Blank Deed in Lieu of Foreclosure Form

The Deed in Lieu of Foreclosure is a crucial legal instrument that offers homeowners an alternative to the lengthy and often distressing foreclosure process. This form allows a property owner to voluntarily transfer ownership of their home to the lender in exchange for the cancellation of the mortgage debt. By opting for this route, homeowners can avoid the negative consequences associated with foreclosure, such as a significant drop in credit score and the stigma of having a foreclosure on their record. The process typically involves several key steps, including the negotiation of terms with the lender, the completion of the necessary documentation, and the recording of the deed with local authorities. It is important to note that while this option can provide relief, it may not be suitable for everyone. Homeowners must weigh the potential benefits against the risks, including the possibility of a deficiency judgment if the property sells for less than the owed amount. Understanding the implications of the Deed in Lieu of Foreclosure is essential for anyone facing financial hardship and considering this option as a way to regain control over their financial future.

State-specific Guidelines for Deed in Lieu of Foreclosure Forms

Popular Deed in Lieu of Foreclosure Documents:

Free Printable Gift Deed Form - This document reflects the goodwill of the donor, capturing the spirit of the gift.

A Sample Tax Return Transcript is a document provided by the Internal Revenue Service (IRS) that summarizes key information from a taxpayer's submitted return. It contains vital taxpayer data, including income, adjustments, and tax obligations, for a specified tax year. This form is often utilized for various purposes, including loan applications and income verification. For more resources and examples, you can visit https://freebusinessforms.org/.

Similar forms

- Short Sale Agreement: Like a Deed in Lieu of Foreclosure, a short sale allows a homeowner to sell their property for less than the amount owed on the mortgage. Both options aim to avoid foreclosure and minimize damage to the homeowner's credit.

- Loan Modification Agreement: This document modifies the terms of an existing loan to make payments more manageable. While a Deed in Lieu of Foreclosure relinquishes the property, a loan modification keeps the homeowner in their home by changing payment terms.

- Forebearance Agreement: A forbearance agreement allows a borrower to temporarily pause or reduce mortgage payments. Similar to a Deed in Lieu, it provides relief, but the homeowner retains ownership during the forbearance period.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings. While a Deed in Lieu of Foreclosure transfers property to the lender, bankruptcy offers a way to reorganize debts and keep the home, at least temporarily.

- Notary Acknowledgement Form: Essential for verifying signatures, the legal All Ohio Forms ensure that documents are executed properly, safeguarding the interests of all parties involved.

- Real Estate Purchase Agreement: This document outlines the sale of a property. In both cases, the property is transferred, but a Deed in Lieu of Foreclosure is initiated by the homeowner to avoid foreclosure rather than a buyer's interest.

- Quitclaim Deed: A quitclaim deed transfers ownership of property without any guarantees. Similar to a Deed in Lieu, it relinquishes ownership but does not involve the lender's agreement or forgiveness of debt.

- Release of Mortgage: This document signifies that a lender has forgiven a mortgage debt. Both a release and a Deed in Lieu of Foreclosure involve the lender relinquishing a claim on the property, but the Deed in Lieu is a proactive step by the homeowner.

- Property Settlement Agreement: Often used in divorce cases, this document outlines how property is divided. Like a Deed in Lieu, it involves transferring ownership, but it typically occurs in a different context involving marital assets.

- Deed of Trust: This document secures a loan by placing a lien on the property. While a Deed in Lieu of Foreclosure transfers property to avoid foreclosure, a Deed of Trust establishes the lender's interest in the property from the outset.

Document Example

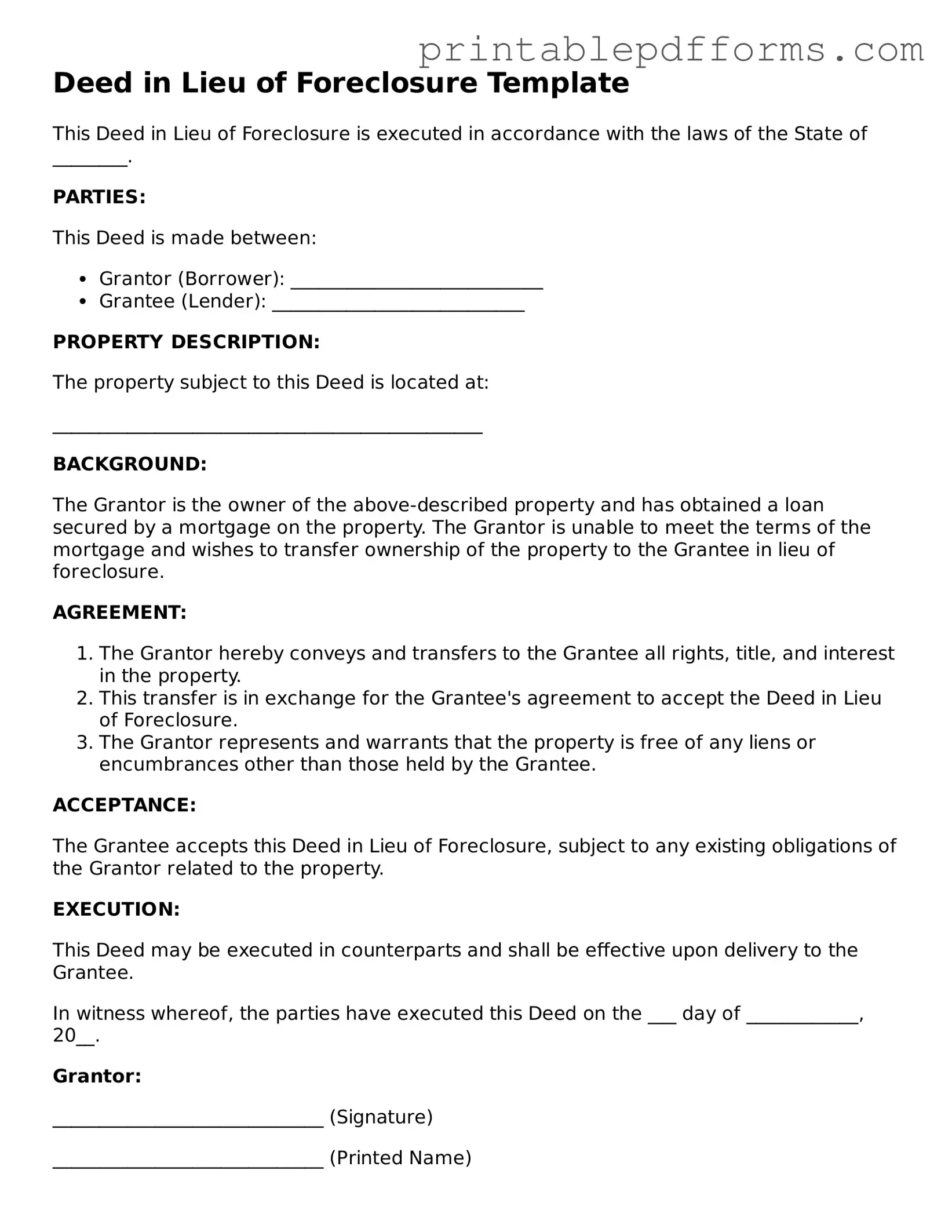

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of ________.

PARTIES:

This Deed is made between:

- Grantor (Borrower): ___________________________

- Grantee (Lender): ___________________________

PROPERTY DESCRIPTION:

The property subject to this Deed is located at:

______________________________________________

BACKGROUND:

The Grantor is the owner of the above-described property and has obtained a loan secured by a mortgage on the property. The Grantor is unable to meet the terms of the mortgage and wishes to transfer ownership of the property to the Grantee in lieu of foreclosure.

AGREEMENT:

- The Grantor hereby conveys and transfers to the Grantee all rights, title, and interest in the property.

- This transfer is in exchange for the Grantee's agreement to accept the Deed in Lieu of Foreclosure.

- The Grantor represents and warrants that the property is free of any liens or encumbrances other than those held by the Grantee.

ACCEPTANCE:

The Grantee accepts this Deed in Lieu of Foreclosure, subject to any existing obligations of the Grantor related to the property.

EXECUTION:

This Deed may be executed in counterparts and shall be effective upon delivery to the Grantee.

In witness whereof, the parties have executed this Deed on the ___ day of ____________, 20__.

Grantor:

_____________________________ (Signature)

_____________________________ (Printed Name)

Grantee:

_____________________________ (Signature)

_____________________________ (Printed Name)

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Purpose | This form helps borrowers avoid the lengthy foreclosure process and its negative impact on credit scores. |

| State-Specific Forms | Each state may have its own specific requirements for a Deed in Lieu of Foreclosure, governed by local real estate laws. |

| Governing Laws | In California, for example, the process is governed by California Civil Code Sections 1475-1485. |

| Eligibility | Borrowers must typically be in default or facing imminent default to qualify for this option. |

| Impact on Credit | While less damaging than foreclosure, a Deed in Lieu of Foreclosure can still negatively affect credit scores. |

| Tax Implications | Borrowers may face tax consequences, as forgiven debt can be considered taxable income. |

Crucial Questions on This Form

- It can be less damaging to your credit score compared to a foreclosure.

- The process is usually quicker and less stressful than going through foreclosure.

- Homeowners may avoid owing a deficiency balance if the property sells for less than the mortgage amount.

- It allows for a more dignified exit from homeownership.

- You may still face tax implications if the lender forgives any debt.

- Not all lenders accept Deeds in Lieu, so it may not be an option for everyone.

- It may still impact your credit score, though generally less severely than a foreclosure.

- Contact your lender and express your interest in a Deed in Lieu of Foreclosure.

- Gather necessary documentation, such as financial statements and proof of hardship.

- Review any potential tax implications and seek advice from a tax professional.

- Negotiate the terms with your lender and obtain legal assistance if needed.

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This process allows the borrower to walk away from the mortgage without the lengthy and often painful foreclosure process.

How does a Deed in Lieu of Foreclosure work?

In a Deed in Lieu of Foreclosure, the homeowner approaches the lender to discuss the possibility of transferring the property. If both parties agree, the homeowner signs the deed, and the lender takes possession of the property. This typically happens after the homeowner has fallen behind on mortgage payments and is unable to catch up.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to this option:

Are there any downsides to a Deed in Lieu of Foreclosure?

Yes, there are potential downsides to consider:

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility can vary by lender, but generally, homeowners who are experiencing financial hardship and are unable to make mortgage payments may qualify. Lenders often require that the homeowner is in default or at risk of defaulting on their mortgage.

What steps should I take to initiate a Deed in Lieu of Foreclosure?

To begin the process, follow these steps:

Will I need to move out immediately?

Typically, homeowners are given some time to vacate the property after signing the Deed in Lieu. The exact timeline can vary based on the lender's policies, so it’s important to discuss this with your lender during negotiations.

Can I negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, negotiation is often possible. Homeowners can discuss various terms, such as the timeline for vacating the property and any potential forgiveness of debt. It’s advisable to have a clear understanding of your rights and options before entering negotiations.

What happens to my mortgage balance after a Deed in Lieu of Foreclosure?

In many cases, the lender may forgive the remaining mortgage balance after the property is transferred. However, this is not guaranteed. It’s essential to clarify this aspect with your lender, as forgiveness can have tax implications for the homeowner.

Documents used along the form

A Deed in Lieu of Foreclosure is a useful tool for homeowners facing financial difficulties. However, several other documents often accompany this form to ensure a smooth process. Here’s a list of forms and documents that may be needed.

- Mortgage Agreement: This document outlines the terms of the loan between the borrower and lender, detailing the amount borrowed, interest rates, and repayment schedule.

- Notice of Default: This is a formal notice sent by the lender to the borrower indicating that they have defaulted on their mortgage payments.

- Loan Modification Agreement: This document modifies the terms of the original mortgage, such as interest rates or payment amounts, to make it more manageable for the borrower.

- Property Appraisal: An assessment of the property's current market value, which helps both parties understand the worth of the property during the deed process.

- Title Search Report: A report that confirms the ownership of the property and checks for any liens or claims against it.

- WC-1 Georgia Form: This essential document serves as the Employer’s First Report of Injury or Occupational Disease and must be completed to comply with regulations. For more details on this form, visit georgiapdf.com/wc-1-georgia.

- Release of Liability: This document releases the borrower from further obligations related to the mortgage once the deed in lieu is executed.

- Affidavit of Title: A sworn statement by the borrower confirming their ownership of the property and that there are no undisclosed liens.

- Settlement Statement: A document that outlines all the financial aspects of the transaction, including any fees or payments due at closing.

- Power of Attorney: A legal document that allows someone else to act on behalf of the borrower in the transaction, which can be helpful if the borrower is unavailable.

- Release of Mortgage: This document formally releases the lender's claim on the property once the deed in lieu is completed.

Having these documents ready can help streamline the process of executing a Deed in Lieu of Foreclosure. It’s essential to understand each document's role and ensure all necessary paperwork is in order to avoid complications.

Misconceptions

Understanding the Deed in Lieu of Foreclosure can be challenging. Here are some common misconceptions that people often have:

- It eliminates all debt immediately. A Deed in Lieu of Foreclosure may help discharge the mortgage, but it does not automatically erase all associated debts. Other liens or debts may still exist.

- It is the same as a short sale. While both options involve transferring property to the lender, a short sale typically requires selling the home for less than what is owed, whereas a Deed in Lieu involves voluntarily transferring ownership without a sale.

- It is a simple process. Although it may seem straightforward, the process can involve legal and financial complexities. Proper documentation and lender approval are necessary.

- It protects the homeowner from all future liability. A Deed in Lieu may not protect homeowners from future claims or liabilities related to the property. It is essential to clarify any remaining obligations with the lender.

- It is available to everyone facing foreclosure. Not all homeowners qualify for a Deed in Lieu of Foreclosure. Lenders typically have specific criteria that must be met.

- It has no impact on credit scores. A Deed in Lieu can still negatively affect a homeowner's credit score, although it may be less damaging than a foreclosure.

- It allows homeowners to stay in their homes longer. Once the deed is transferred, the homeowner usually must vacate the property. This is different from other options where the homeowner may remain in the home longer.

- It is a quick fix for financial problems. While it may provide relief from mortgage payments, it does not address underlying financial issues. Homeowners should consider seeking financial counseling.