Florida Transfer-on-Death Deed Document

In Florida, property owners have a unique opportunity to streamline the transfer of their real estate upon their passing through the use of a Transfer-on-Death Deed (TODD). This legal instrument allows individuals to designate one or more beneficiaries who will automatically receive the property without the need for probate. The simplicity of this process can provide peace of mind, as it enables property owners to maintain control over their assets during their lifetime while ensuring a seamless transition to their heirs. The form itself requires specific information, including the names of the property owners, the designated beneficiaries, and a clear description of the property in question. Importantly, the deed must be executed in accordance with Florida law, which includes signing in the presence of witnesses and notarization. Once properly recorded with the county clerk, the Transfer-on-Death Deed becomes effective, allowing beneficiaries to inherit the property directly upon the owner's death. Understanding the nuances of this form can empower property owners to make informed decisions about their estate planning and ensure their wishes are honored after they are gone.

Discover More Transfer-on-Death Deed Forms for Different States

Texas Transfer on Death Deed Form - Ownership interests can be specifically defined, such as specifying percentages for multiple beneficiaries.

To ensure that your medical preferences are clearly communicated, it is important to utilize the Ohio Living Will form. This document enables individuals to specify their wishes regarding healthcare decisions when they are no longer able to express them. By completing this form, you can provide guidance to your healthcare providers and ensure that your directives about treatment, organ donation, and end-of-life care are followed. For more information and resources to help you with this process, visit All Ohio Forms.

How Much Does a Beneficiary Deed Cost - This deed can help keep family property in the family across generations.

Transfer on Death Deed Ohio Pdf - Property owners should also consider the implications of the Transfer-on-Death Deed in relation to their overall estate plan.

Where Can I Get a Tod Form - Beneficiaries named in a Transfer-on-Death Deed do not have any rights to the property until the property owner has passed away.

Similar forms

The Transfer-on-Death Deed (TODD) is a unique legal document that allows individuals to transfer real estate to beneficiaries upon their death, avoiding probate. However, it shares similarities with several other legal documents. Here’s a list of nine documents that are comparable to the TODD, highlighting how they relate:

- Last Will and Testament: Like a TODD, a will specifies how a person's assets should be distributed after their death, but it typically goes through probate, whereas a TODD does not.

- RV Bill of Sale - This document is essential for transferring ownership of a recreational vehicle, providing necessary details about the transaction to both parties involved. For more information, visit georgiapdf.com/rv-bill-of-sale.

- Living Trust: Both a living trust and a TODD allow for the transfer of assets without probate. However, a living trust can manage assets during a person's lifetime, while a TODD only takes effect after death.

- Beneficiary Designation Forms: Similar to a TODD, these forms allow individuals to designate beneficiaries for accounts like life insurance or retirement plans, ensuring that assets pass directly to the named individuals upon death.

- Joint Tenancy with Right of Survivorship: This arrangement allows co-owners to inherit each other's share of property automatically upon death, similar to how a TODD functions for designated beneficiaries.

- Transfer-on-Death Registration for Securities: Much like a TODD for real estate, this allows individuals to designate beneficiaries for stocks and bonds, enabling direct transfer upon death without probate.

- Payable-on-Death Accounts: These bank accounts allow the owner to name a beneficiary who will receive the funds directly upon the owner's death, similar to the way a TODD transfers property.

- Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime while transferring ownership to another party upon their death, sharing the goal of avoiding probate.

- Community Property with Right of Survivorship: This form of ownership allows spouses to jointly own property, ensuring that the surviving spouse automatically inherits the property without going through probate, akin to a TODD.

- Durable Power of Attorney: While not directly a transfer document, a durable power of attorney allows an agent to manage a person's affairs, including property, which can be relevant in planning for death and asset transfer.

Each of these documents serves a specific purpose in estate planning, and understanding their similarities and differences can help individuals make informed decisions about how to manage and transfer their assets.

Document Example

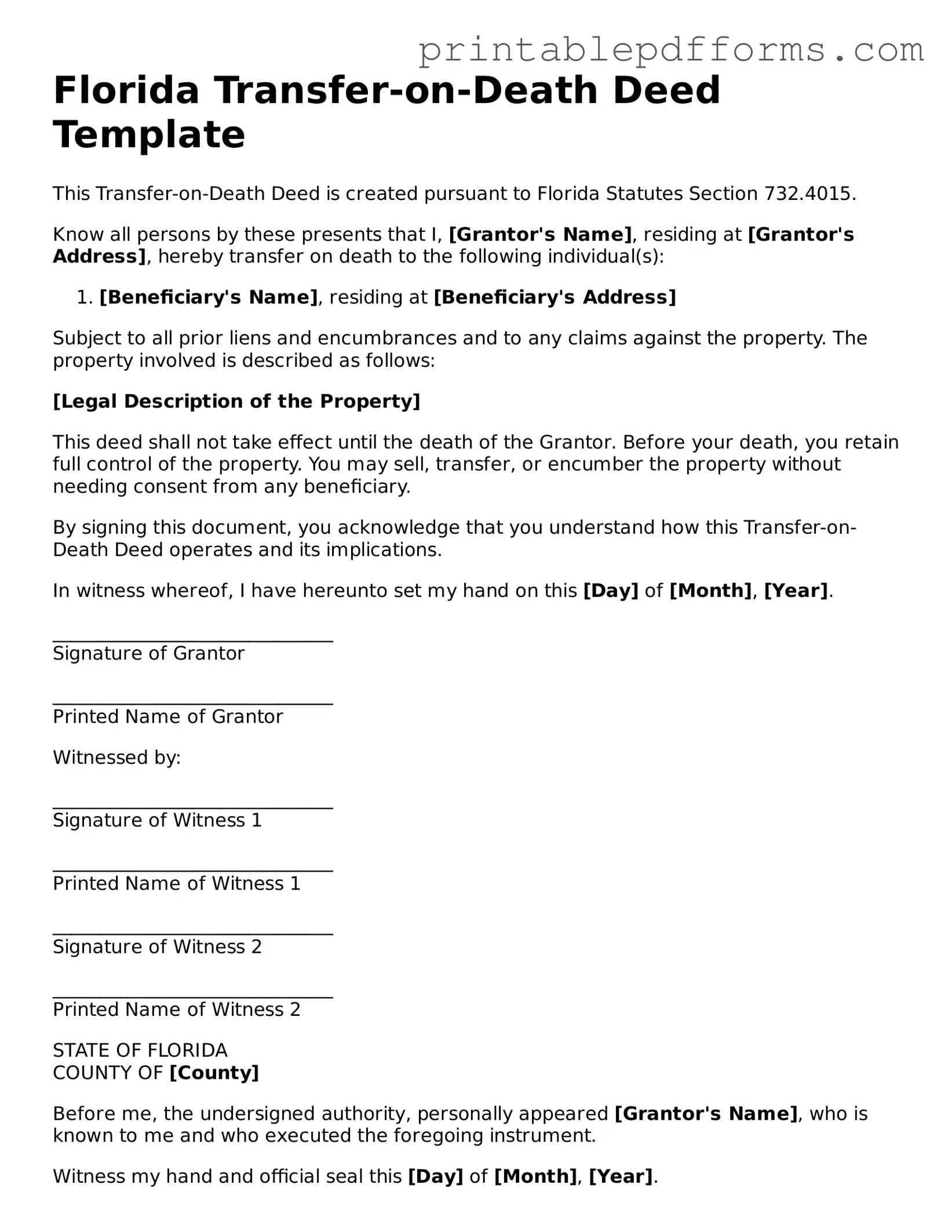

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created pursuant to Florida Statutes Section 732.4015.

Know all persons by these presents that I, [Grantor's Name], residing at [Grantor's Address], hereby transfer on death to the following individual(s):

- [Beneficiary's Name], residing at [Beneficiary's Address]

Subject to all prior liens and encumbrances and to any claims against the property. The property involved is described as follows:

[Legal Description of the Property]

This deed shall not take effect until the death of the Grantor. Before your death, you retain full control of the property. You may sell, transfer, or encumber the property without needing consent from any beneficiary.

By signing this document, you acknowledge that you understand how this Transfer-on-Death Deed operates and its implications.

In witness whereof, I have hereunto set my hand on this [Day] of [Month], [Year].

______________________________

Signature of Grantor

______________________________

Printed Name of Grantor

Witnessed by:

______________________________

Signature of Witness 1

______________________________

Printed Name of Witness 1

______________________________

Signature of Witness 2

______________________________

Printed Name of Witness 2

STATE OF FLORIDA

COUNTY OF [County]

Before me, the undersigned authority, personally appeared [Grantor's Name], who is known to me and who executed the foregoing instrument.

Witness my hand and official seal this [Day] of [Month], [Year].

______________________________

Notary Public

My commission expires: _______________

PDF Form Specs

| Fact Name | Details |

|---|---|

| What is a TOD Deed? | A Transfer-on-Death (TOD) deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, Chapter 732.4015. |

| Benefits of a TOD Deed | This deed simplifies the transfer process, avoids probate, and can provide peace of mind to property owners and their beneficiaries. |

| Eligibility | Any Florida resident who owns real estate can create a TOD deed, provided they are of sound mind and at least 18 years old. |

| Revocation | A TOD deed can be revoked or changed at any time before the property owner’s death, offering flexibility in estate planning. |

| Recording Requirement | To be effective, the TOD deed must be recorded in the county where the property is located before the owner's death. |

| Beneficiary Rights | Beneficiaries do not have rights to the property until the owner's death, ensuring the owner retains full control during their lifetime. |

Crucial Questions on This Form

What is a Florida Transfer-on-Death Deed?

A Florida Transfer-on-Death Deed is a legal document that allows an individual to transfer ownership of real property to a designated beneficiary upon the individual's death. This deed provides a straightforward way to pass on property without the need for probate, simplifying the process for heirs. The transfer becomes effective automatically upon the death of the property owner, provided the deed has been properly executed and recorded.

How do I create a Transfer-on-Death Deed in Florida?

Creating a Transfer-on-Death Deed in Florida involves several steps:

- Obtain the appropriate form. This form can typically be found online or through legal resources.

- Fill out the form with accurate information, including the property description and the names of the beneficiaries.

- Sign the deed in the presence of two witnesses. Florida law requires this to ensure the validity of the document.

- Record the signed deed with the county clerk’s office where the property is located. This step is crucial as it makes the deed public and enforceable.

Can I revoke a Transfer-on-Death Deed once it is executed?

Yes, a Transfer-on-Death Deed can be revoked at any time before the death of the property owner. To do this, the owner must execute a new deed that explicitly revokes the previous one or record a revocation document with the county clerk’s office. It is important to ensure that the revocation is properly documented to avoid any confusion regarding the transfer of the property.

Are there any limitations or restrictions on using a Transfer-on-Death Deed in Florida?

While a Transfer-on-Death Deed is a useful tool, there are some limitations to consider:

- The deed can only be used for real property, such as land and buildings, not for personal property or financial accounts.

- Beneficiaries must be individuals or certain types of entities, such as trusts; however, they cannot be a part of the owner's estate.

- If the property is subject to a mortgage, the transfer may not relieve the beneficiary from the obligation of the mortgage.

- It is advisable to consult with a legal professional to understand how this deed interacts with estate planning and tax implications.

Documents used along the form

When dealing with estate planning in Florida, the Transfer-on-Death Deed is a valuable tool for transferring property to beneficiaries without going through probate. However, there are several other documents and forms that can complement this deed to ensure a smooth transition of assets. Below is a list of commonly used forms that you might encounter in this process.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can include specific bequests and appoints an executor to manage the estate.

- Living Trust: A living trust allows individuals to place their assets into a trust during their lifetime. This can help avoid probate and provide more control over asset distribution.

- Durable Power of Attorney: This form grants someone the authority to make financial decisions on behalf of another person if they become incapacitated. It is crucial for managing finances when one cannot do so themselves.

- Trailer Bill of Sale: This form is essential for officially transferring ownership of a trailer from seller to buyer, acting as a receipt for the transaction. To get your own Trailer Bill of Sale form, download it here.

- Healthcare Surrogate Designation: This document appoints someone to make medical decisions for an individual if they are unable to do so. It ensures that healthcare choices align with the person’s wishes.

- Living Will: A living will expresses an individual’s wishes regarding medical treatment in the event they are unable to communicate their preferences, particularly in end-of-life situations.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person, particularly when there is no will. It can be useful in transferring property to rightful heirs.

- Quitclaim Deed: A quitclaim deed is used to transfer ownership of property without guaranteeing that the title is clear. It is often used between family members or in divorces.

- Notice of Intent to Record: This form notifies interested parties of the intent to record a Transfer-on-Death Deed. It helps ensure transparency in the property transfer process.

Utilizing these documents in conjunction with a Florida Transfer-on-Death Deed can help create a comprehensive estate plan. Each form serves a unique purpose and contributes to a smoother transition of assets, ensuring that your wishes are honored and your loved ones are taken care of.

Misconceptions

Understanding the Florida Transfer-on-Death Deed can be challenging due to common misconceptions. Here are nine of those misconceptions explained:

-

It automatically avoids probate.

While a Transfer-on-Death Deed allows property to pass directly to beneficiaries without going through probate, it does not eliminate the need for probate in all situations. If there are debts or other claims against the estate, probate may still be necessary.

-

It can only be used for real estate.

This deed specifically applies to real property. Personal property, such as bank accounts or vehicles, cannot be transferred using this method.

-

It is irrevocable once signed.

In fact, a Transfer-on-Death Deed can be revoked or modified at any time before the death of the property owner, allowing for flexibility in estate planning.

-

All beneficiaries must agree on the deed.

Only the property owner needs to sign the deed. Beneficiaries do not need to consent to the transfer until after the owner's passing.

-

It is only for married couples.

Anyone can use a Transfer-on-Death Deed, regardless of marital status. This option is available to individuals, couples, and even joint owners.

-

It requires a lawyer to complete.

While legal assistance can be beneficial, it is not mandatory. Many individuals successfully complete the form on their own, provided they understand the requirements.

-

It will affect the owner's ability to sell the property.

The property owner retains full control over the property while alive. They can sell, mortgage, or otherwise manage the property without restriction.

-

It is a one-size-fits-all solution.

Each individual's estate planning needs are unique. A Transfer-on-Death Deed may not be suitable for everyone, and it’s important to consider all options.

-

It can only be used for a single beneficiary.

Multiple beneficiaries can be named on a Transfer-on-Death Deed, allowing for shared ownership among heirs.