Florida Durable Power of Attorney Document

The Florida Durable Power of Attorney form is a crucial legal document that empowers individuals to designate an agent to make financial and legal decisions on their behalf when they are unable to do so. This form is particularly important for planning for future incapacity, ensuring that a trusted person can manage affairs without court intervention. It covers a wide range of powers, from handling bank transactions and real estate decisions to managing investments and filing taxes. The durable aspect of the form means that the authority granted remains effective even if the principal becomes incapacitated, providing peace of mind during uncertain times. Additionally, the form allows for flexibility, as individuals can specify which powers they wish to grant and can revoke or modify the agreement as circumstances change. Understanding the nuances of this form is essential for anyone looking to safeguard their financial and legal interests in Florida.

Discover More Durable Power of Attorney Forms for Different States

How to Get Power of Attorney in Ohio - It designates a trusted person, referred to as the agent, to handle specific decisions on behalf of the principal.

The process of establishing a new business entity requires careful documentation, including the preparation of various forms. One important form in this regard is the fundamental Articles of Incorporation document, which serves as the foundation for setting up your corporation in Washington.

Ny Poa - This form ensures that your chosen representative can manage your affairs when you are unable to do so yourself.

Similar forms

- General Power of Attorney: This document grants someone the authority to act on your behalf in a wide range of matters, similar to the Durable Power of Attorney. However, it typically becomes invalid if you become incapacitated.

- Medical Power of Attorney: This form allows a designated person to make healthcare decisions for you if you are unable to do so. Like the Durable Power of Attorney, it remains effective even if you become incapacitated.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate. It complements the Durable Power of Attorney by providing guidance to your agent about your healthcare preferences.

- ATV Bill of Sale: Essential for recording the sale and transfer of ownership of an all-terrain vehicle (ATV), this document includes vital information about the buyer, seller, and the ATV being sold. To complete your ATV sale, please fill out the ATV Bill of Sale form.

- Revocable Trust: This legal arrangement allows you to manage your assets during your lifetime and specify how they should be distributed after your death. It shares similarities with the Durable Power of Attorney in terms of asset management, but it also avoids probate.

- Healthcare Proxy: This document designates someone to make healthcare decisions on your behalf, similar to a Medical Power of Attorney. Both documents ensure your medical preferences are honored if you cannot communicate.

- Financial Power of Attorney: This form specifically grants authority over financial matters. Like the Durable Power of Attorney, it remains effective during periods of incapacity, focusing solely on financial decisions.

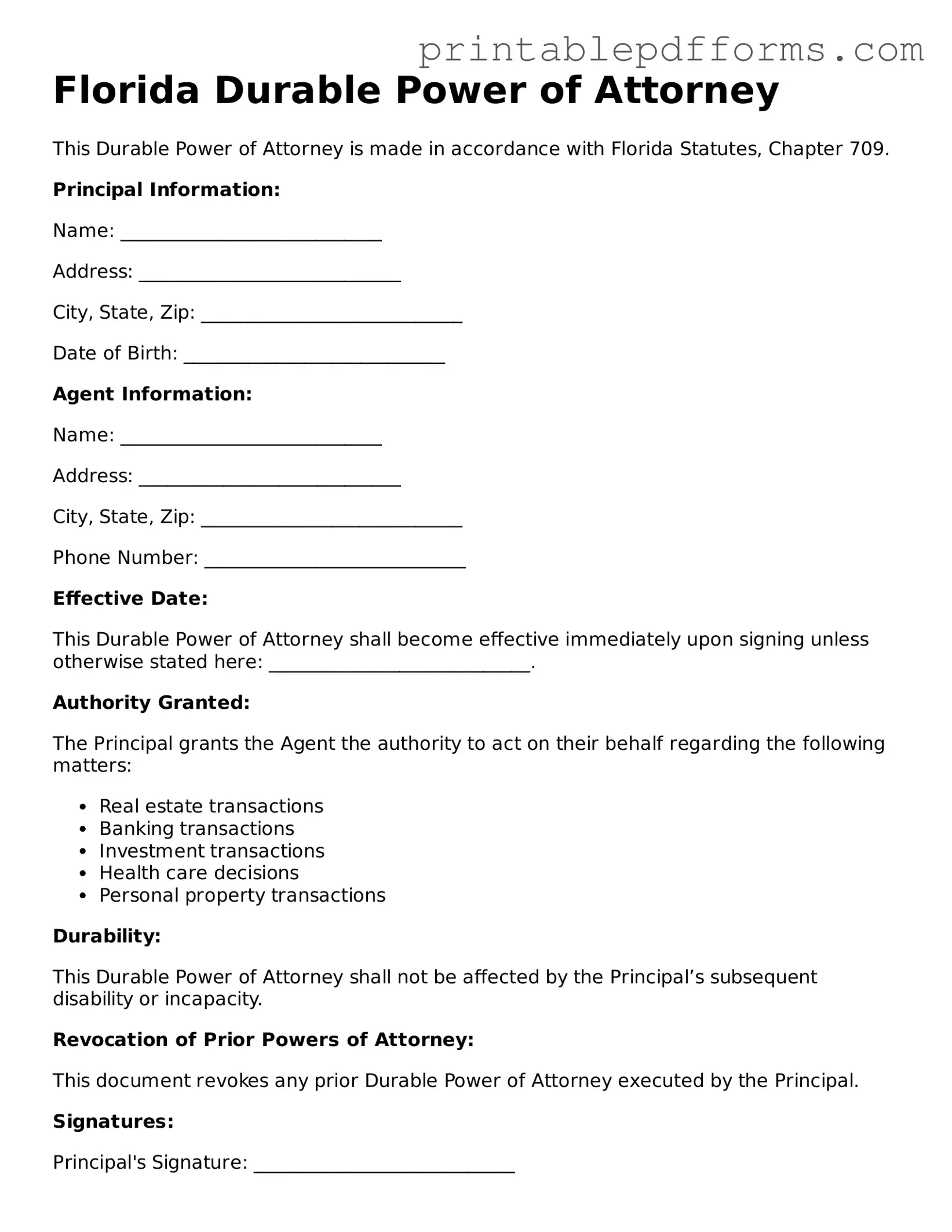

Document Example

Florida Durable Power of Attorney

This Durable Power of Attorney is made in accordance with Florida Statutes, Chapter 709.

Principal Information:

Name: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Date of Birth: ____________________________

Agent Information:

Name: ____________________________

Address: ____________________________

City, State, Zip: ____________________________

Phone Number: ____________________________

Effective Date:

This Durable Power of Attorney shall become effective immediately upon signing unless otherwise stated here: ____________________________.

Authority Granted:

The Principal grants the Agent the authority to act on their behalf regarding the following matters:

- Real estate transactions

- Banking transactions

- Investment transactions

- Health care decisions

- Personal property transactions

Durability:

This Durable Power of Attorney shall not be affected by the Principal’s subsequent disability or incapacity.

Revocation of Prior Powers of Attorney:

This document revokes any prior Durable Power of Attorney executed by the Principal.

Signatures:

Principal's Signature: ____________________________

Date: ____________________________

Agent's Signature: ____________________________

Date: ____________________________

Witnesses:

Witness 1 Name: ____________________________

Witness 1 Signature: ____________________________

Date: ____________________________

Witness 2 Name: ____________________________

Witness 2 Signature: ____________________________

Date: ____________________________

This Durable Power of Attorney must be notarized to be valid.

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone to manage their financial and legal affairs if they become incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Chapter 709 of the Florida Statutes. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Agent's Authority | The agent can perform a variety of tasks, including managing bank accounts, paying bills, and making investment decisions. |

| Execution Requirements | The form must be signed by the principal in the presence of two witnesses and a notary public. |

| Revocation | A Durable Power of Attorney can be revoked at any time by the principal as long as they are competent. |

| Agent's Duties | The agent has a fiduciary duty to act in the best interests of the principal and must keep accurate records. |

| Springing Power | In Florida, a Durable Power of Attorney can be set to spring into effect upon the principal’s incapacity, but this must be clearly stated in the document. |

| Limitations | There are certain powers that cannot be granted, such as the ability to make health care decisions, which requires a separate document. |

| Common Uses | This form is commonly used for estate planning, financial management, and long-term care planning. |

Crucial Questions on This Form

What is a Durable Power of Attorney in Florida?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf. This person, known as your agent or attorney-in-fact, can handle financial and legal matters if you become unable to do so yourself. The "durable" aspect means that the authority remains in effect even if you become incapacitated.

Who can be my agent in a Durable Power of Attorney?

Your agent can be anyone you trust, such as a family member, friend, or professional advisor. However, it is important to choose someone who is responsible and capable of managing your affairs. In Florida, your agent must be at least 18 years old and mentally competent.

What powers can I grant to my agent?

You can grant a wide range of powers to your agent, including:

- Managing bank accounts

- Paying bills

- Buying or selling property

- Making investment decisions

- Handling tax matters

It is essential to specify which powers you want to grant in the document. You can also limit your agent’s authority if desired.

Do I need a lawyer to create a Durable Power of Attorney in Florida?

No, you do not need a lawyer to create a Durable Power of Attorney in Florida. However, it can be helpful to consult with one if you have specific questions or concerns. You can prepare the document yourself using templates or guides that are available.

How do I sign a Durable Power of Attorney?

To make your Durable Power of Attorney valid, you must sign it in front of two witnesses. These witnesses cannot be your agent or your spouse. Additionally, you may want to have the document notarized to ensure its acceptance by financial institutions and other entities.

When does a Durable Power of Attorney take effect?

A Durable Power of Attorney can take effect immediately upon signing, or you can choose for it to take effect only when you become incapacitated. This decision should be clearly stated in the document.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation and notify your agent and any institutions that have a copy of the original document.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may need to appoint a guardian to manage your affairs. This process can be lengthy and costly, making it essential to consider setting up a DPOA while you are still able to make decisions.

Documents used along the form

When creating a Florida Durable Power of Attorney, it's essential to consider additional forms and documents that may complement your power of attorney. These documents can help ensure that your wishes are respected and that your financial and medical affairs are managed according to your preferences. Here’s a list of some commonly used documents:

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and care in the event that you become unable to communicate your wishes. It can include your choices regarding life-sustaining measures and organ donation.

- Living Will: A living will specifically details your wishes regarding end-of-life care. It allows you to express whether you want to receive or refuse life-prolonging treatments in certain medical situations.

- HIPAA Authorization: This form allows you to designate individuals who can access your medical records and make healthcare decisions on your behalf. It ensures that your privacy is maintained while allowing trusted individuals to advocate for your care.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document grants someone the authority to manage your financial affairs, including banking, investments, and property transactions. It can be durable or non-durable, depending on your needs.

- Trust Documents: If you have established a trust, these documents outline how your assets should be managed and distributed. A trust can provide additional control over your estate and help avoid probate.

- Will: A will outlines how you want your assets distributed after your death. It can also name guardians for minor children and specify your funeral arrangements.

- Declaration of Guardian: This document allows you to name a guardian for yourself in case you become incapacitated. It can help ensure that your preferred person is appointed to make decisions on your behalf.

- Mobile Home Bill of Sale: When transferring ownership of mobile homes, the helpful Mobile Home Bill of Sale template ensures all legal aspects of the transaction are properly documented.

- Revocation of Power of Attorney: If you ever need to cancel or change your Durable Power of Attorney, this document formally revokes the previous authority granted to your agent.

- Property Deeds: If you are transferring property to someone else, a property deed is necessary. It serves as a legal document that shows ownership and can be used in conjunction with your power of attorney.

These documents work together to provide a comprehensive plan for your health and financial decisions. By ensuring you have the right forms in place, you can have peace of mind knowing that your wishes will be honored and your affairs will be managed according to your preferences.

Misconceptions

Understanding the Florida Durable Power of Attorney form is crucial for effective estate planning. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- It only applies to financial matters. Many believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also cover healthcare decisions if specified in the document.

- It becomes invalid if the principal becomes incapacitated. This is incorrect. The "durable" aspect means that the power of attorney remains effective even if the principal is incapacitated.

- Anyone can be appointed as an agent. While it's true that you can choose anyone, the agent must be competent and trustworthy. Some may also prefer to appoint a professional, such as an attorney or accountant.

- It is the same as a regular power of attorney. A regular power of attorney ceases to be effective if the principal becomes incapacitated. A Durable Power of Attorney specifically remains in effect under those circumstances.

- It requires notarization to be valid. While notarization is highly recommended, Florida law does not strictly require it for a Durable Power of Attorney to be valid. However, notarization can help prevent disputes.

- It can be revoked only through a court order. A principal can revoke a Durable Power of Attorney at any time, as long as they are competent. This can be done by creating a new document or providing a written notice of revocation.

- Once signed, it cannot be modified. This is not true. The principal can modify the Durable Power of Attorney as needed, provided they are still competent to do so.

Being aware of these misconceptions can help individuals make informed decisions about their Durable Power of Attorney and ensure their wishes are respected.