Florida Loan Agreement Document

The Florida Loan Agreement form serves as a crucial document for individuals and entities entering into a lending arrangement within the state. This form outlines the terms and conditions of the loan, ensuring that both the lender and borrower have a clear understanding of their rights and obligations. Key components of the agreement typically include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the form may address late fees, default provisions, and dispute resolution methods. By establishing these parameters, the Loan Agreement aims to protect both parties and provide a framework for the transaction. It is essential for users to accurately complete the form to avoid potential legal issues in the future, as well as to ensure compliance with Florida's lending laws.

Discover More Loan Agreement Forms for Different States

Promissory Note Template California - Collateral requirements may be included if the loan is secured against an asset.

Promissory Note New York - Provides information on the lender's rights in the event of non-payment.

Understanding the importance of the Ohio Notary Acknowledgement form is essential for individuals engaging in legal transactions, as it plays a crucial role in confirming the legitimacy of signatures. For those looking to obtain the necessary documentation, resources are available, such as All Ohio Forms, which provide the required templates and guidance to ensure the process is completed accurately and efficiently.

Texas Promissory Note - Signatures need to be dated to enforce the agreement.

Similar forms

-

Promissory Note: This document outlines a borrower's promise to repay a loan under specified terms. Like a Loan Agreement, it includes details such as the loan amount, interest rate, and repayment schedule. However, a Promissory Note is typically simpler and focuses primarily on the borrower's obligation to pay back the loan.

-

Mortgage Agreement: This document secures a loan with real property as collateral. Similar to a Loan Agreement, it specifies the loan amount and terms. However, a Mortgage Agreement also includes details about the property being used as security and the rights of the lender in case of default.

- Sample Tax Return Transcript: This document summarizes key taxpayer information and is often used for various purposes, such as loan applications and income verification. For more details, you can visit https://freebusinessforms.org.

-

Credit Agreement: This document governs the terms of a line of credit. Like a Loan Agreement, it outlines the amount of credit available, interest rates, and repayment terms. The main difference is that a Credit Agreement allows for borrowing up to a specified limit, rather than a fixed loan amount.

-

Lease Agreement: This document outlines the terms under which one party rents property from another. While it primarily focuses on rental terms, it shares similarities with a Loan Agreement in that both documents establish obligations and rights related to the use of property or funds. Both documents detail payment amounts, schedules, and consequences for non-compliance.

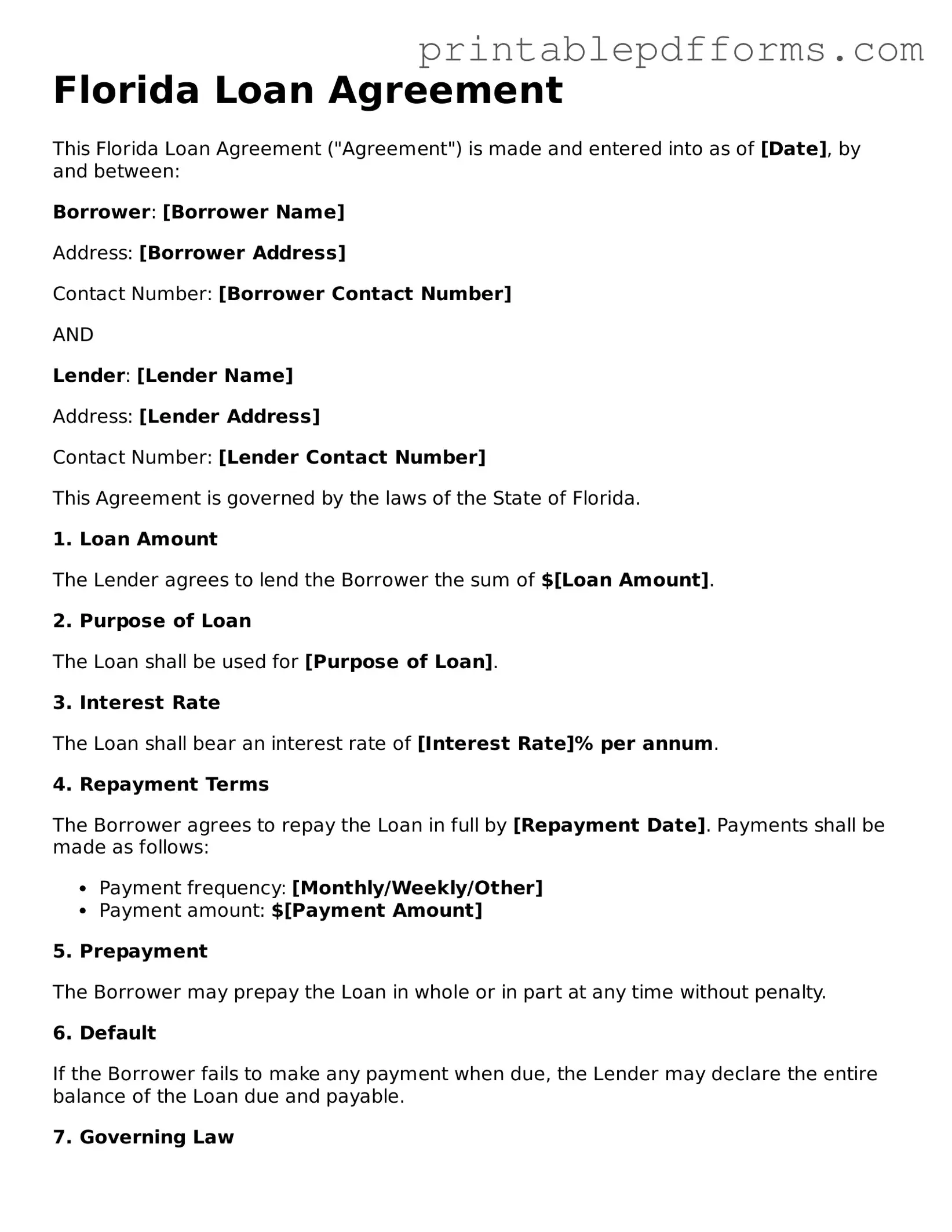

Document Example

Florida Loan Agreement

This Florida Loan Agreement ("Agreement") is made and entered into as of [Date], by and between:

Borrower: [Borrower Name]

Address: [Borrower Address]

Contact Number: [Borrower Contact Number]

AND

Lender: [Lender Name]

Address: [Lender Address]

Contact Number: [Lender Contact Number]

This Agreement is governed by the laws of the State of Florida.

1. Loan Amount

The Lender agrees to lend the Borrower the sum of $[Loan Amount].

2. Purpose of Loan

The Loan shall be used for [Purpose of Loan].

3. Interest Rate

The Loan shall bear an interest rate of [Interest Rate]% per annum.

4. Repayment Terms

The Borrower agrees to repay the Loan in full by [Repayment Date]. Payments shall be made as follows:

- Payment frequency: [Monthly/Weekly/Other]

- Payment amount: $[Payment Amount]

5. Prepayment

The Borrower may prepay the Loan in whole or in part at any time without penalty.

6. Default

If the Borrower fails to make any payment when due, the Lender may declare the entire balance of the Loan due and payable.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of Florida.

8. Entire Agreement

This document represents the entire agreement between the parties. No other understandings, statements, or promises shall be valid or binding.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the day and year first above written.

Borrower Signature: ______________________ Date: _______________

Lender Signature: ______________________ Date: _______________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Purpose | The Florida Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida. |

| Key Components | It typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures Required | Both parties must sign the agreement to indicate their acceptance of the terms outlined. |

Crucial Questions on This Form

What is a Florida Loan Agreement form?

A Florida Loan Agreement form is a legal document that outlines the terms of a loan between a lender and a borrower in the state of Florida. It details the amount borrowed, the interest rate, repayment schedule, and any collateral involved. This form serves to protect both parties by clearly defining their rights and obligations.

Who needs a Loan Agreement?

Anyone who is lending or borrowing money should consider using a Loan Agreement. This includes individuals, businesses, and organizations. Whether it’s a personal loan between friends or a business loan, having a written agreement can help prevent misunderstandings and disputes later on.

What are the key components of a Florida Loan Agreement?

A typical Florida Loan Agreement includes the following key components:

- The names and addresses of the lender and borrower

- The principal amount of the loan

- The interest rate and how it is calculated

- The repayment schedule, including due dates

- Any fees or penalties for late payments

- Collateral, if applicable

- Signatures of both parties

Is a Loan Agreement legally binding in Florida?

Yes, a Loan Agreement is legally binding in Florida as long as it meets certain criteria. Both parties must agree to the terms, and the agreement must be signed by both the lender and the borrower. It’s also important that the agreement does not violate any laws or public policy.

Can I use a Loan Agreement for personal loans?

Absolutely. A Loan Agreement can be used for personal loans between family members, friends, or acquaintances. It helps to clarify expectations and can prevent potential conflicts. Even in personal situations, having a written agreement is wise.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. They can pursue repayment through negotiation, or they may take legal action to recover the owed amount. If collateral was involved, the lender might also have the right to seize that collateral to cover the debt.

Do I need a lawyer to create a Loan Agreement?

While it is not legally required to have a lawyer draft a Loan Agreement, it is often advisable. A lawyer can ensure that the agreement complies with Florida laws and adequately protects your interests. If the loan amount is significant or the terms are complex, legal advice is particularly beneficial.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the updated agreement to maintain clarity and legality.

What should I do if I have more questions about my Loan Agreement?

If you have more questions, consider consulting with a legal professional who specializes in contracts or lending. They can provide personalized guidance based on your specific situation. Additionally, many online resources offer information about Loan Agreements and related topics.

Where can I find a Florida Loan Agreement form?

You can find a Florida Loan Agreement form through various online legal services, local law offices, or state government websites. Ensure that the form you choose is up-to-date and complies with Florida laws. It’s important to select a reputable source to ensure the form is valid.

Documents used along the form

When entering into a loan agreement in Florida, several additional forms and documents may be required to ensure clarity and legal compliance. These documents help define the terms of the loan, protect both parties, and facilitate the lending process.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes details such as the loan amount, interest rate, repayment schedule, and consequences of default.

- Security Agreement: If the loan is secured by collateral, this agreement details the collateral being used. It establishes the lender's rights to the collateral in case of non-payment.

- WC-1 Georgia Form: Essential for reporting workplace injuries or diseases promptly, this form can be found at georgiapdf.com/wc-1-georgia/. Employers must complete it accurately to avoid penalties.

- Loan Disclosure Statement: This statement provides borrowers with essential information about the loan, including fees, interest rates, and the total cost of the loan. It ensures transparency and helps borrowers make informed decisions.

- Personal Guarantee: If a business is borrowing, a personal guarantee may be required from an individual, usually a business owner. This document holds the individual personally responsible for the loan if the business defaults.

- Amortization Schedule: This document outlines each payment over the life of the loan, showing how much of each payment goes toward interest and how much goes toward the principal. It helps borrowers understand their payment obligations.

Each of these documents plays a crucial role in the loan process, providing necessary information and protection for both the lender and the borrower. Understanding these forms can lead to a smoother borrowing experience and reduce potential disputes.

Misconceptions

Understanding the Florida Loan Agreement form is essential for anyone engaging in borrowing or lending money. However, several misconceptions often arise regarding its use and implications. Below are five common misconceptions, along with clarifications to help demystify this important document.

- Misconception 1: The Florida Loan Agreement form is only for large loans.

- Misconception 2: A verbal agreement is sufficient without the form.

- Misconception 3: The form is only necessary for formal lenders, like banks.

- Misconception 4: Once signed, the terms of the agreement cannot be changed.

- Misconception 5: The Florida Loan Agreement form is too complicated for the average person.

This is not true. While it is often associated with significant amounts, the form can be used for loans of any size. Whether you are borrowing a small amount for personal use or a larger sum for business purposes, the agreement provides a clear framework for both parties.

Many believe that a simple handshake or verbal promise suffices. However, without a written agreement, misunderstandings can easily arise. The Florida Loan Agreement form serves to protect both the lender and the borrower by documenting the terms clearly.

This is a common misunderstanding. Individuals lending money to friends or family should also use the form. It helps ensure that all parties are on the same page regarding repayment terms and conditions, regardless of the lender's formal status.

While the agreement is binding, it is possible for the parties involved to modify the terms later. Any changes should be documented in writing and signed by both parties to avoid future disputes.

Many individuals feel intimidated by legal documents. However, the Florida Loan Agreement form is designed to be straightforward. It outlines essential elements such as loan amount, interest rates, and repayment schedules in a manner that is accessible to most people.