California Quitclaim Deed Document

In California, the Quitclaim Deed form serves as a crucial tool for property owners looking to transfer their interest in real estate without the complexities often associated with traditional sales. This straightforward document allows one party, known as the grantor, to convey their rights to a property to another party, the grantee, with minimal fuss. Unlike warranty deeds, which provide guarantees about the property's title, a quitclaim deed offers no such assurances, making it essential for both parties to understand the implications of this type of transfer. Typically used among family members, in divorce settlements, or for clearing up title issues, the Quitclaim Deed is favored for its simplicity and speed. While the form itself is relatively easy to complete, it’s important to ensure that all necessary information is accurately included, such as the property description, the names of the parties involved, and the signature of the grantor. Additionally, recording the deed with the county is a vital step to ensure the transfer is legally recognized. Understanding the nuances of this form can empower individuals to make informed decisions about their property rights.

Discover More Quitclaim Deed Forms for Different States

Pennsylvania Quit Claim Deed Form - Although it allows for quick transfers, parties should consider potential implications, such as tax consequences.

The Ohio IT AR form is a crucial tool for taxpayers aiming to reclaim overpaid amounts on their state income tax, providing a systematic approach to ensure accurate refunds. For those looking to navigate the intricacies of this process and obtain the necessary documentation, resources can be found through All Ohio Forms, which offer guidance and access to the essential forms needed for submission.

Quit Claim Deed Form Ohio - Customarily, Quitclaim Deeds are recorded with local authorities to ensure clarity in ownership records.

Quitclaim Deed Ny - It is a straightforward way to transfer interest in a property.

Similar forms

- Warranty Deed: This document transfers property ownership and guarantees that the title is clear of any claims. Unlike a quitclaim deed, it offers more protection to the buyer.

- Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and implies that the seller has not sold the property to anyone else. It provides some assurance about the title.

- Deed of Trust: This document secures a loan by transferring the title of the property to a trustee until the loan is repaid. It differs from a quitclaim deed in that it involves a financial obligation.

- Special Purpose Deed: Used for specific situations, such as transferring property between family members or in divorce cases. It may not provide the same level of title assurance as a warranty deed.

- Life Estate Deed: This deed allows a person to retain ownership of a property for their lifetime while transferring the remainder interest to another party. It is more complex than a quitclaim deed.

- Executor’s Deed: Issued by an executor of an estate to transfer property after someone’s death. It is typically used in probate situations and provides a different legal context than a quitclaim deed.

- Tax Deed: This document transfers ownership of a property due to unpaid taxes. It conveys ownership but may come with liens or other issues, unlike a quitclaim deed.

- Bill of Sale: When transferring ownership of personal property, refer to our comprehensive bill of sale guidelines to ensure all legal aspects are properly addressed.

- Bargain and Sale Deed: This type of deed conveys property without warranties against encumbrances. It implies that the seller has the right to sell but does not guarantee a clear title.

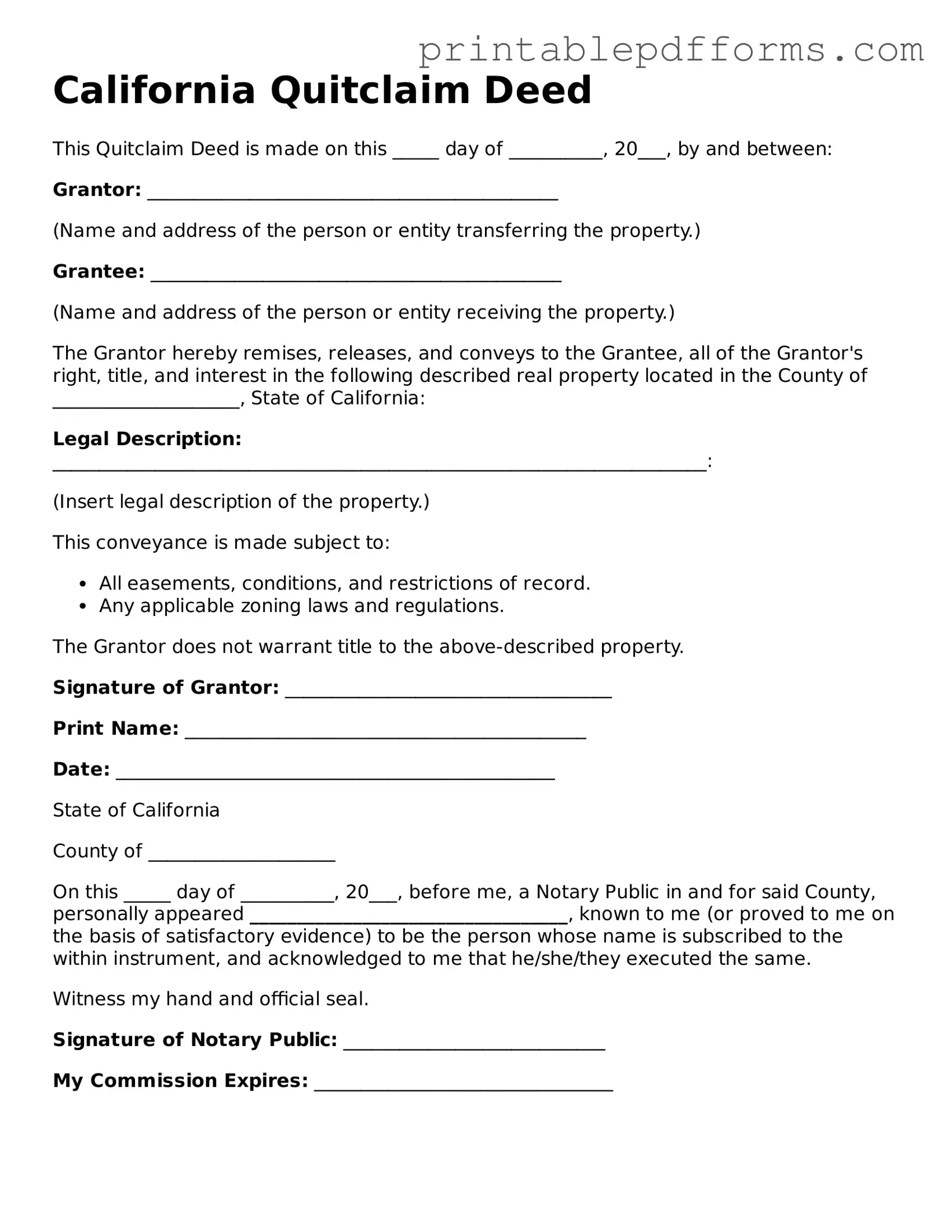

Document Example

California Quitclaim Deed

This Quitclaim Deed is made on this _____ day of __________, 20___, by and between:

Grantor: ____________________________________________

(Name and address of the person or entity transferring the property.)

Grantee: ____________________________________________

(Name and address of the person or entity receiving the property.)

The Grantor hereby remises, releases, and conveys to the Grantee, all of the Grantor's right, title, and interest in the following described real property located in the County of ____________________, State of California:

Legal Description: ______________________________________________________________________:

(Insert legal description of the property.)

This conveyance is made subject to:

- All easements, conditions, and restrictions of record.

- Any applicable zoning laws and regulations.

The Grantor does not warrant title to the above-described property.

Signature of Grantor: ___________________________________

Print Name: ___________________________________________

Date: _______________________________________________

State of California

County of ____________________

On this _____ day of __________, 20___, before me, a Notary Public in and for said County, personally appeared __________________________________, known to me (or proved to me on the basis of satisfactory evidence) to be the person whose name is subscribed to the within instrument, and acknowledged to me that he/she/they executed the same.

Witness my hand and official seal.

Signature of Notary Public: ____________________________

My Commission Expires: ________________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property from one party to another without any warranties. |

| Governing Law | The California Quitclaim Deed is governed by California Civil Code Section 1092. |

| Parties Involved | The parties involved are the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| No Warranty | This type of deed does not guarantee that the grantor has clear title to the property. |

| Common Uses | Quitclaim deeds are often used in divorce settlements, transferring property between family members, or clearing up title issues. |

| Signature Requirement | The grantor must sign the deed in front of a notary public for it to be valid. |

| Recording | To provide public notice of the transfer, the quitclaim deed should be recorded with the county recorder’s office. |

| Tax Implications | Property transfers via quitclaim deed may have tax implications, including potential reassessment of property taxes. |

| Form Availability | California quitclaim deed forms can be obtained online, at legal stationery stores, or through legal professionals. |

| Limitations | Quitclaim deeds do not protect the grantee from claims against the property, such as liens or mortgages. |

Crucial Questions on This Form

What is a Quitclaim Deed in California?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another. In California, it allows the granter (the person giving up their interest) to convey their rights to the property without making any guarantees about the title. This means that if there are any issues with the property title, the new owner (the grantee) cannot hold the granter responsible. Quitclaim Deeds are often used among family members or in situations where the parties know each other well.

How do I complete a Quitclaim Deed in California?

To complete a Quitclaim Deed, follow these steps:

- Obtain a Quitclaim Deed form. You can find this form online or at a local office supply store.

- Fill in the required information, including the names of the granter and grantee, a legal description of the property, and the date of transfer.

- Have the granter sign the document in the presence of a notary public. This step is crucial, as notarization verifies the identity of the signer.

- File the completed Quitclaim Deed with the county recorder’s office where the property is located. There may be a small fee for this service.

Are there any risks associated with using a Quitclaim Deed?

Yes, there are some risks to consider. Since a Quitclaim Deed does not guarantee that the granter holds clear title to the property, the grantee assumes the risk of any claims or liens against the property. It is important to conduct a title search before proceeding to ensure that there are no outstanding issues. Additionally, if the granter has financial obligations related to the property, such as a mortgage, the grantee could be affected if those obligations are not met.

Can a Quitclaim Deed be revoked in California?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked. The transfer of ownership is considered final. However, if there are specific circumstances, such as fraud or undue influence, legal action may be possible to challenge the deed. It is advisable to consult with a legal professional if you believe there are grounds to contest a Quitclaim Deed.

Documents used along the form

The California Quitclaim Deed is a useful document for transferring property ownership, but it is often accompanied by other forms and documents to ensure a smooth transaction. Below is a list of commonly used forms that may be relevant when completing a quitclaim deed in California.

- Grant Deed: This document transfers property ownership and provides some guarantees about the title, such as that the property is free of liens, making it a stronger alternative to a quitclaim deed.

- Title Report: A report that outlines the current status of the property title, including any liens, encumbrances, or claims against it. This is essential for buyers to understand what they are acquiring.

- Preliminary Change of Ownership Report: This form is typically required by the county assessor's office to track changes in property ownership for tax purposes.

- Property Tax Statement: A document that provides information about the property taxes owed on the property. This is important for both buyers and sellers to review before finalizing a transaction.

- Affidavit of Death: If the property is being transferred due to the death of an owner, this affidavit confirms the death and can simplify the transfer process.

- Divorce Settlement Agreement: A crucial document that outlines the terms agreed upon in a divorce, including asset division and support, ensuring both parties understand their rights and obligations. To simplify your divorce process, visit All Washington Forms to start filling out your form.

- Trustee’s Deed: Used when property is transferred by a trustee, this deed is often involved in transactions related to living trusts or estate settlements.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transfers, which can be useful if the property owner is unable to sign the deed themselves.

- Notice of Default: If the property is in foreclosure, this notice informs parties involved of the default status, which can impact the quitclaim deed process.

- Escrow Agreement: An agreement that outlines the terms and conditions under which an escrow company will hold funds and documents until the transaction is complete.

Having these documents prepared and ready can facilitate a smoother transaction when using a California Quitclaim Deed. It is advisable to consult with a legal professional to ensure all necessary paperwork is completed accurately and efficiently.

Misconceptions

Understanding the California Quitclaim Deed can be tricky. Here are nine common misconceptions that often arise:

-

A Quitclaim Deed transfers ownership.

Many believe that a quitclaim deed guarantees a full transfer of ownership. In reality, it only transfers whatever interest the grantor has in the property, if any. There may be no warranty that the title is clear.

-

Quitclaim Deeds are only for divorces.

While quitclaim deeds are often used to transfer property between former spouses, they can also be used in various situations, such as transferring property to family members or between business partners.

-

A Quitclaim Deed eliminates all claims to the property.

This is not true. A quitclaim deed does not remove any liens or claims against the property. If there are existing debts, those may still affect the new owner.

-

Quitclaim Deeds do not require notarization.

In California, a quitclaim deed must be signed by the grantor and notarized to be valid. This step is essential to ensure the deed is legally recognized.

-

Using a Quitclaim Deed is always a quick process.

While the paperwork itself may be simple, it can take time to properly prepare, sign, and record the deed. Rushing through the process can lead to mistakes.

-

Quitclaim Deeds are only for transferring residential property.

This form can be used for any type of real estate, including commercial properties, vacant land, and even timeshares.

-

Once a Quitclaim Deed is signed, it cannot be revoked.

While a quitclaim deed is generally irrevocable once executed, there are circumstances, such as fraud or undue influence, that may allow for legal action to challenge the deed.

-

All parties must be present to sign the Quitclaim Deed.

Only the grantor needs to be present for the signing and notarization. The grantee does not need to be present at that time.

-

A Quitclaim Deed is the same as a Warranty Deed.

These two types of deeds serve different purposes. A warranty deed provides guarantees about the title, while a quitclaim deed does not offer any such assurances.

Being informed about these misconceptions can help ensure a smoother property transfer process in California. Always consider consulting a legal professional when dealing with real estate transactions.