Fill a Valid Employee Advance Form

The Employee Advance form serves as a critical tool for employees seeking financial assistance for work-related expenses before they are incurred. This form is designed to streamline the process of requesting funds, ensuring that employees can access necessary resources without delay. Typically, it includes essential information such as the employee's name, department, and the specific purpose for which the advance is requested. Additionally, it outlines the amount being sought and may require a justification or explanation of how the funds will be utilized. By providing a clear framework for these requests, the form helps maintain transparency and accountability in financial transactions. Once submitted, the form undergoes a review process, which may involve approvals from supervisors or finance personnel, ensuring that all advances are justified and aligned with company policies. Understanding the nuances of this form can empower employees to navigate their financial needs effectively while adhering to organizational guidelines.

Additional PDF Templates

How to Make a Pay Stub for Self-employed - The Independent Contractor Pay Stub provides a summary of earnings for self-employed individuals.

When engaging in the transfer of ownership for a motorcycle in New York State, utilizing the New York Motorcycle Bill of Sale form is crucial. This document outlines key details of the transaction, ensuring clarity and protection for both the buyer and seller. You can find a comprehensive guide and template for this essential form at https://freebusinessforms.org, which can facilitate a smooth and legally sound sale process.

Employer's Quarterly Federal Tax Return - Form 941 contributes to the overall tax compliance landscape in the United States.

Da 638 - The award nomination process is an integral part of military personnel management.

Similar forms

- Expense Reimbursement Form: This document allows employees to request reimbursement for out-of-pocket expenses incurred while performing job duties. Like the Employee Advance form, it requires receipts and justification for the expenses.

- Travel Authorization Form: Employees use this form to seek approval for travel-related expenses before they occur. Similar to the Employee Advance form, it outlines the purpose of travel and estimated costs.

- Payroll Advance Request: This document is used to request an advance on future wages. It shares similarities with the Employee Advance form in that it requires details about the amount requested and reasons for the advance.

- Loan Application Form: Employees may fill out this form to apply for a loan from the employer. Both forms require personal information and a clear explanation of the need for funds.

- Tractor Bill of Sale: Similar to the Employee Advance form, the https://georgiapdf.com/tractor-bill-of-sale/ is essential in recording the transfer of ownership, ensuring that both parties have a clear understanding of the transaction details.

- Purchase Order Request: This document is used to request approval for purchasing goods or services. Like the Employee Advance form, it specifies the amount needed and the purpose of the request.

- Budget Request Form: Employees can use this form to request funding for specific projects or needs. It is similar in that it outlines the amount requested and provides justification for the funds.

- Charitable Contribution Request: This form allows employees to request funds for charitable donations. It shares common elements with the Employee Advance form, such as detailing the amount needed and the reason for the request.

Document Example

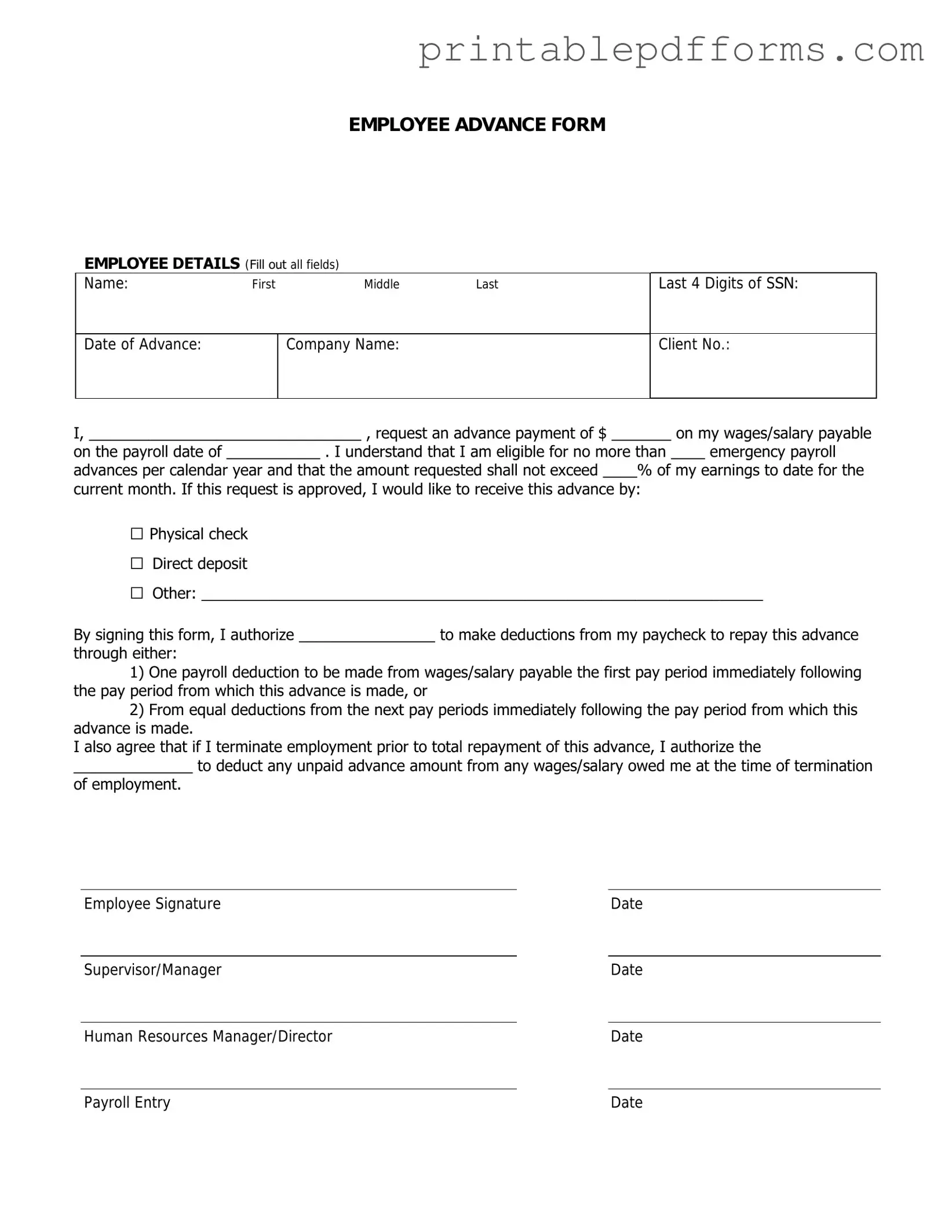

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on wages or expenses before the regular pay period. |

| Eligibility | Employees must be in good standing and have completed a specified duration of employment to qualify for an advance. |

| Repayment Terms | Advances are typically deducted from future paychecks, often over a set number of pay periods. |

| Approval Process | Supervisors or HR personnel must review and approve the request before any funds are disbursed. |

| State-Specific Laws | Some states, such as California, have specific laws governing wage advances, ensuring compliance with labor regulations. |

| Documentation | Employees may need to provide documentation supporting their request, such as receipts for expenses. |

| Limitations | There may be limits on the amount that can be requested, often based on the employee's earnings. |

| Tax Implications | Advances may have tax implications, as they are considered wages and subject to withholding. |

| Confidentiality | Requests for advances are generally treated confidentially, with access limited to relevant personnel. |

| Form Availability | The Employee Advance form is typically available through the company’s HR department or intranet. |

Crucial Questions on This Form

What is the Employee Advance form?

The Employee Advance form is a document used by employees to request an advance on their salary or wages. This form allows employees to receive funds before their regular payday to cover urgent expenses or financial needs.

Who is eligible to request an advance?

Generally, all full-time employees who have completed their probationary period can request an advance. Part-time employees may also be eligible, depending on company policy. It’s important to check with your HR department for specific eligibility criteria.

How do I fill out the Employee Advance form?

To complete the form, follow these steps:

- Provide your personal information, including your name, employee ID, and department.

- Specify the amount you are requesting as an advance.

- Explain the reason for the advance in the designated section.

- Sign and date the form.

Make sure to review the form for accuracy before submitting it to your supervisor or HR department.

How long does it take to process the request?

The processing time for the Employee Advance form can vary. Typically, it takes 3 to 5 business days for the request to be reviewed and approved. If additional information is needed, this may extend the processing time.

What happens if my advance request is denied?

If your request for an advance is denied, you will receive a notification explaining the reason for the denial. You can discuss the decision with your supervisor or HR for further clarification and potential options.

Are there any repayment terms for the advance?

Yes, employees are usually required to repay the advance through deductions from their future paychecks. The repayment terms will be outlined in the approval notification. It’s important to understand these terms before accepting the advance.

Can I submit the Employee Advance form electronically?

Many companies now allow electronic submissions of the Employee Advance form. Check with your HR department to see if this option is available. If electronic submission is permitted, ensure you follow the correct procedure for submitting the form online.

Documents used along the form

When processing an Employee Advance form, several other documents may be required to ensure a smooth and compliant transaction. Each of these documents serves a specific purpose in the overall process, facilitating transparency and accountability.

- Expense Report: This document outlines the specific expenses for which the employee is seeking reimbursement. It includes details such as dates, amounts, and descriptions of each expense, providing a clear record of how the advance will be utilized.

- Repayment Agreement: A repayment agreement is a formal document that outlines the terms under which the employee will repay the advance. It specifies the repayment schedule, amounts, and any applicable interest rates, ensuring both parties are aware of their obligations.

- Approval Memo: An approval memo is often required to document the authorization of the advance. This memo typically includes the reasons for the advance, the amount requested, and the signatures of relevant supervisors or managers, confirming that the request has been reviewed and approved.

- Motor Vehicle Bill of Sale: Essential for documenting the sale of a vehicle in Ohio, this form proves the transaction and facilitates ownership transfer between parties. More details can be found at All Ohio Forms.

- Payroll Deduction Authorization: This form allows the employer to deduct the repayment amount directly from the employee's paycheck. It provides consent from the employee, ensuring that the repayment process is clear and agreed upon by both parties.

These documents work together to create a comprehensive framework for managing employee advances. Proper documentation helps protect both the employee and the employer, fostering trust and clarity in financial transactions.

Misconceptions

Understanding the Employee Advance form is crucial for both employees and employers. However, several misconceptions can lead to confusion and potentially impact the process. Here are five common misconceptions:

-

Only management can request an advance.

This is not true. Any eligible employee can request an advance, provided they follow the proper procedures outlined by the company.

-

All requests for advances will be automatically approved.

Approval is not guaranteed. Each request is evaluated based on specific criteria, including the employee's current financial situation and company policy.

-

Advances are considered loans and must be paid back with interest.

In most cases, advances are not loans. They are typically deducted from future paychecks without interest, making them a more manageable option for employees.

-

The process is the same for every department.

Procedures may vary by department or company policy. Employees should consult their specific guidelines to ensure compliance.

-

Submitting the form is the only step required.

While submitting the form is essential, employees may also need to provide additional documentation or meet with a supervisor to discuss their request.

Addressing these misconceptions can help streamline the process and ensure that employees understand their rights and responsibilities when seeking an advance.