California Last Will and Testament Document

Creating a Last Will and Testament is an essential step in ensuring that your wishes are respected after your passing, especially in California, where specific legal requirements must be met. This document serves as a formal declaration of how you want your assets distributed and who will take care of any minor children. The California Last Will and Testament form includes key components such as the identification of the testator (the person making the will), a clear statement revoking any previous wills, and the appointment of an executor who will manage the estate. Additionally, it outlines beneficiaries, detailing who will receive specific assets and how they will be divided. This form must be signed and witnessed according to California law to be considered valid, ensuring that your intentions are carried out smoothly. Understanding these elements is crucial for anyone looking to create a will that reflects their personal wishes and provides peace of mind for their loved ones.

Discover More Last Will and Testament Forms for Different States

Florida Will Pdf Free - A heartfelt declaration that can honor relationships and life achievements through inheritance.

For those looking to navigate legal agreements, our guide on how to use a Hold Harmless Agreement effectively can be invaluable. This form not only clarifies responsibilities but also safeguards against unforeseen liabilities. To explore this crucial resource, visit the important Hold Harmless Agreement procedures.

How to Create a Will in Pa - A way to document personal wishes alongside legal directives.

Free Will Kit Ohio - Promotes thoughtful planning rather than leaving matters to chance or assumption.

Can I Create My Own Will - Designates an executor responsible for managing the estate after the individual passes away.

Similar forms

The Last Will and Testament is an important legal document that outlines how a person's assets and affairs should be handled after their passing. Several other documents serve similar purposes, ensuring that individual wishes are respected and followed. Below are seven documents that share similarities with a Last Will and Testament:

- Living Will: This document specifies an individual's preferences for medical treatment in situations where they cannot communicate their wishes. Like a Last Will, it provides guidance on personal decisions, but it focuses on health care rather than asset distribution.

- Durable Power of Attorney: This allows someone to make financial or legal decisions on behalf of another person if they become incapacitated. Similar to a Last Will, it ensures that a person's wishes are honored, especially regarding their financial matters.

- Health Care Proxy: This document designates someone to make medical decisions for an individual if they are unable to do so themselves. It parallels a Last Will in that it addresses personal choices and preferences regarding care and treatment.

- Trust: A trust holds assets for the benefit of specific individuals or entities. It can be similar to a Last Will in that it outlines how and when assets will be distributed, often avoiding probate and providing more control over the distribution process.

- Letter of Intent: This informal document expresses a person's wishes regarding their estate or funeral arrangements. While not legally binding like a Last Will, it serves as a guide for loved ones, much like the directives found in a will.

- Traffic Crash Report Form: The Ohio Traffic Crash Report form, designated as OH-1, captures essential details of traffic incidents, facilitating thorough investigations and safety improvements. For more information, visit All Ohio Forms.

- Codicil: A codicil is an amendment to an existing will. It allows changes to be made without creating an entirely new Last Will, ensuring that the individual's current wishes are reflected while maintaining the original document's validity.

- Beneficiary Designation: This document specifies who will receive certain assets, such as life insurance policies or retirement accounts. Similar to a Last Will, it directs the distribution of assets but operates outside of probate, often taking effect immediately upon death.

Document Example

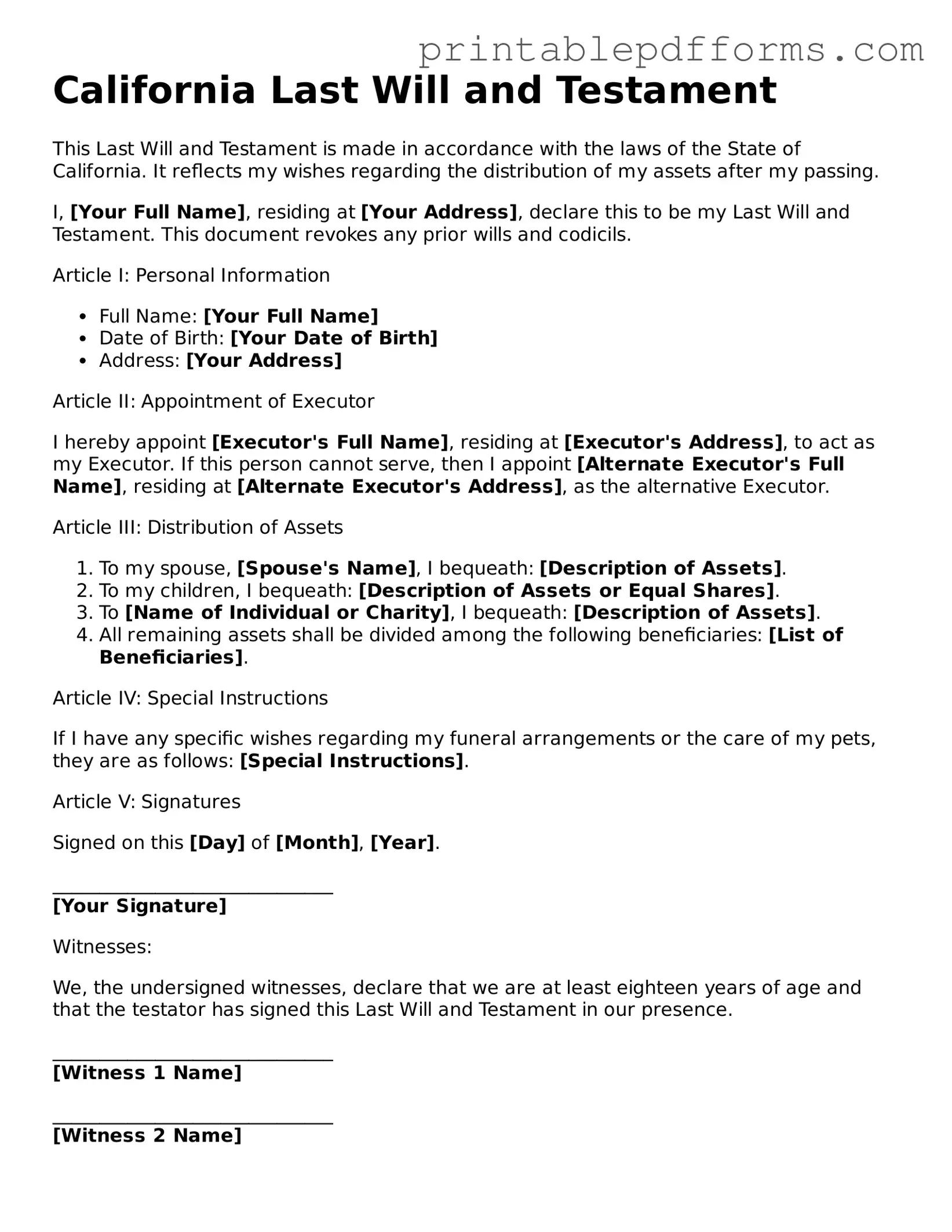

California Last Will and Testament

This Last Will and Testament is made in accordance with the laws of the State of California. It reflects my wishes regarding the distribution of my assets after my passing.

I, [Your Full Name], residing at [Your Address], declare this to be my Last Will and Testament. This document revokes any prior wills and codicils.

Article I: Personal Information

- Full Name: [Your Full Name]

- Date of Birth: [Your Date of Birth]

- Address: [Your Address]

Article II: Appointment of Executor

I hereby appoint [Executor's Full Name], residing at [Executor's Address], to act as my Executor. If this person cannot serve, then I appoint [Alternate Executor's Full Name], residing at [Alternate Executor's Address], as the alternative Executor.

Article III: Distribution of Assets

- To my spouse, [Spouse's Name], I bequeath: [Description of Assets].

- To my children, I bequeath: [Description of Assets or Equal Shares].

- To [Name of Individual or Charity], I bequeath: [Description of Assets].

- All remaining assets shall be divided among the following beneficiaries: [List of Beneficiaries].

Article IV: Special Instructions

If I have any specific wishes regarding my funeral arrangements or the care of my pets, they are as follows: [Special Instructions].

Article V: Signatures

Signed on this [Day] of [Month], [Year].

______________________________

[Your Signature]

Witnesses:

We, the undersigned witnesses, declare that we are at least eighteen years of age and that the testator has signed this Last Will and Testament in our presence.

______________________________

[Witness 1 Name]

______________________________

[Witness 2 Name]

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Governing Law | California Probate Code governs the creation and execution of wills in California. |

| Age Requirement | In California, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | California requires the will to be signed by at least two witnesses who are present at the same time. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Self-Proving Will | A self-proving will includes a notarized affidavit from the witnesses, simplifying the probate process. |

| Holographic Wills | California recognizes holographic wills, which are handwritten and do not require witnesses if the signature is present. |

| Executor Role | The executor is responsible for administering the estate according to the will's instructions. |

| Distribution of Assets | Assets are distributed according to the will's terms, unless there are overriding state laws or claims from heirs. |

Crucial Questions on This Form

What is a Last Will and Testament in California?

A Last Will and Testament is a legal document that outlines how a person's assets and property will be distributed after their death. It allows individuals to specify beneficiaries, appoint guardians for minor children, and name an executor to manage the estate. In California, having a valid will can help ensure that your wishes are followed and can simplify the probate process.

How do I create a valid Last Will and Testament in California?

To create a valid Last Will and Testament in California, you must meet the following requirements:

- You must be at least 18 years old.

- You must be of sound mind, meaning you understand the nature of making a will.

- The will must be in writing.

- It must be signed by you or by someone else at your direction and in your presence.

- At least two witnesses must sign the will, confirming that they witnessed you signing it or acknowledging your signature.

Can I change or revoke my Last Will and Testament?

Yes, you can change or revoke your Last Will and Testament at any time while you are alive. To make changes, you can create a new will or add a codicil, which is an amendment to the existing will. If you wish to revoke the will entirely, you can do so by destroying it or by explicitly stating your intention to revoke it in a new document.

What happens if I die without a will in California?

If you die without a will, you are considered to have died "intestate." In this case, California's intestacy laws will determine how your assets are distributed. Generally, your estate will go to your closest relatives, such as your spouse, children, or parents. However, this may not align with your wishes, making it important to have a will in place.

Do I need a lawyer to create a Last Will and Testament?

While it is not legally required to have a lawyer to create a Last Will and Testament in California, consulting one can be beneficial. A lawyer can help ensure that your will complies with state laws, accurately reflects your wishes, and addresses any complex issues, such as tax implications or the distribution of business interests.

How can I ensure my Last Will and Testament is safe and accessible?

To keep your Last Will and Testament safe and accessible, consider the following options:

- Store the original document in a secure location, such as a safe or a safety deposit box.

- Provide copies to trusted family members or your executor.

- Inform your loved ones about where the will is stored.

- Consider filing the will with the local probate court, which can help ensure it is accessible when needed.

Documents used along the form

When preparing a California Last Will and Testament, it is often helpful to consider additional documents that can support estate planning. These documents serve various purposes, ensuring that your wishes are respected and that your loved ones are taken care of after your passing.

- Living Trust: A living trust allows you to transfer assets into a trust during your lifetime. It helps avoid probate and can provide for your beneficiaries more quickly and privately.

- Durable Power of Attorney: This document gives someone the authority to manage your financial affairs if you become incapacitated. It ensures that your bills are paid and your assets are managed according to your wishes.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment in case you cannot communicate your wishes. It can include a living will and a healthcare power of attorney.

- Beneficiary Designations: Certain assets, like life insurance policies and retirement accounts, allow you to name beneficiaries directly. This ensures that these assets pass outside of probate.

- Letter of Intent: While not a legally binding document, a letter of intent can guide your executor or family members regarding your wishes for funeral arrangements and distribution of personal items.

- Guardianship Designation: If you have minor children, this document allows you to designate a guardian for them in the event of your death. It is crucial for ensuring their care aligns with your wishes.

- ATV Bill of Sale: Necessary for the transfer of ownership of an all-terrain vehicle in New York; for more information, visit https://nypdfforms.com/atv-bill-of-sale-form.

- Estate Inventory: This is a comprehensive list of your assets and liabilities. Keeping an updated inventory can help your executor manage your estate more efficiently.

Considering these documents alongside your Last Will and Testament can provide a more comprehensive approach to estate planning. Each document serves a unique purpose, helping to ensure your wishes are honored and your loved ones are protected.

Misconceptions

Many people have misunderstandings about the California Last Will and Testament form. These misconceptions can lead to confusion and potentially problematic situations for your estate planning. Here’s a list of six common misconceptions:

-

Only wealthy individuals need a will.

This is not true. Everyone, regardless of their financial situation, should have a will. A will ensures that your wishes are honored after your passing and that your loved ones are taken care of.

-

Handwritten wills are not valid.

While it is true that California does have specific requirements for wills, a handwritten will, also known as a holographic will, can be valid if it meets certain criteria. It must be in your own handwriting and signed by you.

-

Once a will is created, it cannot be changed.

This is a common misconception. You can update or revoke your will at any time, as long as you are of sound mind. Life changes, such as marriage, divorce, or the birth of a child, often necessitate updates to your will.

-

A will can avoid probate.

Unfortunately, this is not accurate. A will must go through the probate process, which is the legal procedure for validating a will and distributing assets. However, certain assets can be transferred outside of probate.

-

Only a lawyer can create a valid will.

While it is advisable to consult with a lawyer for complex estates, you can create a valid will on your own, provided you follow California’s legal requirements. There are also templates and resources available to assist you.

-

Wills are only for distributing assets.

While distributing assets is a primary function of a will, it can also address other important matters, such as appointing guardians for minor children and specifying your wishes regarding funeral arrangements.

Understanding these misconceptions can help you make informed decisions about your estate planning. It is always best to seek professional guidance to ensure your will accurately reflects your wishes and complies with the law.