Florida Operating Agreement Document

When starting a business in Florida, particularly a limited liability company (LLC), having a well-drafted Operating Agreement is crucial. This document serves as the backbone of your LLC, outlining the management structure, ownership percentages, and the rights and responsibilities of each member. It helps to clarify how decisions will be made, how profits and losses will be distributed, and what happens if a member wants to leave the business or if new members join. Furthermore, an Operating Agreement can provide guidelines for resolving disputes, ensuring that all members are on the same page and minimizing potential conflicts. Without this agreement, your LLC may be governed by default state laws, which might not reflect your specific intentions or needs. Therefore, understanding the major aspects of the Florida Operating Agreement form is essential for any business owner looking to establish a solid foundation for their company.

Discover More Operating Agreement Forms for Different States

Ohio Llc Operating Agreement - This document protects members’ interests in the event of a dispute.

To ensure a smooth transaction when transferring dirt bike ownership, it’s important to utilize the New York Dirt Bike Bill of Sale form, which you can find at nypdfforms.com/dirt-bike-bill-of-sale-form. This form serves as a legal record of the sale, helping both parties to avoid misunderstandings and ensuring that the terms of the transaction are clearly understood.

How Much Does an Llc Cost in Texas - Having an Operating Agreement is crucial for limited liability companies (LLCs).

How to Make an Operating Agreement - It encourages open communication between members regarding business operations.

Is an Operating Agreement Required for an Llc in California - It can provide a clear procedure for financial contributions from members.

Similar forms

- Bylaws: Bylaws govern the internal management of a corporation, outlining the roles of directors and officers, similar to how an Operating Agreement outlines member roles in an LLC.

- Partnership Agreement: This document details the relationships between partners in a business, much like an Operating Agreement does for LLC members, focusing on profit sharing and responsibilities.

- Living Will: For individuals looking to clearly outline their medical treatment preferences, our essential Living Will documentation guide provides necessary insights and templates for effective planning.

- Shareholder Agreement: A shareholder agreement outlines the rights and obligations of shareholders in a corporation, paralleling how an Operating Agreement addresses member rights in an LLC.

- LLC Membership Certificate: This certificate signifies membership in an LLC, similar to how an Operating Agreement establishes member ownership and rights.

- Business Plan: A business plan outlines the strategy and goals of a business. While it is broader, it may include elements similar to an Operating Agreement, such as management structure and operational guidelines.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared between parties. It can complement an Operating Agreement by safeguarding proprietary information among LLC members.

- Employment Agreement: This document defines the terms of employment for individuals in a business. Like an Operating Agreement, it clarifies roles and responsibilities, albeit for employees rather than members.

- Sales Agreement: A sales agreement outlines the terms of sale for goods or services. While it focuses on transactions, it can include terms that reflect the operational agreements of a business, similar to an Operating Agreement.

- Joint Venture Agreement: This agreement outlines the terms between parties collaborating on a specific project. It shares similarities with an Operating Agreement in defining roles and profit-sharing arrangements.

Document Example

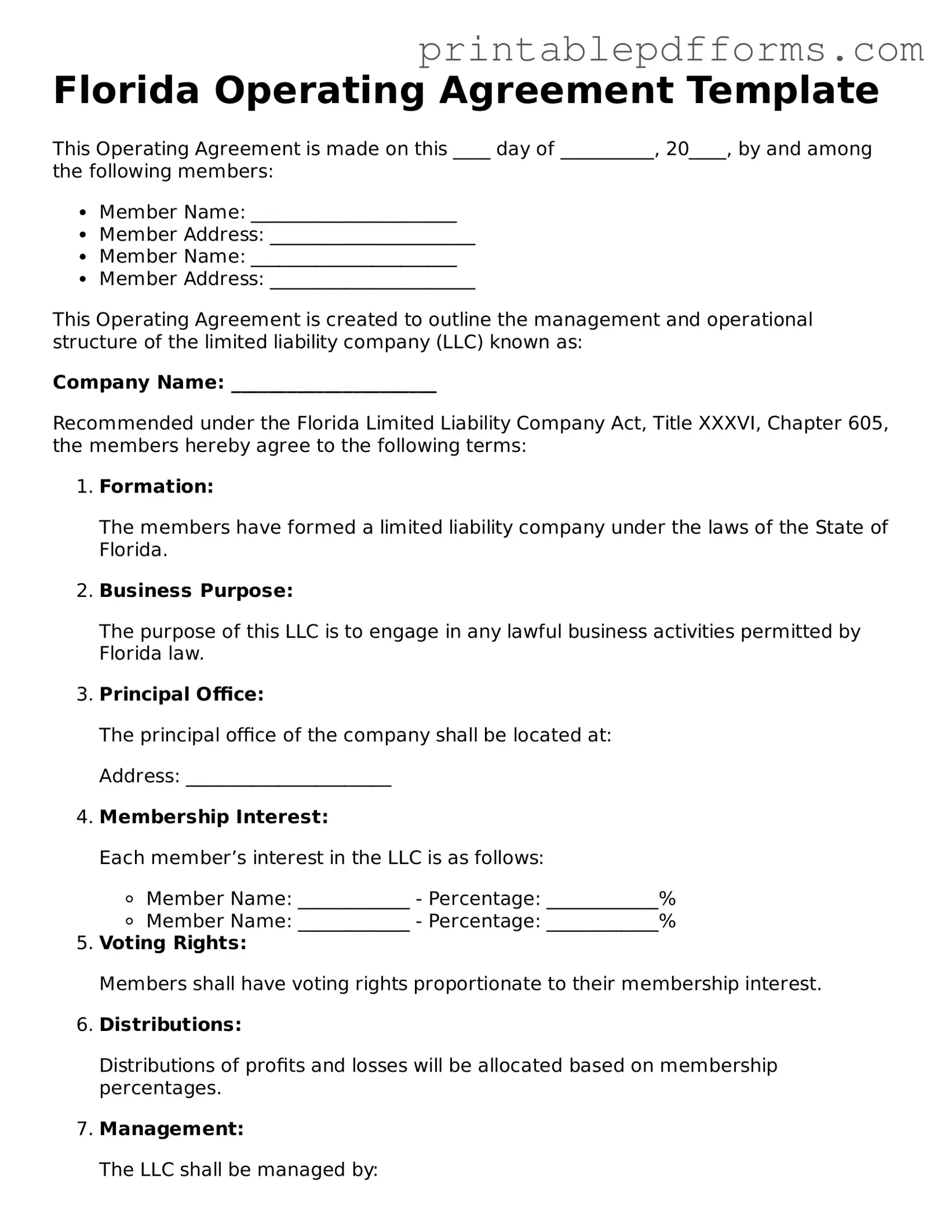

Florida Operating Agreement Template

This Operating Agreement is made on this ____ day of __________, 20____, by and among the following members:

- Member Name: ______________________

- Member Address: ______________________

- Member Name: ______________________

- Member Address: ______________________

This Operating Agreement is created to outline the management and operational structure of the limited liability company (LLC) known as:

Company Name: ______________________

Recommended under the Florida Limited Liability Company Act, Title XXXVI, Chapter 605, the members hereby agree to the following terms:

- Formation:

The members have formed a limited liability company under the laws of the State of Florida.

- Business Purpose:

The purpose of this LLC is to engage in any lawful business activities permitted by Florida law.

- Principal Office:

The principal office of the company shall be located at:

Address: ______________________

- Membership Interest:

Each member’s interest in the LLC is as follows:

- Member Name: ____________ - Percentage: ____________%

- Member Name: ____________ - Percentage: ____________%

- Voting Rights:

Members shall have voting rights proportionate to their membership interest.

- Distributions:

Distributions of profits and losses will be allocated based on membership percentages.

- Management:

The LLC shall be managed by:

- Manager: ______________________ (or "the members collectively")

- Indemnification:

The LLC shall indemnify members and managers to the fullest extent under Florida law.

- Amendments:

This Agreement may be amended only by a written agreement signed by all members.

IN WITNESS WHEREOF, the undersigned members have executed this Operating Agreement as of the date first written above.

- ___________________________

- Member Signature

- ___________________________

- Date

- ___________________________

- Member Signature

- ___________________________

- Date

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Florida. |

| Governing Law | The Florida Operating Agreement is governed by the Florida Limited Liability Company Act, specifically Chapter 605 of the Florida Statutes. |

| Purpose | This agreement serves to protect the members' interests and clarify the roles and responsibilities within the LLC. |

| Flexibility | Members have the freedom to customize the Operating Agreement to suit their specific needs, as long as it complies with state laws. |

| Not Mandatory | While not required by law, having an Operating Agreement is highly recommended for LLCs in Florida to avoid disputes and provide clear guidelines. |

Crucial Questions on This Form

What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC) in Florida. It serves as an internal document that governs the relationship between members, detailing their rights, responsibilities, and obligations. This agreement is crucial for establishing clear expectations and can help prevent disputes among members.

Is an Operating Agreement required in Florida?

While Florida law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having an Operating Agreement in place can provide clarity on management roles, profit distribution, and decision-making processes. Additionally, it can protect members' personal assets by reinforcing the LLC's status as a separate legal entity.

What should be included in a Florida Operating Agreement?

A comprehensive Florida Operating Agreement typically includes the following elements:

- Company Information: Name, address, and purpose of the LLC.

- Member Details: Names and contributions of each member.

- Management Structure: Whether the LLC is member-managed or manager-managed.

- Voting Rights: How decisions are made and the voting power of each member.

- Profit Distribution: How profits and losses will be allocated among members.

- Dispute Resolution: Procedures for resolving conflicts among members.

- Amendments: How the Operating Agreement can be modified in the future.

Can I change my Operating Agreement after it is created?

Yes, an Operating Agreement can be amended after it has been created. Members must follow the procedures outlined in the original agreement for making changes. Typically, this involves obtaining a certain percentage of member approval. It is essential to document any amendments in writing to maintain clarity and avoid future disputes.

How does an Operating Agreement affect liability protection?

An Operating Agreement plays a significant role in reinforcing the limited liability protection of an LLC. By clearly outlining the separation between personal and business affairs, it helps to establish that the LLC is a distinct legal entity. This separation can protect members' personal assets from being used to satisfy business debts, provided that the LLC is operated properly and in accordance with the agreement.

Can I create an Operating Agreement on my own?

Yes, individuals can draft their own Operating Agreement. However, it is advisable to consult with a legal professional to ensure that the agreement complies with Florida laws and meets the specific needs of the LLC. A well-drafted Operating Agreement can prevent misunderstandings and protect the interests of all members involved.

Where can I find a template for a Florida Operating Agreement?

Templates for Florida Operating Agreements can be found online through various legal resources and websites that specialize in business formation. Additionally, many legal service providers offer customizable templates. It is important to ensure that any template used is up-to-date with Florida laws and tailored to the specific needs of your LLC.

Documents used along the form

The Florida Operating Agreement is a crucial document for limited liability companies (LLCs) in Florida, outlining the management structure and operational procedures of the business. Along with this agreement, several other forms and documents are commonly utilized to ensure compliance and proper functioning of the LLC. Here are four key documents that often accompany the Florida Operating Agreement:

- Articles of Organization: This document is filed with the Florida Division of Corporations to officially create the LLC. It includes basic information such as the company name, principal address, and registered agent details.

- Member Consent Resolutions: These resolutions are used to document important decisions made by the members of the LLC. They can cover various matters, such as approving major business transactions or changes in management.

- Bylaws: While not always required for LLCs, bylaws serve as an internal guide for the organization’s governance. They outline the roles and responsibilities of members, meeting procedures, and other operational guidelines.

- USCIS I-864 Form: This form is necessary for sponsors in the immigration process to show they can financially support a family member seeking residency. For more information, visit https://freebusinessforms.org.

- Employer Identification Number (EIN) Application: This form is submitted to the IRS to obtain an EIN, which is necessary for tax purposes. An EIN is required for opening a business bank account and hiring employees.

Each of these documents plays a vital role in establishing and maintaining a compliant and well-organized LLC in Florida. Together, they help ensure that the business operates smoothly and adheres to state regulations.

Misconceptions

Understanding the Florida Operating Agreement form is essential for business owners. However, several misconceptions can lead to confusion. Here are four common misconceptions:

- It is not necessary for single-member LLCs. Many believe that single-member LLCs do not need an Operating Agreement. In reality, having one is beneficial as it outlines the owner's rights and responsibilities, helping to protect personal assets.

- All Operating Agreements are the same. Some think that all Operating Agreements are interchangeable. In fact, each agreement should be tailored to the specific needs of the business and its members, addressing unique operational procedures and management structures.

- It does not need to be filed with the state. There is a misconception that Operating Agreements must be filed with the state. While it is not required to file the agreement, keeping it on record is important for internal purposes and can be crucial during legal disputes.

- It cannot be changed once created. Some individuals believe that once an Operating Agreement is established, it cannot be modified. However, members can amend the agreement as needed, provided they follow the procedures outlined within the document.

By clearing up these misconceptions, business owners can better understand the importance of the Florida Operating Agreement and ensure their LLC operates smoothly.