Blank Deed Form

The Deed form plays a crucial role in real estate transactions and property transfers, serving as a legal document that conveys ownership from one party to another. It outlines essential details such as the names of the grantor and grantee, a description of the property, and the type of ownership being transferred. Various types of deeds exist, including warranty deeds, quitclaim deeds, and special purpose deeds, each offering different levels of protection and assurance regarding the property's title. Proper execution of the Deed form is vital; it must be signed, dated, and often notarized to ensure its validity. Additionally, recording the deed with the appropriate local government office is necessary to provide public notice of the ownership change. Understanding these elements can empower individuals to navigate property transactions confidently and safeguard their interests.

State-specific Guidelines for Deed Forms

Other Templates:

Corrective Deed California - It can be utilized for historical corrections that reflect property changes over time.

For those considering a purchase, our guide on the important aspects of the Trailer Bill of Sale process is indispensable. Ensure that you are fully informed by accessing our detailed guidance on Trailer Bill of Sale documentation before proceeding with your transaction.

Quit Claim Deed Form Iowa - This deed is recorded in the county where the property is located.

Similar forms

- Lease Agreement: A lease agreement outlines the terms under which one party rents property from another. Like a deed, it provides legal proof of the arrangement and specifies rights and responsibilities.

- Sales Contract: A sales contract details the terms of a sale, including price and delivery. Similar to a deed, it serves as a binding agreement between parties regarding the transfer of ownership.

- Bill of Sale: A bill of sale is a document that transfers ownership of personal property. It is akin to a deed as it provides evidence of the transaction and the change of ownership.

- Title Transfer Document: This document is used to transfer ownership of a vehicle or real estate. Like a deed, it serves as official proof of ownership and outlines the terms of the transfer.

- Power of Attorney: A power of attorney grants someone the authority to act on another’s behalf. It is similar to a deed in that it formalizes a relationship and outlines the powers granted.

- Rental Application Form: A key component in the tenant selection process, similar to the aforementioned documents, the freebusinessforms.org provides templates to streamline this process, ensuring landlords can make informed decisions based on applicants' background and financial standing.

- Trust Agreement: A trust agreement establishes a trust and outlines how assets are to be managed. It is similar to a deed in that it provides legal structure and specifies the rights of the parties involved.

- Partnership Agreement: This document outlines the terms of a business partnership. Like a deed, it formalizes the relationship and details the responsibilities and rights of each partner.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information between parties. Similar to a deed, it creates a binding commitment to uphold privacy and outlines the terms of confidentiality.

- Employment Contract: An employment contract specifies the terms of employment, including duties and compensation. Like a deed, it formalizes the relationship and protects the rights of both employer and employee.

Document Example

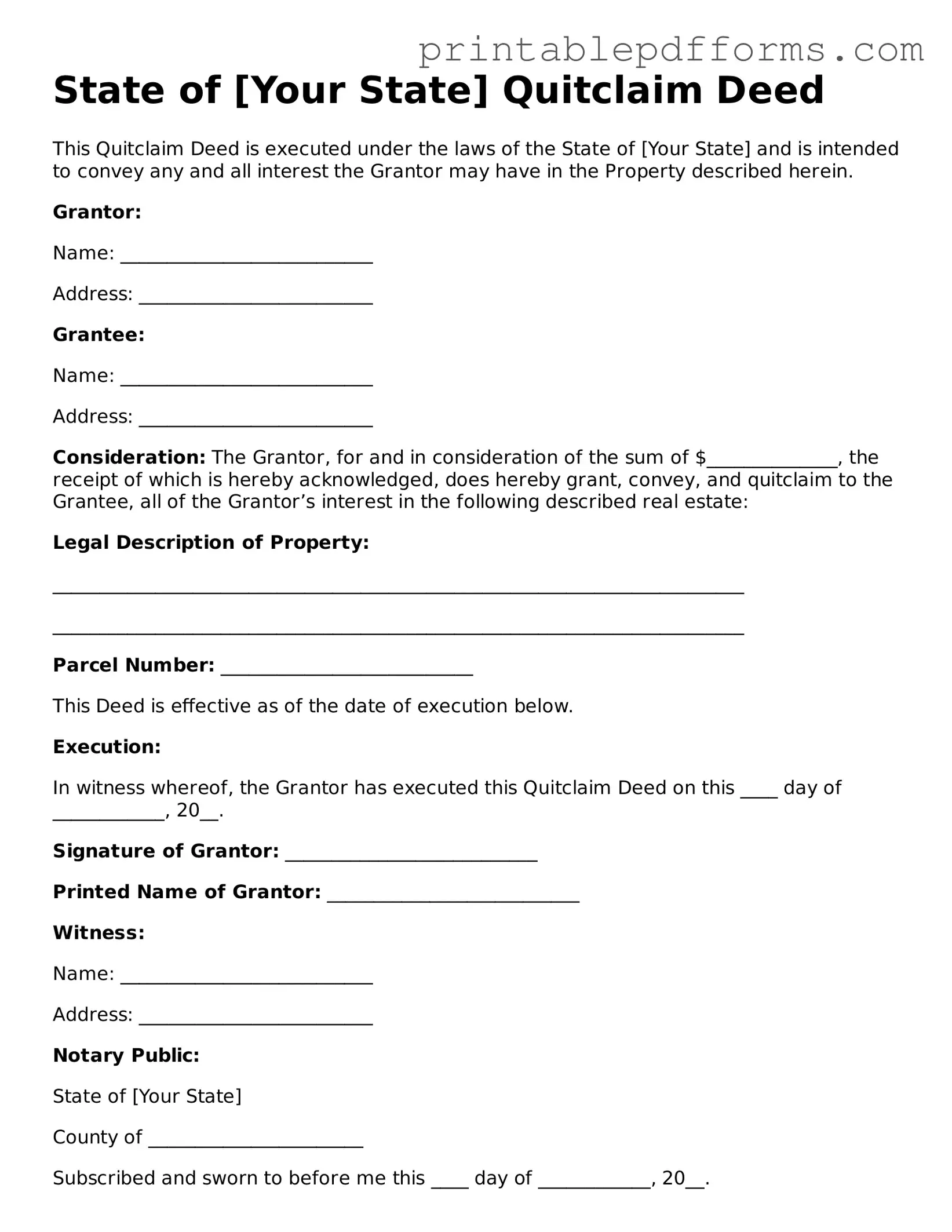

State of [Your State] Quitclaim Deed

This Quitclaim Deed is executed under the laws of the State of [Your State] and is intended to convey any and all interest the Grantor may have in the Property described herein.

Grantor:

Name: ___________________________

Address: _________________________

Grantee:

Name: ___________________________

Address: _________________________

Consideration: The Grantor, for and in consideration of the sum of $______________, the receipt of which is hereby acknowledged, does hereby grant, convey, and quitclaim to the Grantee, all of the Grantor’s interest in the following described real estate:

Legal Description of Property:

__________________________________________________________________________

__________________________________________________________________________

Parcel Number: ___________________________

This Deed is effective as of the date of execution below.

Execution:

In witness whereof, the Grantor has executed this Quitclaim Deed on this ____ day of ____________, 20__.

Signature of Grantor: ___________________________

Printed Name of Grantor: ___________________________

Witness:

Name: ___________________________

Address: _________________________

Notary Public:

State of [Your State]

County of _______________________

Subscribed and sworn to before me this ____ day of ____________, 20__.

Signature of Notary Public: ___________________________

My Commission Expires: ___________________________

Note: A Quitclaim Deed does not guarantee that the Grantor holds a valid title and provides no warranties regarding the condition of the title.

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A deed is a legal document that represents the transfer of property ownership from one party to another. |

| Types of Deeds | Common types include warranty deeds, quitclaim deeds, and special purpose deeds. |

| Governing Law | Deeds are governed by state law, and each state has its own requirements for validity. |

| Signature Requirement | Typically, the grantor (the person transferring the property) must sign the deed for it to be valid. |

| Witnesses | Some states require witnesses to the signing of the deed for it to be legally binding. |

| Notarization | Many states require the deed to be notarized to ensure authenticity. |

| Recording | Deeds should be recorded with the local county clerk or recorder's office to protect the new owner's rights. |

| Title Search | Before executing a deed, a title search is often conducted to ensure the property is free of liens or claims. |

| Revocation | Once a deed is executed and delivered, it cannot be revoked without the consent of the grantee (the person receiving the property). |

| State-Specific Forms | Each state may have specific forms and requirements; for example, California has its own statutory forms for deeds. |

Crucial Questions on This Form

What is a Deed form?

A Deed form is a legal document that conveys ownership of property from one party to another. It serves as a formal record of the transfer and outlines the rights and responsibilities associated with the property. Deeds are often used in real estate transactions and can include various types, such as warranty deeds, quitclaim deeds, and grant deeds.

What information is typically included in a Deed form?

A Deed form generally includes the following information:

- The names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- A legal description of the property being transferred, which may include boundaries and any relevant identifiers.

- The date of the transfer.

- The signature of the grantor, and in some cases, witnesses or a notary public.

Do I need a lawyer to create a Deed form?

While it is not legally required to have a lawyer draft a Deed form, it is highly recommended. A legal professional can ensure that the document meets all state requirements and accurately reflects the intentions of the parties involved. This can help avoid potential disputes in the future.

How do I properly execute a Deed form?

To properly execute a Deed form, follow these steps:

- Ensure all required information is included and accurate.

- Sign the Deed in the presence of a notary public, if required by your state.

- Have any necessary witnesses sign the document.

- File the Deed with the appropriate local government office, such as the county clerk or recorder's office.

Can a Deed form be revoked or changed after it is signed?

Once a Deed form is signed and recorded, it generally cannot be revoked or changed unilaterally. If changes are necessary, a new Deed must be created to reflect the updated terms. In some cases, a legal process may be required to address disputes or errors.

What are the different types of Deeds?

There are several types of Deeds, including:

- Warranty Deed: Offers the highest level of protection to the grantee, guaranteeing that the grantor holds clear title to the property.

- Quitclaim Deed: Transfers any interest the grantor may have in the property without making any guarantees about the title.

- Grant Deed: Provides some assurances to the grantee that the property has not been sold to anyone else and is free from undisclosed encumbrances.

What happens if a Deed form is not recorded?

If a Deed form is not recorded, it may still be valid between the parties involved. However, failing to record the Deed can lead to complications. For example, it may create issues if the grantor sells the property to someone else, or if there are disputes over ownership. Recording the Deed provides public notice of the ownership transfer and protects the grantee's rights.

Documents used along the form

When dealing with property transactions, several forms and documents often accompany the Deed form. Each serves a specific purpose and helps ensure a smooth transfer of ownership. Here’s a list of common documents you might encounter:

- Title Insurance Policy: This document protects the buyer and lender from potential disputes over property ownership. It covers issues like unpaid taxes or claims from previous owners.

- Purchase Agreement: This contract outlines the terms of the sale, including the purchase price, closing date, and any contingencies that must be met before the sale can proceed.

- Disclosure Statement: Sellers are often required to provide this document, which discloses any known issues with the property, such as structural problems or environmental hazards.

- Bill of Sale: This document transfers ownership of personal property included in the sale, such as appliances or furniture, from the seller to the buyer.

- Affidavit of Title: The seller signs this sworn statement confirming their ownership of the property and that there are no undisclosed liens or claims against it.

- Notary Acknowledgement: This form verifies the authenticity of signatures in real estate transactions, ensuring they were made willingly and without duress. For more information, visit All Ohio Forms.

- Closing Statement: This document summarizes the financial aspects of the transaction, detailing all costs, fees, and the final amounts due at closing.

- Power of Attorney: If one party cannot be present at closing, they may grant someone else the authority to sign documents on their behalf.

- Property Survey: A survey shows the boundaries of the property and any easements or encroachments, providing clarity on what is being sold.

- Loan Documents: If financing is involved, various loan documents will be required, detailing the terms of the mortgage and the obligations of the borrower.

Understanding these documents is crucial for anyone involved in a property transaction. Each plays a vital role in protecting your interests and ensuring a legally sound transfer of ownership.

Misconceptions

When it comes to the Deed form, many people hold misconceptions that can lead to confusion or mistakes. Here are five common misunderstandings:

-

All deeds are the same.

This is not true. There are different types of deeds, such as warranty deeds, quitclaim deeds, and grant deeds. Each serves a unique purpose and offers varying levels of protection to the buyer.

-

A deed must be notarized to be valid.

While notarization is often recommended and may be required in some states, it is not universally necessary for a deed to be legally binding. Some deeds can be valid even without a notary's signature, depending on local laws.

-

Once a deed is signed, it cannot be changed.

This is misleading. While a signed deed is a legal document, it can be amended or revoked under certain circumstances. However, the process for doing so may require additional legal steps.

-

Deeds do not need to be recorded.

Recording a deed is crucial in many cases. It provides public notice of ownership and can protect against claims from third parties. Failing to record a deed may lead to complications in the future.

-

Only attorneys can prepare a deed.

This is a common myth. While it is advisable to consult a legal professional, many individuals can prepare a deed themselves, provided they understand the necessary elements and comply with state requirements.

Understanding these misconceptions can help individuals navigate the complexities of property transactions more effectively.