Florida Deed Document

The Florida Deed form is a crucial document in real estate transactions, serving as the legal instrument that transfers property ownership from one party to another. This form encompasses several key components, including the names of the grantor and grantee, a detailed description of the property, and the consideration amount, which is the price paid for the property. Additionally, the form must be signed by the grantor and, in some cases, witnessed to ensure its validity. Different types of deeds, such as warranty deeds and quitclaim deeds, offer varying levels of protection and rights to the grantee, making it essential to choose the appropriate type based on the circumstances of the transaction. Understanding the nuances of the Florida Deed form is vital for both buyers and sellers, as it lays the foundation for the legal transfer of property and helps prevent future disputes. Proper completion and recording of this form with the county clerk's office are necessary to ensure that the new ownership is recognized legally, protecting the rights of the new owner and providing clarity in property records.

Discover More Deed Forms for Different States

Ohio Deed Transfer Form - A deed is integral to the real estate closing process.

The Ohio Motor Vehicle Bill of Sale form is a critical document that records the essential details of the sale of a vehicle between two parties in Ohio. It serves as a proof of transaction and establishes the transfer of ownership from the seller to the buyer, ensuring all parties are protected. For comprehensive information on this process, you can refer to All Ohio Forms, a valuable resource for those involved in vehicle transactions.

Texas Deed Forms - Ensure accurate information is included in your Deed to avoid disputes.

Similar forms

The Deed form is an important legal document used in property transactions. It shares similarities with several other documents in terms of purpose and function. Here are five documents that are similar to the Deed form:

- Title Insurance Policy: This document provides protection against losses arising from defects in the title to a property. Like a Deed, it establishes ownership and outlines the rights associated with that ownership.

- Operating Agreement: The New York Operating Agreement form is crucial for LLCs as it specifies the management structure and member responsibilities. For more information, visit https://freebusinessforms.org.

- Mortgage Agreement: A mortgage agreement is a contract between a borrower and a lender. It secures the loan with the property itself. Both the Mortgage Agreement and the Deed are critical in defining the rights and responsibilities of the parties involved in a property transaction.

- Lease Agreement: This document outlines the terms under which one party agrees to rent property from another. Similar to a Deed, it details the rights of the tenant and landlord, although it typically involves temporary possession rather than ownership.

- Bill of Sale: A Bill of Sale transfers ownership of personal property from one party to another. While a Deed pertains to real property, both documents serve to formalize the transfer of ownership and protect the interests of the parties involved.

- Purchase Agreement: This document outlines the terms and conditions of a sale between a buyer and seller. Like a Deed, it is essential for establishing the transfer of ownership and the obligations of each party in a real estate transaction.

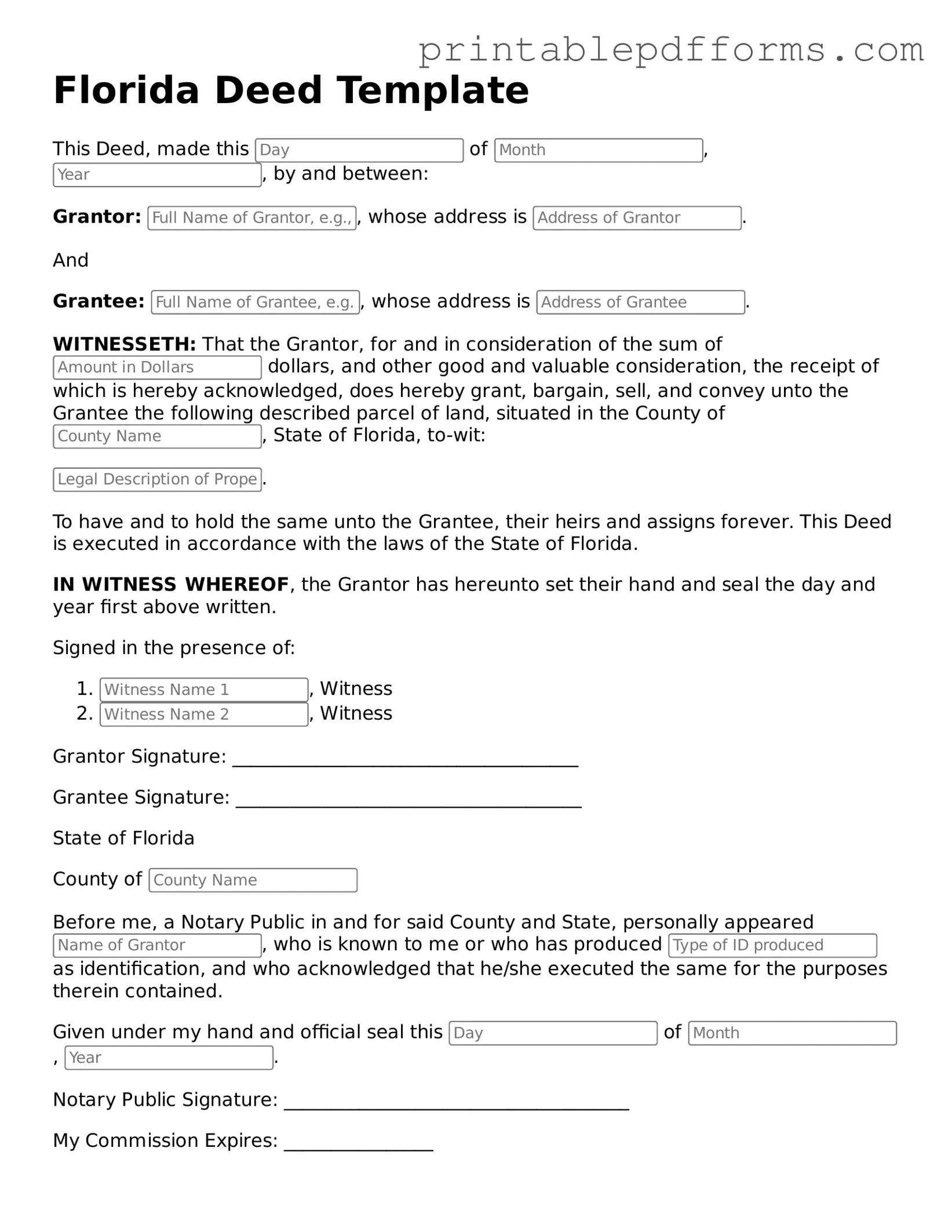

Document Example

Florida Deed Template

This Deed, made this of , , by and between:

Grantor: , whose address is .

And

Grantee: , whose address is .

WITNESSETH: That the Grantor, for and in consideration of the sum of dollars, and other good and valuable consideration, the receipt of which is hereby acknowledged, does hereby grant, bargain, sell, and convey unto the Grantee the following described parcel of land, situated in the County of , State of Florida, to-wit:

.

To have and to hold the same unto the Grantee, their heirs and assigns forever. This Deed is executed in accordance with the laws of the State of Florida.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand and seal the day and year first above written.

Signed in the presence of:

- , Witness

- , Witness

Grantor Signature: _____________________________________

Grantee Signature: _____________________________________

State of Florida

County of

Before me, a Notary Public in and for said County and State, personally appeared , who is known to me or who has produced as identification, and who acknowledged that he/she executed the same for the purposes therein contained.

Given under my hand and official seal this of , .

Notary Public Signature: _____________________________________

My Commission Expires: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Type of Deed | The Florida Deed form can be a warranty deed, quitclaim deed, or special warranty deed. |

| Governing Law | Florida Statutes, Chapter 689 governs the execution and recording of deeds in Florida. |

| Transfer of Title | A deed is used to transfer ownership of real property from one party to another. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property). |

| Witnesses | In Florida, the signature of the grantor must be witnessed by two individuals. |

| Notarization | A notary public must acknowledge the deed for it to be valid. |

| Recording | The deed should be recorded in the county where the property is located to provide public notice. |

| Legal Description | The deed must include a legal description of the property being transferred. |

| Consideration | The deed should state the consideration (payment) given for the transfer, although it can be nominal. |

Crucial Questions on This Form

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Florida. This document outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions or restrictions related to the transfer. There are various types of deeds, such as warranty deeds, quitclaim deeds, and special purpose deeds, each serving a different purpose in the conveyance process.

What types of deeds are commonly used in Florida?

In Florida, several types of deeds are commonly utilized, including:

- Warranty Deed: This type provides the highest level of protection to the buyer, guaranteeing that the seller has clear title to the property and the right to sell it.

- Quitclaim Deed: Often used in situations where the parties know each other, this deed transfers any interest the seller may have in the property without making guarantees about the title.

- Special Purpose Deed: This includes various forms such as Personal Representative Deeds, which are used to transfer property from an estate, or a Trustee Deed, which transfers property held in a trust.

How do I complete a Florida Deed form?

Completing a Florida Deed form involves several key steps:

- Gather necessary information, including the names of the parties, property description, and any relevant legal descriptions.

- Choose the appropriate type of deed based on the nature of the transaction.

- Fill out the deed form accurately, ensuring all details are correct and complete.

- Sign the deed in the presence of a notary public, as notarization is required for the deed to be legally binding.

- Record the completed deed with the county clerk’s office where the property is located to ensure public notice of the transfer.

Are there any fees associated with filing a Florida Deed form?

Yes, there are typically fees associated with filing a Florida Deed form. These fees can vary by county but generally include:

- Recording Fees: Charged by the county clerk’s office for officially recording the deed.

- Documentary Stamp Taxes: Imposed on the transfer of real property, calculated based on the sale price or the value of the property.

- Notary Fees: If you require a notary to witness the signing of the deed, there may be additional costs for their services.

It is advisable to check with the local county clerk’s office for the specific fee schedule and any additional requirements.

Documents used along the form

When transferring property in Florida, several forms and documents often accompany the Florida Deed form to ensure a smooth and legally compliant transaction. Each document serves a specific purpose and helps to clarify the details of the property transfer.

- Title Search Report: This document provides information about the property's ownership history, any liens, or encumbrances. It ensures that the seller has the legal right to transfer the property.

- Property Appraisal: An appraisal assesses the property's market value. This document is essential for both buyers and lenders to ensure the property is worth the agreed purchase price.

- Purchase Agreement: This contract outlines the terms of the sale between the buyer and seller. It includes details such as the purchase price, closing date, and any contingencies.

- Disclosure Statements: Sellers may be required to provide disclosures about the property's condition, including any known defects or issues. This protects buyers by ensuring they are fully informed.

- Tractor Bill of Sale: In Georgia, this essential document is used to record the transfer of ownership of a tractor, ensuring details about the buyer, seller, and tractor are clearly outlined, and can be accessed at georgiapdf.com/tractor-bill-of-sale/.

- Closing Statement: This document summarizes the financial aspects of the transaction, including fees, taxes, and the final amount the buyer needs to pay. It is typically reviewed and signed at closing.

- Affidavit of Title: This sworn statement from the seller confirms their ownership of the property and that there are no undisclosed liens or claims against it.

- Tax Forms: Various tax documents may be required, including those related to property taxes or transfer taxes. These forms ensure compliance with local tax regulations.

- Power of Attorney: If the seller cannot be present at closing, a power of attorney allows someone else to sign documents on their behalf, facilitating the transaction.

- Title Insurance Policy: This policy protects the buyer and lender from potential disputes over property ownership and ensures that any title issues are addressed.

Each of these documents plays a vital role in the property transfer process in Florida. Understanding their purpose can help ensure that all aspects of the transaction are handled correctly and efficiently, providing peace of mind for both buyers and sellers.

Misconceptions

Understanding the Florida Deed form can be challenging due to various misconceptions. Here are six common misunderstandings:

-

All Deeds Are the Same: Many people believe that all deed forms serve the same purpose. In reality, different types of deeds, such as warranty deeds and quitclaim deeds, have distinct legal implications and protections.

-

A Deed Must Be Notarized: While notarization is often required for a deed to be valid, there are exceptions. Certain deeds may not require notarization, depending on the specific circumstances and local laws.

-

Once a Deed is Signed, It Cannot Be Changed: Some individuals think that a deed is permanent once signed. However, deeds can be amended or revoked under specific conditions, allowing for changes in ownership or terms.

-

Only Lawyers Can Prepare Deeds: It is a common belief that only licensed attorneys can draft a deed. While legal expertise is beneficial, individuals can prepare their own deeds if they follow the proper guidelines and requirements.

-

Deeds Are Only Necessary for Property Sales: Many assume that deeds are only needed when buying or selling property. In truth, deeds are also used for gifting property, transferring ownership, or creating trusts.

-

Filing a Deed is Complicated: Some people view the process of filing a deed as overly complex. In reality, with the right information and preparation, the filing process can be straightforward.