California Motorcycle Bill of Sale Document

When purchasing or selling a motorcycle in California, the Motorcycle Bill of Sale form plays a crucial role in the transaction process. This document serves as a legal record that outlines the details of the sale, including the names and addresses of both the buyer and seller, the motorcycle's identification number (VIN), and the sale price. It is important for both parties to accurately complete this form to ensure a smooth transfer of ownership. Additionally, the bill of sale may include information about the motorcycle's condition and any warranties or agreements made between the parties. While not always required by law, having a properly filled-out bill of sale can protect both the buyer and seller by providing proof of the transaction, which can be essential for registration and title transfer with the Department of Motor Vehicles (DMV). Understanding the significance of this document can help facilitate a successful motorcycle sale and prevent potential disputes down the line.

Discover More Motorcycle Bill of Sale Forms for Different States

Bill of Sale Dmv Ny - Can be beneficial for documenting trade-ins.

To ensure a smooth transfer of ownership, it's important to have the right documentation, such as the Trailer Bill of Sale form, which captures all necessary details about the trailer, the buyer, and the seller, making the process both clear and legally binding.

How to Get a Motorcycle Title With Bill of Sale - It documents the sales process and can be used in future transactions or sales.

Texas Motor Vehicle Bill of Sale - Ensures all parties have agreed to the sale terms.

Similar forms

The Motorcycle Bill of Sale form is an important document for transferring ownership of a motorcycle. It shares similarities with several other documents that facilitate the sale or transfer of ownership for various types of property. Here are five documents that are similar to the Motorcycle Bill of Sale:

- Vehicle Bill of Sale: This document is used for the sale of any motor vehicle, including cars and trucks. Like the Motorcycle Bill of Sale, it includes details about the buyer, seller, and vehicle, ensuring a clear transfer of ownership.

- Boat Bill of Sale: Similar to the Motorcycle Bill of Sale, this document is used when selling a boat. It outlines the terms of the sale and provides proof of ownership transfer, protecting both the buyer and seller.

- General Bill of Sale: This document can be used for various types of personal property transactions. It serves as a receipt and proof of sale, much like the Motorcycle Bill of Sale, by documenting the exchange of goods between parties.

- Arizona Motor Vehicle Bill of Sale: This document is crucial for anyone buying or selling a vehicle in Arizona, providing necessary details about the transaction. To assist you further in this process, visit Top Document Templates for a printable version of the bill of sale.

- Real Estate Purchase Agreement: While it pertains to real property, this document outlines the terms of a property sale. Similar to the Motorcycle Bill of Sale, it details the parties involved, the property description, and the terms of the sale.

- Lease Agreement: This document is used for renting property, whether residential or commercial. Like the Motorcycle Bill of Sale, it establishes the terms of use and responsibilities between the lessor and lessee, ensuring clarity in the transaction.

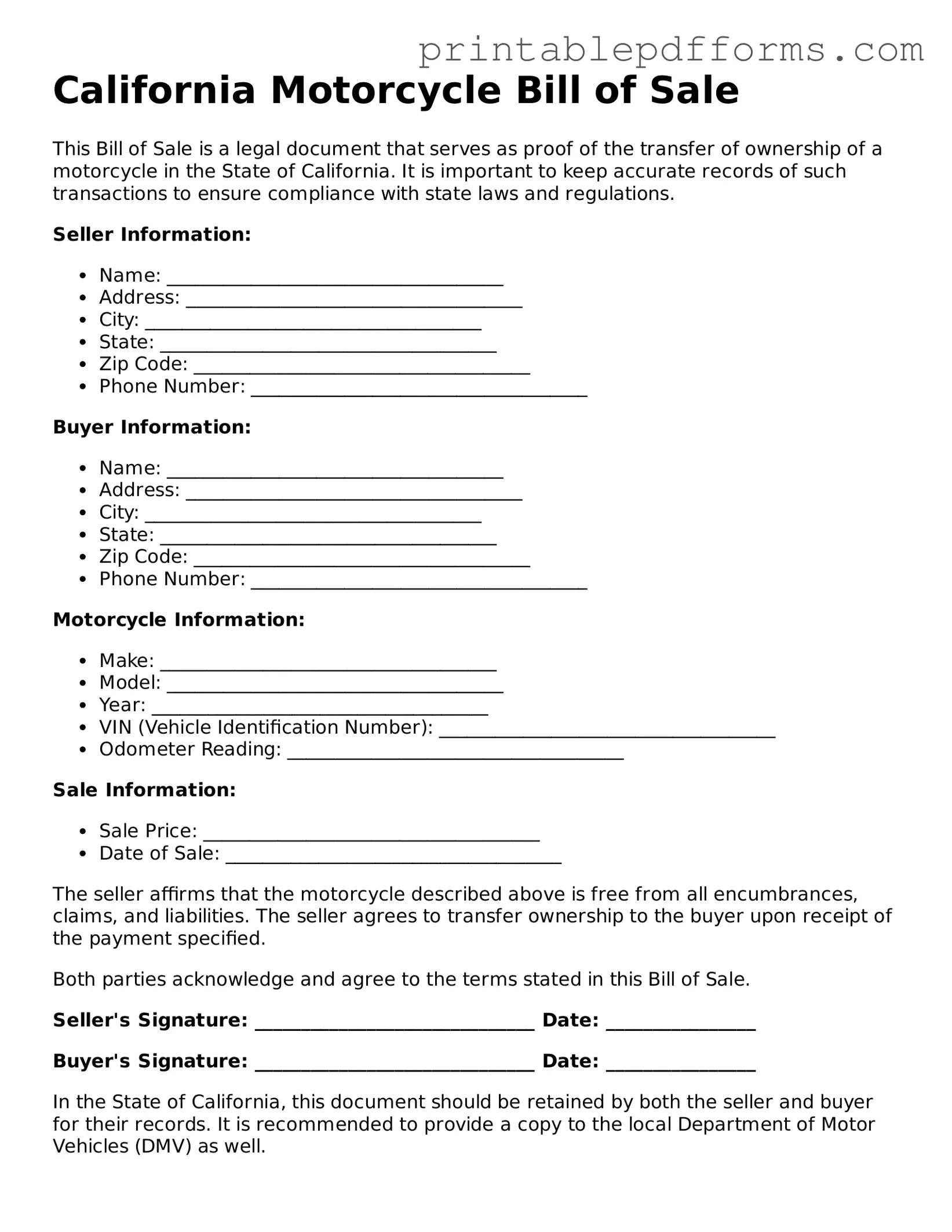

Document Example

California Motorcycle Bill of Sale

This Bill of Sale is a legal document that serves as proof of the transfer of ownership of a motorcycle in the State of California. It is important to keep accurate records of such transactions to ensure compliance with state laws and regulations.

Seller Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ____________________________________

- State: ____________________________________

- Zip Code: ____________________________________

- Phone Number: ____________________________________

Buyer Information:

- Name: ____________________________________

- Address: ____________________________________

- City: ____________________________________

- State: ____________________________________

- Zip Code: ____________________________________

- Phone Number: ____________________________________

Motorcycle Information:

- Make: ____________________________________

- Model: ____________________________________

- Year: ____________________________________

- VIN (Vehicle Identification Number): ____________________________________

- Odometer Reading: ____________________________________

Sale Information:

- Sale Price: ____________________________________

- Date of Sale: ____________________________________

The seller affirms that the motorcycle described above is free from all encumbrances, claims, and liabilities. The seller agrees to transfer ownership to the buyer upon receipt of the payment specified.

Both parties acknowledge and agree to the terms stated in this Bill of Sale.

Seller's Signature: ______________________________ Date: ________________

Buyer's Signature: ______________________________ Date: ________________

In the State of California, this document should be retained by both the seller and buyer for their records. It is recommended to provide a copy to the local Department of Motor Vehicles (DMV) as well.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The California Motorcycle Bill of Sale serves as a legal document that records the transfer of ownership of a motorcycle from one party to another. |

| Legal Requirement | While not required by law, it is highly recommended to create a bill of sale to protect both the buyer and seller during the transaction. |

| Governing Law | The governing laws for motorcycle sales in California can be found in the California Vehicle Code, particularly sections related to vehicle registration and transfer. |

| Information Included | The form typically includes details such as the motorcycle's make, model, year, Vehicle Identification Number (VIN), and the purchase price. |

| Signatures Required | Both the seller and buyer must sign the bill of sale to validate the transaction and confirm their agreement to the terms outlined. |

| Record Keeping | It is advisable for both parties to keep a copy of the bill of sale for their records, as it may be needed for future reference or disputes. |

| Sales Tax Implications | In California, sales tax may apply to the purchase of a motorcycle, and this should be documented on the bill of sale to ensure proper reporting. |

| Notarization | Notarization of the bill of sale is not mandatory in California, but it can add an extra layer of authenticity and protection. |

| Use in Registration | The bill of sale is often required when registering the motorcycle with the California Department of Motor Vehicles (DMV) to prove ownership. |

Crucial Questions on This Form

What is a California Motorcycle Bill of Sale?

A California Motorcycle Bill of Sale is a legal document that records the sale of a motorcycle between a buyer and a seller. This form serves as proof of the transaction and outlines essential details about the motorcycle, the parties involved, and the terms of the sale.

Why do I need a Motorcycle Bill of Sale?

This document is crucial for several reasons:

- It provides legal protection for both the buyer and the seller.

- It helps establish ownership of the motorcycle.

- It is often required when registering the motorcycle with the Department of Motor Vehicles (DMV).

- It can serve as evidence in case of disputes regarding the sale.

What information should be included in the Bill of Sale?

A complete Motorcycle Bill of Sale should include the following details:

- The full names and addresses of both the buyer and the seller.

- The motorcycle's make, model, year, and Vehicle Identification Number (VIN).

- The sale price and payment method.

- The date of the sale.

- Any warranties or guarantees, if applicable.

Do I need to notarize the Bill of Sale?

Notarization is not required for a Motorcycle Bill of Sale in California. However, having the document notarized can add an extra layer of security and credibility, especially if you plan to use it for registration or legal purposes.

Can I create my own Motorcycle Bill of Sale?

Yes, you can create your own Motorcycle Bill of Sale. Just ensure that it includes all necessary information and complies with California laws. Many templates are available online to help you get started.

Is a Motorcycle Bill of Sale the same as a title?

No, a Motorcycle Bill of Sale is not the same as a title. The title is the official document that proves ownership of the motorcycle. The Bill of Sale is a record of the transaction. Both documents are important for transferring ownership.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and the seller should keep a copy for their records. The buyer will need the document to register the motorcycle with the DMV. Additionally, the seller should notify the DMV of the sale to avoid any future liabilities.

How does the Bill of Sale affect taxes?

The sale of a motorcycle may be subject to sales tax in California. The buyer is typically responsible for paying this tax when registering the motorcycle. The Bill of Sale should reflect the sale price, as this amount will be used to calculate the tax owed.

What if the motorcycle has a lien?

If there is a lien on the motorcycle, it’s essential to disclose this information in the Bill of Sale. The seller should ensure that the lien is satisfied before completing the sale. This protects the buyer from potential legal issues related to the lien.

Where can I obtain a California Motorcycle Bill of Sale form?

You can obtain a California Motorcycle Bill of Sale form from various sources. Many websites offer free templates, or you can create your own using the guidelines provided above. Additionally, the DMV may have forms available for download or in-person pickup.

Documents used along the form

When buying or selling a motorcycle in California, several important documents accompany the Motorcycle Bill of Sale. Each of these forms serves a specific purpose in the transaction process, ensuring that both parties are protected and that the transfer of ownership is conducted legally. Below is a list of commonly used documents.

- Title Transfer Form: This document is essential for transferring ownership of the motorcycle from the seller to the buyer. It includes information about the motorcycle, such as its VIN, and must be completed and submitted to the DMV.

- Application for Title or Registration: This form is used by the new owner to apply for a new title or register the motorcycle in their name. It often requires proof of ownership, such as the bill of sale and the previous title.

- Vehicle Verification Form: This form is sometimes required by the DMV to verify the motorcycle's identification number and condition. It may need to be completed by a law enforcement officer or a licensed dealer.

- Smog Certification: Depending on the age and type of motorcycle, a smog certification may be necessary to prove that the vehicle meets California's emissions standards. This is typically required for older motorcycles.

- Release of Liability: This document protects the seller from future liability related to the motorcycle after the sale. It informs the DMV that the seller is no longer responsible for the vehicle.

- Employment Verification Form: To ensure proof of job status, utilize the necessary Employment Verification form resources for seamless verification.

- Odometer Disclosure Statement: If the motorcycle is less than ten years old, this statement is required to disclose the current mileage. It helps prevent fraud and ensures accurate records are kept.

Gathering these documents ensures a smooth transaction and helps both the buyer and seller fulfill their legal obligations. Being prepared can prevent potential issues down the line, making the process more efficient for everyone involved.

Misconceptions

When it comes to the California Motorcycle Bill of Sale, there are several misconceptions that can lead to confusion for buyers and sellers alike. Understanding the truth behind these myths can help ensure a smoother transaction. Here are seven common misconceptions:

- It’s not a legal requirement. Many believe that a bill of sale is unnecessary when selling a motorcycle in California. However, while it's not mandatory, having one can provide legal protection for both parties.

- Only the seller needs to sign it. Some think that only the seller's signature is required. In reality, both the buyer and seller should sign the bill of sale to validate the transaction.

- It doesn’t need to be notarized. There's a belief that notarization is essential for the bill of sale to be valid. In California, notarization is not required, but it can add an extra layer of authenticity.

- It can be a verbal agreement. Some people think that a simple verbal agreement suffices. A written bill of sale is always recommended as it serves as a clear record of the transaction.

- It’s only for used motorcycles. Many assume that a bill of sale is only necessary for used motorcycles. However, even new motorcycle purchases can benefit from a bill of sale to document the transaction.

- It’s only for private sales. There’s a misconception that bills of sale are only needed for private transactions. Businesses selling motorcycles should also provide a bill of sale for their records and for the buyer’s protection.

- All bills of sale are the same. Some believe that any bill of sale will do. In California, it’s important to use a bill of sale that includes specific information about the motorcycle, the buyer, and the seller to ensure it meets legal requirements.

By dispelling these misconceptions, both buyers and sellers can navigate the process of purchasing or selling a motorcycle with greater confidence and clarity.