Fill a Valid Generic Direct Deposit Form

The Generic Direct Deposit form serves as a crucial tool for individuals looking to streamline their payment processes, whether for payroll or other financial transactions. This form requires basic personal information, including your name, Social Security number, and contact details. It also necessitates information about your financial institution, such as the name of the bank, your account number, and the routing transit number, which is essential for directing funds accurately. The form allows you to specify whether you are opening a new account, making a change, or canceling a previous authorization. Additionally, it includes a section for indicating the type of account, whether it be savings or checking. By signing the form, you grant permission for your employer or payment provider to deposit funds directly into your account, ensuring timely access to your earnings. If the account is jointly held or in another person's name, that individual must also provide their signature to authorize the arrangement. Completing the form accurately is important, as it ensures that your financial transactions proceed without delay. Tips for filling out the form include verifying your account and routing numbers with your bank, as well as avoiding the use of deposit slips for confirmation. Overall, the Generic Direct Deposit form is designed to simplify the payment process while providing the necessary safeguards for both the payer and the payee.

Additional PDF Templates

Broward County Animal Care and Adoption - Helps prevent rabies outbreaks by documenting vaccinations.

When starting a new business in Washington, understanding the importance of the Articles of Incorporation form is essential. This document not only registers your corporation but also outlines key elements such as the company name, purpose, and initial directors. To ensure you are well-prepared, review and complete the form with care. For more resources and to assist you in this process, consider exploring All Washington Forms to help you get started.

W-9 Fillable 2023 - You may be asked for a W-9 if you earn interest or dividends from financial institutions.

Roofing Estimate Template Pdf - Get expert advice on DIY roofing vs. professional help.

Similar forms

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. Like the Direct Deposit form, it requires personal information and must be signed for authorization.

- Payroll Deduction Authorization Form: Similar in purpose, this form allows employees to authorize deductions from their paycheck for various purposes, such as insurance or retirement plans. It also requires personal information and a signature.

- Change of Address Form: This document is used to update an individual's address with an organization. It shares the need for personal details and a signature for confirmation.

- Bank Account Change Form: This form is used when an individual wants to change their bank account information for direct deposits. It includes similar fields for account details and requires a signature.

- Direct Deposit Cancellation Form: This document is specifically for canceling a direct deposit arrangement. It mirrors the authorization form in structure but focuses on termination instead.

- Employee Information Form: This form collects essential employee details for HR records. It includes personal information and often requires a signature, similar to the Direct Deposit form.

- Authorization for Release of Information Form: Used to allow an organization to share personal information, this form also requires personal details and a signature, aligning it with the Direct Deposit form's purpose.

- Health Insurance Enrollment Form: This form allows employees to enroll in health insurance plans. It requires personal information and a signature, much like the Direct Deposit authorization.

- Last Will and Testament Form: To secure your final wishes, consider our detailed Last Will and Testament guidance to ensure your assets are distributed as intended.

- Retirement Plan Enrollment Form: Similar to the Direct Deposit form, this document is used to enroll in retirement plans and requires personal information and a signature for consent.

- Beneficiary Designation Form: This form allows individuals to designate beneficiaries for accounts or policies. It requires personal details and a signature, resembling the structure of the Direct Deposit form.

Document Example

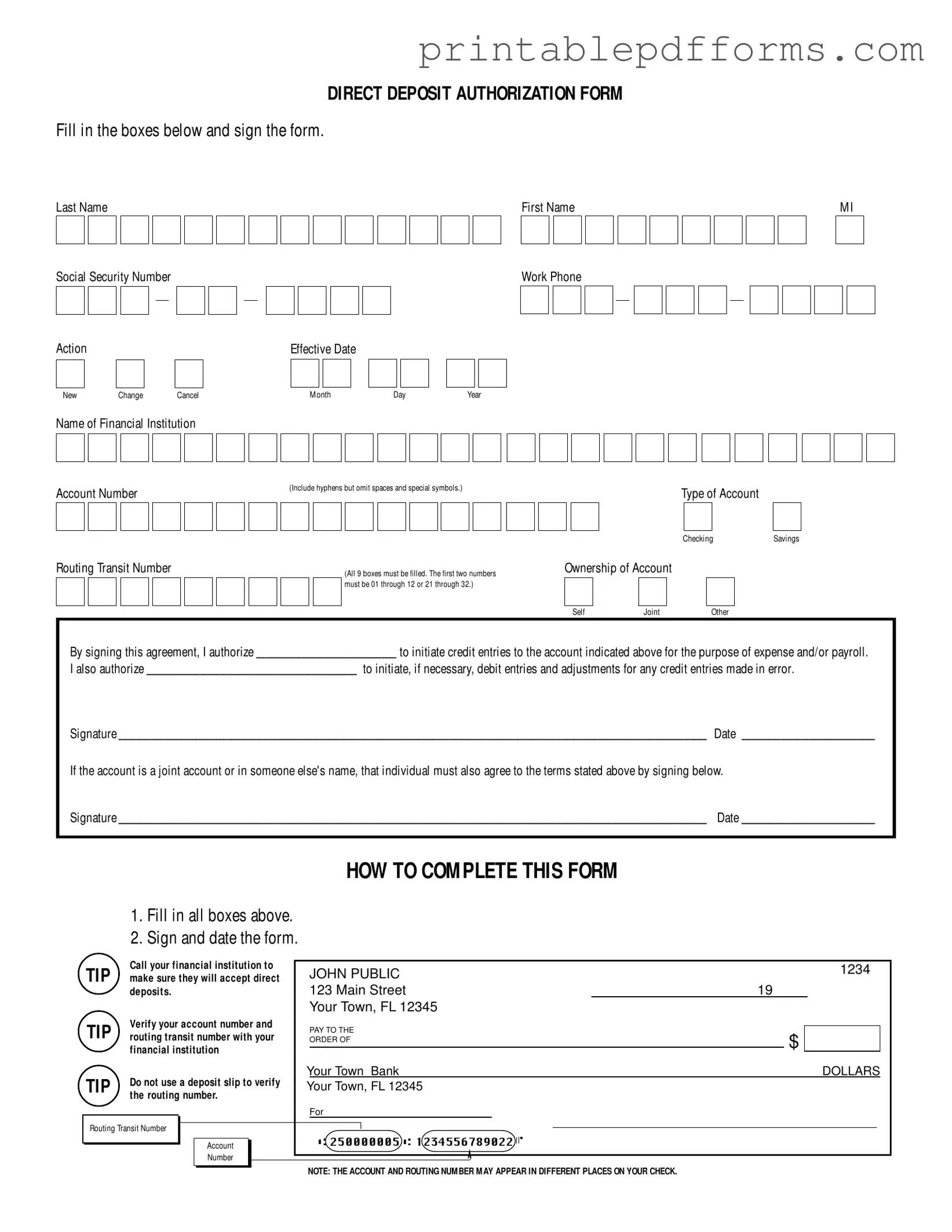

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Generic Direct Deposit form is used to authorize the electronic transfer of funds into a bank account. |

| Information Required | Applicants must provide personal information, including their name, Social Security Number, and account details. |

| Account Types | Users can choose between a savings or checking account for direct deposits. |

| Routing Number | The form requires a valid routing transit number, which consists of nine digits. |

| Ownership Options | Account ownership can be designated as self, joint, or other, depending on the account holder's situation. |

| Authorization | By signing the form, individuals authorize their employer or payment provider to deposit funds into their account. |

| Changes and Cancellations | The form allows for new authorizations, changes to existing ones, or cancellations of direct deposits. |

| Joint Accounts | If the account is joint, all account holders must sign the form to authorize deposits. |

| Completion Tips | It is advisable to verify account and routing numbers with the financial institution before submission. |

| Governing Laws | In the United States, direct deposit practices are governed by the Electronic Fund Transfer Act (EFTA). |

Crucial Questions on This Form

What is the Generic Direct Deposit form?

The Generic Direct Deposit form is a document that allows individuals to authorize their employer or other payers to deposit funds directly into their bank account. This can include payroll, expense reimbursements, or other payments. By using this form, you can ensure that your payments are received quickly and securely.

How do I complete the Generic Direct Deposit form?

To complete the form, follow these steps:

- Fill in all required boxes, including your name, Social Security number, and account details.

- Indicate whether this is a new request, a change to an existing setup, or a cancellation.

- Sign and date the form to authorize the direct deposit.

Make sure to double-check your account number and routing transit number with your financial institution before submitting the form.

What information do I need to provide?

You will need to provide the following information:

- Your last name, first name, and middle initial.

- Your Social Security number.

- Your work phone number.

- The name of your financial institution.

- Your account number (including hyphens, but no spaces or special symbols).

- The routing transit number (ensure all 9 boxes are filled correctly).

- Type of account (checking or savings).

What should I do if I have a joint account?

If you have a joint account, both account holders must agree to the terms. The second account holder must sign the form as well. This ensures that both parties authorize the direct deposit into the account.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information by completing the form again and selecting the "Change" option. Make sure to provide the new account details and sign the form. Submit it to your employer or the appropriate payer as soon as possible.

How do I verify my account and routing numbers?

To verify your account and routing numbers, contact your financial institution directly. Do not use a deposit slip for verification, as this may lead to errors. It’s important to ensure that these numbers are correct to avoid any issues with your direct deposits.

What happens if there is an error in my direct deposit?

If there is an error in your direct deposit, your financial institution may initiate debit entries to correct the mistake. By signing the form, you authorize them to make these adjustments as needed. It’s essential to keep track of your account statements to identify any discrepancies promptly.

How long does it take for direct deposits to start?

The time it takes for direct deposits to begin can vary. Typically, it may take one to two pay cycles for the changes to take effect. Check with your employer or payer for specific timelines. It’s advisable to monitor your bank account to confirm when the direct deposits start.

Documents used along the form

When setting up direct deposit, several other forms and documents may be required to ensure a smooth process. Below is a list of some commonly used documents that often accompany the Generic Direct Deposit form. Each document plays a vital role in facilitating the direct deposit setup and ensuring that all necessary information is accurate and complete.

- W-4 Form: This form is used by employees to indicate their tax situation to their employer. It helps determine the amount of federal income tax withholding from each paycheck. Completing a W-4 is essential for accurate tax deductions.

- Bank Account Verification Letter: This document is provided by your financial institution to confirm your account details. It typically includes your name, account number, and routing number, ensuring that the information on your direct deposit form is correct.

- Operating Agreement Form: An important document for LLCs in Ohio, this form outlines the internal operations and management structure, ensuring clear ownership and financial arrangements among members. For more information, you can refer to All Ohio Forms.

- Employee Information Form: This form collects essential details about the employee, such as their address, contact information, and emergency contacts. It helps the employer maintain accurate records and communicate effectively with employees.

- Payroll Authorization Form: This document authorizes the employer to process payroll for the employee. It outlines how and when payments will be made, ensuring that both parties are clear about the payroll process.

- State Tax Withholding Form: Depending on the state, this form may be necessary to determine state income tax withholding. It is similar to the W-4 but focuses on state tax requirements and ensures compliance with local tax laws.

- Change of Address Form: If an employee has recently moved, this form is essential for updating their address in the employer's records. Keeping contact information current is important for receiving paychecks and other important communications.

By gathering these documents alongside the Generic Direct Deposit form, you can help ensure that the direct deposit process is efficient and error-free. Each form serves a specific purpose and contributes to a seamless payroll experience.

Misconceptions

-

Misconception 1: The Generic Direct Deposit form is only for new accounts.

This form can be used for various purposes, including setting up a new direct deposit, changing an existing account, or canceling a direct deposit. It is not limited to just new accounts.

-

Misconception 2: You must fill out the entire form if you only want to change one detail.

-

Misconception 3: The form does not require a signature from a joint account holder.

If the account is a joint account, the other account holder must also sign the form. This ensures that both parties agree to the terms and authorize the direct deposit.

-

Misconception 4: The routing transit number can be found on any document.

It is essential to verify the routing transit number directly with your financial institution. Using a deposit slip or other documents may lead to errors, as the routing number can vary based on the type of transaction or account.