Florida Power of Attorney Document

In Florida, a Power of Attorney (POA) is an essential legal tool that allows individuals to designate someone they trust to make decisions on their behalf. This form can cover a wide range of responsibilities, from managing financial matters to making healthcare choices. It’s important to understand that a POA can be broad or limited, depending on the specific needs of the person granting the authority. For instance, a durable power of attorney remains effective even if the person becomes incapacitated, while a springing power of attorney only takes effect under certain conditions. The form must be signed by the principal and witnessed, ensuring that the authority granted is both valid and recognized. Additionally, the chosen agent, or attorney-in-fact, must act in the best interest of the principal, making this arrangement both powerful and significant. Understanding the nuances of the Florida Power of Attorney form can help individuals make informed choices about their legal and financial affairs.

Discover More Power of Attorney Forms for Different States

California Durable Power of Attorney - This document can save time and stress for your loved ones during difficult circumstances.

For those navigating the complexities of vehicle transactions, understanding the necessary documentation is vital. A helpful resource for this is the comprehensive guide to Motor Vehicle Bill of Sale templates, which provides insights on the essential elements needed for a successful vehicle sale. You can find more information at this link.

Does a Power of Attorney Need to Be Recorded in Pennsylvania - Some people choose to establish a springing Power of Attorney, which only becomes effective under certain circumstances.

Similar forms

The Power of Attorney (POA) form is a crucial legal document that allows one person to act on behalf of another in various matters. It shares similarities with several other legal documents, each serving specific purposes. Here’s a list of nine documents that are comparable to the Power of Attorney:

- Living Will: A living will outlines an individual's preferences for medical treatment in case they become unable to communicate their wishes. Like a POA, it is focused on decision-making but specifically pertains to healthcare choices.

- Healthcare Proxy: This document appoints someone to make healthcare decisions on your behalf if you are incapacitated. Similar to a POA, it grants authority to another person, but it is exclusively for medical decisions.

- Durable Power of Attorney: This variation of the standard POA remains effective even if the principal becomes incapacitated. It provides a broader scope of authority, much like a traditional POA but with added durability.

- Financial Power of Attorney: This document specifically allows someone to manage financial matters for another person. While it is a type of POA, it is focused solely on financial decisions rather than general affairs.

- ATV Bill of Sale: This document records the sale and transfer of ownership of an all-terrain vehicle, ensuring a smooth transaction. You can access the ATV Bill of Sale form to facilitate the process.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds assets for the benefit of another. Like a POA, it involves a trusted individual acting on behalf of another, but it primarily deals with asset management.

- Executor Appointment: This document names an executor to manage the estate of a deceased person. It shares the concept of delegation found in a POA, but it is specifically related to posthumous affairs.

- Guardian Appointment: This legal document appoints someone to care for a minor or an incapacitated adult. Similar to a POA, it involves a trusted individual making decisions, but it focuses on personal care rather than financial or legal matters.

- Bill of Sale: A bill of sale is a document that transfers ownership of personal property. It may require a POA if the seller is unable to sign the document personally, illustrating the POA's role in facilitating transactions.

- Affidavit: An affidavit is a written statement confirmed by oath, often used as evidence in legal proceedings. While it does not delegate authority like a POA, it can serve as a supporting document in situations where a POA is invoked.

Understanding these documents and their similarities to a Power of Attorney can help individuals make informed decisions about their legal options. Each document serves a unique purpose but often revolves around the theme of delegation and trust.

Document Example

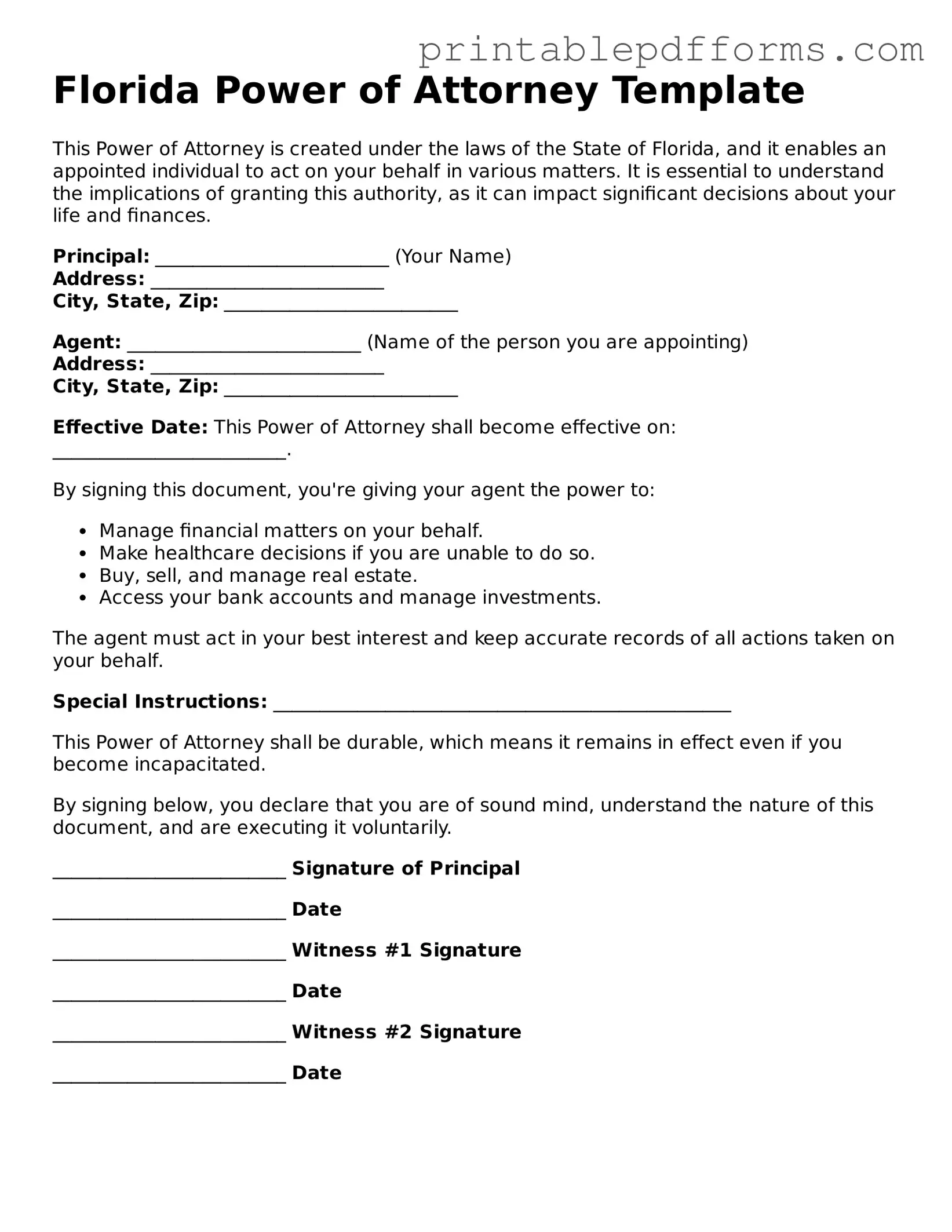

Florida Power of Attorney Template

This Power of Attorney is created under the laws of the State of Florida, and it enables an appointed individual to act on your behalf in various matters. It is essential to understand the implications of granting this authority, as it can impact significant decisions about your life and finances.

Principal: _________________________ (Your Name)

Address: _________________________

City, State, Zip: _________________________

Agent: _________________________ (Name of the person you are appointing)

Address: _________________________

City, State, Zip: _________________________

Effective Date: This Power of Attorney shall become effective on: _________________________.

By signing this document, you're giving your agent the power to:

- Manage financial matters on your behalf.

- Make healthcare decisions if you are unable to do so.

- Buy, sell, and manage real estate.

- Access your bank accounts and manage investments.

The agent must act in your best interest and keep accurate records of all actions taken on your behalf.

Special Instructions: _________________________________________________

This Power of Attorney shall be durable, which means it remains in effect even if you become incapacitated.

By signing below, you declare that you are of sound mind, understand the nature of this document, and are executing it voluntarily.

_________________________ Signature of Principal

_________________________ Date

_________________________ Witness #1 Signature

_________________________ Date

_________________________ Witness #2 Signature

_________________________ Date

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney form allows an individual to grant authority to another person to act on their behalf in legal or financial matters. |

| Governing Law | The Florida Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | The form can be made durable, meaning it remains effective even if the principal becomes incapacitated. |

| Types of Powers | It can grant broad or limited powers, depending on the principal's needs and preferences. |

| Signing Requirements | The form must be signed by the principal and witnessed by two individuals or notarized. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are competent. |

| Agent's Responsibilities | The agent must act in the best interest of the principal and manage their affairs responsibly. |

| Healthcare Decisions | A separate document, a Healthcare Power of Attorney, is needed for medical decisions. |

| Filing Requirements | There is no requirement to file the Power of Attorney with the state, but it may be necessary to present it to financial institutions or other entities. |

| Effective Date | The Power of Attorney can take effect immediately or can be set to activate upon a specific event, such as incapacitation. |

Crucial Questions on This Form

- Durable Power of Attorney: Remains effective even if the principal becomes incapacitated.

- Springing Power of Attorney: Becomes effective only upon the principal's incapacitation.

- Health Care Surrogate: Specifically for making medical decisions on behalf of the principal.

- Limited Power of Attorney: Grants authority for specific tasks or for a limited time.

- Choose a trusted individual to act as your agent.

- Obtain a Florida Power of Attorney form. This can be found online or through legal offices.

- Fill out the form, specifying the powers granted to the agent.

- Sign the document in front of two witnesses or a notary public.

What is a Power of Attorney (POA) in Florida?

A Power of Attorney (POA) is a legal document that allows one person (the principal) to authorize another person (the agent or attorney-in-fact) to act on their behalf. This can include managing finances, making healthcare decisions, or handling legal matters. In Florida, the POA must be signed by the principal and witnessed by two individuals or notarized.

What types of Power of Attorney are available in Florida?

Florida recognizes several types of Power of Attorney:

How do I create a Power of Attorney in Florida?

To create a POA in Florida, follow these steps:

Do I need a lawyer to create a Power of Attorney?

No, you do not need a lawyer to create a Power of Attorney in Florida. However, consulting with a lawyer can help ensure that the document meets your specific needs and complies with Florida laws.

Can I revoke a Power of Attorney in Florida?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To revoke, you should create a written notice of revocation, sign it, and notify your agent and any relevant third parties.

What happens if my agent is unable or unwilling to act?

If your agent is unable or unwilling to act, the authority granted to them ceases. You may need to appoint a new agent by creating a new Power of Attorney or by updating the existing document.

Are there any limitations on what an agent can do?

Yes, an agent's authority can be limited by the principal in the Power of Attorney document. Additionally, Florida law prohibits agents from making certain decisions, such as changing the principal's will or altering their estate plan without explicit permission.

Is a Power of Attorney valid if the principal is incapacitated?

It depends on the type of Power of Attorney. A Durable Power of Attorney remains valid even if the principal becomes incapacitated, while a Springing Power of Attorney only takes effect upon incapacitation.

How long does a Power of Attorney last in Florida?

A Power of Attorney in Florida remains in effect until the principal revokes it, the principal dies, or the specific powers granted in the document expire. It is essential to review the document regularly to ensure it still meets your needs.

Documents used along the form

A Power of Attorney (POA) is a significant legal document that allows one person to act on behalf of another in various matters. In Florida, individuals often use several other forms and documents alongside the Power of Attorney to ensure comprehensive legal coverage. Below is a list of common documents that may accompany a Florida Power of Attorney.

- Advance Healthcare Directive: This document outlines an individual's healthcare preferences in case they become unable to communicate their wishes. It often includes instructions about medical treatment and appoints a healthcare proxy.

- Living Will: A living will specifies the type of medical care a person wishes to receive or avoid in situations where they cannot express their preferences, particularly at the end of life.

- Durable Power of Attorney: This form is similar to a standard Power of Attorney but remains effective even if the principal becomes incapacitated. It is essential for long-term planning.

- Financial Power of Attorney: This document specifically grants authority over financial matters, such as managing bank accounts, paying bills, and handling investments, to the designated agent.

- Property Management Agreement: This agreement allows a designated person to manage real estate and other property on behalf of the property owner, ensuring proper upkeep and financial management.

- Trust Agreement: A trust agreement establishes a trust, which can manage assets for beneficiaries. It can provide instructions on how assets should be handled during the grantor's lifetime and after their death.

- Residential Lease Agreement: The All Ohio Forms provides a comprehensive template to establish clear terms and conditions between landlords and tenants, ensuring a solid foundation for their rental relationship.

- Will: A will outlines how a person's assets should be distributed after their death. It can also appoint guardians for minor children, making it a crucial document in estate planning.

- Beneficiary Designation Forms: These forms allow individuals to specify who will receive certain assets, like life insurance proceeds or retirement accounts, bypassing the probate process.

Understanding these documents and how they relate to the Power of Attorney can help individuals make informed decisions about their legal and financial affairs. Each document serves a unique purpose and can provide clarity and direction during critical times.

Misconceptions

Understanding the Florida Power of Attorney (POA) form is crucial for anyone looking to grant authority to another person. However, several misconceptions can lead to confusion and potentially serious consequences. Here are six common misconceptions about the Florida Power of Attorney form:

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney is permanent and cannot be revoked.

- Misconception 3: Only elderly individuals need a Power of Attorney.

- Misconception 4: A Power of Attorney grants unlimited power to the agent.

- Misconception 5: You do not need witnesses or notarization for a valid Power of Attorney.

- Misconception 6: A Power of Attorney is only useful when someone is incapacitated.

This is not true. While many people associate a POA with financial decisions, it can also cover medical and personal matters. You can specify different powers for different areas, ensuring that your wishes are respected in all aspects of your life.

In reality, you can revoke a Power of Attorney at any time, as long as you are mentally competent. This can be done by creating a new POA or by providing written notice to your agent and any relevant institutions.

This misconception overlooks the fact that anyone, regardless of age, can benefit from having a POA. Unexpected events can happen to anyone, making it wise to have a plan in place.

This is misleading. The authority granted to the agent is defined by the principal in the POA document. You can limit the powers to specific actions or timeframes, ensuring your wishes are followed.

In Florida, a POA must be signed in the presence of two witnesses and notarized to be valid. This requirement helps to prevent fraud and ensures that your intentions are clear.

While a POA is indeed critical during incapacitation, it can also be beneficial during times of travel or when you are unable to manage your affairs for any reason. Having a trusted agent can provide peace of mind and ensure that your needs are met.

By understanding these misconceptions, you can make informed decisions about your Power of Attorney and ensure that your wishes are respected in any situation.