Blank Employee Loan Agreement Form

When employees face unexpected financial challenges, an Employee Loan Agreement can serve as a helpful resource, providing them with access to funds while fostering a supportive workplace environment. This form outlines the terms under which an employer lends money to an employee, ensuring clarity and mutual understanding. Key elements of the agreement include the loan amount, repayment schedule, interest rates, and any applicable fees. Additionally, it often specifies the consequences of missed payments and the rights of both parties involved. By establishing these terms, the agreement not only protects the employer’s interests but also empowers employees to manage their finances responsibly. Understanding the nuances of this form can help both employers and employees navigate the lending process smoothly, promoting a culture of trust and cooperation in the workplace.

Similar forms

- Promissory Note: This document outlines the borrower's promise to repay a loan, detailing the amount, interest rate, and repayment schedule. Like the Employee Loan Agreement, it serves as a formal record of the loan terms.

- Loan Agreement: Similar to the Employee Loan Agreement, this document specifies the terms and conditions of a loan between two parties, including repayment terms and any collateral involved.

Loan Agreement Form: The Florida Loan Agreement form is essential for defining the financial relationship between the borrower and the lender. It includes vital information such as repayment terms and obligations, ensuring both parties are clear on the expectations. For reference, you can access All Florida Forms to find the appropriate documentation.

- Employment Contract: While primarily focused on job responsibilities and compensation, it may include provisions for loans or advances, similar to how the Employee Loan Agreement addresses financial support for employees.

- Repayment Plan: This document details how a borrower will repay their loan, including timelines and amounts, much like the repayment terms outlined in the Employee Loan Agreement.

- Security Agreement: If a loan is secured by collateral, this document outlines what the collateral is and the conditions under which it can be claimed, paralleling the security provisions that may be found in an Employee Loan Agreement.

- Loan Disclosure Statement: This document provides borrowers with important information about the loan, including fees and interest rates, akin to the transparency required in the Employee Loan Agreement.

- Credit Agreement: This document outlines the terms of a line of credit, similar to the Employee Loan Agreement in that it specifies borrowing limits and repayment expectations.

- Debt Acknowledgment: This document confirms that a borrower acknowledges their debt, similar to how the Employee Loan Agreement formalizes the borrower's obligation to repay the loan.

- Forbearance Agreement: In situations where repayment is temporarily halted, this document outlines the terms of the forbearance, much like how the Employee Loan Agreement may address payment flexibility.

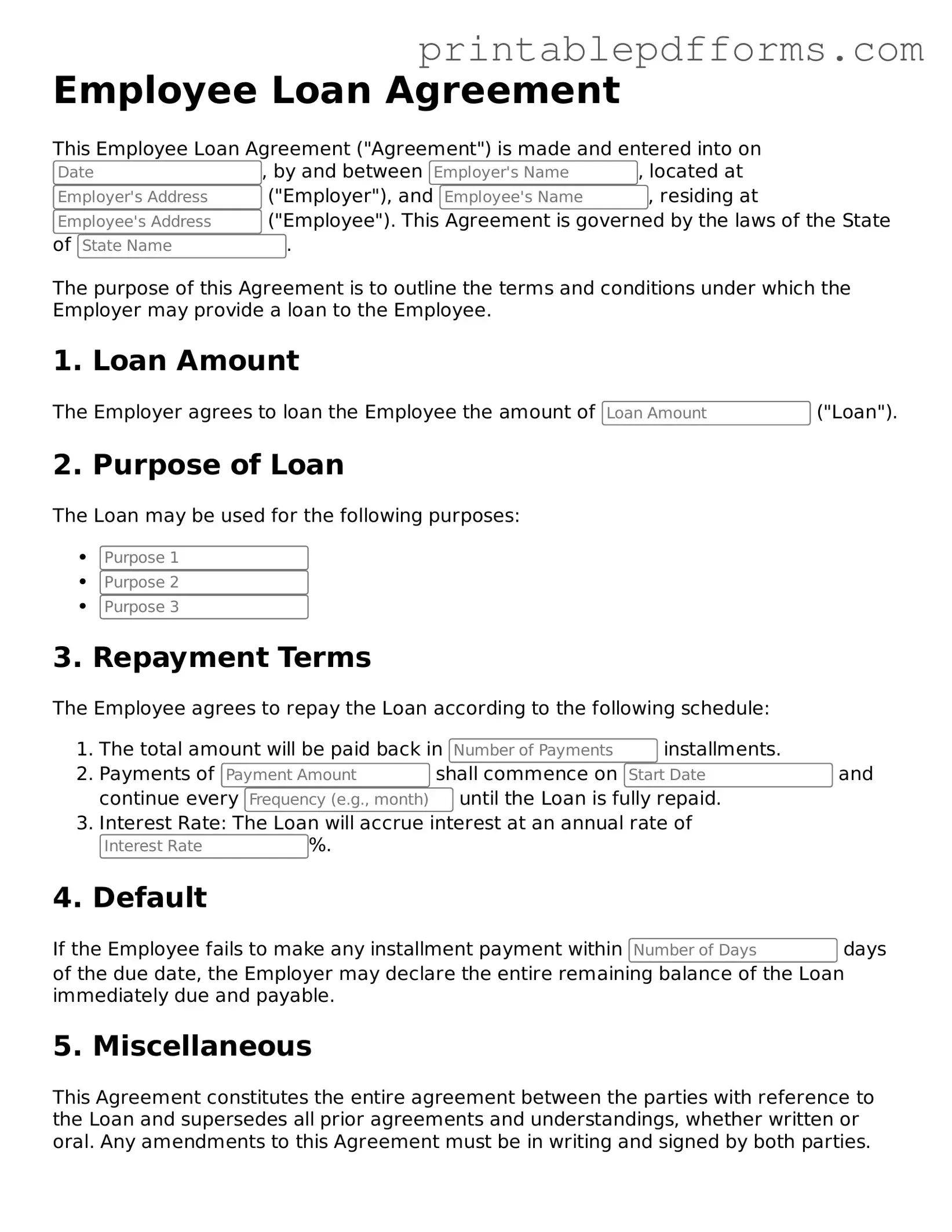

Document Example

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made and entered into on , by and between , located at ("Employer"), and , residing at ("Employee"). This Agreement is governed by the laws of the State of .

The purpose of this Agreement is to outline the terms and conditions under which the Employer may provide a loan to the Employee.

1. Loan Amount

The Employer agrees to loan the Employee the amount of ("Loan").

2. Purpose of Loan

The Loan may be used for the following purposes:

3. Repayment Terms

The Employee agrees to repay the Loan according to the following schedule:

- The total amount will be paid back in installments.

- Payments of shall commence on and continue every until the Loan is fully repaid.

- Interest Rate: The Loan will accrue interest at an annual rate of %.

4. Default

If the Employee fails to make any installment payment within days of the due date, the Employer may declare the entire remaining balance of the Loan immediately due and payable.

5. Miscellaneous

This Agreement constitutes the entire agreement between the parties with reference to the Loan and supersedes all prior agreements and understandings, whether written or oral. Any amendments to this Agreement must be in writing and signed by both parties.

By signing below, both parties agree to the terms specified in this Employee Loan Agreement.

Employer Signature: ____________________________ Date: ________________

Employee Signature: ___________________________ Date: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | An Employee Loan Agreement form is designed to outline the terms under which an employer lends money to an employee. |

| Loan Amount | The form specifies the exact amount of money being loaned, which is crucial for clarity and legal purposes. |

| Repayment Terms | It details the repayment schedule, including the frequency of payments and the total duration for repayment. |

| Interest Rate | The agreement may include an interest rate, which can vary based on state laws and company policies. |

| Governing Law | The agreement is subject to state-specific laws, which can affect its enforceability and the rights of both parties. |

| Default Consequences | It outlines what happens if the employee fails to repay the loan, including potential legal actions or deductions from wages. |

Crucial Questions on This Form

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms under which an employer lends money to an employee. This agreement specifies the loan amount, repayment schedule, interest rates, and any other conditions that apply. It protects both the employer and the employee by ensuring clarity and mutual understanding.

Why would an employer offer a loan to an employee?

Employers may choose to offer loans for various reasons, including:

- To assist employees in times of financial hardship.

- To promote employee loyalty and retention.

- To provide a benefit that can enhance overall job satisfaction.

What information should be included in the agreement?

Key elements of an Employee Loan Agreement typically include:

- The names and contact information of both parties.

- The total loan amount.

- The interest rate, if applicable.

- The repayment schedule, including due dates.

- Consequences of late payments or default.

- Any collateral, if required.

How is the repayment schedule determined?

The repayment schedule can vary based on the loan amount and the employee's financial situation. Employers often consider the employee's ability to repay when setting the schedule. Common practices include monthly payments, bi-weekly deductions from paychecks, or a lump sum payment at the end of the term.

Is there an interest rate for the loan?

Interest rates can be set by the employer and may depend on company policy or state regulations. Some employers choose to offer interest-free loans as a benefit, while others may charge a nominal interest rate. It's essential to clearly state the interest rate in the agreement to avoid any misunderstandings.

What happens if the employee cannot repay the loan?

If an employee is unable to repay the loan, the agreement should outline the consequences. These may include:

- Late fees or penalties.

- Options for restructuring the loan.

- Possible deductions from future paychecks.

- Legal actions, if necessary, to recover the funds.

Can the loan be forgiven?

Loan forgiveness is at the discretion of the employer and should be explicitly stated in the agreement if applicable. Employers may choose to forgive part or all of the loan under certain circumstances, such as long-term employment or exceptional performance.

Is the Employee Loan Agreement legally binding?

Yes, once both parties sign the Employee Loan Agreement, it becomes a legally binding contract. This means that both the employer and the employee are obligated to adhere to the terms outlined in the document. It is advisable for both parties to keep a copy for their records.

Where can I obtain an Employee Loan Agreement form?

Employee Loan Agreement forms can be obtained from various sources, including:

- Online legal form websites.

- Human resources departments within organizations.

- Legal professionals who specialize in employment law.

Documents used along the form

When an Employee Loan Agreement is put in place, several other documents may also be necessary to ensure clarity and compliance. These documents help outline the terms of the loan and protect both the employer and employee. Below are some commonly used forms and documents that accompany an Employee Loan Agreement.

- Promissory Note: This document serves as a written promise from the employee to repay the loan. It includes details such as the loan amount, interest rate, repayment schedule, and consequences of default.

- Loan Agreement Form: For securing the terms of financial arrangements, the detailed Loan Agreement form resources provide necessary protections for both lenders and borrowers.

- Loan Repayment Schedule: This schedule outlines the timeline for repayment. It specifies due dates for payments and the total duration of the loan, making it easier for both parties to track progress.

- Authorization for Payroll Deduction: This form allows the employer to automatically deduct loan payments from the employee's paycheck. It streamlines the repayment process and ensures timely payments.

- Employee Acknowledgment Form: This document confirms that the employee understands the terms of the loan and the repayment obligations. It acts as a record that the employee has received and reviewed the agreement.

- Termination of Loan Agreement: In the event that the employee leaves the company, this document outlines the process for settling the loan. It details how remaining balances will be handled and any potential consequences for non-payment.

These documents work together to create a comprehensive framework for managing employee loans. By ensuring that all parties understand their rights and responsibilities, the risk of misunderstandings can be minimized.

Misconceptions

Understanding the Employee Loan Agreement form is essential for both employers and employees. However, several misconceptions often arise regarding this document. Below is a list of ten common misunderstandings, along with clarifications for each.

- It is a legally binding contract. Many believe that the Employee Loan Agreement is not enforceable. In reality, when properly executed, it serves as a legally binding contract outlining the terms of the loan.

- Only large companies use this form. Some think that only large corporations require an Employee Loan Agreement. In truth, any employer, regardless of size, can utilize this form to formalize loan arrangements with employees.

- It only applies to monetary loans. A common misconception is that the agreement only pertains to cash loans. However, it can also cover other types of assistance, such as advances on wages or loans for specific expenses.

- Employees cannot negotiate the terms. Some employees feel they have no power to negotiate the terms of the agreement. In fact, both parties can discuss and modify the terms before signing, ensuring mutual understanding.

- There are no tax implications. Many assume that loans made under this agreement are tax-free. However, depending on the circumstances, there may be tax implications for both the employer and the employee.

- It is only necessary for formal loans. Some believe that an Employee Loan Agreement is only needed for formal loans. Informal loans can also benefit from having a written agreement to clarify expectations and responsibilities.

- It can be ignored if the employee leaves. There is a misconception that the agreement becomes void if the employee leaves the company. In reality, the employee is still responsible for repayment, and the employer can pursue collection.

- It is a simple document that requires no legal review. Some think that the form is straightforward enough to skip legal review. However, having a legal professional review the agreement can help avoid potential disputes later on.

- All loans must be repaid immediately. Many believe that all loans must be repaid in a short time frame. The agreement can specify flexible repayment terms, which can be tailored to the employee's financial situation.

- It is only for employees in financial distress. Some think that only employees facing financial difficulties can utilize this agreement. In fact, it can be beneficial for any employee seeking assistance for various reasons, such as education or home repairs.

By addressing these misconceptions, both employers and employees can better understand the Employee Loan Agreement and its implications. Clarity in this area can lead to smoother financial transactions and improved workplace relationships.