California Promissory Note Document

The California Promissory Note form serves as a crucial financial instrument, outlining the terms of a loan agreement between a borrower and a lender. This legally binding document specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties understand their obligations. In addition to these key elements, the form may include provisions for late fees, prepayment options, and default consequences, which provide clarity and protection for the lender. The structure of the note is designed to be straightforward, allowing individuals and businesses alike to engage in lending transactions with confidence. Furthermore, the form can be customized to suit specific needs, accommodating various loan amounts and terms. Understanding the components and implications of the California Promissory Note is essential for anyone involved in lending or borrowing money within the state.

Discover More Promissory Note Forms for Different States

Ohio Promissory Note Requirements - It includes details such as the loan amount, interest rate, and payment schedule.

For those engaging in equine transactions, obtaining a reliable Horse Bill of Sale template can be invaluable. This document streamlines the sales process and ensures that both parties have a clear understanding of their rights and obligations. Explore our comprehensive guide to the Horse Bill of Sale for more insights on proper usage and requirements: comprehensive Horse Bill of Sale template.

Texas Promissory Note Requirements - The conversion of a promissory note into cash is sometimes possible.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. However, it often includes additional details such as collateral and obligations of both parties.

- Mortgage: A mortgage is a specific type of loan secured by real property. Similar to a promissory note, it involves a promise to repay, but it also includes the legal claim to the property if the borrower defaults.

- Installment Agreement: This document allows a borrower to repay a debt in regular installments. It shares similarities with a promissory note in that it specifies the amount owed and the payment schedule, but it may cover various types of debts, not just loans.

- Ohio Unclaimed Form: The Ohio Unclaimed Form is essential for individuals aiming to reclaim forgotten assets. It is the necessary step to initiate the recovery process for funds left unclaimed. For more details, visit All Ohio Forms.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay another person's debt if they default. It resembles a promissory note in that it creates a personal obligation to pay, but it is often used in business transactions.

- Security Agreement: This document outlines the terms under which a borrower grants a lender a security interest in collateral. Like a promissory note, it involves a promise to repay, but it also details the lender's rights to the collateral if the borrower fails to pay.

- Debt Acknowledgment: A debt acknowledgment is a simple document in which a borrower recognizes a debt owed to a lender. It is similar to a promissory note because it confirms the existence of a debt, but it typically lacks detailed repayment terms.

- Credit Agreement: A credit agreement establishes the terms under which a lender extends credit to a borrower. It shares features with a promissory note, including repayment terms and interest rates, but it may also cover revolving credit lines and other complex terms.

Document Example

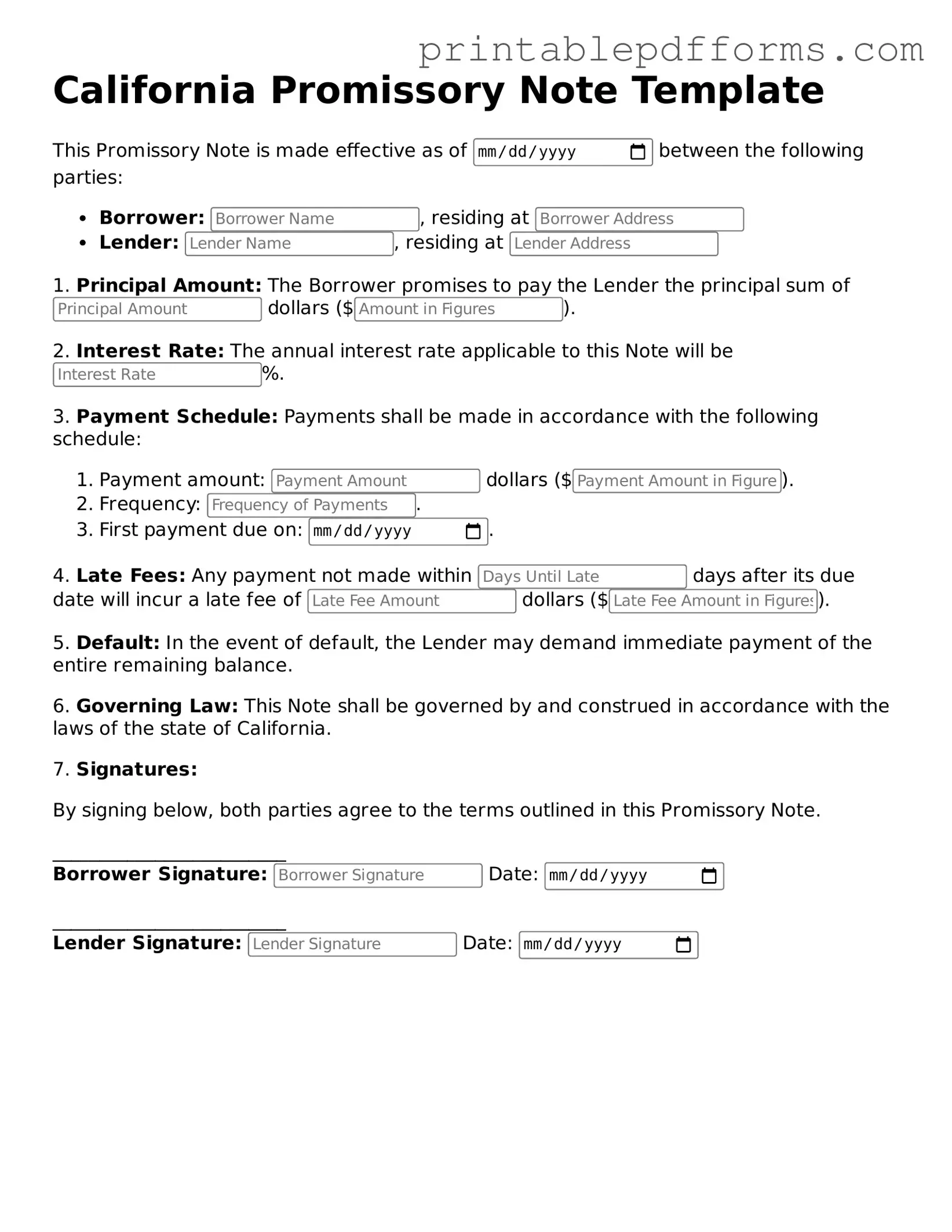

California Promissory Note Template

This Promissory Note is made effective as of between the following parties:

- Borrower: , residing at

- Lender: , residing at

1. Principal Amount: The Borrower promises to pay the Lender the principal sum of dollars ($).

2. Interest Rate: The annual interest rate applicable to this Note will be %.

3. Payment Schedule: Payments shall be made in accordance with the following schedule:

- Payment amount: dollars ($).

- Frequency: .

- First payment due on: .

4. Late Fees: Any payment not made within days after its due date will incur a late fee of dollars ($).

5. Default: In the event of default, the Lender may demand immediate payment of the entire remaining balance.

6. Governing Law: This Note shall be governed by and construed in accordance with the laws of the state of California.

7. Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

_________________________

Borrower Signature: Date:

_________________________

Lender Signature: Date:

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Governing Law | The California Uniform Commercial Code (UCC) governs promissory notes in California. |

| Parties Involved | The note involves two main parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The note can specify an interest rate, which may be fixed or variable, depending on the agreement. |

| Payment Terms | It outlines the payment schedule, including the due date and whether payments are monthly, quarterly, or otherwise. |

| Secured vs. Unsecured | A promissory note can be secured by collateral or may be unsecured, depending on the terms agreed upon. |

| Default Consequences | The note should specify the consequences of default, including late fees or acceleration of the debt. |

| Transferability | Promissory notes can often be transferred to another party, allowing for flexibility in financial arrangements. |

| Legal Enforcement | If the borrower fails to pay, the lender can take legal action to enforce the note and recover the owed amount. |

Crucial Questions on This Form

What is a California Promissory Note?

A California Promissory Note is a legal document in which one party (the borrower) agrees to pay a specific amount of money to another party (the lender) under agreed-upon terms. It outlines the repayment schedule, interest rate, and other relevant details. This document serves as a written record of the loan agreement.

What are the key components of a Promissory Note?

Key components typically include:

- Borrower and Lender Information: Names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The percentage of interest charged on the loan.

- Repayment Terms: Details about how and when the borrower will repay the loan.

- Default Terms: Conditions under which the borrower would be considered in default.

How is a Promissory Note different from a loan agreement?

A Promissory Note is a simpler document focused primarily on the borrower's promise to repay the loan. In contrast, a loan agreement is more comprehensive and may include additional terms such as collateral, warranties, and covenants. Essentially, a Promissory Note is a part of a loan agreement but does not encompass all the terms that may be included in a full agreement.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding. It holds both parties accountable to the terms outlined in the document. If the borrower fails to repay the loan as agreed, the lender has the right to take legal action to recover the owed amount.

Do I need a lawyer to create a Promissory Note?

While it is not mandatory to hire a lawyer to create a Promissory Note, it is advisable to consult with one. A lawyer can ensure that the document complies with California laws and that all necessary terms are included. This can help prevent disputes in the future.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is important to document any modifications in writing and have both parties sign the amended document to maintain clarity and enforceability.

Documents used along the form

When dealing with a California Promissory Note, several other forms and documents often accompany it to ensure clarity and legal compliance. Each of these documents serves a specific purpose in the lending process, making the transaction smoother for both parties involved.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rates, repayment schedule, and any penalties for late payments. It acts as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged to the lender. It protects the lender’s interests in case of default by the borrower.

- Disclosure Statement: This document provides important information about the loan, including the total cost of the loan, any fees, and the rights of the borrower. It ensures transparency and helps borrowers make informed decisions.

- Articles of Incorporation: This essential document is needed for registering a new corporation in Washington and lays the groundwork for the company's legal identity. To ensure compliance and a smooth incorporation process, All Washington Forms should be reviewed and completed carefully.

- Notice of Default: In the event of non-payment, this document formally notifies the borrower of their default status. It serves as a crucial step before any legal action can be taken to recover the owed amount.

Having these documents in place not only protects the interests of both parties but also fosters a clear understanding of the terms and obligations involved in the loan agreement. Proper documentation is key to a successful lending experience.

Misconceptions

Understanding the California Promissory Note form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are ten common misconceptions clarified:

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, terms can vary significantly based on the agreement between the parties involved.

- A Promissory Note is a Loan Agreement: Some think a promissory note serves as a complete loan agreement. While it outlines the borrower's promise to repay, it does not include all terms typically found in a loan agreement.

- Notarization is Required: Many assume that a promissory note must be notarized to be valid. In California, notarization is not required for the note to be enforceable.

- Interest Rates Must Be Specified: Some people think that a promissory note must always specify an interest rate. However, it can be structured as an interest-free loan if both parties agree.

- Only Banks Can Issue Promissory Notes: A common belief is that only banks can issue promissory notes. In fact, any individual or business can create a promissory note as long as it meets legal requirements.

- Promissory Notes are Non-Binding: Some individuals think that promissory notes are not legally binding. However, they are enforceable contracts once signed by both parties.

- They are Only for Large Loans: Many believe promissory notes are only for significant amounts of money. In truth, they can be used for any loan amount, regardless of size.

- They Can’t Be Transferred: Some think that once a promissory note is created, it cannot be transferred to another party. In fact, promissory notes can be sold or assigned to others.

- All Promissory Notes are Written: There is a misconception that all promissory notes must be in writing. While written notes are standard, verbal agreements can also be considered promissory notes in some cases.

- They Are Only Used in Personal Loans: Many people think promissory notes are only applicable in personal loans. However, they are also used in business transactions and real estate deals.

Being aware of these misconceptions can help both borrowers and lenders navigate the complexities of promissory notes more effectively.