Fill a Valid Gift Letter Form

When it comes to securing a mortgage, many homebuyers rely on financial assistance from family or friends. This is where a Gift Letter form comes into play. A Gift Letter serves as a crucial document that outlines the details of the monetary gift being provided to the buyer. It typically includes information such as the donor’s name, relationship to the recipient, the amount of the gift, and a statement confirming that the funds are indeed a gift and not a loan. Lenders often require this form to ensure that the buyer is not taking on additional debt that could affect their ability to repay the mortgage. By clearly documenting the nature of the gift, the form helps streamline the mortgage approval process and provides peace of mind for both the buyer and the lender. Understanding the Gift Letter form is essential for anyone looking to navigate the complexities of home financing with the help of loved ones.

Additional PDF Templates

Planned Parenthood Pregnancy Verification Letter - If applicable, legal guardians must sign to consent on behalf of minors or individuals unable to consent themselves.

To facilitate a smooth trailer sale in Georgia, it is important to have the appropriate documentation in place. The Georgia Trailer Bill of Sale not only records the transaction but also protects both the buyer and seller by ensuring all necessary details are accurately outlined. For those looking to ensure a hassle-free process, you can get the document necessary for a legal transaction.

Employee Advance Agreement - Get an early release of your wages through this request.

Similar forms

-

Affidavit of Support: This document is often used in immigration cases to demonstrate that a sponsor can financially support an immigrant. Like a Gift Letter, it outlines the relationship between the parties and verifies the financial support being provided.

RV Bill of Sale: This document is essential for recording the transfer of ownership of a recreational vehicle in Texas. It ensures that both parties have clarity and protection in the transaction. For more detailed guidance, refer to freebusinessforms.org/.

-

Loan Agreement: A Loan Agreement specifies the terms under which one party lends money to another. Similar to a Gift Letter, it includes details about the amount, the parties involved, and the intent behind the transaction, although a Loan Agreement typically includes repayment terms.

-

Promissory Note: This is a written promise to pay a specified amount to another party. Like a Gift Letter, it identifies the parties involved and the amount, but it includes a commitment to repay, distinguishing it from a gift.

-

Financial Support Letter: This document is often used in various contexts, including college applications and loan applications, to confirm that someone is providing financial assistance. Similar to a Gift Letter, it outlines the support being offered and the relationship between the parties.

-

Transfer of Ownership Document: This document is used to formally transfer ownership of an asset, such as property or vehicles. Like a Gift Letter, it serves to clarify the intent of the transaction and the parties involved, but it typically involves a change in ownership rather than a gift.

Document Example

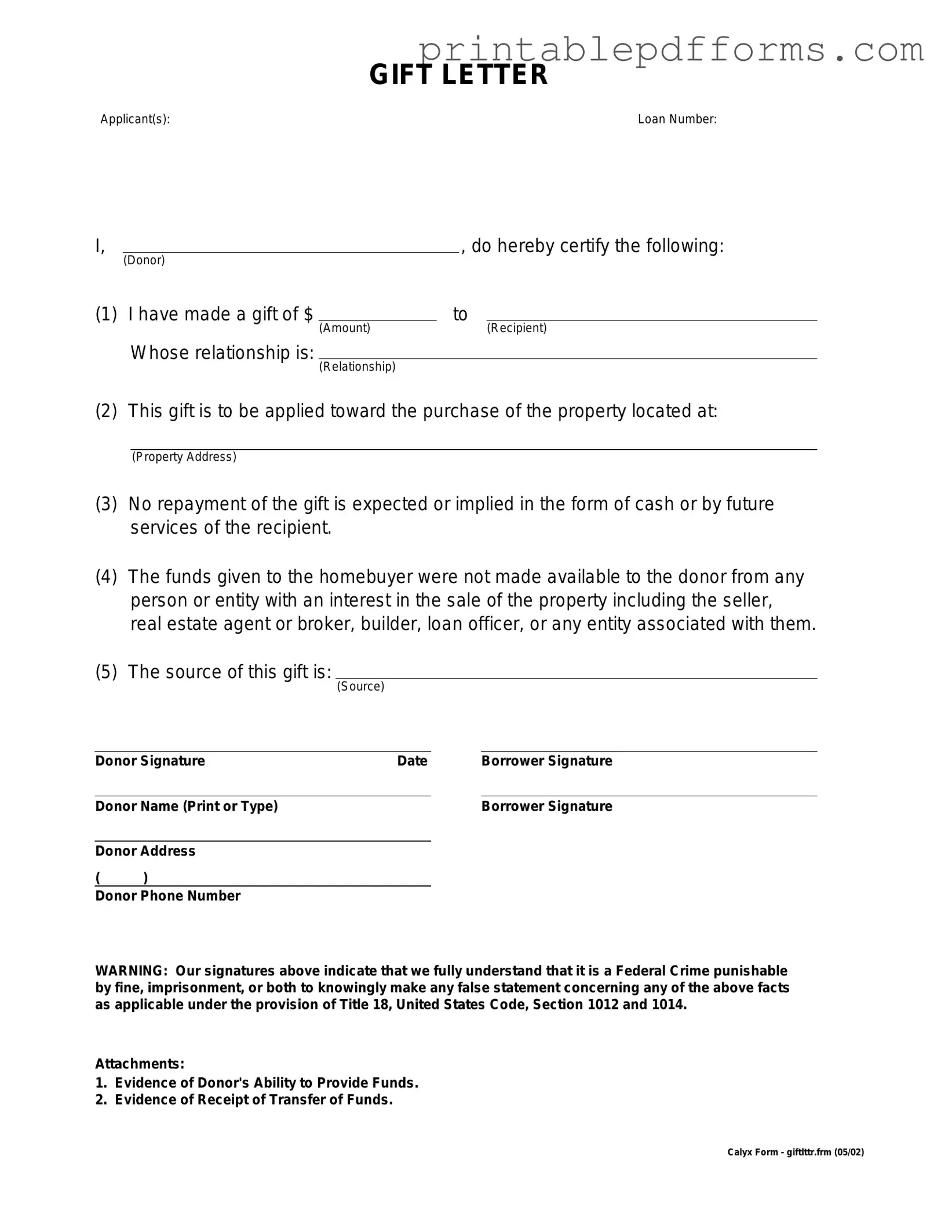

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | A Gift Letter form is used to document monetary gifts given to a borrower, often for down payment assistance in real estate transactions. |

| Donor's Affidavit | The form typically includes a statement from the donor affirming that the funds are a gift and do not require repayment. |

| State Variations | Different states may have specific requirements for gift letters, governed by local real estate laws, such as California Civil Code Section 1624. |

| Required Information | Essential details include the donor's name, address, relationship to the borrower, and the amount of the gift. |

| Submission | Typically, the completed Gift Letter form must be submitted to the lender as part of the mortgage application process. |

Crucial Questions on This Form

What is a Gift Letter?

A Gift Letter is a document that states a monetary gift is being given to a borrower, typically for a down payment on a home. This letter helps clarify that the funds do not need to be repaid, distinguishing them from a loan. It provides reassurance to lenders about the source of the funds.

Who can provide a Gift Letter?

Gift Letters can be provided by family members, friends, or other individuals who are giving financial support. However, lenders often prefer that the gift comes from immediate family members, such as parents, siblings, or children, as this helps establish a clear relationship and intent.

What information should be included in a Gift Letter?

A comprehensive Gift Letter should include the following details:

- The name and address of the donor.

- The name and address of the recipient (borrower).

- The amount of the gift.

- A statement confirming that the funds are a gift and do not need to be repaid.

- The relationship between the donor and the recipient.

- The date the gift was given.

Do I need to provide proof of the gift?

Yes, lenders often require proof of the gift in addition to the Gift Letter. This may include bank statements showing the transfer of funds or a check. Providing this documentation helps verify that the funds are indeed a gift and not a loan.

Can a Gift Letter affect my loan application?

Yes, a Gift Letter can positively impact your loan application. It demonstrates that you have additional financial support, which may enhance your ability to qualify for a mortgage. However, it’s crucial to ensure that all documentation is accurate and complete to avoid any delays in the approval process.

Is there a limit on how much I can receive as a gift?

While there is no specific limit on the amount of a gift, lenders may have guidelines regarding acceptable gift amounts. It's essential to check with your lender to understand any potential implications for larger gifts, as they may require additional documentation or explanation.

What happens if I don’t provide a Gift Letter?

If you do not provide a Gift Letter when required, it may raise questions during the loan approval process. Lenders need to verify the source of funds to ensure compliance with regulations. Without this documentation, your application could be delayed or even denied.

Documents used along the form

The Gift Letter form is commonly used in real estate transactions, particularly when a buyer receives financial assistance from a family member or friend for a down payment. Along with this form, several other documents may be required to provide additional context and support for the transaction. Below is a list of four documents that are often used in conjunction with the Gift Letter form.

- Bank Statement: This document verifies the donor's ability to provide the gift. It shows the donor's account balance and transaction history, ensuring that the funds are available and legitimate.

- Gift Tax Return (Form 709): This form is used to report gifts to the IRS. If the amount of the gift exceeds the annual exclusion limit, the donor may need to file this return to comply with tax regulations.

- ATV Bill of Sale: For those involved in transferring ownership of an all-terrain vehicle, completing the nypdfforms.com/atv-bill-of-sale-form is essential to ensure compliance with state regulations and a smooth transaction process.

- Proof of Relationship: Documentation such as a birth certificate or marriage license may be required to establish the relationship between the donor and the recipient. This helps lenders understand the nature of the gift.

- Settlement Statement: This document outlines the financial details of the real estate transaction. It includes all costs associated with the purchase, providing a comprehensive view of how the gift funds are being applied.

These documents collectively support the legitimacy of the gift and facilitate a smoother transaction process. Each plays a crucial role in ensuring compliance with lending requirements and federal regulations.

Misconceptions

Understanding the Gift Letter form is crucial for those receiving financial assistance from family or friends for a home purchase. However, several misconceptions often arise. Below is a list of common misunderstandings regarding this important document.

- Gift letters are only needed for large sums of money. Many believe that gift letters are only required when the amount exceeds a certain threshold. In reality, lenders may request them for any amount to ensure transparency.

- Gift letters are the same as loan documents. Some confuse gift letters with loan agreements. A gift letter explicitly states that the funds do not need to be repaid, while a loan document outlines terms for repayment.

- Anyone can give a gift without a letter. While it is true that gifts can be made without documentation, lenders often require a gift letter to confirm the nature of the funds, especially for mortgage applications.

- Gift letters are only necessary for first-time homebuyers. This is not accurate. Any homebuyer receiving financial assistance may need to provide a gift letter, regardless of their buying history.

- Gift letters can be verbal. Verbal agreements do not suffice for lenders. A written gift letter is essential to validate the transaction and protect both parties involved.

- Gift letters do not require specific details. In fact, a proper gift letter must include details such as the donor's name, the amount of the gift, and a statement confirming that the funds are a gift, not a loan.

- Only family members can provide gifts. While family members often provide assistance, friends and other individuals can also give gifts. The key is that the donor must clearly state their intent in the letter.

- Gift letters are only for down payments. This is a misconception. Gift funds can also be used for closing costs and other expenses related to the home purchase.

- Once a gift letter is signed, it cannot be changed. Gift letters can be amended if circumstances change. Both the donor and recipient should communicate any necessary adjustments.

- Gift letters are not legally binding. While gift letters are not formal contracts, they serve an important purpose in the lending process and can have legal implications if misrepresented.

By addressing these misconceptions, individuals can better navigate the complexities of the Gift Letter form and ensure a smoother home-buying experience.