Florida Deed in Lieu of Foreclosure Document

In the realm of real estate transactions, particularly in Florida, the Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial distress. This legal instrument allows a borrower to voluntarily transfer ownership of their property to the lender, effectively avoiding the lengthy and often painful foreclosure process. By executing this deed, homeowners can mitigate the impact on their credit scores and potentially negotiate more favorable terms for their outstanding mortgage obligations. The form outlines essential details, including the property description, the parties involved, and any existing liens or encumbrances. Importantly, it also addresses the potential for the lender to forgive remaining debts, offering a pathway for homeowners to regain financial stability. Understanding the nuances of this form is vital for both borrowers and lenders, as it not only facilitates a smoother transition of property ownership but also opens up avenues for negotiation that can benefit both parties in a challenging financial landscape.

Discover More Deed in Lieu of Foreclosure Forms for Different States

Deed in Lieu of Foreclosure Texas - Signing a Deed in Lieu can bring closure for homeowners dealing with financial hardship.

The ST-12B Georgia form is a vital tool for those seeking to reclaim overpaid sales tax, as it allows both individuals and businesses to submit a formal request for a refund. To streamline the process, it's essential to provide complete information about the purchaser, the dealer, and the transaction itself. For detailed guidance on how to complete this form accurately, you can visit georgiapdf.com/st-12b-georgia/ and get started on your refund request.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - The Deed in Lieu may provide a faster resolution than going through the foreclosure process.

California Voluntary Foreclosure Deed - This document marks the end of the borrower-lender relationship, shifting property ownership entirely.

Deed in Lieu of Mortgage - This form can be particularly beneficial in situations where the property's value has declined significantly.

Similar forms

-

Short Sale Agreement: A short sale occurs when a homeowner sells their property for less than the amount owed on the mortgage. Like a deed in lieu of foreclosure, this option allows the homeowner to avoid foreclosure. Both processes require lender approval and can help mitigate the homeowner's financial burden.

-

Medical Power of Attorney: This essential document empowers an individual to designate someone to make health care decisions on their behalf, providing clarity and direction for medical treatment preferences. Understanding the significance of this form is vital for health care planning in Ohio, and residents can access the necessary paperwork through All Ohio Forms.

-

Loan Modification Agreement: This document alters the terms of an existing mortgage to make payments more manageable. Similar to a deed in lieu of foreclosure, a loan modification can prevent foreclosure by allowing the homeowner to keep their property while adjusting the payment structure to fit their financial situation.

-

Forebearance Agreement: In this agreement, the lender allows the homeowner to temporarily pause or reduce mortgage payments. This document shares similarities with a deed in lieu of foreclosure as both aim to provide relief to the homeowner and avoid the negative consequences of foreclosure.

-

Bankruptcy Filing: Filing for bankruptcy can provide a temporary stay on foreclosure proceedings. While a deed in lieu of foreclosure transfers property back to the lender, bankruptcy offers a legal pathway to reorganize debts and potentially keep the home, making both options crucial for homeowners in distress.

Document Example

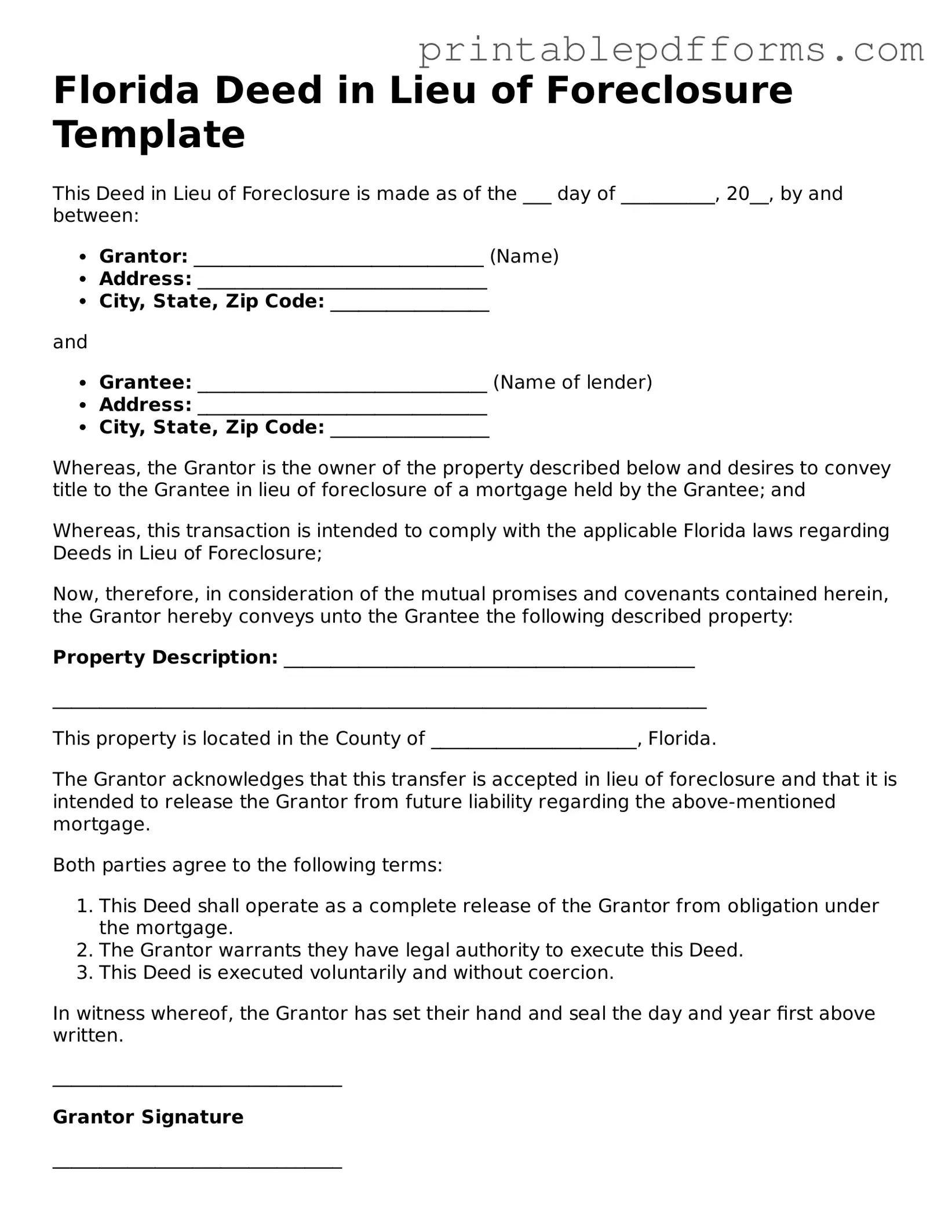

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made as of the ___ day of __________, 20__, by and between:

- Grantor: _______________________________ (Name)

- Address: _______________________________

- City, State, Zip Code: _________________

and

- Grantee: _______________________________ (Name of lender)

- Address: _______________________________

- City, State, Zip Code: _________________

Whereas, the Grantor is the owner of the property described below and desires to convey title to the Grantee in lieu of foreclosure of a mortgage held by the Grantee; and

Whereas, this transaction is intended to comply with the applicable Florida laws regarding Deeds in Lieu of Foreclosure;

Now, therefore, in consideration of the mutual promises and covenants contained herein, the Grantor hereby conveys unto the Grantee the following described property:

Property Description: ____________________________________________

______________________________________________________________________

This property is located in the County of ______________________, Florida.

The Grantor acknowledges that this transfer is accepted in lieu of foreclosure and that it is intended to release the Grantor from future liability regarding the above-mentioned mortgage.

Both parties agree to the following terms:

- This Deed shall operate as a complete release of the Grantor from obligation under the mortgage.

- The Grantor warrants they have legal authority to execute this Deed.

- This Deed is executed voluntarily and without coercion.

In witness whereof, the Grantor has set their hand and seal the day and year first above written.

_______________________________

Grantor Signature

_______________________________

Grantee Signature

State of Florida

County of ______________________

The foregoing instrument was acknowledged before me this ___ day of __________, 20__ by ______________________ (name of Grantor). They are personally known to me or have produced _________________________ (type of identification) as identification.

_______________________________

Notary Public Signature

_______________________________

Notary Seal

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The deed in lieu of foreclosure in Florida is governed by Florida Statutes, specifically Chapter 701. |

| Eligibility | Homeowners facing financial hardship may be eligible for a deed in lieu if they are unable to continue making mortgage payments. |

| Process | The process typically involves negotiations between the homeowner and the lender, followed by the execution of the deed. |

| Impact on Credit | A deed in lieu of foreclosure can have a less severe impact on credit scores compared to a formal foreclosure. |

| Tax Implications | Homeowners may face potential tax consequences, as the IRS may consider forgiven mortgage debt as taxable income. |

| Alternatives | Alternatives to a deed in lieu include loan modifications, short sales, or filing for bankruptcy. |

Crucial Questions on This Form

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is an agreement where a homeowner voluntarily transfers their property to the lender to avoid foreclosure. This process allows the homeowner to walk away from the mortgage obligation without going through the lengthy foreclosure process.

How does the Deed in Lieu of Foreclosure process work?

The process typically involves the following steps:

- The homeowner contacts the lender to discuss the possibility of a deed in lieu.

- The lender reviews the homeowner's financial situation and the property's value.

- If approved, both parties will sign the deed, transferring ownership to the lender.

- The lender may then release the homeowner from the mortgage debt.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits, including:

- It can be quicker than going through foreclosure.

- It may have less impact on the homeowner's credit score.

- The homeowner might avoid additional costs associated with foreclosure.

- It allows the homeowner to move on from the property with less stress.

What are the potential drawbacks?

While there are benefits, there are also drawbacks to consider:

- The homeowner may still be responsible for any deficiency balance if the property sells for less than the mortgage amount.

- It may not be an option if the lender does not agree to it.

- There could be tax implications related to forgiven debt.

Who qualifies for a Deed in Lieu of Foreclosure?

Typically, homeowners who are facing financial hardship and are unable to keep up with mortgage payments may qualify. Lenders often look for the following:

- Proof of financial hardship.

- A willingness to cooperate and communicate with the lender.

- A property that is in good condition.

Is a Deed in Lieu of Foreclosure the same as a short sale?

No, they are not the same. In a short sale, the homeowner sells the property for less than the mortgage balance, and the lender agrees to accept that amount. In a deed in lieu, the homeowner transfers the property back to the lender without selling it.

What should a homeowner do before pursuing a Deed in Lieu of Foreclosure?

Homeowners should consider the following steps:

- Consult with a financial advisor or attorney.

- Gather all relevant financial documents.

- Communicate openly with the lender about their situation.

Can a Deed in Lieu of Foreclosure affect my credit score?

Yes, it can affect your credit score, but typically less severely than a foreclosure. The impact varies based on individual credit history and circumstances. It is essential to check your credit report after the process to understand the effects.

What happens after the Deed in Lieu of Foreclosure is completed?

Once the deed is executed, the lender takes ownership of the property. The homeowner should receive confirmation of the debt being settled. It’s advisable for the homeowner to keep records of the transaction and follow up with the lender to ensure all obligations are resolved.

Documents used along the form

A Deed in Lieu of Foreclosure can be a useful tool for homeowners facing foreclosure in Florida. However, it is often accompanied by several other important documents that help facilitate the process and protect the interests of all parties involved. Below is a list of common forms and documents that are typically used alongside the Florida Deed in Lieu of Foreclosure.

- Mortgage Release: This document officially releases the borrower from their mortgage obligations once the property is transferred to the lender. It ensures that the borrower is no longer liable for the mortgage debt.

- Affidavit of Title: This sworn statement by the property owner confirms that they hold clear title to the property and that there are no undisclosed liens or claims against it. It provides assurance to the lender regarding the ownership status.

- Dirt Bike Bill of Sale: This form is vital for the purchase or sale of dirt bikes in New York, enabling a clear understanding of the transaction details and ownership transfer. More information can be found at https://freebusinessforms.org/.

- Property Condition Disclosure: This form outlines the current condition of the property and any known defects. It helps the lender assess the property’s value and potential repair needs.

- Release of Liability Agreement: This document releases the borrower from any future claims related to the mortgage or property after the deed is transferred. It protects the borrower from potential lawsuits or claims post-transfer.

- Settlement Statement: This statement details all financial aspects of the transaction, including any outstanding fees or costs associated with the deed transfer. It provides transparency for both parties.

- Loan Modification Agreement: In some cases, this document may be used if the lender and borrower agree to modify the terms of the existing loan instead of proceeding with a deed in lieu. It outlines the new terms and conditions of the loan.

Understanding these accompanying documents is crucial for homeowners considering a Deed in Lieu of Foreclosure. Each form serves a specific purpose and helps ensure a smoother transition while protecting the rights of both the borrower and the lender. Always consult with a legal professional to navigate this process effectively.

Misconceptions

The Florida Deed in Lieu of Foreclosure is often misunderstood. Here are nine common misconceptions about this legal process:

-

It eliminates all debts associated with the property.

A Deed in Lieu of Foreclosure only transfers ownership of the property back to the lender. It does not automatically cancel any other debts, such as personal loans or second mortgages, unless specifically agreed upon.

-

It is the same as a foreclosure.

While both processes result in the loss of the property, a Deed in Lieu of Foreclosure is a voluntary transfer. Foreclosure is a legal process initiated by the lender.

-

It will negatively impact your credit score less than a foreclosure.

Both a Deed in Lieu of Foreclosure and a foreclosure can have a significant negative impact on your credit score. The difference in impact may vary based on individual circumstances, but it is essential to be aware of the potential consequences.

-

You can only use it if you are in foreclosure.

A Deed in Lieu of Foreclosure can be an option even if you have not yet entered the foreclosure process. It is often used as a proactive measure to avoid foreclosure.

-

All lenders accept Deeds in Lieu of Foreclosure.

Not all lenders are willing to accept a Deed in Lieu of Foreclosure. Each lender has its policies and requirements, and it is important to discuss this option with them.

-

You will receive cash for the property.

In most cases, a Deed in Lieu of Foreclosure does not involve any cash payment to the homeowner. It is a transfer of ownership rather than a sale.

-

It absolves you of all future liability.

A Deed in Lieu of Foreclosure may not relieve you of all liabilities. If there are any deficiencies or other obligations related to the mortgage, you may still be responsible for them unless otherwise stated.

-

It is a quick and easy process.

The process can be lengthy and may require extensive documentation. Homeowners should be prepared for potential delays and should seek guidance throughout the process.

-

It is only for homeowners with significant equity.

A Deed in Lieu of Foreclosure can be an option for homeowners with little or no equity. The key factor is the homeowner's ability to work with the lender to find a mutually agreeable solution.