California Durable Power of Attorney Document

The California Durable Power of Attorney form is a crucial legal document that empowers individuals to appoint an agent to make financial and legal decisions on their behalf. This form is particularly significant for those who want to ensure their wishes are respected in the event they become incapacitated. It allows the designated agent to manage a wide range of financial matters, from handling bank accounts and paying bills to managing real estate transactions and making investment decisions. Importantly, the durable aspect of this power of attorney means that the authority granted to the agent remains effective even if the principal becomes mentally or physically unable to make decisions. Additionally, the form can be tailored to fit specific needs, allowing individuals to grant broad or limited powers. Understanding the nuances of this document is essential for anyone looking to secure their financial future and ensure that their affairs are managed according to their preferences.

Discover More Durable Power of Attorney Forms for Different States

How to Get Power of Attorney in Ohio - It gives the principal significant control over who makes decisions on their behalf, reflecting their personal preferences.

In addition to understanding the basic functionality of a Quitclaim Deed, it is essential to familiarize yourself with the necessary forms for a seamless transaction; for more information, you can visit All Ohio Forms which provides comprehensive resources for property transfer documentation in Ohio.

Durable Power of Attorney Pa - This document is designed to empower you to make decisions about your future.

Similar forms

The Durable Power of Attorney (DPOA) is a crucial legal document that allows one person to make decisions on behalf of another, particularly in financial and health matters. Several other documents serve similar purposes, providing a framework for decision-making when individuals are unable to act on their own. Here are eight documents that share similarities with the DPOA:

- General Power of Attorney: Like the DPOA, this document allows one person to act on behalf of another. However, it typically becomes void if the principal becomes incapacitated.

- Medical Power of Attorney: When unable to make healthcare decisions, having a well-prepared comprehensive Medical Power of Attorney document ensures your wishes regarding medical treatment are respected.

- Healthcare Power of Attorney: This document specifically grants authority to make medical decisions for someone who is unable to do so. It focuses on health-related matters, unlike the DPOA, which can cover broader financial decisions.

- Living Will: While not a power of attorney, a living will outlines an individual's wishes regarding medical treatment in situations where they cannot express their preferences. It complements a healthcare power of attorney.

- Advance Healthcare Directive: This combines elements of a living will and a healthcare power of attorney, allowing individuals to specify their medical treatment preferences and appoint a decision-maker.

- Financial Power of Attorney: Similar to the DPOA, this document specifically grants authority to manage financial matters. It may be limited to certain transactions or accounts.

- Trust: A trust can manage assets for the benefit of another person. While it does not function exactly like a power of attorney, it allows a trustee to make decisions about the trust assets on behalf of the beneficiaries.

- Guardianship: This legal arrangement appoints someone to care for an individual who is unable to make decisions for themselves. It is often used for minors or incapacitated adults, similar to how a DPOA functions for adults.

- Conservatorship: This is a court-appointed role that allows an individual to manage the financial affairs of someone who cannot do so. Like a DPOA, it is intended for situations where the individual is unable to manage their own affairs.

Document Example

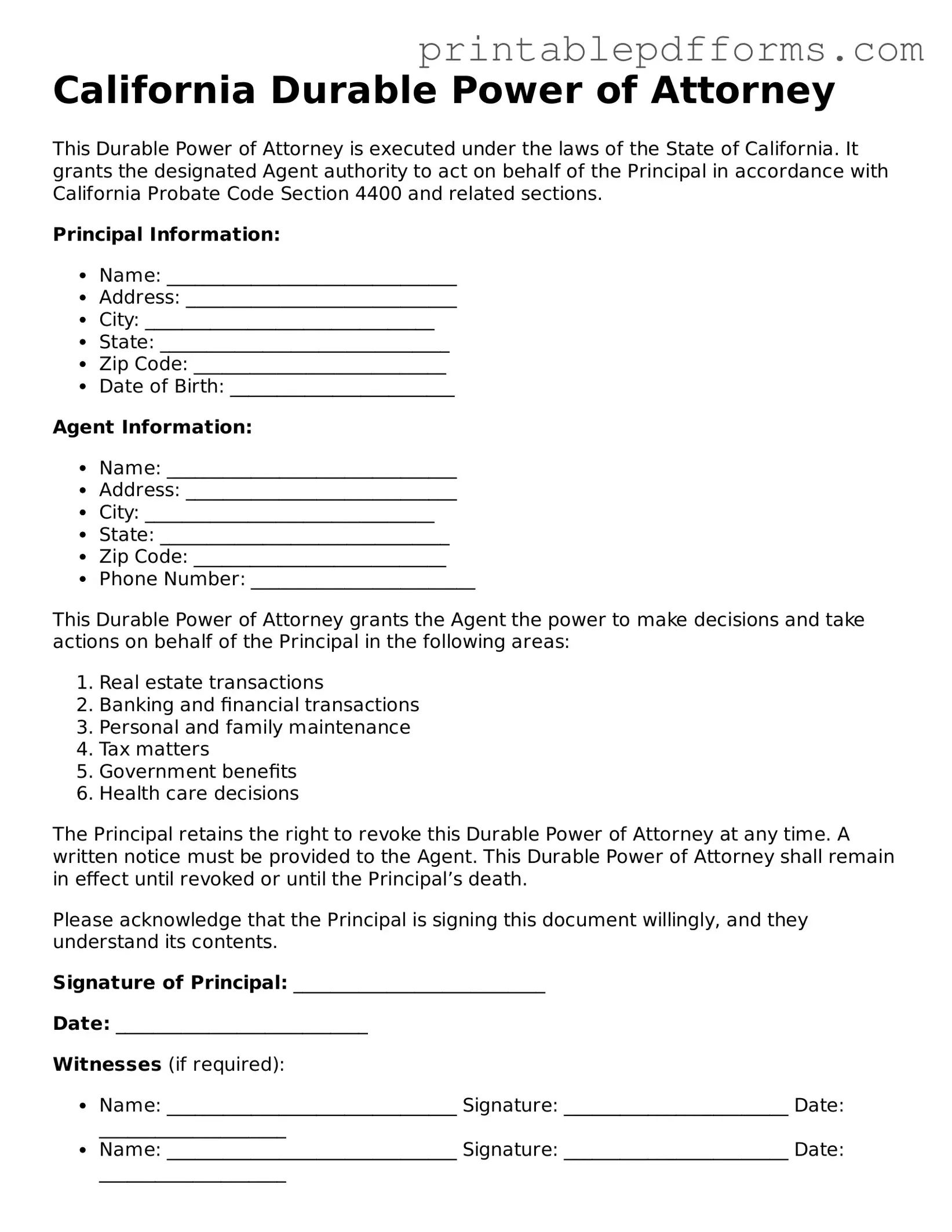

California Durable Power of Attorney

This Durable Power of Attorney is executed under the laws of the State of California. It grants the designated Agent authority to act on behalf of the Principal in accordance with California Probate Code Section 4400 and related sections.

Principal Information:

- Name: _______________________________

- Address: _____________________________

- City: _______________________________

- State: _______________________________

- Zip Code: ___________________________

- Date of Birth: ________________________

Agent Information:

- Name: _______________________________

- Address: _____________________________

- City: _______________________________

- State: _______________________________

- Zip Code: ___________________________

- Phone Number: ________________________

This Durable Power of Attorney grants the Agent the power to make decisions and take actions on behalf of the Principal in the following areas:

- Real estate transactions

- Banking and financial transactions

- Personal and family maintenance

- Tax matters

- Government benefits

- Health care decisions

The Principal retains the right to revoke this Durable Power of Attorney at any time. A written notice must be provided to the Agent. This Durable Power of Attorney shall remain in effect until revoked or until the Principal’s death.

Please acknowledge that the Principal is signing this document willingly, and they understand its contents.

Signature of Principal: ___________________________

Date: ___________________________

Witnesses (if required):

- Name: _______________________________ Signature: ________________________ Date: ____________________

- Name: _______________________________ Signature: ________________________ Date: ____________________

This document has been prepared according to the requirements of California law.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A California Durable Power of Attorney allows an individual to designate someone else to make financial and legal decisions on their behalf. |

| Governing Law | This form is governed by the California Probate Code, specifically sections 4400 to 4465. |

| Durability | The durable aspect means that the authority remains effective even if the principal becomes incapacitated. |

| Principal | The person creating the power of attorney is known as the principal. |

| Agent | The individual designated to act on behalf of the principal is referred to as the agent or attorney-in-fact. |

| Signature Requirement | The principal must sign the document for it to be valid, and it may also require notarization or witness signatures. |

| Scope of Authority | The form can grant broad or limited powers, depending on the principal's wishes as outlined in the document. |

| Revocation | The principal can revoke the durable power of attorney at any time, as long as they are mentally competent. |

| Agent's Duties | The agent has a fiduciary duty to act in the best interests of the principal, managing their affairs responsibly. |

| Limitations | Some powers, such as those related to health care decisions, may require a separate document, like an advance health care directive. |

Crucial Questions on This Form

What is a California Durable Power of Attorney?

A California Durable Power of Attorney is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their affairs can be managed without interruption.

What decisions can an agent make under a Durable Power of Attorney?

The agent can be granted a wide range of powers, which may include:

- Managing financial accounts and transactions

- Handling real estate transactions

- Making healthcare decisions

- Paying bills and managing debts

- Filing taxes and managing benefits

The specific powers granted can be tailored to the principal's needs and preferences, allowing for flexibility in how the agent can act.

How do I create a Durable Power of Attorney in California?

To create a Durable Power of Attorney in California, follow these steps:

- Choose a trusted individual to act as your agent.

- Obtain a Durable Power of Attorney form. These can often be found online or through legal resources.

- Clearly outline the powers you wish to grant your agent.

- Sign the document in the presence of a notary public or two witnesses, as required by California law.

Once completed, provide copies of the document to your agent and any relevant institutions, such as banks or healthcare providers.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent and any institutions that have a copy of the original document. It is advisable to keep a record of the revocation for your own reference.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your loved ones may need to go through a court process to obtain guardianship or conservatorship. This can be time-consuming and may not reflect your wishes. Having a Durable Power of Attorney in place helps avoid this situation and ensures that your preferences are honored.

Is a Durable Power of Attorney the same as a Healthcare Power of Attorney?

No, a Durable Power of Attorney primarily focuses on financial and legal matters, while a Healthcare Power of Attorney specifically addresses medical decisions. However, you can create both documents to ensure comprehensive coverage of your wishes regarding both financial and healthcare decisions. It is important to clearly specify the powers in each document to avoid any confusion.

Documents used along the form

When considering a California Durable Power of Attorney (DPOA), it's important to understand that this document often works in conjunction with several other forms. Each of these documents plays a crucial role in ensuring that your wishes are honored and that your affairs are managed according to your preferences. Below is a list of commonly associated forms and documents.

- Advance Healthcare Directive: This document allows you to outline your healthcare preferences and appoint someone to make medical decisions on your behalf if you become unable to do so. It ensures that your medical treatment aligns with your values and wishes.

- Living Trust: A living trust is a legal arrangement where you place your assets into a trust during your lifetime. It helps avoid probate and allows for the seamless transfer of assets to your beneficiaries upon your death, while also providing for management of your assets if you become incapacitated.

- Will: A will is a legal document that outlines how your assets should be distributed after your death. It allows you to designate guardians for minor children and specify your wishes regarding funeral arrangements, ensuring your intentions are clear and legally binding.

- Motor Vehicle Bill of Sale: This essential document facilitates the transfer of ownership of a motor vehicle and includes important details about the transaction. For your convenience, you can access the Motor Vehicle Bill of Sale form to ensure a smooth transfer process.

- HIPAA Release Form: This form allows you to authorize the release of your medical information to designated individuals. It ensures that your healthcare providers can share necessary information with those you trust, especially during emergencies or when you are unable to communicate.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically grants someone the authority to manage your financial affairs. It can be broad or limited in scope, depending on your needs, and is particularly useful for handling transactions and making financial decisions on your behalf.

Understanding these documents can empower individuals to make informed decisions about their future and ensure their preferences are respected. Each form serves a unique purpose, and together, they create a comprehensive plan for managing both health and financial matters.

Misconceptions

Understanding the California Durable Power of Attorney (DPOA) is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- Misconception 1: A DPOA is only for financial matters.

- Misconception 2: A DPOA is only valid while the principal is alive.

- Misconception 3: You cannot change or revoke a DPOA once it is signed.

- Misconception 4: All DPOAs are the same and have the same powers.

- Misconception 5: A DPOA can only be created by an attorney.

- Misconception 6: The agent can do anything they want with the principal's assets.

- Misconception 7: A DPOA is not necessary if you have a will.

- Misconception 8: Once a DPOA is in effect, the principal loses all control over their affairs.

This is not true. While many use a DPOA for financial decisions, it can also cover health care decisions if specified in the document.

A Durable Power of Attorney remains valid even if the principal becomes incapacitated. This is what makes it "durable."

This is false. A principal can revoke or change their DPOA at any time, as long as they are competent to do so.

Not all DPOAs are identical. The powers granted can vary widely based on the specific language and provisions included in the document.

While it's advisable to consult an attorney, individuals can create a DPOA themselves using the appropriate forms, as long as they meet state requirements.

The agent must act in the best interest of the principal and follow the guidelines set forth in the DPOA. They have a fiduciary duty to act responsibly.

A will only takes effect after death. A DPOA is essential for managing affairs while the principal is still alive but incapacitated.

This is incorrect. The principal can still make decisions and manage their affairs as long as they are competent, even if a DPOA is in place.