Fill a Valid Cash Drawer Count Sheet Form

The Cash Drawer Count Sheet form serves as an essential tool for businesses that handle cash transactions. This form facilitates the accurate tracking of cash flow by providing a structured method for recording the amount of cash present in a drawer at the beginning and end of a shift. It typically includes sections for noting the date, employee identification, and the starting balance, as well as a detailed breakdown of cash sales, refunds, and any discrepancies. By documenting these figures, the form helps to ensure accountability and transparency in cash management. Additionally, it can assist in identifying patterns of cash handling and potential areas for improvement. The use of this form can also play a crucial role in preventing theft and errors, contributing to the overall financial integrity of the organization. In essence, the Cash Drawer Count Sheet is not just a record-keeping tool; it is a fundamental component of effective cash management practices.

Additional PDF Templates

Ca Marriage Certificate - It may require information about the date and location of the marriage ceremony.

To ensure a smooth recovery process, individuals interested in reclaiming their lost assets should access the necessary documentation, including the All Ohio Forms, as this is essential for effectively navigating the system and retrieving their funds.

Cash Payment Receipts - Every Cash Receipt should bear the signature of the personnel processing the transaction.

Similar forms

The Cash Drawer Count Sheet form serves an important role in financial management, particularly in retail and service industries. Below are ten documents that share similarities with the Cash Drawer Count Sheet, each serving a unique purpose while maintaining a common theme of tracking and managing cash flow.

- Daily Sales Report: This document summarizes the total sales made during a specific day, including cash and credit transactions. Like the Cash Drawer Count Sheet, it helps in reconciling cash flow and ensuring accuracy in financial records.

- Petty Cash Log: Used to track small cash expenditures, this log documents each transaction made from the petty cash fund. Both documents focus on cash management and accountability.

- Bank Deposit Slip: This form is used to record the cash and checks being deposited into a bank account. Similar to the Cash Drawer Count Sheet, it provides a record of cash movement and assists in balancing accounts.

- Cash Register Tape: This printout from a cash register details each transaction made during a shift. It complements the Cash Drawer Count Sheet by providing a breakdown of sales, aiding in reconciliation.

- End-of-Day Cash Report: This report outlines the cash on hand at the end of the business day, similar to the Cash Drawer Count Sheet, which also tracks cash totals to ensure they match sales records.

- Expense Report: This document records expenses incurred by employees during business operations. Both the Expense Report and Cash Drawer Count Sheet involve tracking financial transactions for accountability.

- Cash Flow Statement: A financial statement that summarizes cash inflows and outflows over a specific period. Like the Cash Drawer Count Sheet, it provides insights into the cash position of a business.

- Reconciliation Statement: This document compares two sets of records to ensure they match, often used to reconcile bank statements with internal records. It shares the goal of accuracy with the Cash Drawer Count Sheet.

- Vehicle Purchase Agreement: Similar to the Cash Drawer Count Sheet, this form clearly outlines the terms of a sale. For detailed information, you can refer to https://freebusinessforms.org.

- Invoice Payment Record: This record tracks payments received against invoices issued. Both documents help in maintaining accurate financial records and tracking cash movements.

- Sales Receipt: Issued to customers after a transaction, it serves as proof of purchase. Similar to the Cash Drawer Count Sheet, it documents cash transactions and supports financial accountability.

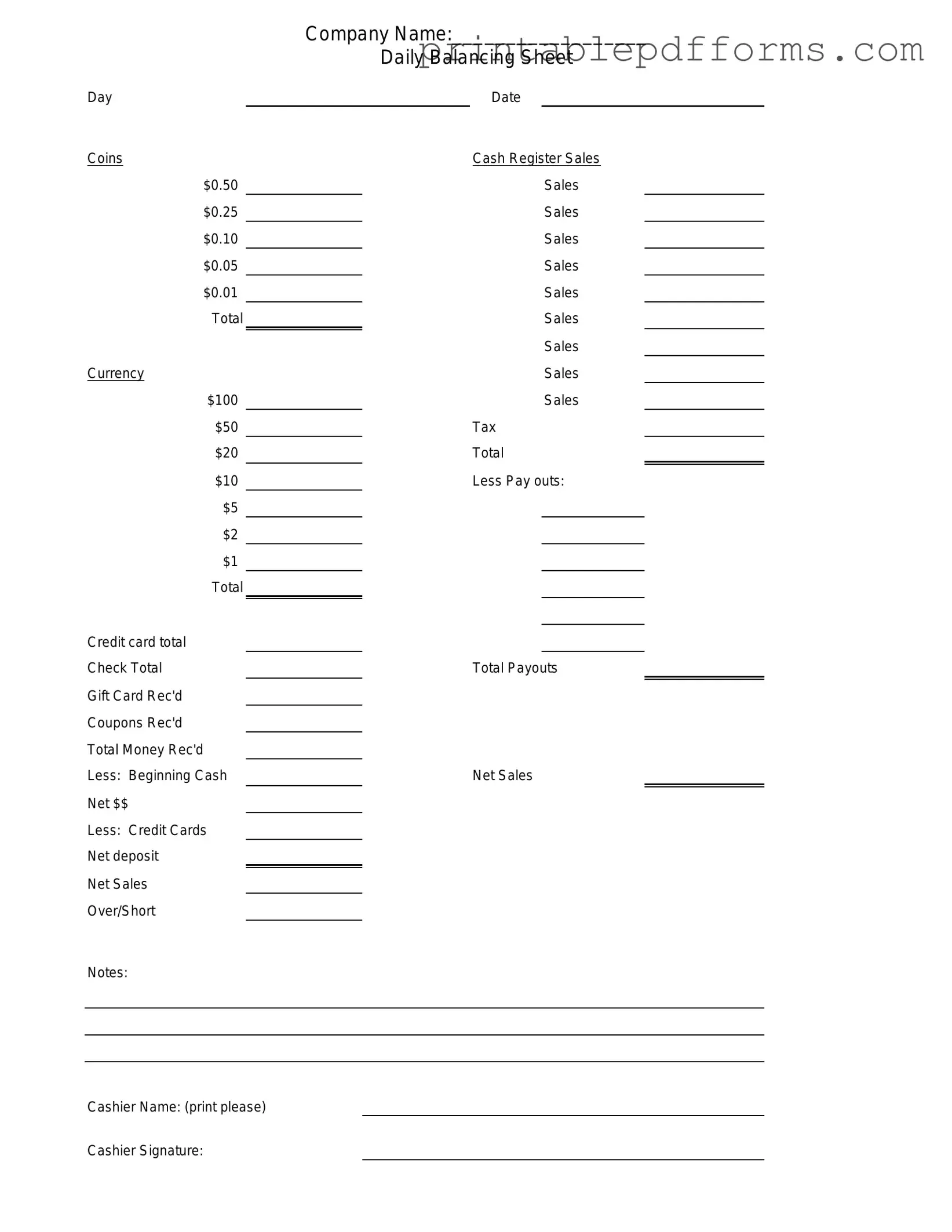

Document Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to document the cash on hand in a cash register or drawer at the end of a business day. |

| Importance | This form helps in maintaining accurate financial records and aids in identifying discrepancies in cash handling. |

| Frequency of Use | Businesses typically use this form daily, especially those that handle cash transactions regularly. |

| Components | The form generally includes sections for recording the starting cash amount, cash received, cash paid out, and the ending cash amount. |

| Signature Requirement | It is often required that a manager or supervisor signs the form to verify the accuracy of the count. |

| State-Specific Regulations | Some states may have specific laws regarding cash handling and record-keeping, which can affect how this form is used. |

| Record Retention | Businesses should retain completed Cash Drawer Count Sheets for a specified period, often for tax and audit purposes. |

| Digital vs. Paper | While many businesses use paper forms, digital versions are becoming more common due to ease of storage and retrieval. |

Crucial Questions on This Form

What is the purpose of the Cash Drawer Count Sheet form?

The Cash Drawer Count Sheet form is designed to help businesses accurately track and manage cash transactions. It provides a systematic way to record the amount of cash in the drawer at the beginning and end of a shift. This ensures that all cash is accounted for and helps identify any discrepancies. By maintaining accurate records, businesses can improve financial accountability and streamline cash management processes.

How do I fill out the Cash Drawer Count Sheet form?

Filling out the Cash Drawer Count Sheet form involves several straightforward steps:

- Start by entering the date and the name of the person responsible for the cash drawer.

- Record the initial cash amount at the beginning of the shift in the designated section.

- As transactions occur, keep track of cash received and cash paid out. Ensure that each transaction is noted accurately.

- At the end of the shift, count the cash in the drawer and enter the total in the appropriate section.

- Finally, calculate the difference between the initial amount and the final amount to identify any variances.

Always double-check your entries for accuracy before submitting the form to ensure proper record-keeping.

Why is it important to use the Cash Drawer Count Sheet regularly?

Regular use of the Cash Drawer Count Sheet is crucial for several reasons:

- It helps prevent theft and fraud by ensuring that all cash transactions are documented and monitored.

- Frequent counting and recording of cash can highlight patterns or issues that may need to be addressed.

- Accurate records aid in financial reporting and can support audits or financial reviews.

- It promotes accountability among employees handling cash, fostering a culture of responsibility.

By consistently using the form, businesses can maintain better control over their cash flow and financial integrity.

What should I do if there is a discrepancy in the cash count?

If you encounter a discrepancy in the cash count, take the following steps:

- First, double-check your calculations and ensure that all entries on the Cash Drawer Count Sheet are accurate.

- Review the transaction records for the shift to identify any missed entries or errors.

- If the discrepancy persists, consult with a supervisor or manager to discuss the findings.

- Document the discrepancy and any actions taken to resolve it on the form.

- Implement additional measures, if necessary, to prevent future discrepancies.

Addressing discrepancies promptly is essential for maintaining trust and accuracy in financial operations.

Documents used along the form

When managing cash transactions in a business, several forms and documents work together with the Cash Drawer Count Sheet. Each of these documents plays a crucial role in maintaining accurate financial records and ensuring accountability.

- Cash Register Tape: This document provides a summary of all sales made during a specific period. It shows the total amount of cash collected and helps verify the cash count.

- ATV Bill of Sale Form: This legal document facilitates the transfer of ownership for all-terrain vehicles in New York, ensuring compliance with state regulations. For further information, visit nypdfforms.com/atv-bill-of-sale-form.

- Deposit Slip: A deposit slip is used when transferring cash from the cash drawer to the bank. It details the amount being deposited and serves as proof of the transaction.

- Sales Receipt: A sales receipt is given to customers upon purchase. It records individual transactions and can be used for returns or exchanges, ensuring transparency in sales.

- Expense Report: This report tracks any cash expenses made during the business day. It provides insight into cash outflows and helps reconcile the cash drawer at the end of the day.

- Cash Handling Policy: This document outlines the procedures for managing cash within the business. It includes guidelines for cash counts, deposits, and handling discrepancies.

- Daily Sales Report: This report summarizes daily sales figures, including cash, credit, and other payment methods. It helps management analyze sales trends and performance.

Using these documents alongside the Cash Drawer Count Sheet enhances financial accuracy and operational efficiency. Together, they create a comprehensive system for managing cash flow in any business.

Misconceptions

The Cash Drawer Count Sheet form is often misunderstood. Here are four common misconceptions about this form:

-

It is only necessary for large businesses.

Many believe that only large retailers need a Cash Drawer Count Sheet. However, this form is beneficial for any business that handles cash transactions, regardless of size. It helps ensure accurate cash management.

-

It is only used at the end of the day.

Some people think the form is only relevant for end-of-day cash counts. In reality, it can be used at any time to track cash flow, identify discrepancies, and maintain accountability throughout the day.

-

It is a complicated document.

There is a misconception that the Cash Drawer Count Sheet is complex and difficult to complete. In truth, it is designed to be straightforward, making it easy for employees to fill out accurately.

-

It is not necessary if there are no cash transactions.

Some may think that if a business primarily accepts card payments, a Cash Drawer Count Sheet is unnecessary. However, even minimal cash transactions should be documented to ensure transparency and proper financial tracking.