Fill a Valid Cg 20 10 07 04 Liability Endorsement Form

The CG 20 10 07 04 Liability Endorsement form is a crucial component of commercial general liability insurance, specifically designed to extend coverage to additional insured parties such as owners, lessees, or contractors. This endorsement modifies the existing insurance policy, ensuring that the specified individuals or organizations receive protection against claims of bodily injury, property damage, or personal and advertising injury. Coverage is applicable when these liabilities arise from the acts or omissions of the primary insured or their representatives while performing ongoing operations for the additional insured at designated locations. However, it is important to note that this coverage is limited to what is legally permissible and cannot exceed the terms outlined in any contract or agreement. Additionally, specific exclusions apply, such as liabilities arising after the completion of work or when the work has been put to its intended use by parties outside the project. The endorsement also clarifies that the maximum payout for additional insureds will not exceed the lesser of the contractual requirement or the policy's available limits, ensuring that the coverage remains consistent with the terms agreed upon. Understanding these key elements is essential for both policyholders and additional insured parties to effectively manage their risks and liabilities.

Additional PDF Templates

CBP Form 6059B - Failure to declare items appropriately can lead to future travel complications.

The New York Articles of Incorporation form is a fundamental legal document required to establish a corporation in the state of New York. It details critical information regarding the corporation, including its name, purpose, and structure. For those interested in utilizing this essential form to set up a business, more information can be found at nypdfforms.com/articles-of-incorporation-form, making the process clearer and more accessible.

Passport Form Ds-82 - The form includes a section for emergency contact information, if applicable.

Similar forms

CG 20 10 12 19 Additional Insured Endorsement: Similar to the CG 20 10 07 04, this form also provides coverage for additional insureds but may have different conditions or exclusions that apply.

CG 20 33 07 04 Additional Insured - Owners, Lessees or Contractors: This endorsement extends coverage to additional insureds, focusing on liability arising from the named insured’s operations.

CG 20 37 07 04 Additional Insured - Completed Operations: This document covers additional insureds for liability arising from completed operations, similar to the coverage offered in CG 20 10 07 04.

CG 20 10 04 13 Additional Insured - Designated Person or Organization: This endorsement also adds specific individuals or organizations as additional insureds, with similar limitations on coverage.

CG 20 10 11 85 Additional Insured - Joint Venture: This form provides coverage for additional insureds involved in a joint venture, paralleling the liability coverage structure of CG 20 10 07 04.

- WC-240 Form – Employment Opportunities: This form is essential for informing employees about available job offers that consider their health conditions, similar in importance to the georgiapdf.com/wc-240-georgia/ for understanding workers' compensation rights.

CG 20 10 07 13 Additional Insured - By Contract: This endorsement similarly offers coverage based on contractual obligations, ensuring compliance with contractual requirements.

CG 20 10 06 98 Additional Insured - Managers or Lessors of Premises: This form extends coverage to managers or lessors of premises, mirroring the additional insured provisions in CG 20 10 07 04.

CG 20 10 10 01 Additional Insured - State or Political Subdivision: This endorsement provides coverage for additional insureds that are governmental entities, similar in structure to CG 20 10 07 04.

CG 20 10 04 10 Additional Insured - Vendors: This document extends coverage to vendors, reflecting the same principles of additional insured coverage as seen in CG 20 10 07 04.

CG 20 10 09 99 Additional Insured - Real Estate Management: This endorsement provides coverage for real estate managers, similar to the additional insured provisions in CG 20 10 07 04.

Document Example

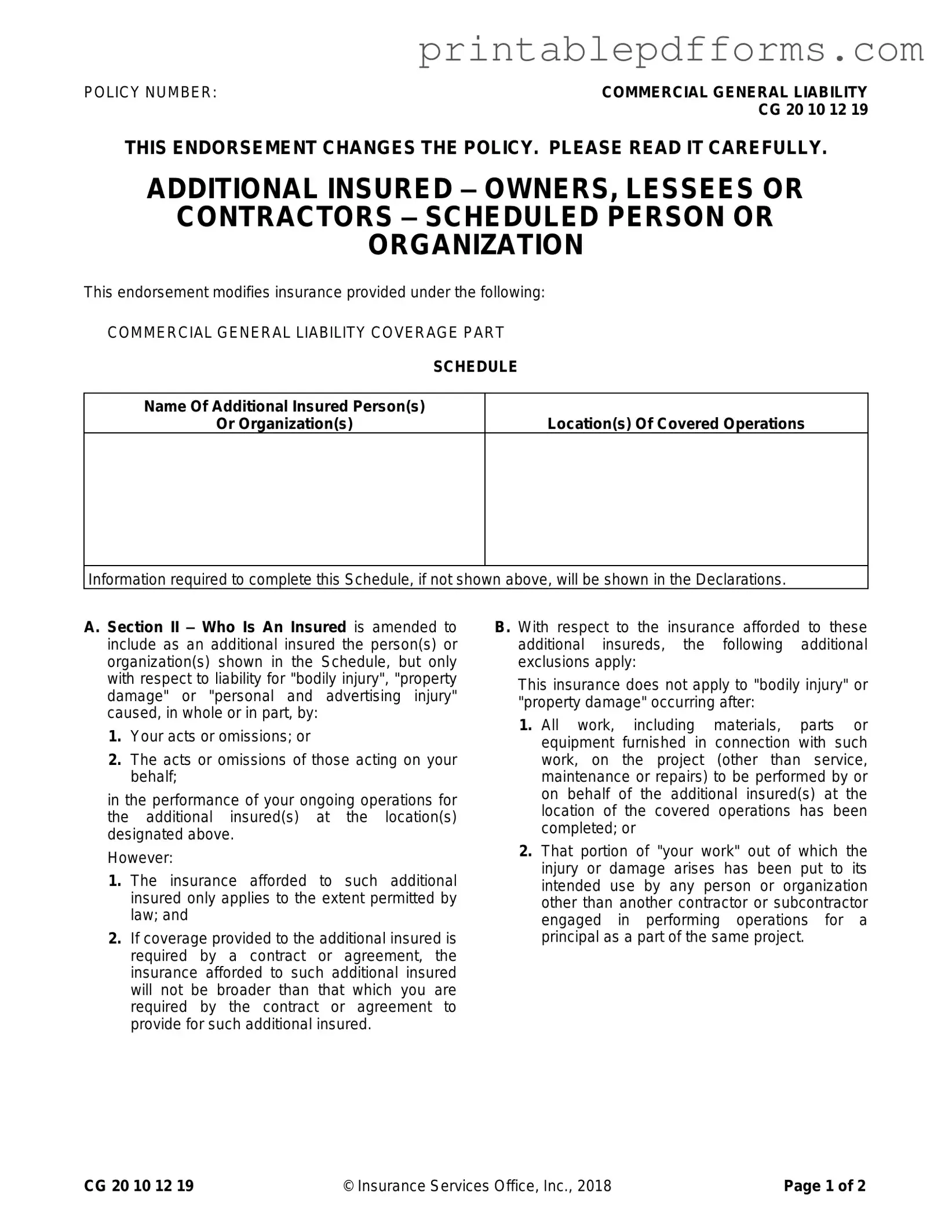

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 10 12 19 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR

CONTRACTORS – SCHEDULED PERSON OR

ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location(s) Of Covered Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by:

1.Your acts or omissions; or

2.The acts or omissions of those acting on your behalf;

in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply:

This insurance does not apply to "bodily injury" or "property damage" occurring after:

1.All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed; or

2.That portion of "your work" out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

CG 20 10 12 19 |

© Insurance Services Office, Inc., 2018 |

Page 1 of 2 |

C. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable limits of insurance;

whichever is less.

This endorsement shall not increase the applicable limits of insurance.

Page 2 of 2 |

© Insurance Services Office, Inc., 2018 |

CG 20 10 12 19 |

Form Specs

| Fact Name | Details |

|---|---|

| Policy Number | CG 20 10 12 19 |

| Type of Endorsement | Additional Insured – Owners, Lessees or Contractors |

| Insurance Coverage | Modifies Commercial General Liability Coverage Part |

| Who is Insured? | Includes additional insured as listed in the schedule for specific liabilities |

| Liability Coverage | Covers bodily injury, property damage, or personal and advertising injury |

| Completion of Work | Coverage does not apply after all work on the project is completed |

| Contractual Limitations | Coverage is limited to what is required by contract or available under policy limits |

| Exclusions | Does not cover injury or damage after work has been put to intended use |

| Governing Law | Varies by state; check specific state laws for details |

Crucial Questions on This Form

What is the CG 20 10 07 04 Liability Endorsement form?

The CG 20 10 07 04 Liability Endorsement form is an addition to a Commercial General Liability (CGL) policy. It allows for specific individuals or organizations to be added as additional insureds. This endorsement provides coverage for bodily injury, property damage, or personal and advertising injury that may arise from the actions of the primary insured or those acting on their behalf during ongoing operations.

Who can be added as an additional insured?

The endorsement allows you to list specific individuals or organizations as additional insureds. These could include owners, lessees, or contractors involved in the project. Their names and the locations of the covered operations should be clearly outlined in the endorsement schedule.

What types of injuries or damages are covered?

This endorsement covers liability for three main categories of injuries or damages:

- Bodily injury

- Property damage

- Personal and advertising injury

However, it is essential to note that coverage applies only if the injury or damage is caused, in whole or in part, by your actions or those acting on your behalf.

Are there any limitations to the coverage provided?

Yes, there are specific limitations. The coverage for additional insureds is restricted to the extent permitted by law. If the coverage is required by a contract, it cannot exceed what the contract stipulates. Additionally, the endorsement does not cover injuries or damages occurring after all work related to the project has been completed.

What happens if the work has been completed?

If all work related to the project has been completed, the insurance does not apply to any bodily injury or property damage that occurs afterward. This includes any materials, parts, or equipment furnished in connection with the work.

How does this endorsement affect the limits of insurance?

The endorsement does not increase the overall limits of insurance. If coverage for the additional insured is required by a contract, the maximum amount payable will be the lesser of what is required by the contract or the available limits of insurance under the policy.

Can I add multiple additional insureds?

Yes, you can add multiple additional insureds to the endorsement. Each additional insured must be listed in the endorsement schedule, along with the specific locations of the operations for which they are being added. This flexibility allows for comprehensive coverage tailored to the needs of various projects.

How should I complete the endorsement schedule?

To complete the endorsement schedule, you need to provide the names of the additional insured persons or organizations and the locations of the covered operations. Ensure that all required information is accurately filled out, as this will determine the extent of coverage provided under the endorsement.

What should I do if I have more questions about this endorsement?

If you have further questions about the CG 20 10 07 04 Liability Endorsement form, it is advisable to consult with your insurance agent or a legal professional. They can provide personalized guidance based on your specific situation and help ensure that you have the appropriate coverage for your needs.

Documents used along the form

The CG 20 10 07 04 Liability Endorsement form is often accompanied by several other important documents. Each of these documents plays a crucial role in ensuring clarity and compliance in contractual agreements. Below is a list of related forms and documents that are frequently used alongside the endorsement.

- Certificate of Insurance: This document provides proof of insurance coverage. It details the types of coverage, policy limits, and the insured parties, ensuring all stakeholders are aware of the insurance status.

- General Liability Insurance Policy: This is the main policy that outlines the coverage for bodily injury, property damage, and personal injury. It serves as the foundation for the endorsement.

- Contract Agreement: This document outlines the terms of engagement between parties. It specifies the responsibilities and liabilities of each party, which may dictate the need for the endorsement.

- Ohio IT AR Form: This form is essential for individuals seeking a state income tax refund, detailing the process of calculating refunds after filing an Ohio tax return. Learn more at All Ohio Forms.

- Additional Insured Endorsement Form: This form explicitly adds a person or organization as an additional insured. It is crucial for clarifying who is covered under the policy.

- Indemnity Agreement: This document outlines the obligation of one party to compensate another for certain damages or losses. It often complements the liability coverage provided by the endorsement.

- Waiver of Subrogation: This form prevents the insurer from pursuing a third party for recovery of damages paid under the policy. It is often required in contracts to protect all parties involved.

- Scope of Work Document: This outlines the specific tasks and responsibilities to be performed under a contract. It helps define the operations covered by the liability endorsement.

- Claims Reporting Form: This document is used to report any claims made under the insurance policy. It ensures that all claims are documented and processed in a timely manner.

Understanding these documents is essential for effective risk management and compliance in contractual agreements. Proper documentation can prevent disputes and ensure that all parties are adequately protected.

Misconceptions

Misconceptions about the CG 20 10 07 04 Liability Endorsement form can lead to confusion regarding coverage and responsibilities. Here are five common misunderstandings:

- All parties are automatically covered: Many believe that simply listing an additional insured on the endorsement guarantees full coverage. In reality, coverage is limited to specific liabilities arising from the named insured's operations.

- Coverage applies indefinitely: Some think that the coverage lasts forever. However, the insurance only applies until the project is completed or the work has been put to its intended use, after which the coverage ceases.

- Higher limits of insurance are provided: It is a common belief that adding an additional insured increases the limits of insurance. In fact, the endorsement does not raise the existing limits but rather restricts coverage to the lesser of what is required by contract or what is available under the policy.

- All types of injuries are covered: Many assume that any injury or damage will be covered. The endorsement specifically excludes coverage for bodily injury or property damage occurring after the work is completed, limiting the scope of protection.

- Coverage is unconditional: Some individuals think that the coverage is guaranteed regardless of circumstances. However, the endorsement explicitly states that coverage is only provided to the extent permitted by law and as dictated by the terms of any relevant contracts.

Understanding these misconceptions can help ensure that all parties involved have a clear grasp of their responsibilities and the limits of coverage under the CG 20 10 07 04 Liability Endorsement form.