Fill a Valid Childcare Receipt Form

The Childcare Receipt form serves as an essential document for parents and childcare providers alike, facilitating clear communication and record-keeping regarding childcare services rendered. This form captures vital information, including the date of service, the total amount paid, and the name of the individual or entity providing the care. Additionally, it requires the names of the children receiving care, ensuring that the receipt is specific and traceable. Each receipt also includes a designated period during which the childcare services were provided, allowing for precise tracking of care dates. To validate the transaction, the childcare provider must sign the form, confirming receipt of payment. This structured approach not only helps parents maintain accurate financial records for budgeting and tax purposes but also supports providers in their bookkeeping efforts. By using the Childcare Receipt form, both parties can establish a clear, professional relationship built on trust and accountability.

Additional PDF Templates

Dr Excuse for School - An essential tool for employees needing to inform their employer about a health issue.

The completion of the WC-240 form is essential for employees navigating Georgia's workers' compensation landscape, as it provides necessary information on job offers suited to their health conditions, reinforcing their ability to make informed decisions regarding their employment. For more information, you can visit https://georgiapdf.com/wc-240-georgia/.

Da 638 - The form requires personal information, including name, rank, and organization.

Form for Direct Deposit - Check your bank’s policies regarding direct deposit to ensure compliance.

Similar forms

-

Invoice: An invoice is a document that outlines the services provided and the amount due for those services. Like the Childcare Receipt form, it includes details such as the date, amount, and recipient's information. Both documents serve as proof of payment for services rendered.

- Ohio Bill of Sale Form: When transferring personal property, refer to the comprehensive Ohio bill of sale documentation to ensure all legal requirements are met.

-

Payment Voucher: A payment voucher is used to authorize a payment. It typically contains similar information as the Childcare Receipt, including the date, amount, and purpose of the payment. Both documents confirm that a transaction has taken place.

-

Service Agreement: A service agreement outlines the terms and conditions between a service provider and a client. While it may not serve as a receipt, it shares similar elements, such as details about the services provided and the parties involved. Both documents help clarify expectations and responsibilities.

-

Billing Statement: A billing statement provides a summary of charges over a specific period. Like the Childcare Receipt, it details the services provided and the amounts owed. Both documents help track payments and outstanding balances.

-

Contract: A contract formalizes an agreement between two parties, detailing the services to be provided and the payment terms. While a contract is more comprehensive, it includes essential information that can also be found on the Childcare Receipt, such as the names of the parties and the services rendered.

-

Tax Document (Form 1099): A Form 1099 is used to report income received from self-employment or other sources. While it serves a different purpose, it shares similarities with the Childcare Receipt in that it includes details about payments received and the recipient's information, making it important for tax purposes.

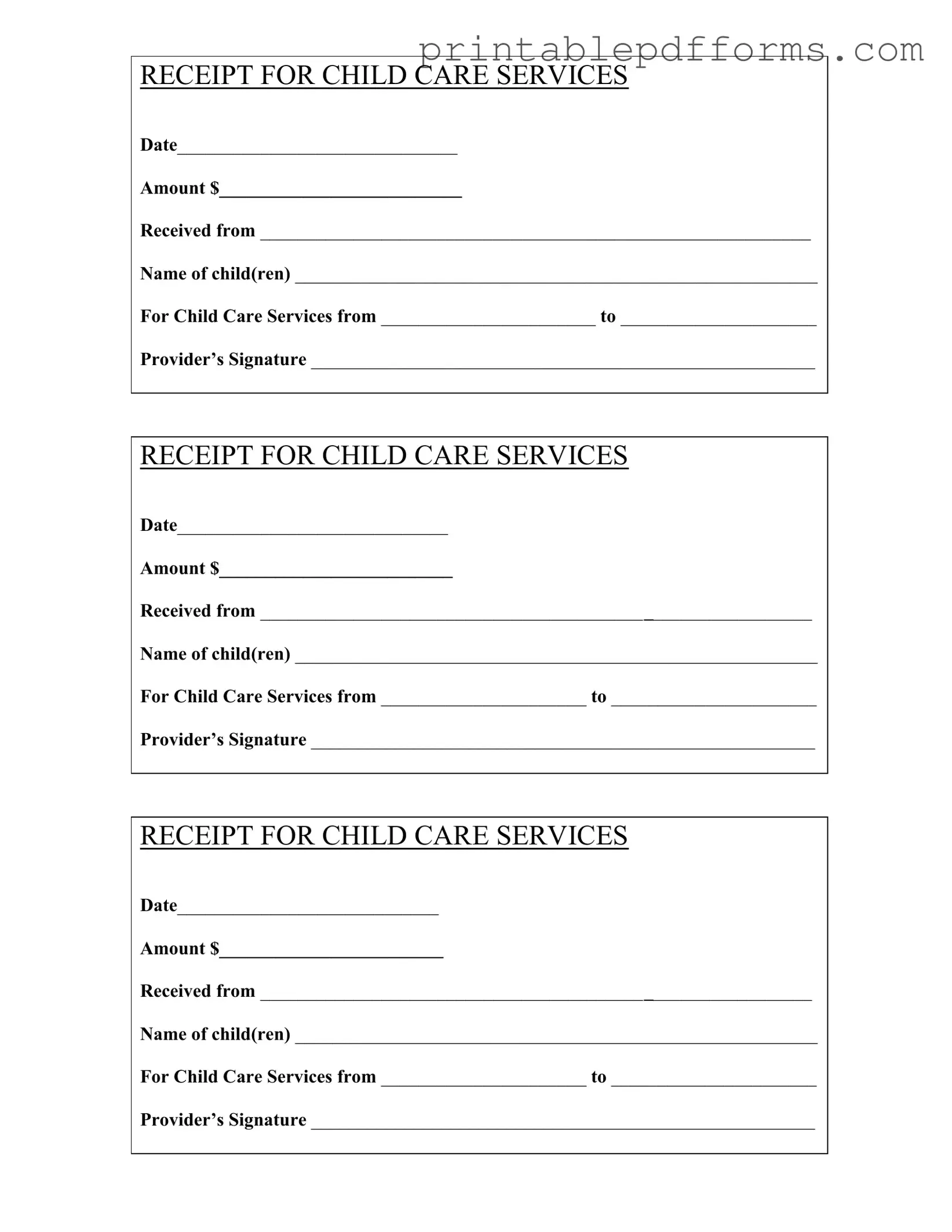

Document Example

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Childcare Receipt form serves as proof of payment for childcare services rendered. |

| Date Requirement | The form requires the date of payment to be clearly indicated for record-keeping purposes. |

| Amount Specification | The total amount paid for the childcare services must be recorded on the form. |

| Provider Information | The signature of the childcare provider is necessary to validate the receipt. |

| Child Identification | Parents or guardians must list the names of the child or children receiving care. |

| Service Dates | The form includes fields to specify the start and end dates of the childcare services provided. |

| State-Specific Laws | In some states, such as California, the use of this form may be governed by state regulations regarding childcare and tax deductions. |

Crucial Questions on This Form

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a formal record of payment for childcare services. It provides essential details such as the date of service, the amount paid, and the names of the children receiving care. This document is important for both parents and childcare providers, as it can be used for tracking expenses and may be necessary for tax purposes.

What information is required on the Childcare Receipt form?

The form requires several key pieces of information:

- Date of service

- Amount paid

- Name of the person making the payment

- Name(s) of the child(ren) receiving care

- Dates of the childcare services provided

- Provider's signature

Each of these elements is crucial for ensuring clarity and accountability in childcare transactions.

How can I obtain a Childcare Receipt form?

You can obtain a Childcare Receipt form from various sources. Many childcare providers have their own templates, which they can provide upon request. Additionally, you can find printable versions of the form online. Ensure that the form you use includes all necessary fields for your specific situation.

Do I need to keep the Childcare Receipt form for tax purposes?

Yes, it is advisable to keep the Childcare Receipt form for tax purposes. If you claim childcare expenses as a deduction, you may need to provide documentation of your payments. Retaining these receipts can help substantiate your claims and ensure compliance with tax regulations.

What should I do if I lose my Childcare Receipt form?

If you lose your Childcare Receipt form, contact your childcare provider as soon as possible. They may be able to issue a duplicate receipt or provide you with a new one. It's important to address this promptly, especially if you need the receipt for tax documentation or reimbursement purposes.

Documents used along the form

When managing childcare services, several documents often accompany the Childcare Receipt form. Each of these forms plays a crucial role in maintaining clear communication and proper record-keeping between parents and childcare providers. Below is a list of common documents that you may encounter.

- Childcare Agreement: This document outlines the terms and conditions of the childcare services, including fees, hours of operation, and responsibilities of both the provider and the parents.

- Ohio IT AR Form: This form is essential for taxpayers seeking a refund on their state income tax or school district income tax. It provides a detailed framework for calculating refunds, ensuring taxpayers include necessary information such as withheld taxes and estimated payments, facilitating a thorough claim process. For more details, you can refer to All Ohio Forms.

- Enrollment Form: This form collects essential information about the child, such as emergency contacts, medical history, and any special needs or allergies.

- Payment Agreement: This document specifies the payment schedule, accepted payment methods, and any late fees or penalties for missed payments.

- Tax Identification Form: This form provides the provider's tax identification number, which parents may need for tax purposes, especially when claiming childcare expenses.

- Attendance Log: This log tracks the days and hours the child attends childcare, helping both parents and providers monitor attendance and billing accurately.

- Emergency Contact Form: This form lists individuals who can be contacted in case of an emergency, ensuring the safety and well-being of the child.

- Health and Immunization Records: These records provide information on the child's health status and vaccination history, which may be required by the childcare provider.

- Incident Report: This document records any accidents or unusual occurrences during childcare, ensuring transparency and accountability.

- Withdrawal Notice: This form is used when parents decide to withdraw their child from the childcare program, outlining any final payments or notice periods required.

Having these documents organized and readily available can make the childcare experience smoother for both parents and providers. Proper documentation helps ensure that everyone is on the same page, leading to a more positive and efficient relationship.

Misconceptions

Understanding the Childcare Receipt form is essential for parents and caregivers. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- It is only necessary for tax purposes. Many believe the receipt is only for tax deductions. In reality, it serves as proof of payment and can be useful for personal record-keeping.

- All childcare providers must issue receipts. Not all providers are required to issue receipts. However, it is a good practice to request one for transparency and record-keeping.

- The receipt must be printed. Some think that a printed receipt is the only valid form. Digital receipts are acceptable as long as they contain the necessary information.

- Only full-time care requires a receipt. This is not true. Receipts should be provided for any childcare service, whether part-time or full-time.

- Receipts need to be issued immediately. While timely issuance is ideal, providers may issue receipts after payment, as long as they are provided within a reasonable timeframe.

- Information on the receipt is not important. Every detail on the receipt is crucial. Missing information can lead to issues during tax filing or if disputes arise.

- Childcare receipts are only for parents. This misconception overlooks that guardians and other caregivers can also request receipts for their records.

- There is a standard format for receipts. While many receipts will look similar, there is no strict standard format. As long as they include the necessary details, variations are acceptable.

Clearing up these misconceptions can help ensure that parents and caregivers have a better understanding of the importance and use of the Childcare Receipt form.