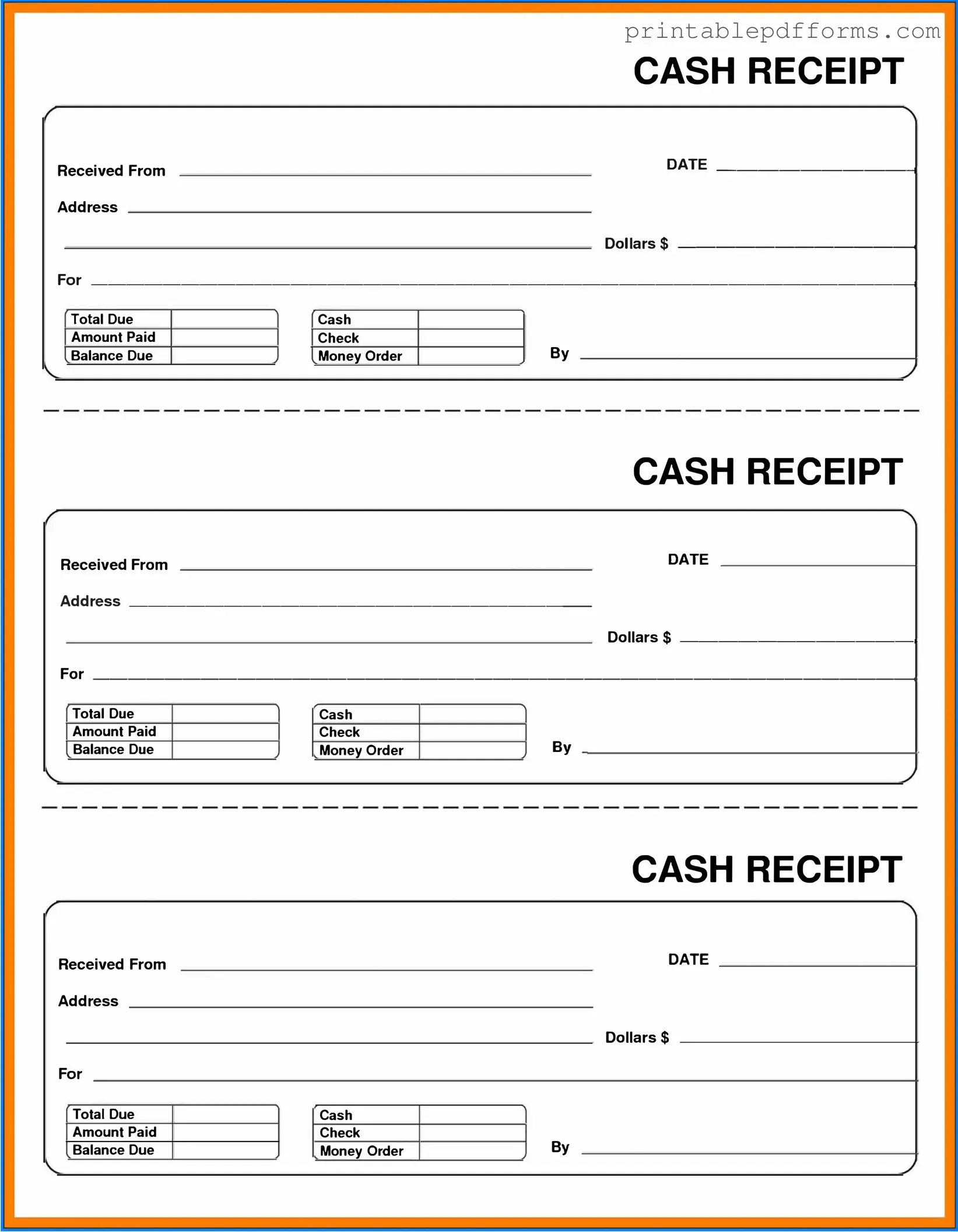

Fill a Valid Cash Receipt Form

The Cash Receipt form serves as a vital document in financial transactions, capturing essential details related to the receipt of cash. This form typically includes information such as the date of the transaction, the amount received, the method of payment, and the purpose of the payment. It often features fields for both the payer's information and the recipient's details, ensuring accountability and traceability. Additionally, a unique receipt number is usually assigned to each transaction, facilitating easy reference and record-keeping. By documenting these elements, the Cash Receipt form not only aids in maintaining accurate financial records but also provides a clear record for auditing and reconciliation purposes. Ensuring that this form is completed accurately can prevent potential disputes and streamline financial processes, making it an indispensable tool for businesses and organizations alike.

Additional PDF Templates

Shared Well Agreement Template - Each party's rights are defined and cannot be transferred to uninvolved individuals or parties.

For those interested in the equestrian world, understanding the importance of a reliable Horse Bill of Sale document is vital, especially when acquiring or selling livestock. It serves as a crucial piece of evidence in horse transactions, ensuring both parties have clear terms. You can find a helpful template for this at your essential Horse Bill of Sale guide.

Texas Temporary Tag - The form ensures that new vehicle owners can drive legally right away.

Similar forms

- Invoice: An invoice details the goods or services provided and the amount due. Like a cash receipt, it serves as a record of a transaction.

- Sales Receipt: A sales receipt confirms a purchase and includes similar information to a cash receipt, such as the date and amount paid.

- Ohio Unclaimed Form: This form is essential for individuals looking to claim forgotten assets. To learn more about the process, visit All Ohio Forms.

- Payment Voucher: A payment voucher outlines the payment details for a specific expense. It functions similarly by documenting the transaction and the amount paid.

- Deposit Slip: A deposit slip is used when depositing cash or checks into a bank account. It records the amount and source of funds, similar to a cash receipt.

- Credit Memo: A credit memo is issued to reduce the amount owed by a customer. It serves as a record of adjustments, akin to how a cash receipt documents payments.

- Purchase Order: A purchase order initiates a purchase and includes details about the items ordered. It is similar in that it documents the financial transaction process.

- Transaction Record: A transaction record logs all financial transactions for a business. It parallels a cash receipt by providing a detailed account of payments received.

Document Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Cash Receipt form is a document used to record cash transactions, typically when payment is received for goods or services. |

| Purpose | The primary purpose is to provide a record for both the payer and the payee, ensuring transparency in cash transactions. |

| Components | Common components include the date, amount received, payer's information, and the purpose of the payment. |

| Legal Requirement | In many states, businesses are required to maintain accurate records of cash transactions for tax purposes. |

| State-Specific Forms | Some states may have specific forms or requirements for cash receipts. For example, California requires businesses to keep detailed records under the California Revenue and Taxation Code. |

| Record Keeping | It is advisable to keep copies of all cash receipts for a minimum of three years, as they may be needed for audits. |

| Signature | A signature from the person receiving the cash is often included to verify the transaction. |

| Digital Formats | Cash Receipt forms can be created and stored digitally, providing ease of access and organization. |

| Tax Implications | Cash receipts can impact tax filings, as they serve as proof of income received and may need to be reported. |

| Best Practices | It is best practice to issue a receipt immediately upon receiving cash to ensure accuracy and accountability. |

Crucial Questions on This Form

What is a Cash Receipt form?

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. It serves as proof of transaction for both the payer and the recipient. This form is essential for maintaining accurate financial records and can be used in various settings, such as businesses, non-profits, and educational institutions.

Why is a Cash Receipt form important?

The Cash Receipt form plays a crucial role in financial transparency. It helps to:

- Provide clear documentation of cash transactions.

- Ensure proper record-keeping for audits and financial reviews.

- Protect both parties in case of disputes regarding payments.

Who should use a Cash Receipt form?

Anyone who receives cash payments should consider using a Cash Receipt form. This includes:

- Retail businesses accepting cash sales.

- Service providers collecting fees.

- Non-profit organizations receiving donations.

- Educational institutions collecting tuition or fees.

What information is typically included on a Cash Receipt form?

A well-structured Cash Receipt form generally includes the following details:

- Date of the transaction.

- Name of the payer.

- Amount received.

- Purpose of the payment.

- Method of payment (e.g., cash, check).

- Signature of the person receiving the payment.

How do I create a Cash Receipt form?

Creating a Cash Receipt form can be straightforward. You can either design one from scratch or use a template. Here’s how to do it:

- Choose a format (digital or paper).

- Include all necessary fields as mentioned above.

- Ensure there’s space for signatures.

- Consider adding your business logo for professionalism.

Can a Cash Receipt form be used for non-cash transactions?

While a Cash Receipt form is specifically designed for cash transactions, you can adapt it for other payment methods, such as checks or credit cards. Just ensure that the payment method is clearly indicated on the form.

Is it necessary to keep a copy of the Cash Receipt form?

Yes, it is essential to keep a copy of the Cash Receipt form for your records. This practice helps in tracking income and can be invaluable during tax season or if any discrepancies arise regarding the transaction.

How long should I keep Cash Receipt forms?

Generally, it’s advisable to keep Cash Receipt forms for at least three to seven years. This duration aligns with the typical statute of limitations for tax purposes. However, check with a tax professional for specific guidance tailored to your situation.

What should I do if I lose a Cash Receipt form?

If you lose a Cash Receipt form, it’s important to recreate it as soon as possible. Document the details of the transaction to the best of your ability, and if necessary, inform the payer about the situation. Maintaining open communication can help prevent misunderstandings.

Can I customize my Cash Receipt form?

Absolutely! Customizing your Cash Receipt form can enhance its effectiveness. Consider adding your branding, adjusting the layout, or including additional fields that are relevant to your business or organization. Just ensure that all essential information is still included.

Documents used along the form

The Cash Receipt form is an essential document used to acknowledge the receipt of cash payments. It serves as proof of payment and is often accompanied by other forms and documents that provide additional context or support for financial transactions. Below is a list of commonly used documents that may accompany the Cash Receipt form.

- Invoice: This document outlines the goods or services provided to a customer and specifies the amount due. It serves as a formal request for payment.

- Articles of Incorporation: For those looking to establish a corporation, the essential Articles of Incorporation filing details provide crucial guidance for compliance in Washington state.

- Payment Voucher: A payment voucher is used to authorize a payment. It includes details such as the amount, purpose, and recipient of the funds.

- Deposit Slip: A deposit slip is used when cash is deposited into a bank account. It records the amount deposited and the account information.

- Credit Memo: This document is issued to a customer when a return or adjustment is made. It indicates that the customer is owed a certain amount, which can be applied to future purchases.

- Transaction Log: A transaction log is a record of all transactions made, including dates, amounts, and descriptions. It helps in tracking financial activities over time.

- Reconciliation Statement: This statement compares the cash receipts with bank statements to ensure that all transactions are accurately recorded and accounted for.

These documents work together to ensure that financial transactions are properly documented and accounted for. Utilizing them effectively can enhance clarity and transparency in financial dealings.

Misconceptions

Understanding the Cash Receipt form is essential for accurate financial documentation. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- All cash transactions require a Cash Receipt form. Many believe that every cash transaction must be documented with this form. In reality, only transactions that involve a payment received for goods or services need to be recorded.

- The Cash Receipt form is only for businesses. While businesses frequently use this form, individuals can also benefit from it. Anyone receiving cash payments can utilize the Cash Receipt form for personal record-keeping.

- Cash Receipt forms are only necessary for large transactions. Some think that small cash payments do not require documentation. However, maintaining records for all cash transactions, regardless of size, is a good practice for accountability.

- Once completed, a Cash Receipt form does not need to be stored. Many assume that after filling out the form, it can be discarded. In truth, it is crucial to keep these forms for a designated period for tax and auditing purposes.