Florida Promissory Note Document

The Florida Promissory Note form serves as a crucial financial document in various lending scenarios, facilitating the borrowing and repayment of money between parties. This legally binding agreement outlines the borrower's commitment to repay the loan amount, along with any applicable interest, by a specified date. Key components include the principal amount, interest rate, repayment schedule, and the consequences of default. Additionally, the form may include provisions for prepayment, allowing borrowers the flexibility to pay off the loan early without penalties. Both parties should understand their rights and obligations as detailed in the note, ensuring transparency and minimizing potential disputes. By utilizing this form, lenders can secure their interests while borrowers can access necessary funds with clear terms laid out in writing.

Discover More Promissory Note Forms for Different States

Promissory Note Form California - The repayment terms may include a fixed schedule or flexible payments.

Understanding the importance of a Durable Power of Attorney guide can empower individuals to make informed decisions about managing their affairs. This document ensures that trusted agents are appointed to act on behalf of the principal, safeguarding their interests during times of incapacity.

Texas Promissory Note Requirements - This document outlines the terms of a loan between a lender and a borrower.

Create a Promissory Note - The form can be customized to fit various lending scenarios and borrower needs.

Similar forms

A Promissory Note is a financial document that outlines a promise to pay a specific amount of money to a designated party under agreed-upon terms. While it stands out for its unique purpose, several other documents share similarities in structure and function. Here’s a look at nine documents that relate closely to a Promissory Note:

- Loan Agreement: Like a Promissory Note, a Loan Agreement details the terms of borrowing, including repayment schedules and interest rates. However, it often includes more comprehensive clauses about default and obligations.

- Mortgage: A Mortgage is a specific type of loan secured by real property. It resembles a Promissory Note in that it includes a promise to repay, but it also outlines the consequences of default, such as foreclosure.

- Lease Agreement: A Lease Agreement allows one party to use property owned by another for a specified time in exchange for payment. Both documents establish clear terms for payment and can include penalties for late payments.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While it may lack the formalities of a Promissory Note, it still serves as a promise to pay back a specified amount.

Divorce Settlement Agreement: This essential form outlines the terms of the divorce, including asset division, child support, and alimony, ensuring both parties understand their obligations. To support your divorce process, you can find helpful resources at All Washington Forms.

- Credit Agreement: A Credit Agreement outlines the terms under which credit is extended to a borrower. Similar to a Promissory Note, it specifies repayment terms and interest rates but often covers a broader range of conditions.

- Installment Agreement: This document sets out a plan for repaying a debt in installments. It shares the essence of a Promissory Note by detailing the payment schedule and total amount due.

- Personal Loan Agreement: A Personal Loan Agreement is a contract between a borrower and a lender that specifies the loan amount, interest rate, and repayment terms. It functions similarly to a Promissory Note but is often more detailed.

- Business Loan Agreement: This document is specifically tailored for business loans. Like a Promissory Note, it includes payment obligations but also addresses business-specific conditions and collateral.

- Secured Promissory Note: This is a variation of a standard Promissory Note that is backed by collateral. It retains the core promise to pay while adding an extra layer of security for the lender.

Each of these documents plays a crucial role in financial transactions, ensuring that both parties understand their rights and responsibilities. Whether borrowing money for personal use or securing a loan for a business, knowing these similarities can help navigate the world of financial agreements more effectively.

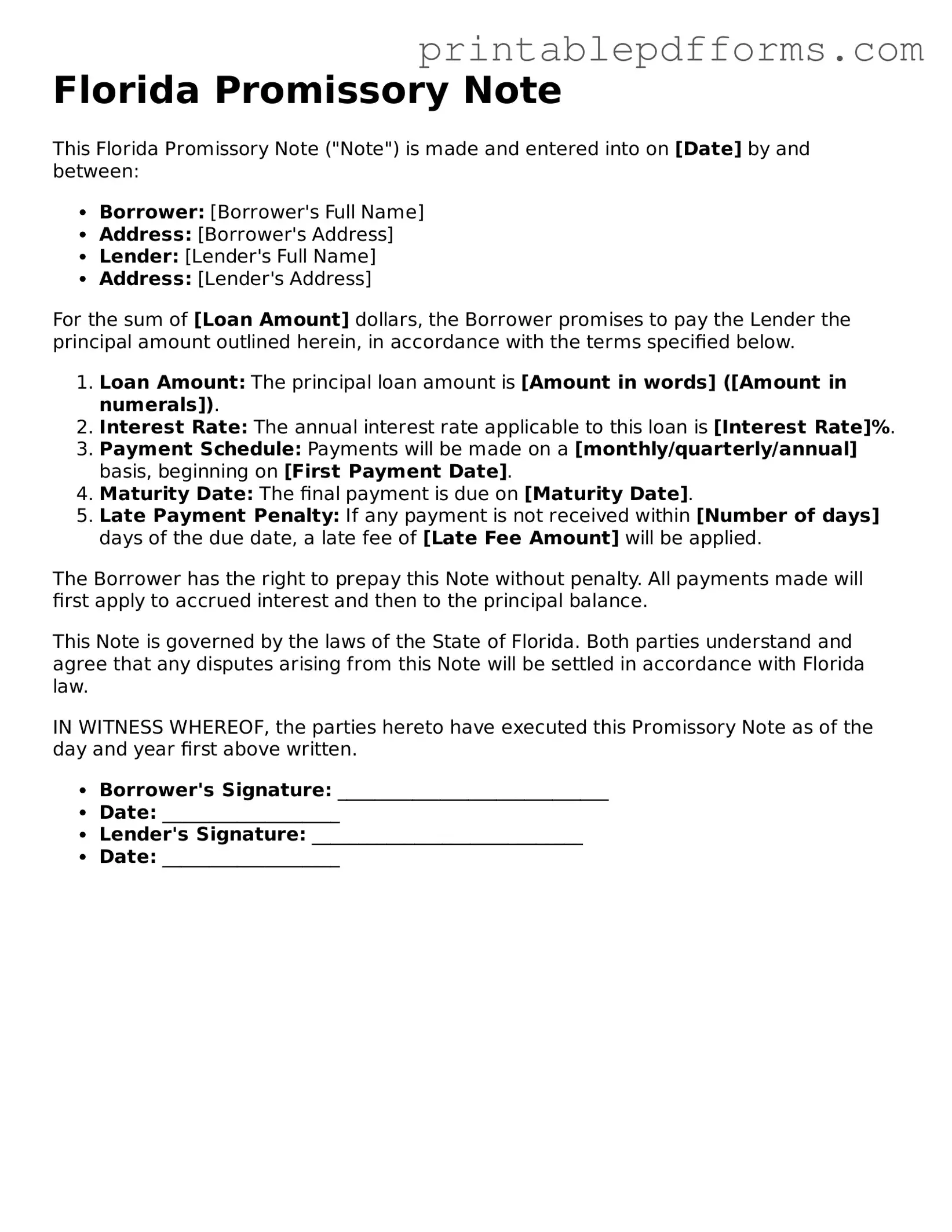

Document Example

Florida Promissory Note

This Florida Promissory Note ("Note") is made and entered into on [Date] by and between:

- Borrower: [Borrower's Full Name]

- Address: [Borrower's Address]

- Lender: [Lender's Full Name]

- Address: [Lender's Address]

For the sum of [Loan Amount] dollars, the Borrower promises to pay the Lender the principal amount outlined herein, in accordance with the terms specified below.

- Loan Amount: The principal loan amount is [Amount in words] ([Amount in numerals]).

- Interest Rate: The annual interest rate applicable to this loan is [Interest Rate]%.

- Payment Schedule: Payments will be made on a [monthly/quarterly/annual] basis, beginning on [First Payment Date].

- Maturity Date: The final payment is due on [Maturity Date].

- Late Payment Penalty: If any payment is not received within [Number of days] days of the due date, a late fee of [Late Fee Amount] will be applied.

The Borrower has the right to prepay this Note without penalty. All payments made will first apply to accrued interest and then to the principal balance.

This Note is governed by the laws of the State of Florida. Both parties understand and agree that any disputes arising from this Note will be settled in accordance with Florida law.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the day and year first above written.

- Borrower's Signature: _____________________________

- Date: ___________________

- Lender's Signature: _____________________________

- Date: ___________________

PDF Form Specs

| Fact Name | Details |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money to a designated person or entity. |

| Governing Law | The Florida Promissory Note is governed by Florida Statutes, specifically Chapter 673, which covers negotiable instruments. |

| Parties Involved | The note typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and it should be clearly stated in the note. |

| Repayment Terms | The repayment schedule must be defined, including the due date and payment frequency. |

| Default Conditions | The note should outline what constitutes a default and the remedies available to the lender. |

| Signatures Required | Both parties must sign the note for it to be legally binding. |

| Notarization | While notarization is not required, it is recommended to add an extra layer of authenticity. |

| Transferability | Promissory notes in Florida can be transferred or sold to another party unless otherwise stated. |

Crucial Questions on This Form

What is a Florida Promissory Note?

A Florida Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a future date. This legal document outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any penalties for late payment. It serves as a record of the agreement between the borrower and the lender, providing clarity and protection for both parties.

Who can use a Promissory Note in Florida?

Almost anyone can use a Promissory Note in Florida. Individuals, businesses, and organizations often use it for various transactions, such as personal loans, business loans, or even real estate transactions. Whether you’re lending money to a friend or financing a business venture, a Promissory Note can formalize the agreement and help prevent misunderstandings.

What are the essential elements of a Florida Promissory Note?

To create a valid Promissory Note in Florida, certain key elements must be included:

- Parties Involved: Clearly identify the borrower and the lender.

- Principal Amount: State the amount of money being borrowed.

- Interest Rate: Specify the interest rate, if applicable.

- Repayment Terms: Outline how and when the borrower will repay the loan.

- Default Conditions: Include any penalties or consequences for late payments.

Including these elements helps ensure that the note is legally enforceable and reduces the potential for disputes.

Do I need a lawyer to create a Promissory Note?

While it's not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A lawyer can help ensure that the document complies with Florida laws and meets your specific needs. If the loan amount is significant or if there are complex terms involved, having legal guidance can provide peace of mind and protect your interests.

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to repay the loan as agreed, the lender has several options. The lender can pursue legal action to recover the debt, which may involve filing a lawsuit. In Florida, the lender may also have the right to charge late fees or interest on the overdue amount, depending on what was outlined in the Promissory Note. It’s crucial for both parties to understand the implications of default before entering into the agreement.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. It’s important to document any modifications in writing, as verbal agreements may not be enforceable. Including an amendment clause in the original note can simplify the process of making changes in the future. Always ensure that both parties sign any amendments to maintain clarity and legal standing.

Documents used along the form

In Florida, a Promissory Note is a crucial document that outlines the terms of a loan between a lender and a borrower. However, it is often accompanied by various other forms and documents to ensure clarity and legal protection for both parties involved. Below is a list of documents commonly used alongside the Florida Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the amount, interest rate, repayment schedule, and any collateral involved.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the collateral and the rights of the lender in case of default.

- Disclosure Statement: This form provides borrowers with important information about the loan, including fees, interest rates, and the total cost of borrowing.

- Personal Guarantee: This document may be required from the borrower or a third party, ensuring that they will be personally liable for the loan if the borrower defaults.

- Deed of Trust: In some cases, this document may be used to secure the loan with real property, outlining the lender's rights to the property in the event of default.

- Loan Application: This form collects necessary information from the borrower, including financial history and purpose of the loan, to assess creditworthiness.

- Amortization Schedule: This schedule outlines the breakdown of each payment over the life of the loan, detailing principal and interest amounts.

- Payment Receipt: This document serves as proof of payment made towards the loan, which can be important for record-keeping and tax purposes.

- Ohio Payoff Form: This form is essential for the resolution of debts owed to the State of Ohio, ensuring transparency in property transactions. For detailed information, refer to All Ohio Forms.

- Default Notice: If the borrower fails to make payments, this notice informs them of the default and the potential consequences.

Utilizing these documents in conjunction with the Florida Promissory Note can provide a comprehensive framework for managing loans. Each document serves a specific purpose, ensuring that both parties have a clear understanding of their rights and responsibilities. Proper documentation is key to fostering a transparent and legally sound lending process.

Misconceptions

Understanding the Florida Promissory Note form is essential for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are seven common misconceptions explained:

- It must be notarized to be valid. Many believe that notarization is necessary for a promissory note to be enforceable. In Florida, notarization is not a requirement, though it can provide additional legal protection.

- All promissory notes are the same. Not all promissory notes are created equal. The terms and conditions can vary significantly based on the agreement between the parties involved.

- Only banks can issue promissory notes. This is false. Individuals and businesses can also create promissory notes as long as they meet the legal requirements.

- Promissory notes do not need to specify a payment schedule. While it is possible to create a note without a payment schedule, including one helps clarify the terms and expectations for both parties.

- Once signed, a promissory note cannot be changed. This is incorrect. Parties can modify the terms of a promissory note if both agree to the changes and document them properly.

- Promissory notes are only for large loans. Many think that promissory notes are only used for substantial amounts. In reality, they can be used for any amount, regardless of size.

- Defaulting on a promissory note has no consequences. This misconception is dangerous. Defaulting can lead to legal action, including lawsuits and damage to credit scores.

Being aware of these misconceptions can help individuals navigate the complexities of promissory notes more effectively.