California Gift Deed Document

The California Gift Deed form serves as a vital legal instrument for individuals wishing to transfer property ownership without monetary exchange. This document facilitates the process of gifting real estate, ensuring that the transfer is clear, legally binding, and compliant with state laws. It typically includes essential details such as the names of the donor and recipient, a description of the property being gifted, and any specific terms or conditions associated with the transfer. Importantly, the Gift Deed must be signed by the donor in the presence of a notary public, which helps to prevent disputes and confirm the donor's intent. Additionally, while the recipient does not need to sign the deed, it is crucial for the transfer to be recorded with the county recorder’s office to provide public notice of the change in ownership. Understanding the nuances of the Gift Deed form can help individuals navigate the complexities of property transfers in California, ensuring that their intentions are honored and legally recognized.

Discover More Gift Deed Forms for Different States

Texas Gift Deed Form - Gift Deeds can play a role in minimizing the complexity of probate processes.

In order to ensure smooth and legal transactions, it is essential for buyers and sellers in Washington to utilize the appropriate documentation, such as the Washington Bill of Sale form. This critical document not only records the details of the transaction but also serves as proof of the sale, safeguarding both parties involved. For those looking to simplify this process, consider accessing All Washington Forms to fill out your necessary paperwork efficiently.

Similar forms

- Quitclaim Deed: This document transfers ownership of property without any warranties. Like a Gift Deed, it allows the grantor to give up their interest in the property, making it a simple way to transfer ownership without a sale.

- Warranty Deed: This form provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. While a Gift Deed does not include such warranties, both documents serve to change ownership of real estate.

- Transfer on Death Deed: This document allows property owners to designate beneficiaries who will receive the property upon their death. Similar to a Gift Deed, it facilitates the transfer of property without going through probate.

- Deed of Trust: Often used in real estate transactions, this document secures a loan with the property as collateral. While it involves a financial transaction, both it and a Gift Deed involve the transfer of property rights.

- Bill of Sale: This document is used for transferring ownership of personal property, such as vehicles or equipment. Like a Gift Deed, it signifies a change in ownership, though it typically involves tangible items rather than real estate.

- Lease Agreement: While primarily a rental contract, a lease can include provisions for transferring rights to the property. Both documents establish an agreement regarding property use, though a Gift Deed permanently transfers ownership.

- Mobile Home Bill of Sale: This document serves to legally record the sale of a mobile home in Ohio, ensuring that ownership is properly transferred and documented. For more information, you can visit All Ohio Forms.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can facilitate the execution of a Gift Deed by enabling someone to sign on behalf of the grantor.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased property owner. While it doesn't transfer property directly, it can lead to a Gift Deed if heirs decide to gift property to one another.

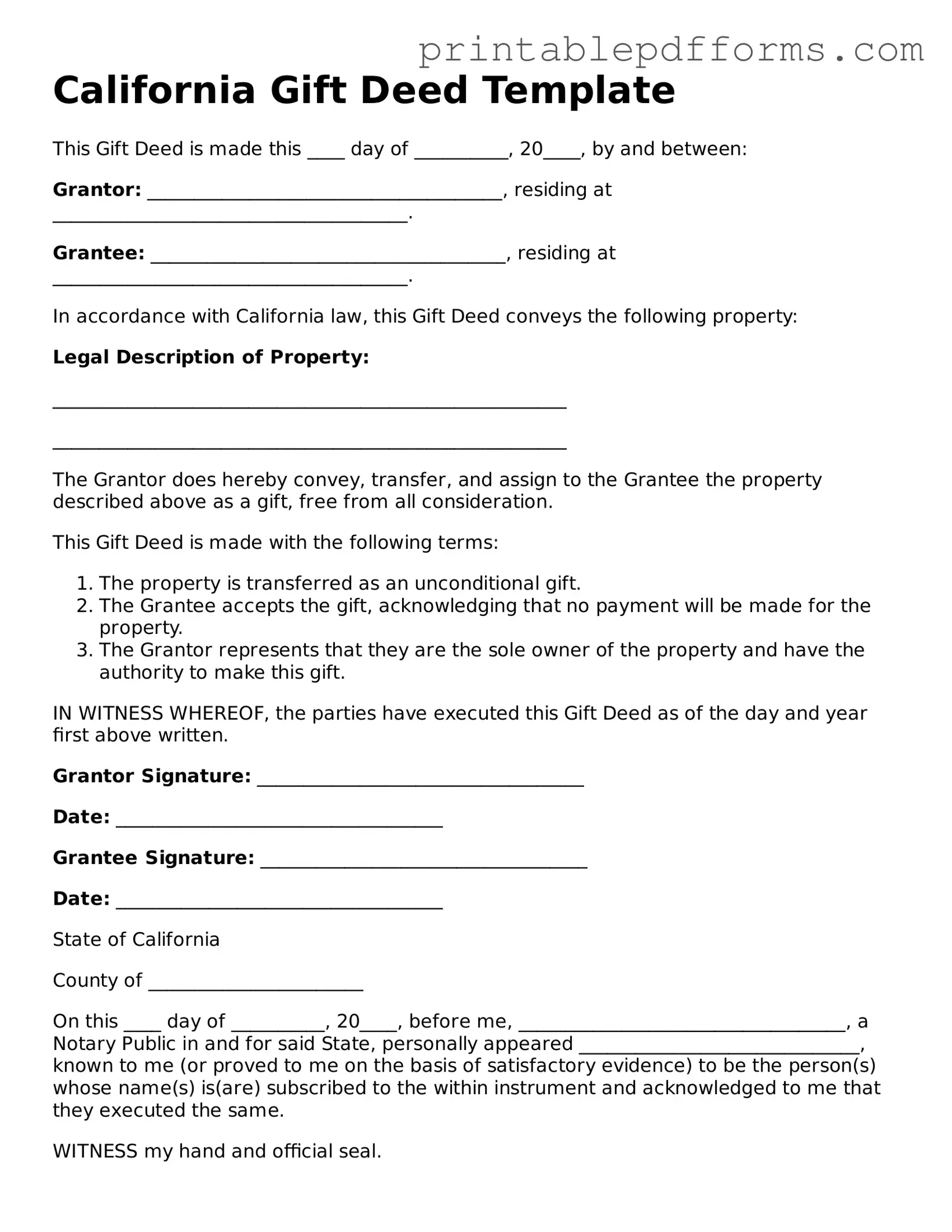

Document Example

California Gift Deed Template

This Gift Deed is made this ____ day of __________, 20____, by and between:

Grantor: ______________________________________, residing at ______________________________________.

Grantee: ______________________________________, residing at ______________________________________.

In accordance with California law, this Gift Deed conveys the following property:

Legal Description of Property:

_______________________________________________________

_______________________________________________________

The Grantor does hereby convey, transfer, and assign to the Grantee the property described above as a gift, free from all consideration.

This Gift Deed is made with the following terms:

- The property is transferred as an unconditional gift.

- The Grantee accepts the gift, acknowledging that no payment will be made for the property.

- The Grantor represents that they are the sole owner of the property and have the authority to make this gift.

IN WITNESS WHEREOF, the parties have executed this Gift Deed as of the day and year first above written.

Grantor Signature: ___________________________________

Date: ___________________________________

Grantee Signature: ___________________________________

Date: ___________________________________

State of California

County of _______________________

On this ____ day of __________, 20____, before me, ___________________________________, a Notary Public in and for said State, personally appeared ______________________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is(are) subscribed to the within instrument and acknowledged to me that they executed the same.

WITNESS my hand and official seal.

Notary Public Signature: ___________________________________

My Commission Expires: _________________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any payment involved. |

| Governing Law | The California Gift Deed is governed by California Civil Code Section 11911. |

| Eligibility | Any property owner can use a Gift Deed to transfer their property to another individual or entity. |

| Consideration | No monetary consideration is required; the transfer is made voluntarily and without compensation. |

| Tax Implications | Gift transfers may have tax implications for both the giver and the recipient, including potential gift tax liabilities. |

| Recording Requirement | The Gift Deed must be recorded with the county recorder's office to be legally effective against third parties. |

| Signature Requirement | The deed must be signed by the donor (the person giving the gift) to be valid. |

| Witnesses | While not always required, having witnesses sign the Gift Deed can strengthen its validity. |

| Revocability | Once executed and delivered, a Gift Deed is generally irrevocable unless specific conditions allow for revocation. |

| Legal Advice | It is advisable to seek legal counsel when preparing a Gift Deed to ensure compliance with all legal requirements. |

Crucial Questions on This Form

What is a California Gift Deed?

A California Gift Deed is a legal document used to transfer property ownership from one person to another without any exchange of money. This type of deed is often used when a property owner wishes to give their property as a gift to a family member or friend. The gift deed must be signed by the donor (the person giving the gift) and typically needs to be notarized to be valid.

How do I complete a Gift Deed in California?

Completing a Gift Deed involves several steps:

- Gather necessary information, including the names of the donor and recipient, property description, and the county where the property is located.

- Obtain a California Gift Deed form, which can be found online or at local legal stationery stores.

- Fill out the form accurately, ensuring all details are correct.

- Have the donor sign the deed in front of a notary public.

- File the completed deed with the county recorder's office where the property is located.

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications when transferring property as a gift. The donor may need to file a gift tax return if the value of the gift exceeds the annual exclusion limit set by the IRS. However, gifts below this limit typically do not incur taxes. It is advisable to consult a tax professional for guidance on specific situations and to ensure compliance with all tax regulations.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and recorded, it is generally considered final. However, if the donor wishes to revoke the gift, they may need to take legal steps, such as creating a new deed that explicitly states the revocation. It's important to seek legal advice in these situations to understand the options available.

What if the recipient of the Gift Deed is a minor?

If the recipient of the Gift Deed is a minor, the gift can still be made, but there are additional considerations. Typically, a guardian or custodian will need to manage the property until the minor reaches legal age. It's essential to consult with a legal professional to ensure the proper steps are taken to protect the minor's interests.

Documents used along the form

When it comes to transferring property as a gift in California, the Gift Deed form is just one piece of the puzzle. Several other documents often accompany this form to ensure a smooth and legally sound transfer. Below is a list of essential forms and documents that may be required or beneficial in conjunction with the California Gift Deed.

- Grant Deed: This document is used to transfer real property and guarantees that the property has not been sold to anyone else. It’s often used in conjunction with a Gift Deed to provide additional legal assurance.

- Quitclaim Deed: A Quitclaim Deed transfers any interest the grantor has in the property without making any guarantees about the title. This can be useful in informal gift situations.

- Title Insurance Policy: This document protects the buyer against any title issues that may arise after the transfer. It’s a good idea to have this in place to safeguard against potential claims.

- Property Tax Transfer Form: This form informs the local tax assessor's office about the property transfer, which may affect property tax assessments and exemptions.

- Affidavit of Value: This document provides information about the value of the property being gifted. It may be necessary for tax purposes and helps establish the fair market value.

- Quitclaim Deed: To ensure safe property transfers when titles are uncertain, consider using our essential Quitclaim Deed template for Missouri to streamline the process.

- Gift Tax Return (Form 709): If the value of the gift exceeds the annual exclusion limit, the donor may need to file this federal tax form to report the gift.

- Beneficiary Designation Form: If the property is part of a trust or estate plan, this form may be needed to designate who will receive the property upon the donor's passing.

- Power of Attorney: If the donor cannot be present to sign the Gift Deed, a Power of Attorney allows another person to sign on their behalf, ensuring the transfer can still occur.

- Escrow Instructions: If the transfer involves an escrow process, these instructions outline how the transaction will be handled, including payment and document exchange details.

Each of these documents plays a crucial role in the gift property transfer process. Understanding their purpose can help ensure that the transfer is executed smoothly and in compliance with applicable laws. Always consider consulting with a professional to navigate these forms effectively.

Misconceptions

Understanding the California Gift Deed form is essential for anyone considering gifting property. However, several misconceptions can lead to confusion. Here are five common misconceptions:

-

Gift Deeds are only for family members.

While many people use gift deeds to transfer property to family, they can also be used for friends or charitable organizations. The key factor is the intent to gift the property without expecting anything in return.

-

A Gift Deed does not require any formalities.

Some believe that a gift deed can be created informally. However, it must be in writing, signed by the donor, and notarized to be legally valid.

-

Gift Deeds are irrevocable.

While a gift deed generally transfers ownership, the donor can retain certain rights or conditions. In some cases, it may be possible to revoke the gift if specific terms are included in the deed.

-

There are no tax implications with Gift Deeds.

Many people think that gifting property is tax-free. However, the IRS may impose gift taxes if the value exceeds a certain threshold. It is important to consult a tax professional to understand potential liabilities.

-

A Gift Deed automatically transfers all property rights.

While a gift deed transfers ownership, it does not necessarily transfer all rights related to the property, such as easements or liens. It’s crucial to clarify what rights are included in the transfer.