California Power of Attorney Document

When it comes to managing your affairs, having a California Power of Attorney form can be an essential tool. This document allows you to designate someone you trust—often referred to as your agent—to make decisions on your behalf when you are unable to do so. Whether it’s handling financial matters, making healthcare choices, or dealing with legal issues, this form provides a clear framework for how your wishes should be carried out. In California, the Power of Attorney can be tailored to fit your specific needs, with options for durable powers that remain effective even if you become incapacitated. Additionally, you can choose between general powers, which grant broad authority, or limited powers that specify certain tasks. Understanding the nuances of this form can empower you to take control of your future and ensure that your preferences are honored, regardless of the circumstances. It's a proactive step towards safeguarding your interests and providing peace of mind for both you and your loved ones.

Discover More Power of Attorney Forms for Different States

Does a Power of Attorney Need to Be Recorded in Pennsylvania - A well-drafted Power of Attorney is an essential part of responsible personal management.

To ensure a smooth startup process for your business, it's important to understand the significance of the New York Articles of Incorporation form, which serves as the official paperwork to establish your corporation. This essential document details key information such as the corporation's name, address, and purpose. For those looking to begin this important journey, completing the form accurately is vital. You can take the first step by accessing the Articles of Incorporation form and getting started today.

Nys Power of Attorney Form - This form gives the agent the authority to access bank accounts and pay bills.

Similar forms

- Living Will: Similar to a Power of Attorney, a living will outlines your wishes regarding medical treatment in case you become unable to communicate. It focuses on end-of-life decisions, while a Power of Attorney can cover broader financial and legal matters.

- Healthcare Proxy: This document allows you to appoint someone to make medical decisions on your behalf if you cannot do so. Like a Power of Attorney, it grants authority to another person, but it is specifically for healthcare decisions.

- Medical Power of Attorney: This form designates an individual to make healthcare decisions on your behalf, ensuring your medical preferences are honored. For more insights, refer to the important Medical Power of Attorney resources.

- Durable Power of Attorney: A durable Power of Attorney is a type of Power of Attorney that remains effective even if you become incapacitated. It serves a similar purpose but emphasizes ongoing authority during periods of incapacity.

- Financial Power of Attorney: This document specifically grants someone authority to manage your financial affairs. It is a subset of the broader Power of Attorney, focusing solely on financial matters.

- Trust: A trust allows you to transfer assets to a trustee who manages them for your benefit or the benefit of others. Both a trust and a Power of Attorney involve delegating authority, but a trust is more about asset management and distribution.

- Will: A will outlines how your assets should be distributed after your death. While a Power of Attorney is effective during your lifetime, a will takes effect upon your passing, making them similar in purpose but different in timing and application.

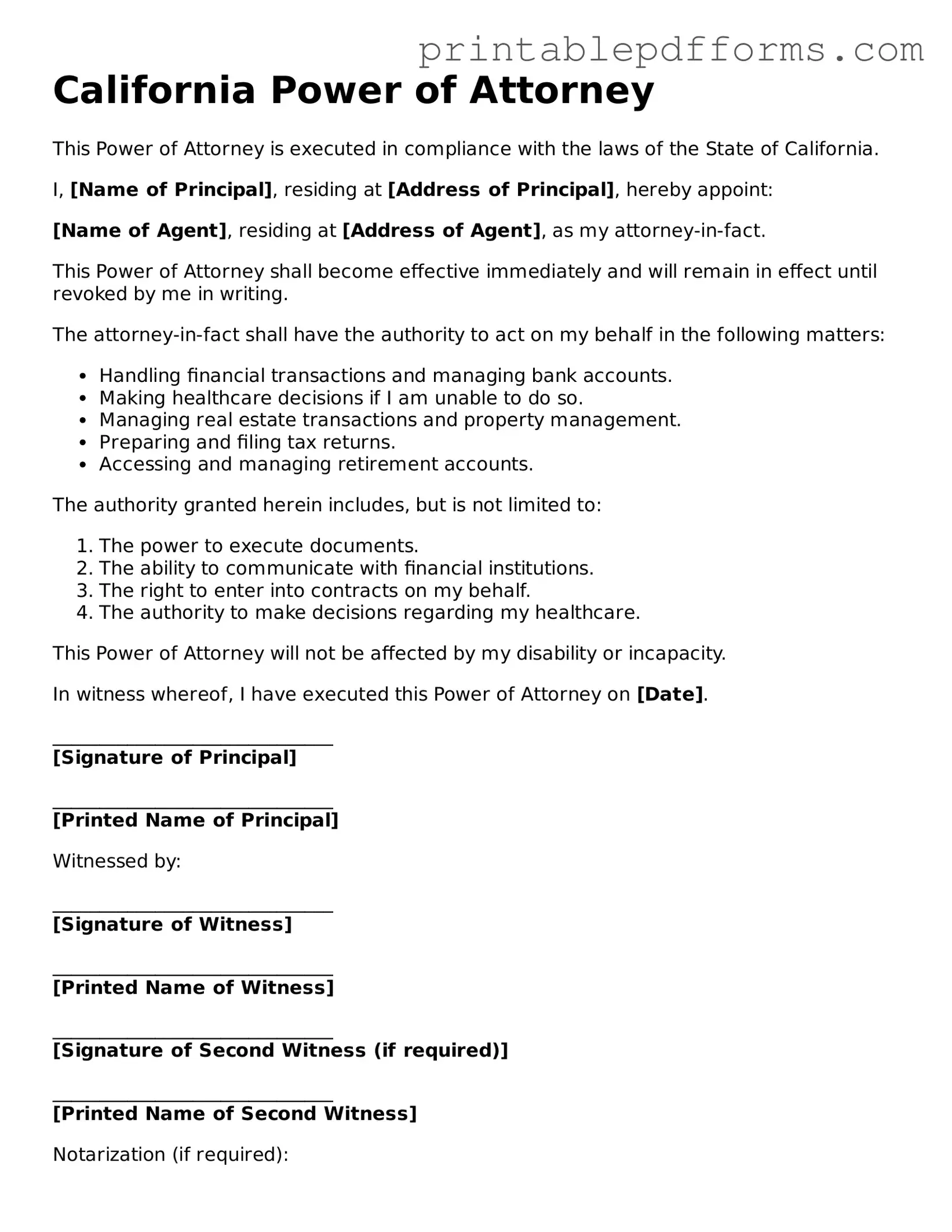

Document Example

California Power of Attorney

This Power of Attorney is executed in compliance with the laws of the State of California.

I, [Name of Principal], residing at [Address of Principal], hereby appoint:

[Name of Agent], residing at [Address of Agent], as my attorney-in-fact.

This Power of Attorney shall become effective immediately and will remain in effect until revoked by me in writing.

The attorney-in-fact shall have the authority to act on my behalf in the following matters:

- Handling financial transactions and managing bank accounts.

- Making healthcare decisions if I am unable to do so.

- Managing real estate transactions and property management.

- Preparing and filing tax returns.

- Accessing and managing retirement accounts.

The authority granted herein includes, but is not limited to:

- The power to execute documents.

- The ability to communicate with financial institutions.

- The right to enter into contracts on my behalf.

- The authority to make decisions regarding my healthcare.

This Power of Attorney will not be affected by my disability or incapacity.

In witness whereof, I have executed this Power of Attorney on [Date].

______________________________

[Signature of Principal]

______________________________

[Printed Name of Principal]

Witnessed by:

______________________________

[Signature of Witness]

______________________________

[Printed Name of Witness]

______________________________

[Signature of Second Witness (if required)]

______________________________

[Printed Name of Second Witness]

Notarization (if required):

______________________________

[Notary Public Signature]

______________________________

[Printed Name of Notary Public]

My Commission Expires: [Date]

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) in California allows an individual to appoint someone else to make decisions on their behalf. |

| Governing Laws | The California Power of Attorney is governed by the California Probate Code, specifically Sections 4000-4545. |

| Types of POA | California recognizes several types of POA, including Durable, Springing, and Limited Power of Attorney. |

| Durability | A Durable Power of Attorney remains effective even if the principal becomes incapacitated, ensuring continuity in decision-making. |

| Revocation | The principal can revoke a Power of Attorney at any time, provided they are mentally competent to do so. |

Crucial Questions on This Form

What is a Power of Attorney in California?

A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. In California, this document can be tailored to give specific powers or broad authority, depending on the needs of the principal (the person granting the authority).

What types of Power of Attorney are available in California?

California recognizes several types of Power of Attorney, including:

- General Power of Attorney: Grants broad powers to the agent to manage the principal's affairs.

- Limited Power of Attorney: Specifies particular tasks or decisions the agent can make, such as selling property or managing a bank account.

- Durable Power of Attorney: Remains effective even if the principal becomes incapacitated, ensuring that the agent can continue to act on their behalf.

- Springing Power of Attorney: Becomes effective only upon the occurrence of a specified event, such as the principal's incapacity.

Who can serve as an agent under a Power of Attorney?

In California, an agent can be anyone the principal trusts, including a family member, friend, or professional. However, the agent must be at least 18 years old and mentally competent. It is important to choose someone who will act in the principal's best interests.

How do I create a Power of Attorney in California?

To create a Power of Attorney in California, follow these steps:

- Choose the type of Power of Attorney that suits your needs.

- Complete the appropriate form, ensuring it includes the principal's name, the agent's name, and the powers granted.

- Sign the document in the presence of a notary public or two witnesses, depending on the type of POA.

- Distribute copies to relevant parties, including the agent and any institutions that may need it.

Does a Power of Attorney need to be notarized?

Yes, in California, a Power of Attorney must be notarized or signed by two witnesses to be valid. This requirement helps ensure that the document is legitimate and that the principal is making the decision voluntarily.

Can I revoke a Power of Attorney?

Yes, a principal can revoke a Power of Attorney at any time, as long as they are mentally competent. To revoke, the principal should create a written revocation document and notify the agent and any institutions that were given the original Power of Attorney.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated and has executed a Durable Power of Attorney, the agent can continue to act on their behalf. If the Power of Attorney is not durable, it becomes invalid upon the principal's incapacity, and a court may need to appoint a conservator.

Are there any limitations on what an agent can do?

Yes, there are limitations. An agent cannot make decisions that are against the principal's best interests or act outside the powers granted in the Power of Attorney document. Additionally, agents cannot make medical decisions unless specifically authorized to do so in a healthcare Power of Attorney.

Is a Power of Attorney valid in other states?

A California Power of Attorney is generally valid in other states, but it’s advisable to check the specific laws of the state where it will be used. Some states may have different requirements or forms, so confirming local regulations is important.

Can I use a Power of Attorney for healthcare decisions?

Yes, but you will need a specific type of Power of Attorney known as an Advance Healthcare Directive or Healthcare Power of Attorney. This document allows an agent to make medical decisions on behalf of the principal if they are unable to do so themselves.

Documents used along the form

When creating a California Power of Attorney, there are several other forms and documents that may be necessary to ensure your wishes are clearly outlined and legally recognized. Here’s a brief overview of some of these important documents.

- Advance Healthcare Directive: This document allows individuals to specify their healthcare preferences and appoint someone to make medical decisions on their behalf if they become unable to do so.

- Durable Power of Attorney: Similar to a standard Power of Attorney, this document remains effective even if the principal becomes incapacitated, ensuring that the agent can continue to act on their behalf.

- Financial Power of Attorney: This form specifically grants authority to manage financial matters, such as banking, investments, and property transactions.

- Quitclaim Deed: A Quitclaim Deed form in Ohio is a legal document used to transfer a property owner's interest in real estate with no guarantee regarding the title's clarity. It is often used between family or friends, simplifying the transfer process while requiring careful consideration due to its lack of assurances on the title's status. For more information, refer to All Ohio Forms.

- Living Will: This document outlines an individual’s wishes regarding medical treatment and end-of-life care, providing guidance to healthcare providers and family members.

- Trust Agreement: A trust can be established to manage assets during a person’s lifetime and after their passing, often used for estate planning purposes.

- Will: This legal document states how a person’s assets should be distributed after their death, and it can also name guardians for minor children.

- HIPAA Authorization: This form allows individuals to authorize healthcare providers to share their medical information with designated persons, which is crucial for effective healthcare management.

- Property Transfer Deed: If property is being transferred, this document is used to legally change ownership from one party to another.

- Guardian Nomination Form: This document allows parents to nominate a guardian for their minor children in the event of their death or incapacity.

- Notice of Revocation: If a Power of Attorney is no longer valid, this document serves to formally revoke the authority granted to the agent.

Each of these documents plays a vital role in ensuring that your preferences are respected and that your affairs are managed according to your wishes. It’s important to consider which forms may be relevant to your situation and to seek assistance if needed.

Misconceptions

When it comes to the California Power of Attorney form, many people hold misconceptions that can lead to confusion or even legal issues. Here are five common misunderstandings:

- All Powers of Attorney are the Same: Not all Power of Attorney forms serve the same purpose. In California, there are different types, such as General, Durable, and Limited Power of Attorney, each designed for specific situations.

- Once Signed, It Cannot Be Changed: Many believe that once a Power of Attorney is signed, it is set in stone. In reality, the principal can revoke or amend the document at any time, as long as they are mentally competent.

- Agents Can Do Whatever They Want: Some think that an agent has unlimited power. However, the authority granted is limited to what is specified in the document. Agents must act in the best interest of the principal and within the scope of their authority.

- A Power of Attorney Is Only for Financial Matters: While financial decisions are a common use, a Power of Attorney can also cover healthcare decisions. This is often referred to as a Healthcare Power of Attorney, allowing agents to make medical choices on behalf of the principal.

- It Is Only Necessary for the Elderly: Many assume that only older adults need a Power of Attorney. However, anyone over 18 can benefit from this document, especially those who may face unexpected health issues or travel frequently.

Understanding these misconceptions can help individuals make informed decisions about their legal rights and responsibilities. It's essential to approach the Power of Attorney with clarity and awareness.