Florida Quitclaim Deed Document

In the realm of real estate transactions, the Florida Quitclaim Deed serves as a vital tool for property owners looking to transfer their interest in a property without the complexities often associated with other deed types. This form is particularly useful when the transfer occurs between family members, friends, or in situations where the parties trust one another. Unlike warranty deeds, which provide guarantees about the title, a quitclaim deed offers no such assurances; it merely conveys whatever interest the grantor has in the property at the time of transfer. This means that if the grantor has a clear title, the recipient receives that title, but if not, the recipient may face challenges. The quitclaim deed must be executed with care, requiring signatures from the grantor and the proper notarization to ensure its validity. Furthermore, the form must be recorded in the county where the property is located to provide public notice of the transfer. Understanding these elements is crucial for anyone considering using a quitclaim deed in Florida, as it can significantly impact property rights and future transactions.

Discover More Quitclaim Deed Forms for Different States

How Much Does a Quick Deed Cost - Tax implications may arise from property transfers using this deed.

Pennsylvania Quit Claim Deed Form - A Quitclaim Deed allows a property owner to transfer interest in a property to another party without guaranteeing the title is free of claims.

When engaging in the sale or purchase of a boat, it is crucial to complete the New York Boat Bill of Sale form, which serves as a formal record of the transaction. This document not only captures vital information about the parties involved and the vessel itself but also helps to prevent future disputes. For more information and to access the form, you can visit nypdfforms.com/boat-bill-of-sale-form.

Quitclaim Deed Ny - Using a Quitclaim Deed is often faster than other methods of property transfer.

Similar forms

- Warranty Deed: This document transfers ownership of property and guarantees that the seller has clear title to the property. Unlike a quitclaim deed, it provides more protection to the buyer.

- Last Will and Testament: Ensure your final wishes are honored with a thorough Last Will and Testament document, which clarifies how your assets should be distributed after your passing.

- Grant Deed: Similar to a warranty deed, a grant deed transfers property ownership but offers limited guarantees. It assures that the seller has not sold the property to anyone else and that the property is free from undisclosed encumbrances.

- Deed of Trust: This document secures a loan with real estate as collateral. It involves three parties: the borrower, the lender, and a trustee. While it does not transfer ownership outright, it plays a crucial role in real estate transactions.

- Bill of Sale: This document transfers ownership of personal property, such as vehicles or equipment. It is similar to a quitclaim deed in that it conveys ownership without warranties, focusing on the transfer of title.

- Lease Agreement: This document allows one party to use property owned by another for a specified time in exchange for payment. While it does not transfer ownership, it establishes rights to use the property, similar to how a quitclaim deed establishes ownership rights.

- Affidavit of Title: This document is a sworn statement confirming the seller's ownership of the property and the absence of liens or claims against it. It provides some assurance to the buyer, akin to the assurances found in a warranty deed.

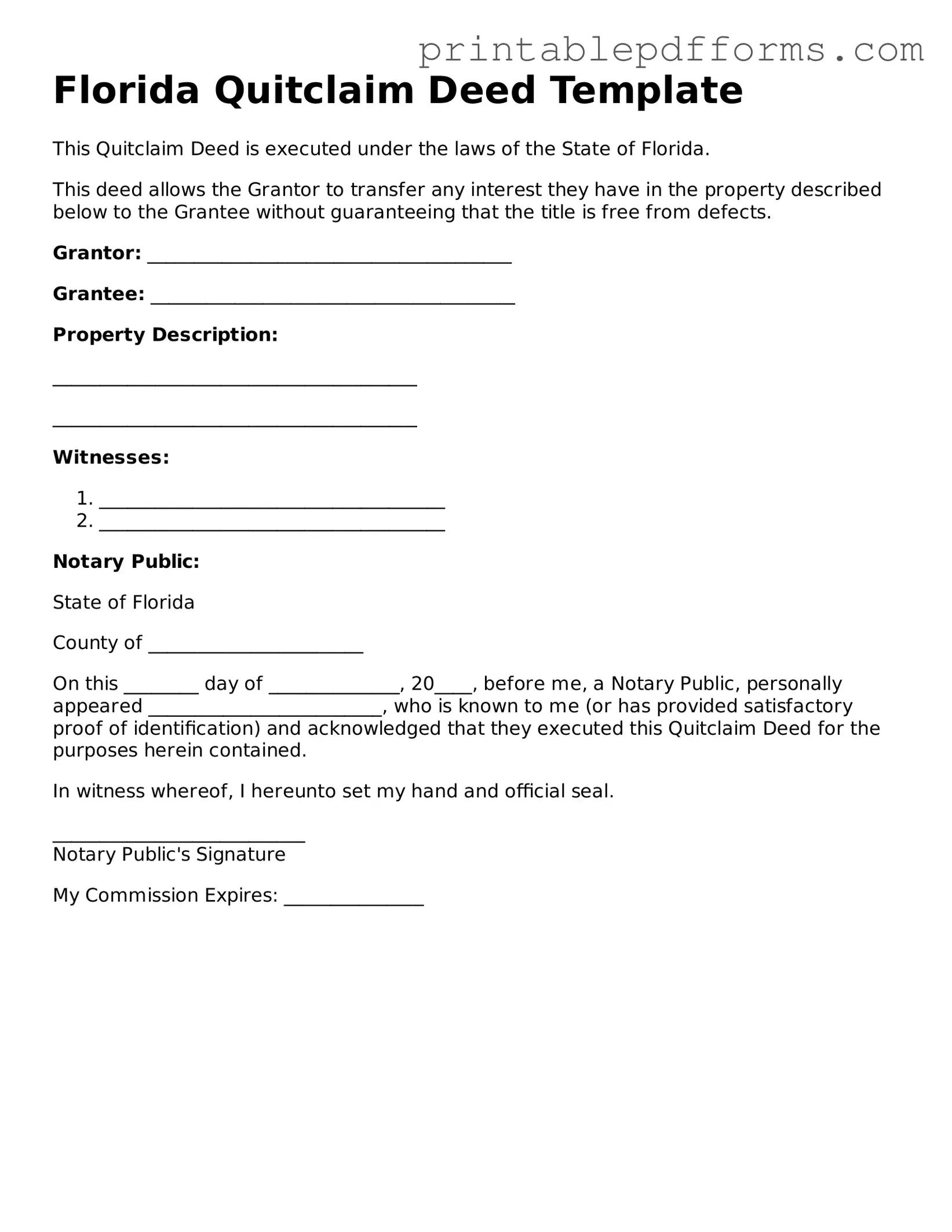

Document Example

Florida Quitclaim Deed Template

This Quitclaim Deed is executed under the laws of the State of Florida.

This deed allows the Grantor to transfer any interest they have in the property described below to the Grantee without guaranteeing that the title is free from defects.

Grantor: _______________________________________

Grantee: _______________________________________

Property Description:

_______________________________________

_______________________________________

Witnesses:

- _____________________________________

- _____________________________________

Notary Public:

State of Florida

County of _______________________

On this ________ day of ______________, 20____, before me, a Notary Public, personally appeared _________________________, who is known to me (or has provided satisfactory proof of identification) and acknowledged that they executed this Quitclaim Deed for the purposes herein contained.

In witness whereof, I hereunto set my hand and official seal.

___________________________

Notary Public's Signature

My Commission Expires: _______________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate without guaranteeing that the title is clear. |

| Governing Law | This deed is governed by Florida Statutes, Chapter 689, which outlines the requirements for property conveyance. |

| Use Cases | Commonly used in situations such as divorce settlements, transferring property between family members, or clearing up title issues. |

| Limitations | It does not provide any warranties or guarantees regarding the property’s title, meaning the grantee assumes all risks associated with the title. |

Crucial Questions on This Form

What is a Florida Quitclaim Deed?

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the property title. This means that the person transferring the property, known as the grantor, does not assure the recipient, or grantee, that the title is free from claims or liens. This type of deed is often used between family members or in situations where the parties know each other well and trust each other.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in several scenarios, including:

- Transferring property between family members, such as during a divorce or inheritance.

- Clearing up title issues, such as removing an ex-spouse’s name from a property title.

- Transferring property into a trust or LLC for estate planning purposes.

It’s important to note that while Quitclaim Deeds are straightforward, they do not provide any protection against future claims. If you need to ensure that the title is clear, consider other types of deeds, like a Warranty Deed.

How do I complete a Quitclaim Deed in Florida?

Completing a Quitclaim Deed in Florida involves several steps:

- Obtain a Quitclaim Deed form, which can be found online or at legal stationery stores.

- Fill out the form with the necessary information, including the names of the grantor and grantee, the property description, and the date of transfer.

- Sign the deed in the presence of a notary public. The notary will verify your identity and witness your signature.

- File the completed Quitclaim Deed with the appropriate county clerk’s office. There may be a small filing fee.

Ensure that all information is accurate to avoid issues later on.

Are there any tax implications when using a Quitclaim Deed?

Using a Quitclaim Deed can have tax implications, especially if the property is transferred as part of a sale or for compensation. In many cases, transferring property between family members may not trigger immediate tax consequences. However, it’s essential to consider the following:

- Gift Tax: If the property is transferred without payment, it may be considered a gift, which could have gift tax implications.

- Capital Gains Tax: If the grantee sells the property later, they may be subject to capital gains tax based on the property’s appreciated value.

Consulting with a tax professional is advisable to understand the specific implications for your situation.

Can I revoke a Quitclaim Deed once it is executed?

Once a Quitclaim Deed is executed and filed, it cannot be unilaterally revoked. However, the grantor can execute a new deed to reverse the transfer, effectively transferring the property back to themselves or to another party. This new deed must also be properly executed and filed with the county clerk’s office. It’s important to keep in mind that the ability to revoke or reverse a transfer can depend on the specific circumstances and any agreements made between the parties involved.

Documents used along the form

When completing a real estate transaction in Florida, several forms and documents may accompany the Quitclaim Deed. Each of these documents serves a specific purpose, ensuring that the transfer of property rights is clear and legally binding. Below is a list of commonly used forms.

- Property Transfer Tax Declaration: This form is required to disclose the value of the property being transferred. It helps determine the applicable documentary stamp tax.

- Affidavit of Title: This document certifies that the seller has clear title to the property and that there are no outstanding liens or claims against it.

- Trailer Bill of Sale: This legal document serves as proof of purchase and outlines essential details of the trailer transfer. For more information, visit freebusinessforms.org/.

- Notice of Intent to Convey: This notice informs interested parties of the intent to transfer property ownership, often required in certain transactions.

- Title Insurance Policy: This policy protects the buyer from any future claims against the property’s title, ensuring that they have clear ownership rights.

- Sales Contract: This agreement outlines the terms of the sale, including price, contingencies, and responsibilities of both the buyer and seller.

- Warranty Deed: Unlike a Quitclaim Deed, this document guarantees that the seller has full ownership of the property and will defend against any claims to the title.

- Power of Attorney: This legal document allows one person to act on behalf of another in legal matters, including signing the Quitclaim Deed.

- Property Survey: A survey provides a detailed map of the property boundaries and any existing structures, which can be essential for resolving disputes.

- Estoppel Certificate: This certificate confirms the terms of an existing lease or mortgage, ensuring that the buyer is aware of any obligations tied to the property.

- Certificate of Good Standing: This document verifies that a corporation or LLC is authorized to conduct business in Florida, relevant if the seller is a business entity.

Understanding these documents can facilitate a smoother transaction process. Each plays a crucial role in ensuring that property transfers are conducted legally and transparently.

Misconceptions

Understanding the Florida Quitclaim Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can cloud one’s judgment about its purpose and implications. Below is a list of common misunderstandings.

- A Quitclaim Deed Transfers Ownership Completely. Many believe that a quitclaim deed conveys full ownership rights. In reality, it transfers whatever interest the grantor has in the property, which may be minimal or nonexistent.

- Quitclaim Deeds Are Only for Family Transfers. While often used among family members, quitclaim deeds can be utilized in various situations, including transferring property between unrelated parties or in divorce settlements.

- Quitclaim Deeds Offer Buyer Protection. A common myth is that these deeds protect the buyer from any claims against the property. However, they provide no warranties, meaning the buyer assumes all risks associated with the property.

- All Quitclaim Deeds Are the Same. Some assume that all quitclaim deeds follow a universal format. In Florida, specific requirements must be met for a quitclaim deed to be valid, including proper execution and notarization.

- Using a Quitclaim Deed Is Always Quick and Easy. Although quitclaim deeds can simplify transactions, they may still require careful consideration of legal implications, especially if there are existing liens or encumbrances.

- Quitclaim Deeds Eliminate the Need for Title Insurance. Many mistakenly believe that using a quitclaim deed negates the necessity for title insurance. In fact, title insurance is still advisable to protect against unforeseen claims or defects.

- Once a Quitclaim Deed Is Filed, It Cannot Be Changed. Some individuals think that a quitclaim deed is irrevocable once recorded. However, the grantor can execute a new deed to reverse the transaction, provided they still hold interest in the property.

- Quitclaim Deeds Are Only Used in Florida. While this form is prevalent in Florida, quitclaim deeds are used in many states across the U.S., each with its own rules and regulations governing their use.

- All Property Transfers Require a Quitclaim Deed. Lastly, it is a misconception that every property transfer must involve a quitclaim deed. Various other forms of deeds, like warranty deeds, may be more appropriate depending on the situation.

By debunking these misconceptions, individuals can approach real estate transactions with a clearer understanding of the implications of using a Florida Quitclaim Deed.