Blank Gift Deed Form

A Gift Deed form is an essential legal document used to transfer ownership of property or assets from one person to another without any exchange of money. This form is often utilized in various situations, such as when a parent wishes to give a house to their child or when friends decide to share valuable items. It outlines the details of the gift, including the names of the donor and recipient, a description of the property being gifted, and any conditions that may apply to the transfer. Additionally, the Gift Deed form typically requires signatures from both parties and may need to be notarized to ensure its validity. Understanding the implications of a Gift Deed is crucial, as it can affect tax liabilities and ownership rights. By clearly documenting the intent to give, this form helps prevent future disputes and ensures that the gift is legally recognized. In this article, we will explore the key components of a Gift Deed, the process of creating one, and important considerations to keep in mind when making a gift.

State-specific Guidelines for Gift Deed Forms

Popular Gift Deed Documents:

Lady Bird Deed Michigan Form - It's an effective way to deal with property ownership while considering future needs.

What Is a Deed-in-lieu of Foreclosure? - Homeowners can use this option to avoid the lengthy foreclosure process.

When engaging in the buying or selling of a dirt bike, it is crucial to utilize the New York Dirt Bike Bill of Sale form, which can be found at freebusinessforms.org. This document ensures that all necessary transaction details are accurately captured, protecting both the seller and buyer throughout the ownership transfer process.

Corrective Deed California - This form ensures that any corrections made are officially recognized.

Similar forms

A Gift Deed is a legal document that outlines the transfer of property or assets from one person to another without any exchange of money. Several other documents share similarities with a Gift Deed, each serving a specific purpose in property transfer or asset allocation. Below are four documents that are similar to a Gift Deed:

- Will: A Will is a legal document that specifies how a person's assets should be distributed after their death. Like a Gift Deed, it involves the transfer of property, but a Will takes effect only upon the individual's passing, while a Gift Deed is effective immediately.

- Sales Tax Refund: The ST-12B Georgia form enables individuals and businesses to reclaim overpaid sales tax on eligible purchases; for details, visit georgiapdf.com/st-12b-georgia.

- Trust Agreement: A Trust Agreement allows a person to place their assets into a trust for the benefit of others. Similar to a Gift Deed, it can transfer ownership of property, but it often includes specific conditions and may involve a trustee to manage the assets.

- Quitclaim Deed: A Quitclaim Deed transfers any interest a person has in a property to another party without guaranteeing that the title is clear. This document is similar to a Gift Deed in that it can be used to transfer property without monetary compensation, but it does not provide the same level of assurance regarding ownership rights.

- Deed of Trust: A Deed of Trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose than a Gift Deed, both documents involve the transfer of property rights, albeit under different circumstances and for different reasons.

Document Example

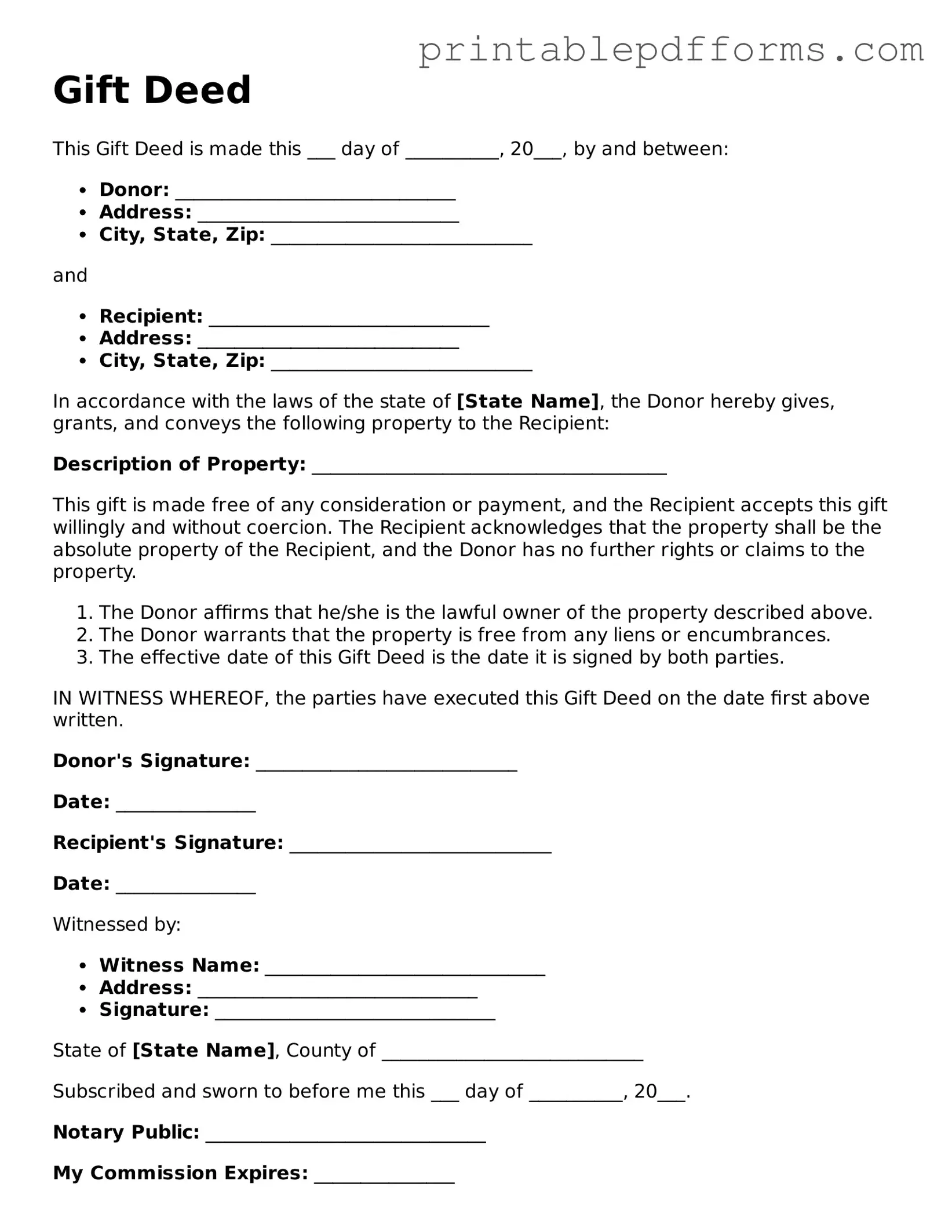

Gift Deed

This Gift Deed is made this ___ day of __________, 20___, by and between:

- Donor: ______________________________

- Address: ____________________________

- City, State, Zip: ____________________________

and

- Recipient: ______________________________

- Address: ____________________________

- City, State, Zip: ____________________________

In accordance with the laws of the state of [State Name], the Donor hereby gives, grants, and conveys the following property to the Recipient:

Description of Property: ______________________________________

This gift is made free of any consideration or payment, and the Recipient accepts this gift willingly and without coercion. The Recipient acknowledges that the property shall be the absolute property of the Recipient, and the Donor has no further rights or claims to the property.

- The Donor affirms that he/she is the lawful owner of the property described above.

- The Donor warrants that the property is free from any liens or encumbrances.

- The effective date of this Gift Deed is the date it is signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Gift Deed on the date first above written.

Donor's Signature: ____________________________

Date: _______________

Recipient's Signature: ____________________________

Date: _______________

Witnessed by:

- Witness Name: ______________________________

- Address: ______________________________

- Signature: ______________________________

State of [State Name], County of ____________________________

Subscribed and sworn to before me this ___ day of __________, 20___.

Notary Public: ______________________________

My Commission Expires: _______________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Consideration | Unlike a sale, a Gift Deed does not involve any monetary consideration; the transfer is made voluntarily and without compensation. |

| Governing Law | The laws governing Gift Deeds vary by state. For example, in California, the relevant laws can be found in the California Civil Code. |

| Requirements | For a Gift Deed to be valid, it generally must be in writing, signed by the donor, and delivered to the recipient. |

| Acceptance | The recipient must accept the gift for the transfer to be legally effective. Acceptance can be explicit or implied. |

| Tax Implications | Gift taxes may apply depending on the value of the property being transferred. The IRS has annual exclusions for gifts. |

| Revocation | A Gift Deed can typically be revoked by the donor before it is accepted by the recipient. |

| Notarization | While notarization is not always required, it is often recommended to ensure the document's authenticity and to prevent disputes. |

| Recording | Recording the Gift Deed with the local county recorder's office may be necessary to provide public notice of the transfer. |

| State-Specific Forms | Some states have specific forms for Gift Deeds. For example, Florida has its own statutory form under Florida Statutes. |

Crucial Questions on This Form

What is a Gift Deed?

A Gift Deed is a legal document used to transfer ownership of property or assets from one person (the donor) to another (the recipient or donee) without any exchange of money. This type of deed is often used for real estate, personal property, or financial assets. The donor voluntarily gives the gift, and the donee accepts it, making the transfer official.

What are the requirements for a valid Gift Deed?

To ensure that a Gift Deed is valid, several key requirements must be met:

- The donor must be of legal age and mentally competent to make the gift.

- The deed must clearly identify the property being gifted.

- Both the donor and the donee must sign the deed, indicating their consent.

- In some cases, witnesses may be required to sign the document.

- The deed should be notarized to add an extra layer of authenticity and legal protection.

Are there any tax implications when using a Gift Deed?

Yes, there can be tax implications associated with gifting property. In the United States, the IRS allows individuals to gift up to a certain amount each year without incurring gift tax. This limit is known as the annual exclusion. If the value of the gift exceeds this amount, the donor may need to file a gift tax return. However, it’s important to note that the donor is typically responsible for any gift tax, not the recipient. Consulting a tax professional can provide clarity on specific situations.

Can a Gift Deed be revoked?

Generally, once a Gift Deed is executed and accepted, it cannot be revoked. However, there are certain circumstances under which a gift may be contested or deemed invalid. For example, if the donor was under duress or lacked mental capacity at the time of the gift, the deed may be challenged in court. Additionally, if the donor and donee agree to reverse the transaction, they can create a new document to formally revoke the gift.

How do I create a Gift Deed?

Creating a Gift Deed involves several straightforward steps:

- Determine the property or asset you wish to gift.

- Gather the necessary information, including the legal description of the property and the names of both the donor and donee.

- Draft the Gift Deed, ensuring all required elements are included.

- Have both parties sign the deed in the presence of a notary public.

- File the deed with the appropriate local government office, if necessary, especially for real estate transactions.

Documents used along the form

When completing a Gift Deed, several other documents may be necessary to ensure the process is smooth and legally sound. These forms help clarify the intentions of the parties involved and provide additional legal protections. Below are some commonly used documents that often accompany a Gift Deed.

- Affidavit of Gift: This document serves as a sworn statement by the donor, affirming their intention to give the gift without any coercion. It adds an extra layer of authenticity to the transaction.

- Mobile Home Bill of Sale: Essential for documenting the sale and purchase details of a mobile home in Ohio, this form serves as proof of ownership transfer and can be found under All Ohio Forms.

- Transfer of Title: If the gift involves real property, a Transfer of Title document is needed. This form officially transfers ownership from the donor to the recipient, ensuring that the new owner has legal rights to the property.

- Gift Tax Return (Form 709): Depending on the value of the gift, the donor may be required to file a Gift Tax Return. This form reports the gift to the IRS and helps the donor keep track of their lifetime gift tax exemption.

- Letter of Intent: While not always required, a Letter of Intent can clarify the donor's wishes regarding the gift. This document outlines the reasons for the gift and any specific conditions or expectations associated with it.

These documents work together with the Gift Deed to create a comprehensive record of the gift transaction. By ensuring that all necessary paperwork is in order, both the donor and recipient can avoid potential disputes and misunderstandings in the future.

Misconceptions

Gift deeds are important legal documents, but there are many misconceptions surrounding them. Understanding these misconceptions can help clarify the true nature of a gift deed and its implications. Here’s a list of ten common misunderstandings:

- Gift deeds are only for real estate. Many people believe that gift deeds can only be used for transferring property like houses or land. In reality, a gift deed can also be used for personal items, money, or other assets.

- You need a lawyer to create a gift deed. While having legal assistance can be beneficial, it is not mandatory. Individuals can draft a gift deed themselves, provided they follow the necessary guidelines.

- Gift deeds are not legally binding. This is false. Once properly executed and signed, a gift deed is a legally binding document that transfers ownership of the gift from one person to another.

- Gift deeds can be revoked at any time. While the donor may feel they can change their mind, once a gift deed is executed and delivered, it generally cannot be revoked unless specific conditions were outlined in the deed itself.

- Gift deeds must be notarized. Although notarization can add an extra layer of validity, it is not always required. However, having a notary can help in proving the authenticity of the document if disputes arise.

- There are no tax implications for gift deeds. This is misleading. In some cases, the donor may be subject to gift tax if the value of the gift exceeds a certain threshold set by the IRS.

- Only family members can receive gifts through a gift deed. Gift deeds can be made to anyone, including friends or charitable organizations. There are no restrictions on who can be the recipient.

- A gift deed is the same as a will. This is incorrect. A gift deed transfers ownership immediately, while a will only distributes assets after the person’s death.

- Gift deeds can only be used for tangible items. Many people think that gift deeds are limited to physical items. However, they can also apply to intangible assets like stocks or shares.

- Once a gift deed is signed, the donor has no rights to the gift. This is a misconception. Depending on the terms of the gift deed, the donor may retain certain rights, such as the right to use the property during their lifetime.

Understanding these misconceptions can help individuals make informed decisions when it comes to gifting property or assets. Always consider seeking advice if unsure about the process or implications involved.