California Loan Agreement Document

When engaging in a loan transaction in California, the Loan Agreement form serves as a crucial document that outlines the terms and conditions agreed upon by both the lender and the borrower. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. It also specifies the rights and responsibilities of each party, ensuring clarity and mutual understanding throughout the loan process. Additionally, the agreement may address collateral, if applicable, providing security for the lender in case of default. By incorporating provisions for late payments and default scenarios, the form aims to protect both parties while fostering a transparent lending relationship. Understanding the nuances of the California Loan Agreement form can empower individuals to navigate their financial commitments more effectively, making informed decisions that align with their needs and circumstances.

Discover More Loan Agreement Forms for Different States

Free Promissory Note Template Florida - Clarifies if the loan is fixed rate or variable rate.

For those looking to ensure a smooth transaction, understanding the essential aspects of the ATV Bill of Sale document is crucial. This important form provides both parties with the necessary legal protection and documentation. You can find a reliable template for this purpose at your comprehensive ATV Bill of Sale solution.

Promissory Note New York - May include provisions for early repayment and associated fees.

Similar forms

When dealing with financial agreements, it's helpful to understand how a Loan Agreement form relates to other documents. Here’s a list of seven similar documents, along with a brief explanation of each:

- Promissory Note: This is a written promise from the borrower to pay back a loan. It outlines the amount borrowed, interest rate, and repayment terms, similar to a Loan Agreement.

- Mortgage Agreement: This document secures a loan with property as collateral. Like a Loan Agreement, it includes terms about repayment but also specifies what happens if the borrower defaults.

- Credit Agreement: This outlines the terms of a credit line. It’s similar to a Loan Agreement in that it details the amount available to borrow and the repayment schedule.

- Lease Agreement: This contract allows one party to use another's property in exchange for payment. While it’s different in purpose, it shares the structure of outlining terms and conditions like a Loan Agreement.

- Partnership Agreement: This document governs the relationships and obligations between business partners. It resembles a Loan Agreement in that it clearly defines responsibilities and expectations.

- Bill of Sale: A Bill of Sale form is essential for documenting the transfer of property ownership. It plays a vital role in providing proof of transaction details between the buyer and seller for various items sold in Washington, and for more resources, visit All Washington Forms.

- Service Agreement: This outlines the terms under which services will be provided. Similar to a Loan Agreement, it specifies the obligations of each party, although it focuses on services rather than financial transactions.

- Sales Contract: This document details the terms of a sale of goods or services. Like a Loan Agreement, it includes important information about payment terms and conditions.

Understanding these documents can help you navigate financial agreements more effectively. Each serves a specific purpose but shares common elements with the Loan Agreement.

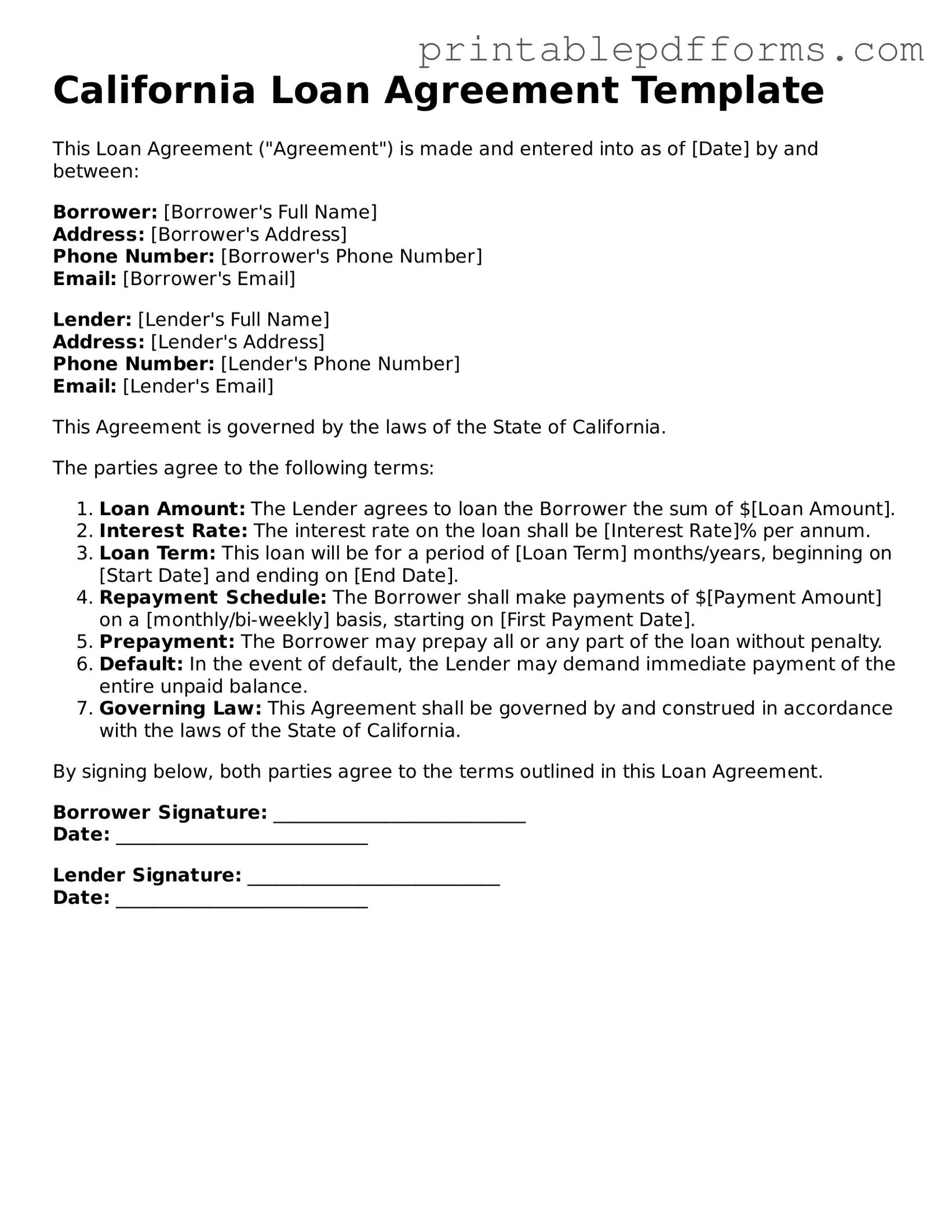

Document Example

California Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of [Date] by and between:

Borrower: [Borrower's Full Name]

Address: [Borrower's Address]

Phone Number: [Borrower's Phone Number]

Email: [Borrower's Email]

Lender: [Lender's Full Name]

Address: [Lender's Address]

Phone Number: [Lender's Phone Number]

Email: [Lender's Email]

This Agreement is governed by the laws of the State of California.

The parties agree to the following terms:

- Loan Amount: The Lender agrees to loan the Borrower the sum of $[Loan Amount].

- Interest Rate: The interest rate on the loan shall be [Interest Rate]% per annum.

- Loan Term: This loan will be for a period of [Loan Term] months/years, beginning on [Start Date] and ending on [End Date].

- Repayment Schedule: The Borrower shall make payments of $[Payment Amount] on a [monthly/bi-weekly] basis, starting on [First Payment Date].

- Prepayment: The Borrower may prepay all or any part of the loan without penalty.

- Default: In the event of default, the Lender may demand immediate payment of the entire unpaid balance.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of California.

By signing below, both parties agree to the terms outlined in this Loan Agreement.

Borrower Signature: ___________________________

Date: ___________________________

Lender Signature: ___________________________

Date: ___________________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The California Loan Agreement form outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of California. |

| Parties Involved | The form requires identification of both the lender and the borrower, including their legal names and addresses. |

| Loan Amount | The total amount being borrowed must be clearly stated in the agreement. |

| Interest Rate | The form specifies the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment amounts, must be included. |

Crucial Questions on This Form

- The names and addresses of the borrower and lender

- The loan amount

- The interest rate

- The repayment schedule

- Any collateral securing the loan

- Default terms and conditions

- Governing law (California law)

- Late fees

- Acceleration of the loan (demanding full repayment immediately)

- Legal action to recover the owed amount

What is a California Loan Agreement form?

A California Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a borrower and a lender. It details the amount borrowed, the interest rate, repayment schedule, and any other relevant terms. This form ensures that both parties understand their rights and obligations, helping to prevent disputes down the line.

Who needs a Loan Agreement?

Anyone who is lending or borrowing money in California should consider using a Loan Agreement. This includes individuals, businesses, and organizations. Having a written agreement protects both parties by clearly stating the terms of the loan and can be especially important for larger amounts of money.

What should be included in a California Loan Agreement?

A comprehensive California Loan Agreement should include the following key elements:

Is it necessary to have the Loan Agreement notarized?

While it is not legally required to notarize a Loan Agreement in California, doing so can add an extra layer of security. Notarization can help verify the identities of the parties involved and ensure that they are entering into the agreement willingly. This can be particularly useful if disputes arise later.

What happens if the borrower defaults on the loan?

If the borrower fails to repay the loan as agreed, the lender has several options. The Loan Agreement should specify the consequences of default, which may include:

It's important for both parties to understand these terms before signing the agreement.

Can a Loan Agreement be modified after it's signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the borrower and the lender to ensure clarity and enforceability.

What is the difference between secured and unsecured loans?

A secured loan is backed by collateral, meaning the borrower pledges an asset (like a car or property) that the lender can claim if the loan is not repaid. An unsecured loan does not require collateral, relying instead on the borrower's creditworthiness. Secured loans often have lower interest rates due to the reduced risk for the lender.

Can I use a California Loan Agreement for business loans?

Absolutely! A California Loan Agreement can be used for both personal and business loans. When drafting a business loan agreement, it’s important to include specific terms related to the business context, such as the purpose of the loan and any relevant business information.

Where can I find a template for a California Loan Agreement?

Templates for California Loan Agreements can be found online through various legal websites, or you may consider consulting with a legal professional to ensure that the agreement meets your specific needs. Using a template can save time, but it’s crucial to customize it to reflect the unique terms of your loan.

What should I do if I have more questions about Loan Agreements?

If you have additional questions or need assistance with a Loan Agreement, consider reaching out to a legal professional. They can provide tailored advice based on your specific situation and ensure that your agreement complies with California laws.

Documents used along the form

When entering into a loan agreement in California, several other forms and documents may be necessary to ensure clarity and legal compliance. Below is a list of common documents that are often used alongside the California Loan Agreement form.

- Promissory Note: This document outlines the borrower's promise to repay the loan amount, including the terms of repayment, interest rate, and any penalties for late payment.

- Security Agreement: If the loan is secured by collateral, this agreement details the assets being used as security and the rights of the lender in case of default.

- Notice to Quit Form: This legal document is essential for landlords in Ohio to notify tenants of eviction due to lease violations, such as non-payment of rent. For more details, refer to All Ohio Forms.

- Personal Guarantee: This document is signed by an individual who agrees to be personally responsible for the loan if the borrowing entity defaults.

- Loan Disclosure Statement: This statement provides borrowers with important information about the loan terms, including fees, interest rates, and the total cost of the loan.

- Amortization Schedule: This schedule outlines the payment plan over the life of the loan, detailing each payment amount, principal, interest, and remaining balance.

- Default Notice: This document is sent to the borrower if they fail to meet the loan terms, detailing the default and the potential consequences.

- Release of Lien: Once the loan is paid in full, this document confirms that the lender relinquishes any claim to the collateral used to secure the loan.

- Loan Modification Agreement: If the terms of the original loan need to be changed, this agreement outlines the new terms and conditions agreed upon by both parties.

These documents work together to create a comprehensive framework for the loan transaction, protecting the interests of both the lender and the borrower. It is essential to understand each document's purpose to ensure a smooth borrowing process.

Misconceptions

Understanding the California Loan Agreement form is crucial for anyone involved in lending or borrowing money in the state. However, several misconceptions can lead to confusion. Here’s a look at some common myths surrounding this important document.

- Misconception 1: The California Loan Agreement form is only for large loans.

- Misconception 2: You don’t need a written agreement for informal loans.

- Misconception 3: The form is only for individuals, not businesses.

- Misconception 4: Once signed, the loan agreement cannot be changed.

- Misconception 5: The loan agreement must be notarized to be valid.

- Misconception 6: All loan agreements are the same.

This is not true. The form can be used for loans of any size, whether it's a small personal loan or a larger business loan. It provides a clear framework for both parties, regardless of the amount involved.

While some people believe that verbal agreements are sufficient, having a written loan agreement is always recommended. It protects both the lender and the borrower by outlining the terms and conditions clearly.

This is incorrect. The California Loan Agreement form can be utilized by both individuals and businesses. It is versatile and can accommodate various lending scenarios.

Many believe that a signed agreement is set in stone. However, both parties can negotiate changes to the agreement, provided they both consent and make those changes in writing.

While notarization can add an extra layer of security, it is not a requirement for the California Loan Agreement to be legally binding. What matters most is that both parties agree to the terms.

This is a common misunderstanding. Each loan agreement can be tailored to fit the specific needs of the lender and borrower. It’s essential to customize the terms to reflect the unique situation of the loan.