Fill a Valid Citibank Direct Deposit Form

When it comes to managing your finances, setting up direct deposit with Citibank can simplify your life significantly. This convenient service allows your paycheck, government benefits, or other recurring payments to be automatically deposited into your bank account, ensuring you receive your funds quickly and securely. The Citibank Direct Deposit form is a key component in this process. It requires you to provide essential information, such as your account number and routing number, to ensure that deposits are directed to the right place. Additionally, you may need to include details about your employer or the source of the funds. Completing this form accurately is crucial; any errors can delay your payments. Once submitted, the form enables a seamless transfer of funds, allowing you to access your money without the hassle of physical checks. Understanding how to fill out the Citibank Direct Deposit form can empower you to take control of your finances and enjoy the peace of mind that comes with timely deposits.

Additional PDF Templates

Miscarriage Papers - This certification is important for women as it enables them to seek necessary emotional and medical support.

To facilitate the transfer of boat ownership in New York, it is crucial to complete the New York Boat Bill of Sale form, which can be found at nypdfforms.com/boat-bill-of-sale-form. This legal document captures vital information such as the buyer's and seller's details, along with a description of the boat and the agreed sale price. Ensuring its proper completion is essential for recording the transaction and safeguarding the interests of both parties.

Dnd Character Sheet How to Fill Out - Relationships with NPCs or significant figures.

Direction to Pay - Ensures payments are made efficiently throughout the process.

Similar forms

The Citibank Direct Deposit form serves a specific purpose in facilitating the electronic transfer of funds to an individual's bank account. However, there are several other documents that share similarities in function or intent. Below is a list of eight such documents:

- Payroll Authorization Form: This document allows employees to authorize their employer to deposit their wages directly into their bank accounts, similar to how the Citibank Direct Deposit form operates.

- ACH Authorization Form: The Automated Clearing House (ACH) Authorization form permits businesses or organizations to withdraw funds electronically from an individual's account, mirroring the direct deposit process.

- Bank Account Verification Form: This form is used to confirm an individual's bank account details, ensuring accuracy for direct deposits, akin to the information required on the Citibank form.

-

Trailer Bill of Sale: This legal document serves as proof of the purchase and transfer of ownership of a trailer. It includes important details such as buyer and seller information, trailer specifications, and sales price. For more resources, you can visit freebusinessforms.org/.

- Social Security Direct Deposit Form: Individuals can use this form to have their Social Security benefits deposited directly into their bank accounts, much like the Citibank Direct Deposit form for other types of payments.

- Retirement Fund Direct Deposit Form: Similar to the Citibank form, this document allows retirees to have their pension or retirement benefits deposited directly into their bank accounts.

- Tax Refund Direct Deposit Form: This form enables taxpayers to choose direct deposit for their tax refunds, paralleling the convenience provided by the Citibank Direct Deposit form.

- Vendor Payment Authorization Form: Businesses often use this form to authorize direct payments to vendors, reflecting the same principle of direct electronic transfer found in the Citibank form.

- Loan Payment Authorization Form: This document allows borrowers to authorize automatic withdrawals for loan payments, similar to how direct deposits are set up for incoming funds.

Each of these documents plays a crucial role in ensuring that funds are transferred efficiently and securely, providing individuals and organizations with the convenience of electronic banking.

Document Example

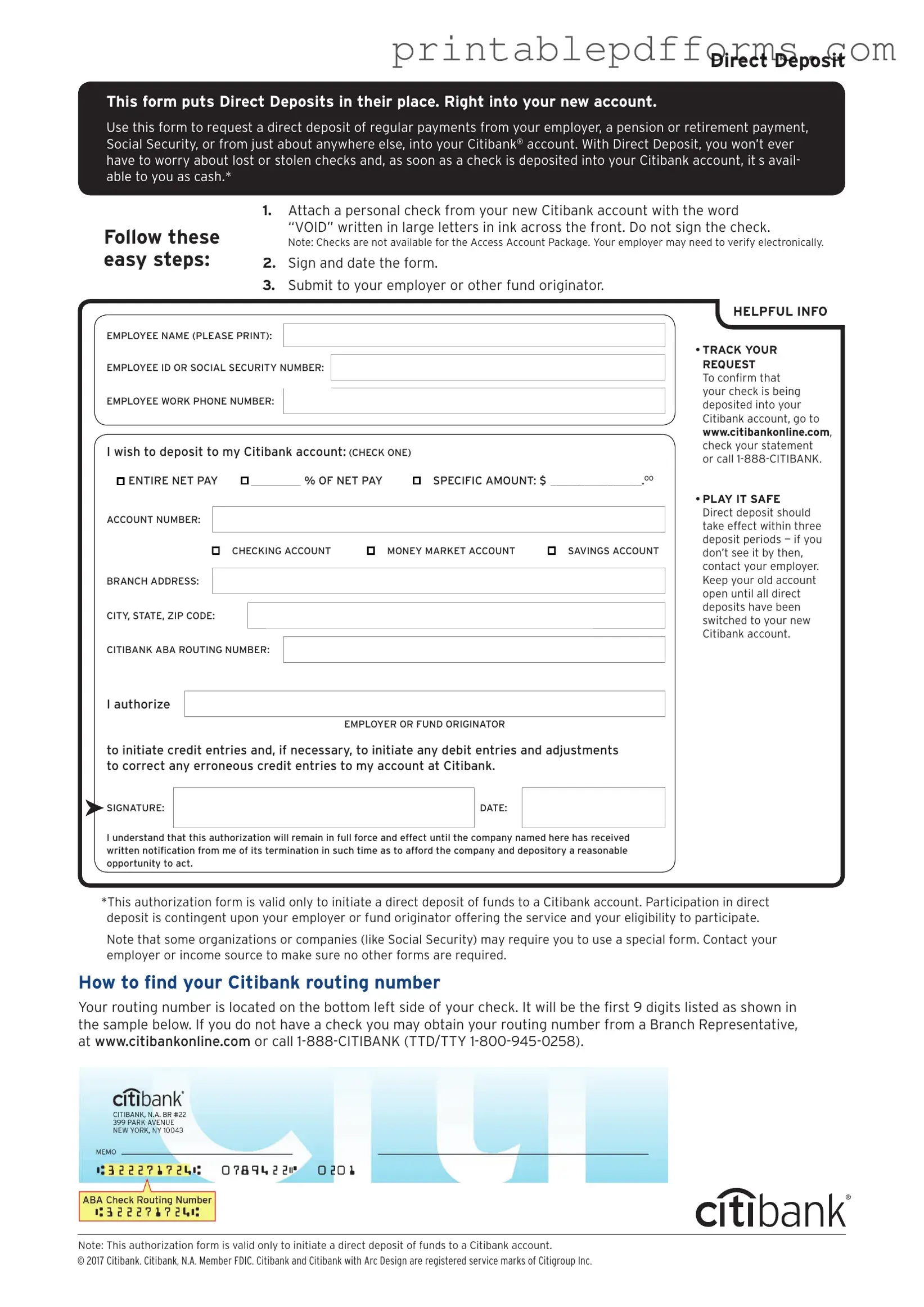

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

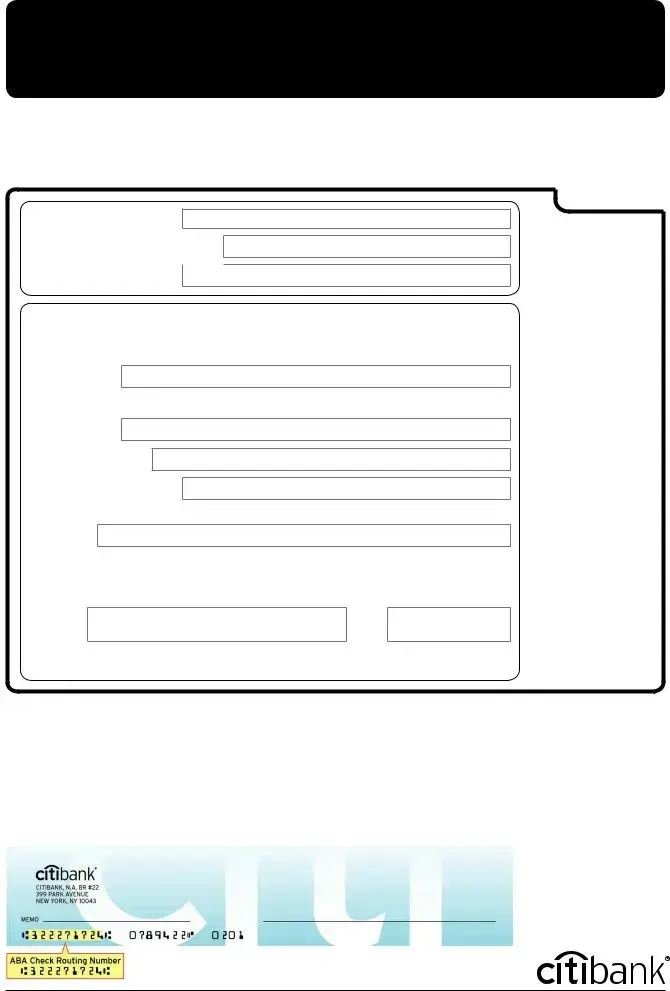

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form allows customers to authorize automatic deposits into their bank accounts. |

| Eligibility | Available to all Citibank account holders who wish to set up direct deposit for payroll, government benefits, or other recurring payments. |

| Information Required | Users must provide their account number, routing number, and personal identification details. |

| Submission Process | The completed form can be submitted online, via mail, or in person at a local branch. |

| Processing Time | Typically, it takes 1 to 2 business days for the direct deposit setup to be processed after submission. |

| State-Specific Forms | Some states may have additional requirements governed by local laws, such as California's Labor Code Section 213 regarding payroll deposits. |

Crucial Questions on This Form

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows individuals to authorize their employer or other payers to deposit funds directly into their Citibank account. This service ensures that funds are available immediately on the payment date, eliminating the need for paper checks and manual deposits.

How do I complete the Citibank Direct Deposit form?

To complete the form, follow these steps:

- Provide your personal information, including your name, address, and Social Security number.

- Enter your Citibank account number and the routing number for Citibank.

- Indicate the type of account (checking or savings) where the funds will be deposited.

- Sign and date the form to authorize the direct deposit.

Ensure all information is accurate to avoid delays in processing.

Where can I obtain the Citibank Direct Deposit form?

The Citibank Direct Deposit form can typically be obtained from your employer's human resources department or directly from the Citibank website. Additionally, many employers provide their own versions of the form, which may include specific instructions related to their payroll processes.

How long does it take for direct deposit to start?

Once the completed form is submitted, it generally takes one to two pay cycles for direct deposit to become active. However, this timeframe may vary depending on your employer's payroll schedule and processing times. It's advisable to confirm with your employer regarding their specific timeline.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time. To do this, simply fill out a new Citibank Direct Deposit form with your updated account details and submit it to your employer or payer. Make sure to do this well in advance of the next payment cycle to ensure a smooth transition.

What should I do if my direct deposit doesn't arrive?

If your direct deposit does not arrive as expected, first check with your employer to confirm that the payment was processed. If the payment was made, verify that your account information is correct. If everything appears to be in order, contact Citibank customer service for assistance. They can help determine if there are any issues with your account or the deposit itself.

Documents used along the form

The Citibank Direct Deposit form is essential for setting up automatic deposits into your bank account. However, several other documents may be required or helpful in conjunction with this form. Below is a list of commonly used forms and documents that can aid in the direct deposit process, providing you with a comprehensive understanding of what you might need.

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. It helps employers determine how much federal income tax to withhold from your paycheck.

- Employee Information Form: Often required by employers, this document collects essential personal details such as your address, phone number, and emergency contact information.

- Bank Account Information Form: This form provides your bank details, including your account number and routing number, ensuring that deposits are made accurately.

- Pay Stub: A pay stub is a document provided by your employer that outlines your earnings, deductions, and net pay. It can be useful for verifying income when setting up direct deposit.

- Employment Verification Letter: This letter confirms your employment status and income. It may be required by financial institutions when opening a new account or applying for loans.

- Power of Attorney Form: In certain circumstances, you may need to authorize someone to handle your financial matters, and having the All Ohio Forms can be invaluable for this purpose.

- Void Check: A voided check is often requested to verify your bank account details. It provides the necessary routing and account numbers for direct deposit setup.

- Direct Deposit Authorization Form: Some employers may have their own authorization form that you need to complete to initiate direct deposit, separate from the Citibank form.

- State Tax Withholding Form: Depending on your state, this form may be necessary to establish state tax withholding preferences, similar to the W-4 for federal taxes.

- IRS Form 4506-T: This form allows you to request a transcript of your tax return. It can be useful if you need to verify income for loan applications or other financial transactions.

Having these documents ready can streamline the process of setting up your direct deposit. By understanding each document's purpose, you can ensure that everything is in order, making your banking experience smoother and more efficient.

Misconceptions

Many people have misunderstandings about the Citibank Direct Deposit form. Here are some common misconceptions:

- Direct deposit is only for payroll. Many believe that direct deposit can only be used for salary payments. In reality, it can also be used for government benefits, tax refunds, and other types of payments.

- You need a Citibank account to use direct deposit. Some think that only Citibank account holders can set up direct deposit. However, any bank can accept direct deposits as long as you provide the correct account information.

- Direct deposit is complicated to set up. There is a belief that setting up direct deposit requires extensive paperwork. In fact, it usually involves filling out a simple form and providing your bank details.

- Direct deposits are always immediate. Many assume that once the form is submitted, the funds will be available instantly. However, it may take one or two pay cycles for the direct deposit to begin.

- You cannot change your direct deposit information. Some people think that once they set up direct deposit, they cannot make changes. In reality, you can update your information whenever necessary by submitting a new form.

- Direct deposit eliminates the need for bank accounts. There is a misconception that direct deposit can replace the need for a bank account. However, you still need a bank account to receive the funds directly.