process is governed by California Civil Code Section 2943. |

| Eligibility | Homeowners must be experiencing financial hardship and unable to make mortgage payments. |

| Benefits | It can help homeowners avoid the lengthy foreclosure process and may have less impact on credit scores. |

| Process | The homeowner must negotiate with the lender and submit a formal request for the deed in lieu of foreclosure. |

| Documentation | Required documents typically include a hardship letter, financial statements, and the deed itself. |

| Potential Risks | Homeowners may still face tax implications or deficiency judgments if the property value is less than the mortgage balance. |

| Alternatives | Other options include loan modification, short sale, or filing for bankruptcy, depending on individual circumstances. |

Crucial Questions on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender. This is typically done to avoid the lengthy and costly foreclosure process. In this arrangement, the homeowner hands over the deed to the property, and in return, the lender may agree to forgive the remaining mortgage debt. This option can be beneficial for both parties, as it can save time and reduce financial losses associated with foreclosure.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several advantages to opting for a Deed in Lieu of Foreclosure:

- Avoiding Foreclosure: The process is generally quicker and less stressful than foreclosure.

- Debt Forgiveness: Homeowners may have their remaining mortgage balance forgiven, relieving them of financial burden.

- Less Damage to Credit: While it still impacts credit scores, it may be less damaging than a foreclosure.

- Potential for Relocation Assistance: Some lenders offer financial assistance to help homeowners move after the transfer.

Are there any eligibility requirements for a Deed in Lieu of Foreclosure?

Yes, there are specific criteria that homeowners typically need to meet to qualify for a Deed in Lieu of Foreclosure. These may include:

- The homeowner must be experiencing financial hardship, such as job loss or medical expenses.

- The property must be the homeowner's primary residence.

- The homeowner must be current on mortgage payments or in default.

- The property must not have other liens or debts that could complicate the transfer.

It is essential to communicate openly with the lender to determine if you meet their specific requirements.

How does the process work?

The process for executing a Deed in Lieu of Foreclosure generally involves several steps:

- Contact the Lender: Homeowners should reach out to their lender to express their interest in a Deed in Lieu.

- Submit Documentation: The lender will likely require financial information and documentation to assess the homeowner's situation.

- Negotiate Terms: If approved, the homeowner and lender will negotiate the terms of the deed transfer, including any potential debt forgiveness.

- Complete the Deed Transfer: Once terms are agreed upon, the homeowner signs the deed, transferring ownership to the lender.

- Finalize the Process: The lender will record the deed with the appropriate county office, completing the transaction.

What should homeowners consider before proceeding with a Deed in Lieu of Foreclosure?

Before deciding on a Deed in Lieu of Foreclosure, homeowners should carefully consider several factors:

- Impact on Credit Score: While it may be less damaging than foreclosure, it will still negatively affect credit ratings.

- Tax Implications: Homeowners may face tax consequences if the lender forgives any debt, as it could be considered taxable income.

- Future Housing Options: A Deed in Lieu may limit future homeownership opportunities for a period.

- Legal Advice: Consulting with a legal or financial advisor can provide valuable insights and help navigate the complexities of the process.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in California, several other forms and documents may be necessary to complete the process. These documents help clarify the terms and conditions of the agreement and ensure that all parties understand their rights and responsibilities. Below is a list of commonly used documents that accompany a Deed in Lieu of Foreclosure.

- Loan Modification Agreement: This document outlines the new terms of the loan, including changes to the interest rate, payment schedule, or loan amount. It is used when the lender agrees to modify the existing mortgage instead of proceeding with foreclosure.

- Trailer Bill of Sale: This essential document facilitates the transfer of trailer ownership, acting as a receipt for the transaction and necessary for registration in various states; you can find for the document.

- Notice of Default: This notice is typically filed by the lender to inform the borrower that they are in default on their mortgage payments. It serves as a formal warning before foreclosure proceedings begin.

- Release of Liability: This document releases the borrower from any further obligations related to the mortgage after the Deed in Lieu is executed. It ensures that the borrower will not be held responsible for any remaining debt.

- Property Inspection Report: Often required by lenders, this report assesses the condition of the property. It helps determine the property's value and whether any repairs are needed before the deed transfer.

- Title Report: This report provides information about the property’s ownership history and any liens or encumbrances. It is crucial for ensuring that the title can be transferred without issues.

- Settlement Statement: This document outlines the financial aspects of the transaction, including any closing costs, fees, and the final amounts paid by both parties. It ensures transparency in the financial dealings.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and their right to transfer the title. It is an important part of the documentation process for the Deed in Lieu of Foreclosure.

These documents play a vital role in the Deed in Lieu of Foreclosure process. Each one serves a specific purpose, helping to protect the interests of both the borrower and the lender. Understanding these forms can facilitate a smoother transaction and provide clarity during what can be a challenging time.

Misconceptions

When facing financial difficulties, homeowners often consider various options to avoid foreclosure. One such option is a Deed in Lieu of Foreclosure. However, several misconceptions surround this process. Understanding the truth behind these myths can help homeowners make informed decisions.

- Myth 1: A Deed in Lieu of Foreclosure is the same as a short sale.

- Myth 2: You can only pursue a Deed in Lieu of Foreclosure if you are already in foreclosure.

- Myth 3: A Deed in Lieu of Foreclosure eliminates all debt associated with the mortgage.

- Myth 4: The process is quick and easy.

This is not true. In a short sale, the homeowner sells the property for less than the mortgage balance, and the lender agrees to accept this reduced amount. In contrast, a Deed in Lieu of Foreclosure involves the homeowner voluntarily transferring the property title to the lender to avoid foreclosure. The two processes have different implications for credit scores and future homeownership.

Many believe that this option is only available once foreclosure proceedings have started. However, homeowners can initiate a Deed in Lieu of Foreclosure at any point during financial distress, even before the foreclosure process begins. This proactive approach may provide more favorable terms.

This misconception can lead to confusion. While a Deed in Lieu of Foreclosure can help relieve the burden of the mortgage, it does not automatically erase all debt. Depending on state laws and the lender's policies, the homeowner may still be responsible for any remaining deficiency balance unless specifically negotiated otherwise.

While a Deed in Lieu of Foreclosure can be quicker than a traditional foreclosure, it is not without its complexities. Homeowners must still navigate negotiations with their lender, complete necessary paperwork, and may need to provide financial documentation. The timeline can vary significantly based on individual circumstances and lender requirements.

By dispelling these misconceptions, homeowners can better understand their options and make decisions that align with their financial goals. Seeking professional guidance can also provide clarity and support throughout the process.