California Real Estate Purchase Agreement Document

The California Real Estate Purchase Agreement form is a crucial document in the home buying process, serving as a blueprint for the transaction between buyers and sellers. This comprehensive form outlines key details such as the purchase price, property description, and terms of financing, ensuring that both parties have a clear understanding of their obligations. It includes important contingencies that protect buyers, such as inspections and financing approvals, while also detailing the timeline for closing the sale. Additionally, the agreement addresses disclosures, which inform buyers of any known issues with the property, and specifies the earnest money deposit, a sign of the buyer's commitment. By clearly defining the roles and responsibilities of each party, the California Real Estate Purchase Agreement helps facilitate a smooth transaction, minimizing misunderstandings and potential disputes. Understanding this form is essential for anyone involved in real estate transactions in California, as it lays the groundwork for a successful sale and promotes transparency throughout the process.

Discover More Real Estate Purchase Agreement Forms for Different States

Purchase and Sale Agreement Florida - Establishes the timeframe for the title transfer process.

The Texas Motorcycle Bill of Sale form not only serves as a crucial legal document for recording the sale and transfer of ownership of a motorcycle in Texas, but it also provides a valuable resource for those looking to create it. For more information, you can visit freebusinessforms.org/, where you can find templates and guidelines to ensure a smooth transaction and protect the rights of both buyers and sellers.

House Sales Contract - The agreement promotes accountability and clarity in the property transfer.

How to Make a Purchase Agreement - Many use templates for these agreements but it is recommended to tailor them to fit each unique situation.

Similar forms

- Lease Agreement: This document outlines the terms under which a property can be rented. Like the Real Estate Purchase Agreement, it details the parties involved, property description, and payment terms.

- Sales Contract: A general sales contract serves a similar purpose in various transactions. It establishes the obligations of both the buyer and seller, including price and delivery terms, similar to a Real Estate Purchase Agreement.

- Option to Purchase Agreement: This document gives a potential buyer the right to purchase a property at a later date. It includes terms and conditions, much like a Real Estate Purchase Agreement, but focuses on the option rather than an immediate sale.

- Joint Venture Agreement: In real estate, this document outlines the terms of collaboration between parties to develop or purchase property. It shares similarities in detailing responsibilities and financial arrangements.

- Escrow Agreement: This document establishes a neutral third party to hold funds during a transaction. It parallels the Real Estate Purchase Agreement by ensuring that all conditions are met before the sale is finalized.

- Tax Refund Application: After filing an Ohio income tax or school district income tax return, individuals may utilize the Ohio IT AR form to claim their refund. For more details, refer to All Ohio Forms.

- Title Transfer Document: This document is used to officially transfer ownership of a property. It is similar in that it is a critical step in the real estate transaction process, confirming the buyer's rights.

- Disclosure Statement: Sellers often provide this document to inform buyers of any known issues with the property. It complements the Real Estate Purchase Agreement by ensuring transparency and informed decision-making.

- Home Inspection Report: While not a contract, this report details the condition of a property. It is closely related to the Real Estate Purchase Agreement as it can influence the terms of the sale.

- Deed: This legal document transfers ownership of real estate. Like the Real Estate Purchase Agreement, it is essential for completing a property transaction.

- Financing Agreement: This document outlines the terms of a loan for purchasing property. It is similar in that it details financial obligations and conditions related to the purchase.

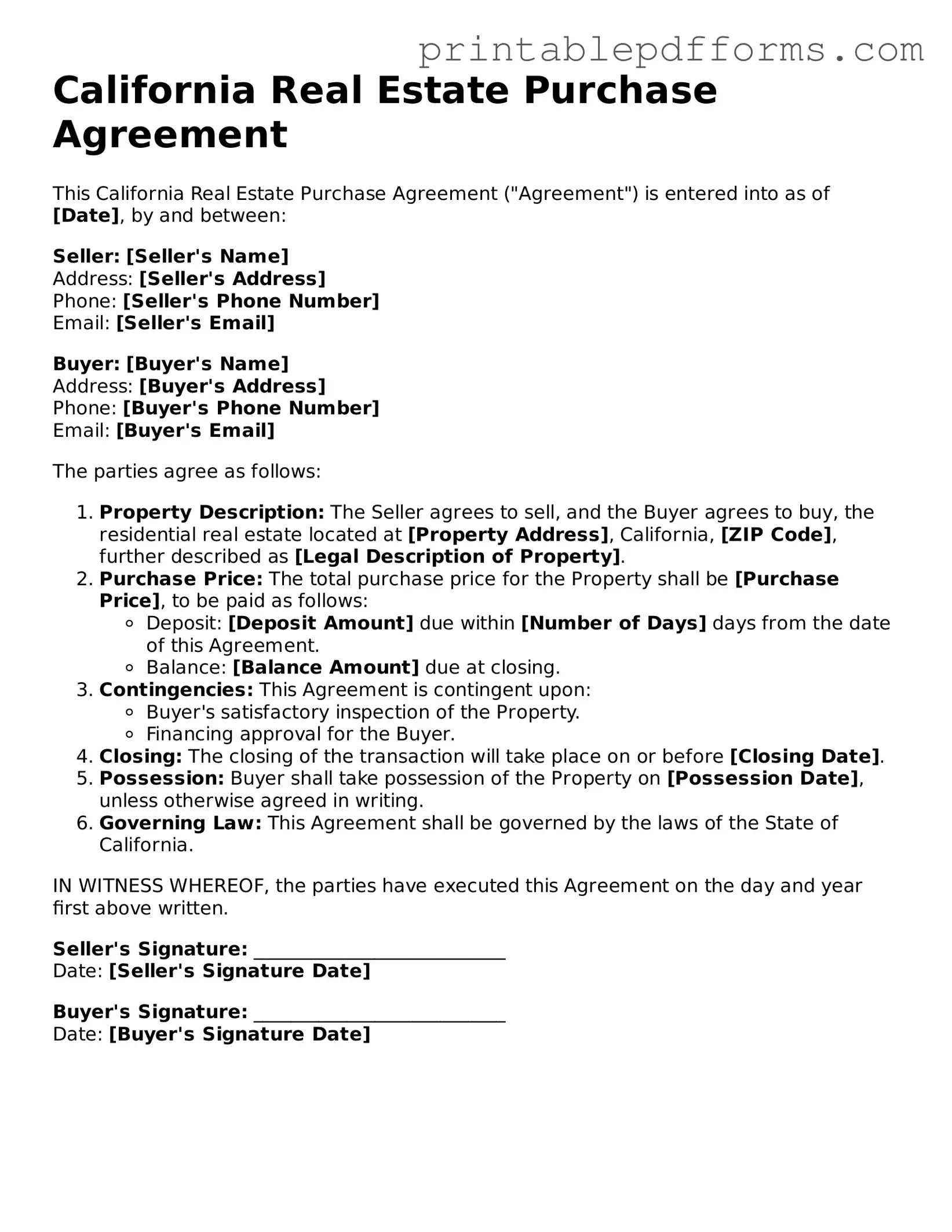

Document Example

California Real Estate Purchase Agreement

This California Real Estate Purchase Agreement ("Agreement") is entered into as of [Date], by and between:

Seller: [Seller's Name]

Address: [Seller's Address]

Phone: [Seller's Phone Number]

Email: [Seller's Email]

Buyer: [Buyer's Name]

Address: [Buyer's Address]

Phone: [Buyer's Phone Number]

Email: [Buyer's Email]

The parties agree as follows:

- Property Description: The Seller agrees to sell, and the Buyer agrees to buy, the residential real estate located at [Property Address], California, [ZIP Code], further described as [Legal Description of Property].

- Purchase Price: The total purchase price for the Property shall be [Purchase Price], to be paid as follows:

- Deposit: [Deposit Amount] due within [Number of Days] days from the date of this Agreement.

- Balance: [Balance Amount] due at closing.

- Contingencies: This Agreement is contingent upon:

- Buyer's satisfactory inspection of the Property.

- Financing approval for the Buyer.

- Closing: The closing of the transaction will take place on or before [Closing Date].

- Possession: Buyer shall take possession of the Property on [Possession Date], unless otherwise agreed in writing.

- Governing Law: This Agreement shall be governed by the laws of the State of California.

IN WITNESS WHEREOF, the parties have executed this Agreement on the day and year first above written.

Seller's Signature: ___________________________

Date: [Seller's Signature Date]

Buyer's Signature: ___________________________

Date: [Buyer's Signature Date]

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The California Real Estate Purchase Agreement is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Governing Law | This agreement is governed by the laws of the State of California, specifically under the California Civil Code. |

| Parties Involved | The form typically includes sections for the buyer and seller, ensuring that both parties are clearly identified. |

| Property Description | A detailed description of the property being sold is included, which may consist of the address, legal description, and any included fixtures. |

| Purchase Price | The agreement specifies the purchase price, along with any deposits or earnest money required to secure the transaction. |

| Contingencies | Buyers can include contingencies in the agreement, such as financing, inspections, or the sale of their current home. |

| Closing Date | The agreement outlines the anticipated closing date, which is the date when the ownership of the property is officially transferred. |

Crucial Questions on This Form

What is a California Real Estate Purchase Agreement?

The California Real Estate Purchase Agreement is a legal document that outlines the terms and conditions for buying and selling real estate in California. This agreement details the rights and obligations of both the buyer and the seller. It typically includes information such as the purchase price, financing details, contingencies, and closing dates. By formalizing the transaction, this document helps protect the interests of both parties involved.

What are the key components of the agreement?

A well-structured Real Estate Purchase Agreement includes several essential components:

- Parties Involved: Names and contact information of the buyer and seller.

- Property Description: A detailed description of the property, including the address and any included fixtures.

- Purchase Price: The agreed-upon amount for the property and how it will be paid.

- Contingencies: Conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Closing Details: The date and process for finalizing the sale.

How does the contingency clause work?

The contingency clause in the agreement allows buyers to set specific conditions that must be fulfilled before the sale can be completed. Common contingencies include:

- Home inspections to ensure the property is in good condition.

- Appraisals to confirm the property's value.

- Financing approval to secure a mortgage.

If any contingency is not met, the buyer may have the option to withdraw from the agreement without penalty.

Can the agreement be modified after signing?

Yes, modifications can be made to the Real Estate Purchase Agreement after it has been signed. However, both parties must agree to any changes. It is essential to document these modifications in writing and have both parties sign the revised agreement. This ensures clarity and prevents misunderstandings in the future.

What happens if one party breaches the agreement?

If one party fails to fulfill their obligations under the agreement, it is considered a breach. The non-breaching party has several options, including:

- Seeking damages, which may include financial compensation for losses incurred.

- Requesting specific performance, which means asking the court to enforce the terms of the agreement.

- Terminating the agreement if the breach is significant enough.

It's advisable to consult with a legal professional to understand the best course of action in such situations.

Documents used along the form

When engaging in a real estate transaction in California, several key documents accompany the California Real Estate Purchase Agreement. These forms help clarify terms, protect parties' interests, and ensure compliance with state laws. Below are five essential documents commonly used alongside the Purchase Agreement.

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers must provide this information to buyers to ensure transparency and informed decision-making.

- Pre-Approval Letter: A letter from a lender indicating that a buyer is pre-approved for a mortgage up to a specified amount. This document enhances the buyer's credibility and strengthens their offer.

- WC-240 Form - A crucial document in Georgia's workers' compensation system that informs employees about job offers that align with their health conditions, ensuring they are aware of suitable employment opportunities. For further details, visit georgiapdf.com/wc-240-georgia.

- Counter Offer: If the seller does not accept the initial offer, they may issue a counter offer. This document outlines new terms and conditions, allowing negotiations to continue until both parties reach an agreement.

- Escrow Instructions: This document provides detailed instructions to the escrow agent on how to handle the transaction. It includes information on funds, documents to be exchanged, and timelines for completing the sale.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document summarizes all financial transactions related to the sale. It details costs, fees, and the final amounts due at closing, ensuring both parties understand their financial obligations.

These documents play a crucial role in the real estate transaction process, helping to safeguard the interests of buyers and sellers alike. Understanding each form's purpose can lead to smoother negotiations and successful closings.

Misconceptions

Understanding the California Real Estate Purchase Agreement (RPA) is essential for anyone involved in a real estate transaction. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- The RPA is a standard form that can be filled out without legal assistance. Many believe that the RPA is a simple template that requires little more than filling in the blanks. In reality, while it is a standardized form, the nuances of each transaction can be complex. Consulting with a professional can help ensure that all necessary details are accurately addressed.

- Once signed, the RPA is set in stone and cannot be changed. Some people think that once both parties sign the agreement, it is unchangeable. However, the RPA can be amended if both parties agree to the changes in writing. Flexibility exists, but communication is key.

- The RPA guarantees a successful transaction. A common misconception is that signing the RPA guarantees the sale will go through. The agreement outlines the terms, but it does not ensure that the transaction will close. Various factors, such as financing issues or inspection results, can affect the outcome.

- Only the buyer needs to understand the RPA. Many assume that only the buyer should be familiar with the details of the RPA. In truth, both buyers and sellers should understand the agreement fully. Each party has rights and responsibilities that must be acknowledged.

- The RPA does not require disclosures. Some individuals believe that the RPA itself does not involve disclosures. However, California law mandates that sellers provide certain disclosures about the property, which are often attached to the RPA. Ignoring these can lead to legal complications.

- All contingencies are automatically included in the RPA. There is a belief that the RPA includes all necessary contingencies by default. In reality, contingencies must be specifically outlined in the agreement. Buyers and sellers should discuss which contingencies are important for their transaction.

By addressing these misconceptions, individuals can approach the California Real Estate Purchase Agreement with a clearer understanding, ultimately leading to smoother transactions.