Blank Durable Power of Attorney Form

The Durable Power of Attorney (DPOA) is an essential legal document that empowers individuals to designate someone they trust to make decisions on their behalf, particularly during times when they may be unable to do so themselves. This form not only allows for the management of financial matters but can also extend to healthcare decisions, ensuring that your preferences are honored even if you are incapacitated. By selecting an agent, you can rest assured that your affairs will be handled according to your wishes. The DPOA remains effective even if you become mentally or physically unable to manage your own affairs, providing peace of mind in uncertain situations. It is crucial to understand the responsibilities of the appointed agent, as well as the specific powers granted, which can be tailored to meet your unique needs. Furthermore, the DPOA can be revoked at any time, giving you control over your decisions throughout your life. This flexibility makes the Durable Power of Attorney a vital component of any comprehensive estate plan.

State-specific Guidelines for Durable Power of Attorney Forms

Popular Durable Power of Attorney Documents:

Power of Attorney Florida for Child - A Power of Attorney for a Child form allows parents to designate another person to make decisions for their child.

Power of Attorney Template - This document can simplify the management of rental properties by allowing a representative to act autonomously.

To ensure your medical treatment preferences are honored, it's important to utilize a well-crafted document. A Living Will, especially a personalized Ohio version, can clarify your healthcare decisions and provide peace of mind during challenging times. For those interested in understanding how to create this document, a comprehensive guide to a Living Will is available for Ohio residents.

Revocation of Power of Attorney California - This form reflects your current wishes regarding representation.

Similar forms

The Durable Power of Attorney (DPOA) is a crucial legal document that allows one person to make decisions on behalf of another. Several other documents serve similar purposes, each with its own specific focus. Below is a list of nine documents that share similarities with the DPOA:

- General Power of Attorney: Like the DPOA, this document grants someone authority to act on your behalf. However, it typically becomes invalid if you become incapacitated.

- Healthcare Power of Attorney: This document specifically allows an individual to make medical decisions for you if you are unable to do so. It focuses solely on healthcare matters.

- Living Will: A living will outlines your wishes regarding medical treatment in end-of-life situations. While it does not appoint an agent, it complements the Healthcare Power of Attorney.

- Financial Power of Attorney: This document gives someone the authority to manage your financial affairs, similar to the DPOA, but it may not include health-related decisions.

- Trust Agreement: A trust can manage your assets and specify how they should be distributed. While it operates differently than a DPOA, it also allows someone to act on your behalf regarding asset management.

- Advance Directive: This document combines elements of a living will and a healthcare power of attorney. It provides guidance on medical decisions and designates an agent for healthcare choices.

- Guardian Appointment: In cases where an individual is unable to manage their affairs, a court may appoint a guardian. This process is more formal than a DPOA but serves a similar purpose of decision-making.

- Release of Liability: This document protects one party from being held liable for any injuries or damages during an activity, allowing participants to acknowledge risks and waive their right to sue. To learn more, check the Waiver of Liability.

- Representative Payee Authorization: This document allows someone to manage your Social Security or other government benefits. It focuses on financial matters but does not cover broader decision-making.

- Estate Plan: While not a single document, an estate plan encompasses various legal tools, including a DPOA, to manage your assets and healthcare decisions during your lifetime and after your death.

Understanding these documents can help ensure that your wishes are respected and that the right people are in place to make decisions on your behalf when needed.

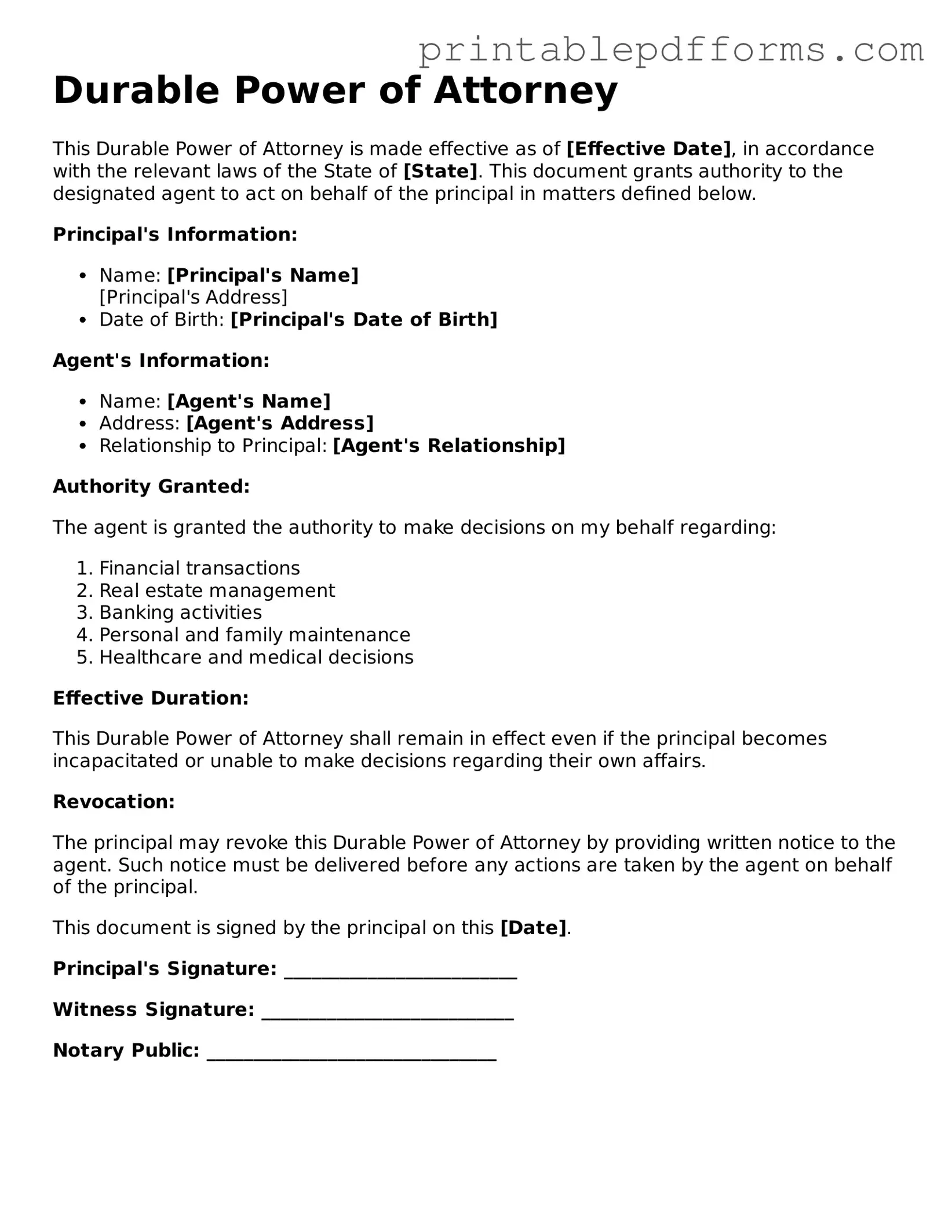

Document Example

Durable Power of Attorney

This Durable Power of Attorney is made effective as of [Effective Date], in accordance with the relevant laws of the State of [State]. This document grants authority to the designated agent to act on behalf of the principal in matters defined below.

Principal's Information:

- Name: [Principal's Name]

- Date of Birth: [Principal's Date of Birth]

Agent's Information:

- Name: [Agent's Name]

- Address: [Agent's Address]

- Relationship to Principal: [Agent's Relationship]

Authority Granted:

The agent is granted the authority to make decisions on my behalf regarding:

- Financial transactions

- Real estate management

- Banking activities

- Personal and family maintenance

- Healthcare and medical decisions

Effective Duration:

This Durable Power of Attorney shall remain in effect even if the principal becomes incapacitated or unable to make decisions regarding their own affairs.

Revocation:

The principal may revoke this Durable Power of Attorney by providing written notice to the agent. Such notice must be delivered before any actions are taken by the agent on behalf of the principal.

This document is signed by the principal on this [Date].

Principal's Signature: _________________________

Witness Signature: ___________________________

Notary Public: _______________________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) is a legal document that allows an individual (the principal) to designate someone else (the agent) to make decisions on their behalf, even if they become incapacitated. |

| Durability | The term "durable" means that the authority granted to the agent remains effective even if the principal is no longer able to make decisions due to mental or physical incapacity. |

| State-Specific Laws | Each state has its own laws governing Durable Power of Attorney forms. For example, in California, the governing law is found in the California Probate Code, while in Texas, it is outlined in the Texas Statutes, Title 2, Chapter 752. |

| Revocation | The principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. This can be done through a written notice to the agent and any relevant institutions. |

Crucial Questions on This Form

What is a Durable Power of Attorney (DPOA)?

A Durable Power of Attorney is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. This can include financial matters, healthcare decisions, or both. The "durable" aspect means that the authority remains in effect even if you become incapacitated.

Who can be appointed as an agent under a DPOA?

You can choose anyone you trust as your agent, also known as an attorney-in-fact. This can be a family member, friend, or a professional such as an attorney. It's important to select someone who understands your wishes and is willing to take on this responsibility.

What powers does a Durable Power of Attorney grant?

The powers granted can vary based on your preferences. Common powers include:

- Managing bank accounts

- Paying bills

- Making investment decisions

- Handling real estate transactions

- Making healthcare decisions

You can specify which powers you want to grant and can limit or expand them as needed.

Do I need to have a lawyer to create a DPOA?

No, you do not necessarily need a lawyer to create a Durable Power of Attorney. Many states provide templates that you can fill out. However, consulting with a lawyer can help ensure that your document meets all legal requirements and accurately reflects your wishes.

How do I revoke a Durable Power of Attorney?

If you decide to revoke your DPOA, you can do so by creating a written notice of revocation. Be sure to inform your agent and any institutions that may have a copy of the original DPOA. This ensures that your wishes are clear and prevents any confusion.

When does a Durable Power of Attorney take effect?

A Durable Power of Attorney can take effect immediately upon signing, or it can be set to activate only if you become incapacitated. This is known as a "springing" DPOA. You should specify your preference in the document.

Can I change my DPOA once it is created?

Yes, you can change your Durable Power of Attorney at any time as long as you are mentally competent. You would need to create a new DPOA and revoke the previous one to ensure clarity about your wishes.

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, a court may appoint a guardian or conservator to make decisions for you. This process can be lengthy and may not reflect your personal wishes, making it beneficial to have a DPOA in place.

Is a Durable Power of Attorney valid in all states?

While a Durable Power of Attorney is recognized in all states, the specific requirements can vary. It's important to follow your state's laws when creating the document to ensure it is valid and enforceable.

Documents used along the form

A Durable Power of Attorney (DPOA) is a vital document that allows an individual to designate someone else to make decisions on their behalf, particularly regarding financial and legal matters. However, there are several other forms and documents that often complement a DPOA. Here’s a list of some commonly used documents that can enhance your estate planning and ensure your wishes are respected.

- Living Will: This document outlines your preferences for medical treatment in situations where you cannot communicate your wishes. It typically addresses end-of-life care and life-sustaining measures.

- Healthcare Power of Attorney: Similar to a DPOA, this form designates someone to make healthcare decisions for you if you are unable to do so. It focuses specifically on medical treatment and healthcare choices.

- Last Will and Testament: This legal document specifies how your assets will be distributed after your death. It also allows you to name guardians for minor children.

- Revocable Living Trust: A trust that can be altered or revoked during your lifetime. It holds your assets and can help avoid probate, making the transfer of your estate smoother and more private.

- Prenuptial Agreement: A legal document that couples in Ohio can use before marriage to establish the ownership and division of their current and future assets and debts. It outlines what will happen to each partner's finances and property in the event of a divorce or death. For more details, consult All Ohio Forms.

- Beneficiary Designations: These are forms associated with financial accounts and insurance policies that specify who will receive the assets upon your death. They can override instructions in a will.

- HIPAA Authorization: This document allows designated individuals to access your medical records and information. It ensures your healthcare agents can make informed decisions on your behalf.

- Financial Power of Attorney: A specific type of DPOA that focuses solely on financial matters. It grants someone the authority to handle your financial affairs, such as managing bank accounts and paying bills.

Each of these documents serves a unique purpose and can work together with a Durable Power of Attorney to create a comprehensive plan for your future. Properly preparing these forms ensures that your wishes are honored and your affairs are managed according to your preferences.

Misconceptions

When it comes to a Durable Power of Attorney (DPOA), many people hold misconceptions that can lead to confusion. Understanding these misconceptions can help you make informed decisions about your legal and financial matters. Here are four common misunderstandings:

- A Durable Power of Attorney is only for the elderly. Many believe that this document is only necessary for older adults. In reality, anyone can benefit from having a DPOA, regardless of age. Accidents or sudden illnesses can happen to anyone, making it essential to have a plan in place.

- A Durable Power of Attorney gives someone complete control over your life. Some people worry that granting a DPOA means losing all control over their decisions. However, a DPOA is designed to allow you to specify the powers you want to grant. You can limit the authority to specific areas, such as financial matters or healthcare decisions.

- A Durable Power of Attorney is permanent and cannot be revoked. This is a common myth. In fact, as long as you are mentally competent, you can revoke or change your DPOA at any time. It’s important to communicate any changes to the appointed agent and to any institutions that may have a copy of the document.

- Once a Durable Power of Attorney is created, it never needs to be updated. Many people think that once they have a DPOA, they can forget about it. However, life changes such as marriage, divorce, or the birth of a child may necessitate updates to your DPOA. Regularly reviewing your document ensures it still reflects your wishes.

By dispelling these misconceptions, you can better understand the role of a Durable Power of Attorney and ensure that your wishes are honored in the event you cannot make decisions for yourself.