California Operating Agreement Document

In the vibrant landscape of California's business environment, the Operating Agreement form serves as a foundational document for limited liability companies (LLCs). This essential agreement outlines the management structure and operational procedures of the LLC, providing clarity and guidance to its members. It addresses key aspects such as the distribution of profits and losses, the roles and responsibilities of members, and the procedures for adding or removing members. Additionally, the Operating Agreement can specify how decisions are made, ensuring that all members have a clear understanding of their rights and obligations. By establishing these parameters, the form helps to prevent misunderstandings and disputes, fostering a collaborative atmosphere among members. Ultimately, the Operating Agreement is not merely a legal requirement; it is a vital tool that supports the growth and sustainability of an LLC in California, reflecting the unique vision and goals of its members.

Discover More Operating Agreement Forms for Different States

How Much Does an Llc Cost in Texas - It provides a formal framework for how day-to-day operations will be conducted.

Before executing a Power of Attorney form, it is essential to educate yourself about its specifics and how it can impact your affairs. With the right information, you can ensure that the authority granted aligns with your intentions. For those looking for comprehensive resources, All Ohio Forms can provide valuable guidance and templates to help navigate this important legal process.

Ohio Llc Operating Agreement - This form helps prevent misunderstandings among members by clarifying procedures.

How to Make an Operating Agreement - A well-crafted Operating Agreement can help establish trust among members by providing clarity.

Similar forms

- Bylaws: Similar to an Operating Agreement, bylaws outline the internal rules governing a corporation. They detail the roles of officers, the process for holding meetings, and the voting rights of shareholders, ensuring smooth operations within the organization.

- Partnership Agreement: This document serves as a contract between partners in a business. Like an Operating Agreement, it defines the roles, responsibilities, and profit-sharing arrangements among partners, helping to prevent disputes.

- Shareholders Agreement: In a corporation, a Shareholders Agreement is comparable to an Operating Agreement. It outlines the rights and obligations of shareholders, including how shares can be transferred and how decisions are made, promoting transparency and cooperation.

-

Boat Bill of Sale: This legal document is essential for transferring ownership of a boat, ensuring all parties' interests are protected. It includes vital information such as the buyer's and seller's details, a description of the boat, and the sale price. For further information, you can access the form at https://nypdfforms.com/boat-bill-of-sale-form.

- LLC Membership Certificate: This document certifies a member's ownership interest in an LLC. It is similar to an Operating Agreement in that it provides proof of membership and may also outline rights and obligations of the member.

- Joint Venture Agreement: When two or more parties collaborate on a specific project, they may create a Joint Venture Agreement. This document, like an Operating Agreement, details each party's contributions, responsibilities, and how profits or losses will be shared.

- Franchise Agreement: A Franchise Agreement outlines the relationship between a franchisor and franchisee. It shares similarities with an Operating Agreement in that it defines the rights, obligations, and operational guidelines for both parties involved.

- Employment Agreement: This contract between an employer and employee specifies the terms of employment. While it focuses on the employer-employee relationship, it parallels an Operating Agreement in that it sets clear expectations and responsibilities for both parties.

- Confidentiality Agreement (NDA): An NDA is used to protect sensitive information shared between parties. It is similar to an Operating Agreement in that it establishes the terms under which confidential information must be handled, thereby safeguarding the interests of the involved parties.

Document Example

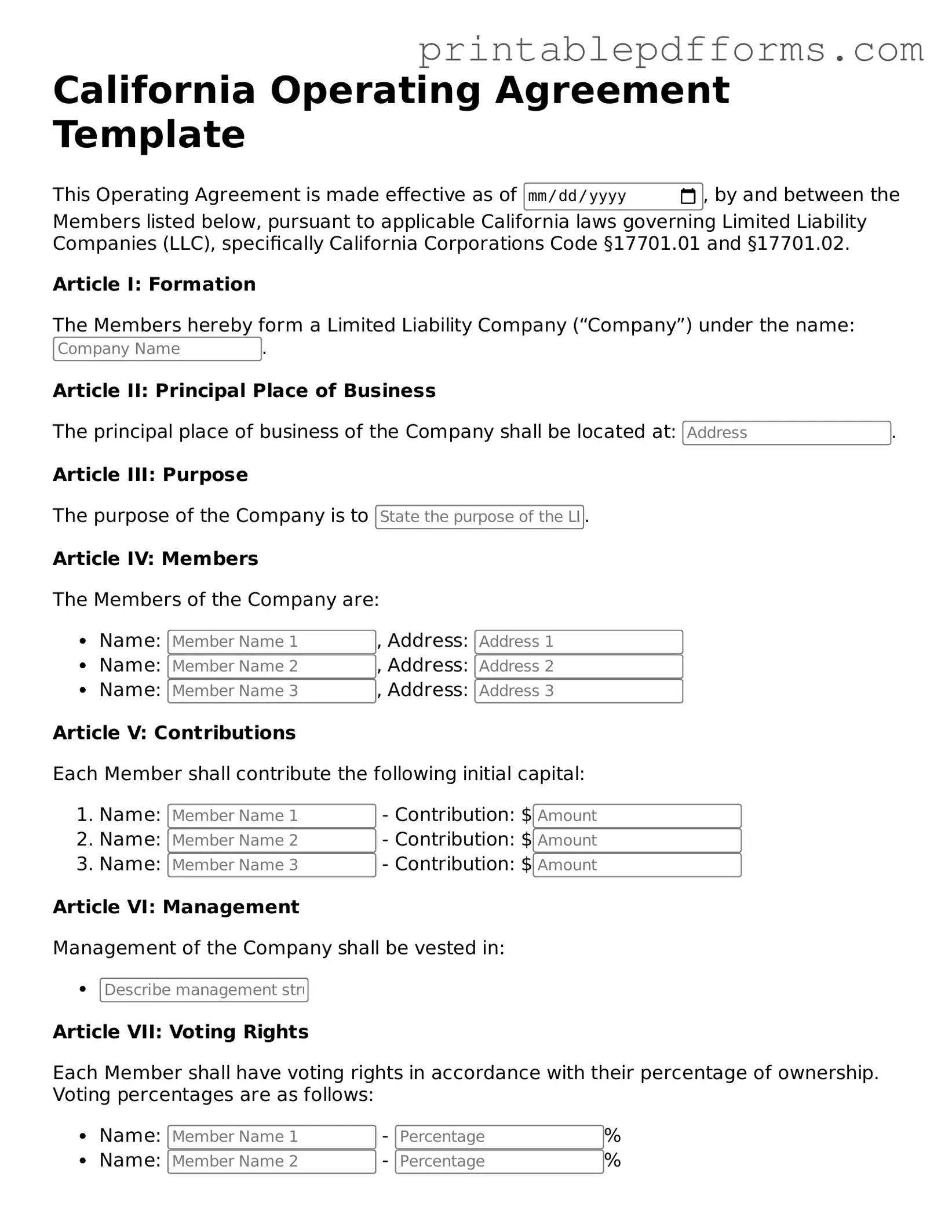

California Operating Agreement Template

This Operating Agreement is made effective as of , by and between the Members listed below, pursuant to applicable California laws governing Limited Liability Companies (LLC), specifically California Corporations Code §17701.01 and §17701.02.

Article I: Formation

The Members hereby form a Limited Liability Company (“Company”) under the name: .

Article II: Principal Place of Business

The principal place of business of the Company shall be located at: .

Article III: Purpose

The purpose of the Company is to .

Article IV: Members

The Members of the Company are:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article V: Contributions

Each Member shall contribute the following initial capital:

- Name: - Contribution: $

- Name: - Contribution: $

- Name: - Contribution: $

Article VI: Management

Management of the Company shall be vested in:

Article VII: Voting Rights

Each Member shall have voting rights in accordance with their percentage of ownership. Voting percentages are as follows:

- Name: - %

- Name: - %

- Name: - %

Article VIII: Distributions

The profits and losses shall be allocated among the Members in proportion to their respective ownership percentages.

Article IX: Amendment

This Agreement may be amended only by a written agreement signed by all Members.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of California.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the day and year first above written.

Member Signatures:

- _________________________ (Member Name 1)

- _________________________ (Member Name 2)

- _________________________ (Member Name 3)

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | The California Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Governing Law | This agreement is governed by the California Corporations Code, specifically sections 17300 to 17360. |

| Purpose | The primary purpose is to define the roles, rights, and responsibilities of the LLC members. |

| Flexibility | Members can customize the agreement to fit their specific needs, allowing for various management structures. |

| Not Mandatory | While not required by law, having an Operating Agreement is highly recommended for clarity and legal protection. |

| Dispute Resolution | The agreement often includes provisions for resolving disputes among members, potentially avoiding costly litigation. |

| Amendments | Members can amend the Operating Agreement as needed, provided that the process for amendments is clearly defined within the document. |

| Tax Implications | The agreement can also address how profits and losses are allocated among members for tax purposes. |

Crucial Questions on This Form

What is a California Operating Agreement?

A California Operating Agreement is a document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in California. It serves as a roadmap for how the LLC will function, detailing the rights and responsibilities of its members.

Why do I need an Operating Agreement?

Having an Operating Agreement is crucial for several reasons:

- It helps clarify the roles and responsibilities of each member.

- It provides a framework for decision-making and conflict resolution.

- It can protect your personal assets by reinforcing the LLC's status as a separate entity.

- It may be required by banks or investors when seeking funding.

Is an Operating Agreement required in California?

While California law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having one can prevent misunderstandings among members and provide legal protection in case of disputes.

What should be included in an Operating Agreement?

An effective Operating Agreement typically includes:

- The name and purpose of the LLC.

- The names of the members and their ownership percentages.

- The management structure, whether member-managed or manager-managed.

- Voting rights and procedures.

- Rules for adding or removing members.

- How profits and losses will be distributed.

- Procedures for handling disputes.

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. Many templates are available online, but it’s wise to tailor the document to fit your specific needs. Consulting with a legal professional can also help ensure that your agreement complies with state laws.

How do I amend an Operating Agreement?

To amend an Operating Agreement, follow the procedures outlined in the original document. Typically, this requires a vote among the members. Make sure to document any changes in writing and update the agreement accordingly.

What happens if I don’t have an Operating Agreement?

If your LLC does not have an Operating Agreement, California's default rules will apply. This may not align with your intentions and could lead to conflicts among members. Without a clear agreement, resolving disputes can become complicated and time-consuming.

Can an Operating Agreement be verbal?

While an Operating Agreement can technically be verbal, it is not advisable. A written agreement provides clear evidence of the terms agreed upon by members. A verbal agreement can lead to misunderstandings and disputes, making it difficult to enforce your rights.

How often should I review my Operating Agreement?

It’s a good practice to review your Operating Agreement regularly, especially when significant changes occur, such as adding a new member or altering the management structure. Regular reviews ensure that the document remains relevant and reflects the current state of your LLC.

Where can I find a sample Operating Agreement?

Sample Operating Agreements can be found on various legal websites, in business books, or through legal professionals. Many resources offer templates that can be customized to fit your LLC’s specific needs.

Documents used along the form

The California Operating Agreement is a crucial document for Limited Liability Companies (LLCs) operating in California. However, it is often accompanied by several other forms and documents that support the establishment and management of the LLC. Here are some commonly used documents that may be required alongside the Operating Agreement:

- Articles of Organization: This document is filed with the California Secretary of State to officially create the LLC. It includes basic information such as the LLC's name, address, and registered agent.

- Initial Statement of Information: Required to be filed within 90 days of forming the LLC, this document provides updated information about the LLC, including its management and business address.

- Bylaws: While not mandatory for LLCs, bylaws can outline the internal rules and procedures for managing the company, similar to those for corporations.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They can help clarify ownership stakes and are useful for record-keeping.

- Operating Procedures: This document outlines the day-to-day operations of the LLC, detailing how decisions are made and how tasks are delegated among members.

- Tax Identification Number (TIN): Obtaining a TIN from the IRS is essential for tax purposes. It allows the LLC to open bank accounts and file taxes under its own name.

- Last Will and Testament: To ensure your final wishes are respected, consult the essential Last Will and Testament resources for comprehensive guidance on creating this important document.

- Business License: Depending on the type of business and location, a business license may be required to operate legally in California.

- Non-Disclosure Agreement (NDA): If the LLC will be sharing sensitive information with employees or partners, an NDA can protect proprietary information from being disclosed to outside parties.

Utilizing these documents in conjunction with the California Operating Agreement can streamline the formation and operation of an LLC, ensuring compliance with state regulations and promoting effective management practices.

Misconceptions

When it comes to the California Operating Agreement form, several misconceptions can lead to confusion. Understanding these misconceptions can help you navigate the process more effectively.

- All LLCs must have an Operating Agreement. Many people believe that an Operating Agreement is mandatory for all LLCs in California. While it's not legally required, having one is highly recommended for clarity and protection.

- Operating Agreements are only for multi-member LLCs. Some think that Operating Agreements are only necessary for LLCs with multiple members. However, single-member LLCs also benefit from having one to outline ownership and management structure.

- Once created, an Operating Agreement cannot be changed. There is a misconception that Operating Agreements are set in stone. In reality, they can be amended as needed to reflect changes in the business or membership.

- Operating Agreements are only for legal purposes. While they do serve legal functions, Operating Agreements also provide a framework for daily operations, decision-making processes, and conflict resolution, making them valuable for all members.

- All Operating Agreements are the same. Many believe that a generic template will suffice for any LLC. In truth, each Operating Agreement should be tailored to the specific needs and goals of the business and its members.

- Filing an Operating Agreement with the state is necessary. Some think that they must file the Operating Agreement with the state. However, it is a private document and does not need to be submitted to any government agency.

By dispelling these misconceptions, you can better understand the importance of a California Operating Agreement and how it can benefit your LLC.