California Transfer-on-Death Deed Document

The California Transfer-on-Death Deed (TOD) is a powerful estate planning tool that allows property owners to transfer real estate to designated beneficiaries upon their death, without the need for probate. This form simplifies the process of passing on property, ensuring a smoother transition for heirs and minimizing potential disputes. By executing a TOD, individuals can retain full control over their property during their lifetime, as the transfer occurs automatically upon death. Importantly, the TOD deed must be properly recorded with the county recorder's office to be effective, and it can be revoked or modified at any time before the owner’s death. This flexibility makes the TOD deed an appealing option for many California residents looking to streamline their estate planning while providing for their loved ones. Understanding the nuances of this form is essential, as it can significantly impact the way property is handled after one's passing.

Discover More Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Florida Form - Using this deed can ensure that property goes to your chosen beneficiaries without hassle.

For those looking to navigate the intricacies of vehicle transfers, a thorough understanding of the ATV Bill of Sale process is crucial. You can download a reliable template for the ATV Bill of Sale at essential ATV Bill of Sale requirements to ensure all aspects of the transaction are properly documented.

Transfer on Death Deed Ohio Pdf - This deed functions as a straightforward, low-cost method to plan for property transfers upon death.

Texas Transfer on Death Deed Form - It is a common misconception that property must go through probate; a Transfer-on-Death Deed offers an alternative solution.

Similar forms

The Transfer-on-Death Deed (TOD) form is a useful estate planning tool that allows individuals to transfer real property to a beneficiary upon their death, without going through probate. Several other documents serve similar purposes in estate planning and property transfer. Below are nine documents that share similarities with the Transfer-on-Death Deed:

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death, including real property. Unlike a TOD, a will must go through probate.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. Upon death, the assets can be transferred to beneficiaries without probate, similar to a TOD.

- Beneficiary Designation Forms: These forms are often used for financial accounts and insurance policies to designate beneficiaries who will receive the assets upon the account holder's death.

- Joint Tenancy with Right of Survivorship: Property held in joint tenancy automatically passes to the surviving owner upon death, similar to how a TOD deed transfers property to a beneficiary.

- Transfer-on-Death Registration for Securities: This allows individuals to designate a beneficiary for stocks and bonds, ensuring a smooth transfer upon death without probate.

- Payable-on-Death Accounts: These bank accounts allow individuals to name a beneficiary who will receive the funds directly upon the account holder's death, bypassing probate.

- Life Estate Deed: This deed allows a person to retain the right to live in a property during their lifetime, with the property automatically transferring to a designated beneficiary upon their death.

- Community Property with Right of Survivorship: In certain states, this form of ownership allows married couples to hold property together, automatically passing it to the surviving spouse upon death.

- Ohio BMV Application Form: Essential for establishing legal vehicle ownership, this form provides a detailed guide on the necessary information required by the Ohio Bureau of Motor Vehicles and outlines the consequences of inaccurate declarations. For additional resources, visit All Ohio Forms.

- Assignment of Benefits: This document allows a person to assign benefits from various assets or accounts to a beneficiary, similar to how a TOD deed designates a recipient for real estate.

Document Example

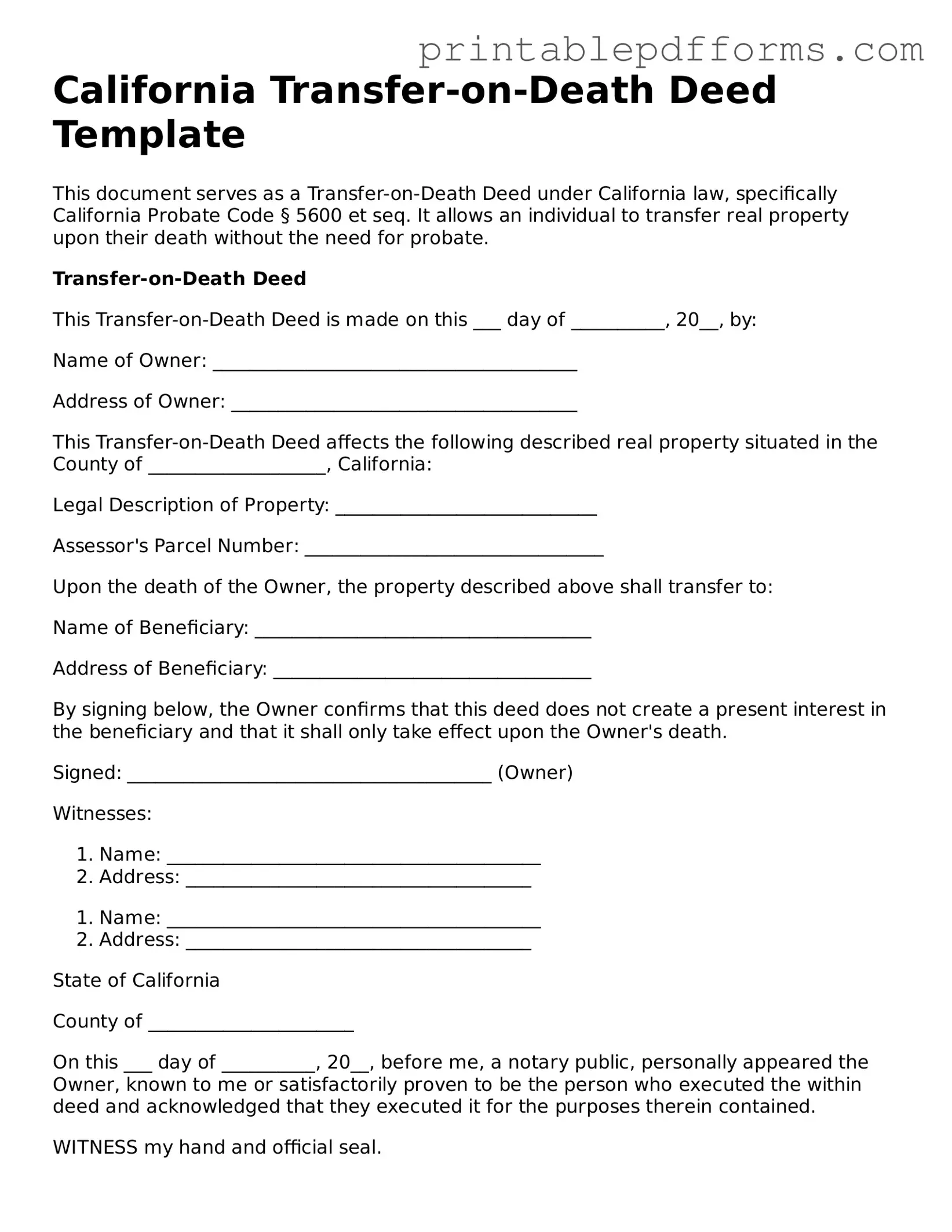

California Transfer-on-Death Deed Template

This document serves as a Transfer-on-Death Deed under California law, specifically California Probate Code § 5600 et seq. It allows an individual to transfer real property upon their death without the need for probate.

Transfer-on-Death Deed

This Transfer-on-Death Deed is made on this ___ day of __________, 20__, by:

Name of Owner: _______________________________________

Address of Owner: _____________________________________

This Transfer-on-Death Deed affects the following described real property situated in the County of ___________________, California:

Legal Description of Property: ____________________________

Assessor's Parcel Number: ________________________________

Upon the death of the Owner, the property described above shall transfer to:

Name of Beneficiary: ____________________________________

Address of Beneficiary: __________________________________

By signing below, the Owner confirms that this deed does not create a present interest in the beneficiary and that it shall only take effect upon the Owner's death.

Signed: _______________________________________ (Owner)

Witnesses:

- Name: ________________________________________

- Address: _____________________________________

- Name: ________________________________________

- Address: _____________________________________

State of California

County of ______________________

On this ___ day of __________, 20__, before me, a notary public, personally appeared the Owner, known to me or satisfactorily proven to be the person who executed the within deed and acknowledged that they executed it for the purposes therein contained.

WITNESS my hand and official seal.

Signature: ________________________________________ (Notary Public)

My commission expires: ____________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The California Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by California Probate Code Section 5600-5694. |

| Revocability | The Transfer-on-Death Deed can be revoked or changed at any time by the property owner during their lifetime. |

| Eligibility | Only real property, such as residential or commercial land, can be transferred using this deed. |

| Filing Requirement | The deed must be recorded with the county recorder's office where the property is located to be effective. |

Crucial Questions on This Form

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon their death. This type of deed provides a simple way to pass property without the need for probate. The owner retains full control of the property during their lifetime, and the beneficiary does not have any rights to the property until the owner passes away.

How do I create a Transfer-on-Death Deed in California?

Creating a TOD Deed in California involves a few straightforward steps:

- Obtain the proper form: You can find the California Transfer-on-Death Deed form online or at legal stationery stores.

- Complete the form: Fill in the required information, including the property description and the name of the beneficiary.

- Sign the deed: The owner must sign the deed in front of a notary public to ensure its validity.

- Record the deed: Submit the signed and notarized deed to the county recorder’s office where the property is located.

Once recorded, the deed is effective, and the property will transfer to the beneficiary upon the owner's death.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do so, you need to execute a new TOD Deed that explicitly revokes the previous one or simply record a revocation document with the county recorder’s office. It is essential to ensure that any changes are properly documented to avoid confusion later.

Are there any tax implications for the beneficiary receiving property through a Transfer-on-Death Deed?

Generally, the transfer of property through a TOD Deed does not trigger immediate tax consequences for the beneficiary. However, the beneficiary may be responsible for property taxes and any capital gains taxes if they sell the property in the future. It is advisable for beneficiaries to consult with a tax professional to understand their specific tax obligations.

What happens if the beneficiary predeceases the owner?

If the designated beneficiary passes away before the owner, the property will not transfer to that beneficiary. Instead, the property will become part of the owner’s estate and will be distributed according to their will or, if there is no will, according to California's intestate succession laws. To avoid complications, it is wise to name an alternate beneficiary in the TOD Deed.

Documents used along the form

The California Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. However, several other forms and documents are often used in conjunction with this deed to ensure a smooth transfer process and clarify intentions. Below is a list of these commonly associated documents.

- Grant Deed: This document is used to transfer ownership of real property. It provides a clear record of the transfer and protects the interests of the new owner.

- WC-200A Georgia Form: This form is essential for requesting a change of physician or additional treatment in workers' compensation cases. Proper completion is crucial for ensuring medical care compliance with state regulations. More information can be found at https://georgiapdf.com/wc-200a-georgia.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and specify how they should be distributed after death. It can help avoid probate and streamline the transfer process.

- Will: A will outlines how a person's assets should be distributed upon their death. It can include instructions for property not covered by the Transfer-on-Death Deed.

- Affidavit of Death: This document is used to officially declare the death of an individual. It may be required to complete the transfer of property under the Transfer-on-Death Deed.

- Change of Beneficiary Form: If the property owner wishes to update the beneficiaries listed in the Transfer-on-Death Deed, this form is necessary to make those changes legally binding.

Using these documents in conjunction with the Transfer-on-Death Deed can help ensure that your wishes are honored and that the transfer of property occurs smoothly. It is advisable to consult with a legal professional to navigate these processes effectively.

Misconceptions

The California Transfer-on-Death Deed (TOD) is a valuable tool for estate planning, allowing individuals to transfer property to beneficiaries without the need for probate. However, several misconceptions exist about this form. Here is a list of ten common misunderstandings:

- It automatically transfers property upon death. The TOD deed does not transfer ownership until the property owner passes away. Until that point, the owner retains full control over the property.

- It eliminates the need for a will. While a TOD deed can transfer property, it does not replace the need for a will. A will addresses other assets and may include specific instructions for the distribution of the estate.

- All types of property can be transferred using a TOD deed. Not all property qualifies. For instance, certain types of real estate, such as commercial properties, may have restrictions.

- Beneficiaries can access the property before the owner's death. Beneficiaries cannot access or manage the property until the owner dies. The owner retains all rights until that time.

- It is a one-size-fits-all solution. Each individual's situation is unique. A TOD deed may not be the best option for everyone, and personal circumstances should dictate estate planning choices.

- Filing a TOD deed is expensive. The cost of preparing and filing a TOD deed is generally low compared to the expenses associated with probate. It can be a cost-effective solution for many.

- Once filed, it cannot be changed. A TOD deed can be revoked or modified by the property owner at any time before their death. Changes can be made as long as the owner is competent.

- It is only for married couples. The TOD deed can be used by any individual, regardless of marital status. Single individuals, partners, and families can all benefit from it.

- It is only valid in California. While the TOD deed is specific to California law, other states have similar provisions. However, the rules and requirements can vary significantly.

- It guarantees that the property will avoid probate. While a TOD deed typically allows for the transfer of property outside of probate, complications can arise. For example, if the property owner has outstanding debts, creditors may still have claims.

Understanding these misconceptions can help individuals make informed decisions about their estate planning strategies and ensure that their wishes are honored after they pass away.