Florida Lady Bird Deed Document

The Florida Lady Bird Deed, also known as an enhanced life estate deed, is a powerful estate planning tool that allows property owners to retain control over their real estate while simplifying the transfer process upon their passing. This unique form enables individuals to designate beneficiaries who will automatically inherit the property without the need for probate, thus streamlining the transfer of ownership. One of the key features of the Lady Bird Deed is that the original owner maintains the right to live in and manage the property during their lifetime, including the ability to sell or mortgage it without the beneficiaries' consent. This flexibility ensures that property owners can make decisions that best suit their needs, while also providing peace of mind that their loved ones will benefit from the property after they are gone. Furthermore, the Lady Bird Deed can help avoid potential tax implications and protect the property from creditors, making it an attractive option for many Floridians looking to preserve their estate and provide for their heirs. Understanding the nuances of this deed can empower property owners to make informed decisions about their estate planning strategies.

Discover More Lady Bird Deed Forms for Different States

Texas Lady Bird Deed Form - It helps avoid the complications of a traditional will when it comes to transferring property interest.

Understanding the significance of the Ohio Unclaimed Form is essential for residents who wish to recover overlooked assets or funds. By utilizing this form, individuals can take the necessary steps to reclaim their rightful possessions from financial institutions or companies that have designated them as unclaimed. It is important for Ohio residents to be aware of resources available to them, including All Ohio Forms, which can guide them through the claim process efficiently.

Similar forms

The Lady Bird Deed is a unique estate planning tool, but there are several other documents that serve similar purposes in terms of property transfer and estate management. Below is a list of nine documents that share similarities with the Lady Bird Deed:

- Transfer on Death Deed (TODD): Like the Lady Bird Deed, a TODD allows property owners to transfer their real estate to beneficiaries upon their death without going through probate.

- Life Estate Deed: This document creates a life estate, allowing the property owner to retain use of the property during their lifetime while transferring the remainder interest to others.

- Vehicle Purchase Agreement: This agreement details the terms of a vehicle transaction in Texas, ensuring clarity and protection for both buyer and seller. To learn more about this essential document, visit https://freebusinessforms.org.

- Revocable Living Trust: A revocable living trust can hold property during the owner’s lifetime and allows for easy transfer upon death, similar to the intentions of a Lady Bird Deed.

- Will: A will specifies how a person's assets will be distributed after their death. While it does not avoid probate, it serves as a key document for estate planning.

- Quitclaim Deed: This deed transfers ownership of property without any warranties. It is often used between family members and can be part of estate planning.

- General Warranty Deed: This type of deed guarantees that the grantor holds clear title to the property and has the right to transfer it, providing assurance to the buyer.

- Power of Attorney: A power of attorney allows someone to make financial and legal decisions on behalf of another, which can include managing property and real estate.

- Beneficiary Designation: Similar to a Lady Bird Deed, certain assets like bank accounts and retirement accounts can have designated beneficiaries, allowing for direct transfer upon death.

- Joint Tenancy with Right of Survivorship: This form of ownership allows two or more people to own property together, with the surviving owner automatically inheriting the property upon the death of another owner.

Document Example

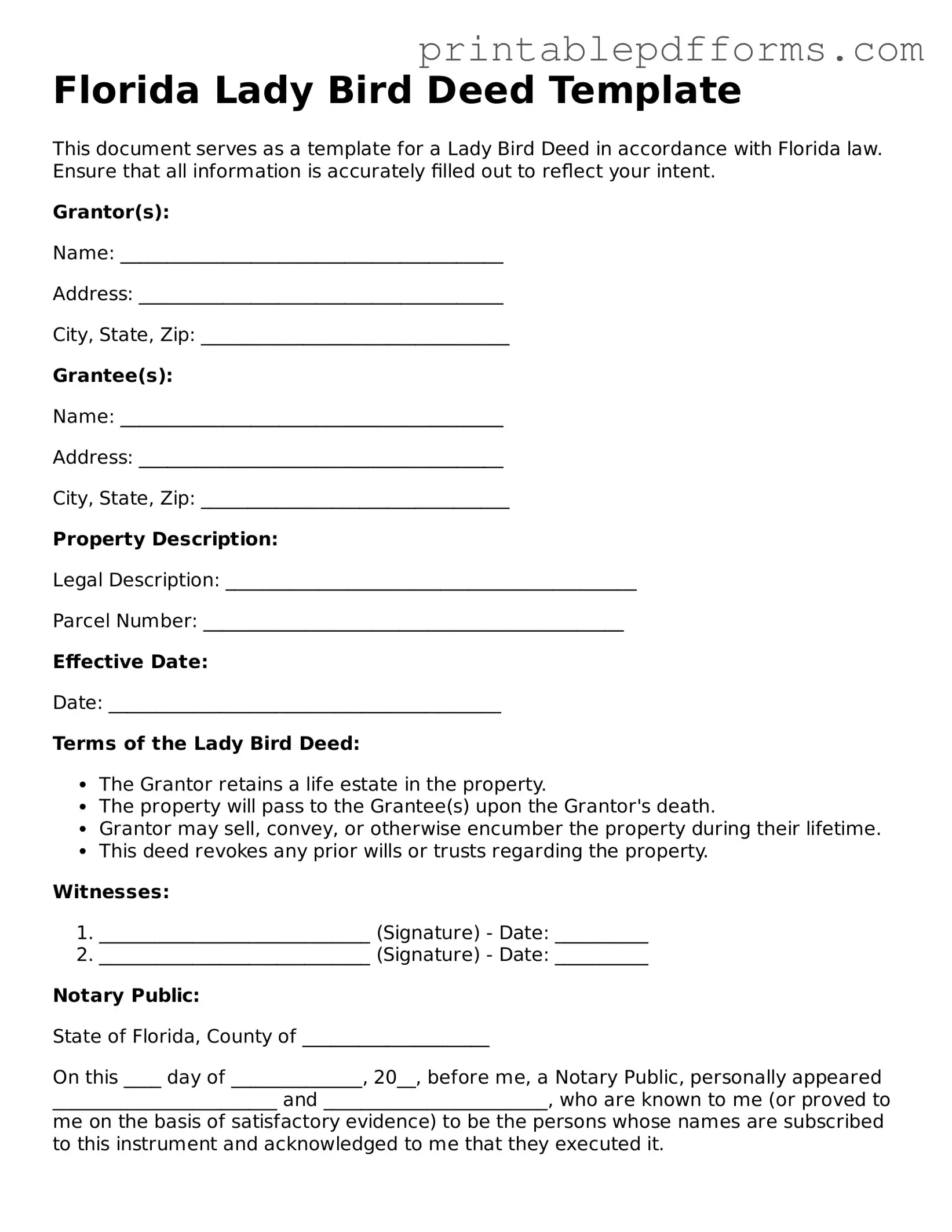

Florida Lady Bird Deed Template

This document serves as a template for a Lady Bird Deed in accordance with Florida law. Ensure that all information is accurately filled out to reflect your intent.

Grantor(s):

Name: _________________________________________

Address: _______________________________________

City, State, Zip: _________________________________

Grantee(s):

Name: _________________________________________

Address: _______________________________________

City, State, Zip: _________________________________

Property Description:

Legal Description: ____________________________________________

Parcel Number: _____________________________________________

Effective Date:

Date: __________________________________________

Terms of the Lady Bird Deed:

- The Grantor retains a life estate in the property.

- The property will pass to the Grantee(s) upon the Grantor's death.

- Grantor may sell, convey, or otherwise encumber the property during their lifetime.

- This deed revokes any prior wills or trusts regarding the property.

Witnesses:

- _____________________________ (Signature) - Date: __________

- _____________________________ (Signature) - Date: __________

Notary Public:

State of Florida, County of ____________________

On this ____ day of ______________, 20__, before me, a Notary Public, personally appeared ________________________ and ________________________, who are known to me (or proved to me on the basis of satisfactory evidence) to be the persons whose names are subscribed to this instrument and acknowledged to me that they executed it.

Witness my hand and official seal.

_____________________________

Notary Public Signature

My Commission Expires: _______________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed is a type of property deed used in Florida that allows property owners to transfer their property upon death without going through probate. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, specifically under Chapter 732, which outlines the laws regarding wills, trusts, and estates. |

| Benefits | This deed allows the original owner to retain control of the property during their lifetime, including the ability to sell or mortgage it without consent from the beneficiaries. |

| Tax Implications | Using a Lady Bird Deed may help in avoiding capital gains taxes for beneficiaries, as they receive a step-up in basis upon the owner's death. |

| Revocability | The deed can be revoked or modified at any time by the original owner, providing flexibility and peace of mind. |

Crucial Questions on This Form

What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their real estate to their beneficiaries while retaining certain rights during their lifetime. The property owner can live in, sell, or mortgage the property without needing the consent of the beneficiaries. Upon the owner's death, the property automatically transfers to the named beneficiaries, bypassing the probate process.

Who can benefit from using a Lady Bird Deed?

Individuals looking to simplify the transfer of property upon their death may find a Lady Bird Deed beneficial. It is particularly useful for seniors who want to ensure their property goes directly to their heirs without the complications of probate. Additionally, those who wish to maintain control over their property while planning for the future may also consider this option.

What are the advantages of a Lady Bird Deed?

- Avoids probate: The property transfers automatically to the beneficiaries, eliminating the lengthy probate process.

- Retained control: The original owner retains the right to use, sell, or change the property as desired during their lifetime.

- Tax benefits: Beneficiaries may receive a step-up in basis, potentially reducing capital gains taxes when they sell the property.

- Medicaid planning: A Lady Bird Deed can help protect the property from being counted as an asset for Medicaid eligibility purposes.

Are there any disadvantages to using a Lady Bird Deed?

While a Lady Bird Deed offers many advantages, it may not be suitable for everyone. Potential disadvantages include:

- The original owner may lose the ability to control the property if they become incapacitated, as the deed cannot be easily revoked.

- Beneficiaries may face challenges if they disagree on how to manage the property before the owner's passing.

- It may not be recognized in all states, so individuals with properties outside Florida should consult local laws.

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed involves several steps:

- Identify the property to be transferred.

- Determine the beneficiaries who will receive the property upon the owner's death.

- Complete the Lady Bird Deed form with accurate information.

- Sign the deed in front of a notary public.

- Record the deed with the county clerk’s office where the property is located to ensure it is legally recognized.

Can I revoke a Lady Bird Deed?

Yes, a Lady Bird Deed can be revoked or modified by the original property owner at any time during their lifetime. This can be done by creating a new deed that explicitly revokes the previous one or by simply executing a new deed with different terms. It is advisable to consult with a legal professional to ensure that the revocation is properly executed and recorded.

Documents used along the form

The Florida Lady Bird Deed is a unique estate planning tool that allows property owners to transfer real estate to their beneficiaries while retaining certain rights during their lifetime. When utilizing this deed, several other forms and documents may be necessary to ensure a comprehensive estate plan. Below is a list of commonly used documents that often accompany the Lady Bird Deed.

- Last Will and Testament: This document outlines how a person's assets will be distributed upon their death. It can address any assets not transferred via the Lady Bird Deed.

- Durable Power of Attorney: This form grants someone the authority to make financial decisions on behalf of the property owner if they become incapacitated.

- Health Care Surrogate Designation: This document designates an individual to make medical decisions for the property owner in the event they are unable to do so themselves.

- Living Will: A living will expresses a person's wishes regarding medical treatment and end-of-life care, ensuring their preferences are honored.

- Beneficiary Designation Forms: These forms specify who will receive assets from accounts like life insurance or retirement plans, complementing the property transfer outlined in the Lady Bird Deed.

- Bill of Sale: A legal document that serves as proof of the transfer of ownership of personal property, such as vehicles or equipment. For more information, you can visit nypdfforms.com/bill-of-sale-form.

- Transfer on Death Deed (TOD): This deed allows for the transfer of real property upon death without going through probate, similar to the Lady Bird Deed but with different legal implications.

Utilizing these documents in conjunction with the Florida Lady Bird Deed can create a more robust estate plan, ensuring that your wishes are clearly defined and legally enforceable. It is advisable to consult with an estate planning professional to tailor these documents to individual circumstances.

Misconceptions

When discussing the Florida Lady Bird Deed, several misconceptions often arise. Understanding these can help individuals make informed decisions regarding their estate planning. Here are eight common misconceptions:

- It is only for married couples. Many believe that the Lady Bird Deed is exclusively for married couples. In reality, anyone can use this deed, including single individuals and business partners.

- It avoids probate entirely. While a Lady Bird Deed can help simplify the transfer of property upon death, it does not completely avoid probate in all situations. Certain circumstances may still require probate proceedings.

- It is a complicated legal document. Some think that the Lady Bird Deed is overly complex. In fact, it is relatively straightforward and can be understood with basic knowledge of property transfer.

- It eliminates property taxes for heirs. A common myth is that using a Lady Bird Deed will exempt heirs from property taxes. However, property taxes are generally based on assessed value, and this deed does not change that obligation.

- It can only be used for residential properties. Many assume that the Lady Bird Deed applies solely to residential properties. This is not the case; it can also be used for other types of real estate, such as commercial properties.

- It is the same as a traditional transfer on death deed. Some confuse the Lady Bird Deed with a standard transfer on death deed. While both serve similar purposes, the Lady Bird Deed allows the original owner to retain more control over the property during their lifetime.

- All states recognize the Lady Bird Deed. Although popular in Florida, not all states recognize this type of deed. It is essential to check the laws in your state before proceeding.

- Once signed, it cannot be changed. There is a belief that a Lady Bird Deed is irrevocable once executed. However, the property owner can revoke or change the deed at any time before their death.

Understanding these misconceptions can help individuals navigate their estate planning more effectively. Clarity about the Lady Bird Deed allows for better decision-making and ensures that property is handled according to one's wishes.