Florida Prenuptial Agreement Document

In the landscape of marital relationships, the Florida Prenuptial Agreement form serves as a vital tool for couples contemplating marriage, particularly in an era where financial independence and asset protection are paramount. This legal document allows individuals to outline their financial rights and obligations before entering into matrimony, thereby fostering transparency and mutual understanding. Key elements of the form typically include provisions regarding the division of property, spousal support, and the handling of debts, which can significantly influence the dynamics of a future divorce. By addressing these issues upfront, couples can mitigate potential conflicts and misunderstandings that may arise later. Furthermore, the form must adhere to specific legal requirements to ensure its enforceability, such as being in writing and signed voluntarily by both parties. In Florida, prenuptial agreements are particularly relevant given the state's equitable distribution laws, which dictate how marital property is divided upon dissolution of marriage. Thus, understanding the nuances of this agreement can empower couples to make informed decisions that align with their personal and financial goals.

Discover More Prenuptial Agreement Forms for Different States

Texas Prenup - A prenuptial agreement can be a sign of financial compatibility between partners.

For anyone looking to ensure a smooth transaction, utilizing a precise Ohio ATV Bill of Sale template is crucial for protecting both the buyer's and seller's interests during the sale process. You can find an effective resource at thorough Ohio ATV Bill of Sale forms.

California Prenup - Each party should have independent legal advice when creating the agreement.

Similar forms

- Postnuptial Agreement: Similar to a prenuptial agreement, this document is created after marriage. It outlines how assets and debts will be divided in case of divorce or separation, addressing financial matters during the marriage.

- Separation Agreement: This document is used when a couple decides to live apart. It details the terms of the separation, including asset division, child custody, and support obligations, similar to a prenuptial agreement's financial provisions.

- BMV Application Form: The Ohio BMV Application Form serves as a crucial document for establishing vehicle ownership, emphasizing the importance of accurate information, particularly in light of legal consequences, and can be accessed at All Ohio Forms.

- Divorce Settlement Agreement: This is a legally binding document that outlines the terms of a divorce. It includes asset division, alimony, and child support, much like the financial arrangements in a prenuptial agreement.

- Living Together Agreement: For couples who choose to cohabit without marriage, this agreement covers property ownership and financial responsibilities, similar to the asset discussions in a prenuptial agreement.

- Will: While primarily focused on the distribution of assets after death, a will can address similar concerns regarding asset management and intentions, akin to the financial aspects of a prenuptial agreement.

- Trust Agreement: This document establishes a trust to manage assets for beneficiaries. It can outline how assets are handled during marriage or after death, paralleling the asset management discussed in a prenuptial agreement.

- Power of Attorney: Although primarily for medical or financial decisions, this document can include provisions about asset management, similar to the financial planning aspect of a prenuptial agreement.

- Financial Disclosure Statement: This document requires both parties to disclose their financial situations. It is crucial for transparency in a prenuptial agreement and ensures both parties are aware of each other's assets and liabilities.

- Child Custody Agreement: This outlines the terms of custody and support for children in the event of a separation or divorce. While focused on children, it shares similarities with the prenuptial agreement's focus on family financial planning.

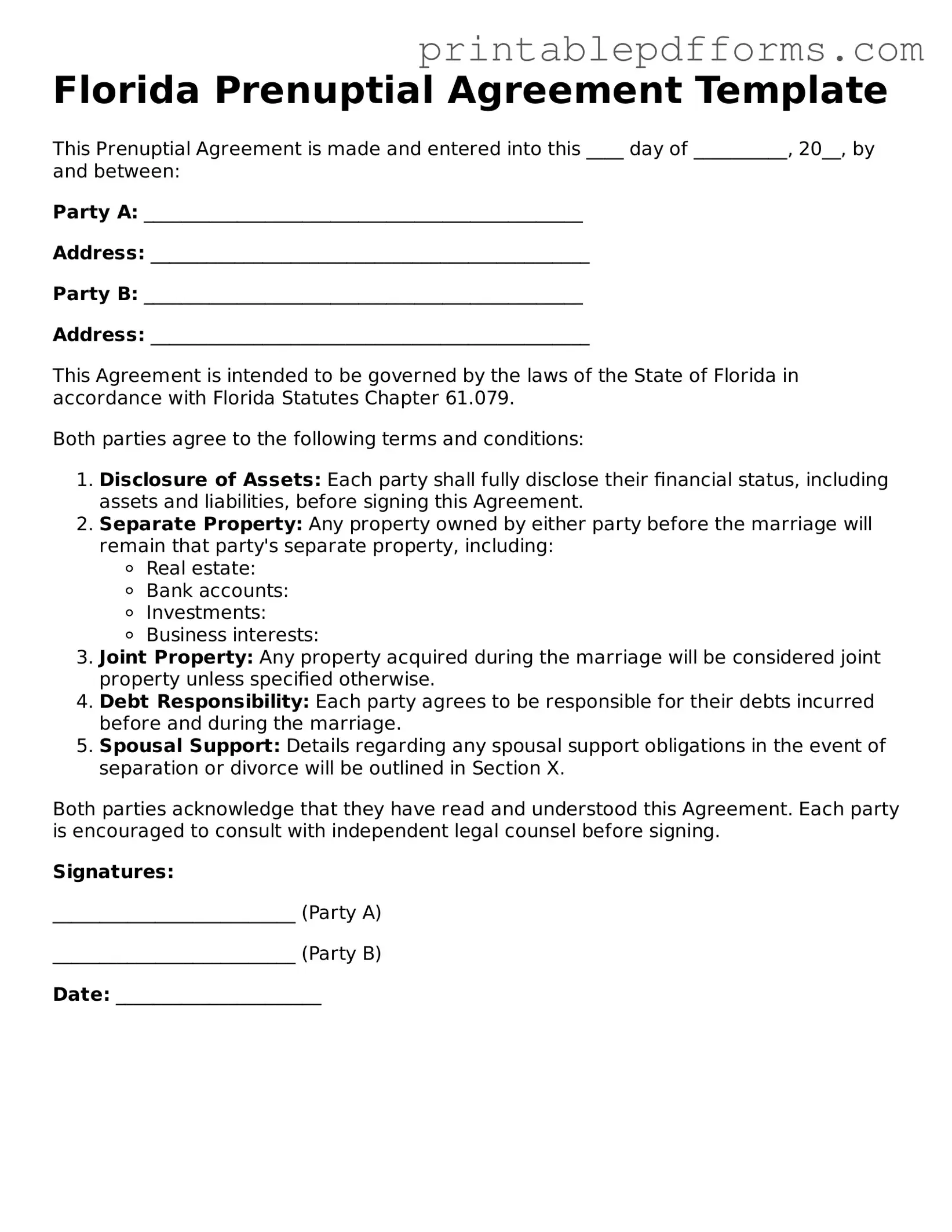

Document Example

Florida Prenuptial Agreement Template

This Prenuptial Agreement is made and entered into this ____ day of __________, 20__, by and between:

Party A: _______________________________________________

Address: _______________________________________________

Party B: _______________________________________________

Address: _______________________________________________

This Agreement is intended to be governed by the laws of the State of Florida in accordance with Florida Statutes Chapter 61.079.

Both parties agree to the following terms and conditions:

- Disclosure of Assets: Each party shall fully disclose their financial status, including assets and liabilities, before signing this Agreement.

- Separate Property: Any property owned by either party before the marriage will remain that party's separate property, including:

- Real estate:

- Bank accounts:

- Investments:

- Business interests:

- Joint Property: Any property acquired during the marriage will be considered joint property unless specified otherwise.

- Debt Responsibility: Each party agrees to be responsible for their debts incurred before and during the marriage.

- Spousal Support: Details regarding any spousal support obligations in the event of separation or divorce will be outlined in Section X.

Both parties acknowledge that they have read and understood this Agreement. Each party is encouraged to consult with independent legal counsel before signing.

Signatures:

__________________________ (Party A)

__________________________ (Party B)

Date: ______________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A prenuptial agreement is a contract between two individuals before marriage, outlining the distribution of assets and responsibilities in the event of divorce or separation. |

| Governing Law | Florida Statutes, Chapter 61, governs prenuptial agreements in Florida. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing and signed by both parties. |

| Full Disclosure | Both parties must provide a fair and reasonable disclosure of their assets and liabilities prior to signing the agreement. |

| Legal Representation | It is advisable for both parties to seek independent legal counsel to ensure that their rights are protected. |

| Modification | A prenuptial agreement can be modified or revoked at any time, provided both parties agree to the changes in writing. |

Crucial Questions on This Form

What is a prenuptial agreement in Florida?

A prenuptial agreement, often referred to as a "prenup," is a legal contract created by two individuals before they marry. In Florida, this agreement outlines how assets and debts will be divided in the event of a divorce or separation. It can also address issues such as spousal support. The primary purpose of a prenup is to protect each party's interests and provide clarity regarding financial matters in the marriage.

What are the requirements for a valid prenuptial agreement in Florida?

For a prenuptial agreement to be considered valid in Florida, certain criteria must be met:

- Both parties must enter into the agreement voluntarily, without any coercion.

- There must be full and fair disclosure of each party's financial situation, including assets and debts.

- The agreement must be in writing and signed by both parties.

- The terms should be reasonable and not unconscionable at the time of enforcement.

It is advisable for each party to seek independent legal counsel to ensure their rights are protected and that they fully understand the implications of the agreement.

Can a prenuptial agreement be modified or revoked in Florida?

Yes, a prenuptial agreement can be modified or revoked in Florida. Both parties must agree to any changes, and the modifications should be made in writing and signed by both individuals. If a couple decides to revoke the agreement entirely, they should also do so in writing to avoid any future disputes. Clear communication and documentation are essential to ensure that both parties are on the same page regarding any alterations to the original agreement.

What happens if a prenuptial agreement is not created?

If a couple does not create a prenuptial agreement before marriage, Florida law will govern the division of assets and debts in the event of a divorce. This means that the court will apply state laws to determine how property is divided, which may not align with the couple's preferences. In the absence of a prenup, all assets acquired during the marriage are typically considered marital property, while assets owned before marriage may be deemed separate property. Without a clear agreement, disputes may arise, potentially leading to a lengthy and contentious divorce process.

Documents used along the form

A prenuptial agreement is a vital document for couples entering into marriage, especially when there are significant assets or debts involved. However, several other forms and documents are often used in conjunction with a Florida Prenuptial Agreement to ensure that both parties are fully informed and protected. Below is a list of these documents, each serving a specific purpose in the marriage planning process.

- Financial Disclosure Statement: This document requires both parties to provide a detailed account of their assets, liabilities, income, and expenses. Transparency is key, as it helps ensure that both individuals understand each other's financial situation before entering into the agreement.

- Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after the marriage has taken place. It outlines how assets and debts will be divided in the event of a divorce or separation, making it an important consideration for couples who may have acquired significant assets during the marriage.

- Separation Agreement: This document is used when a couple decides to separate. It outlines the terms of the separation, including asset division, child custody, and support obligations. Having this document can help streamline the divorce process if the couple decides to proceed with one.

- Marital Settlement Agreement: This agreement is typically reached during divorce proceedings. It details how marital property will be divided and addresses issues such as alimony and child support. It is crucial for ensuring that both parties agree on the terms of their separation.

- Will: A will outlines how a person's assets will be distributed upon their death. Couples may want to create or update their wills in conjunction with a prenuptial agreement to ensure their wishes are clearly stated and aligned with their financial plans.

- Trust Documents: Setting up a trust can help manage assets during marriage and provide for beneficiaries after death. Trust documents specify how the trust will be managed and how assets will be distributed, offering an additional layer of protection.

- Power of Attorney: This document allows one person to make legal and financial decisions on behalf of another if they become incapacitated. Establishing a power of attorney is essential for couples to ensure that their partner can act on their behalf in critical situations.

- WC-200A Georgia form: This essential document is used to request a change of physician or additional treatment in workers' compensation cases. For more information, visit https://georgiapdf.com/wc-200a-georgia.

- Health Care Proxy: A health care proxy designates someone to make medical decisions on behalf of another individual if they are unable to do so themselves. This is particularly important for couples who want to ensure their partner's wishes are honored in medical situations.

These documents complement a Florida Prenuptial Agreement by addressing various aspects of financial and personal planning for couples. By understanding and utilizing these forms, individuals can better protect their interests and foster a healthy foundation for their marriage.

Misconceptions

Many people have misunderstandings about prenuptial agreements in Florida. Here are six common misconceptions:

-

Only wealthy people need a prenuptial agreement.

This is not true. Anyone can benefit from a prenuptial agreement, regardless of their financial status. It helps clarify financial responsibilities and protect individual assets.

-

Prenuptial agreements are only for divorce situations.

While they do outline what happens in case of divorce, they can also clarify financial matters during the marriage. This can help avoid misunderstandings later on.

-

They are difficult to enforce.

When properly drafted, prenuptial agreements are enforceable in court. It’s essential to follow legal guidelines and ensure both parties understand the terms.

-

Prenuptial agreements are unfair.

These agreements can be tailored to fit both partners' needs. They can include terms that protect both parties, making them fair and equitable.

-

Signing a prenuptial agreement means you expect to get divorced.

This is a misconception. Many couples view it as a practical step to protect their interests and ensure clarity in their financial relationship.

-

Prenuptial agreements are only valid if signed well before the wedding.

While it’s advisable to sign them ahead of time, they can still be valid if signed closer to the wedding date. However, both parties should have adequate time to review the terms.