Fill a Valid Goodwill donation receipt Form

The Goodwill donation receipt form plays a crucial role in the donation process, serving as a record for both donors and Goodwill. When individuals contribute items to Goodwill, they receive this form as proof of their charitable contribution. This receipt typically includes essential details such as the donor's name, the date of the donation, and a description of the items donated. Additionally, the form may indicate the estimated value of the donated goods, which can be important for tax purposes. It is important to note that while Goodwill provides a general estimate of the value of items, it is ultimately the donor's responsibility to determine the fair market value for tax deductions. By keeping this receipt, donors can substantiate their contributions when filing taxes, ensuring compliance with IRS regulations. Overall, the Goodwill donation receipt form not only facilitates the donation process but also helps individuals maximize their tax benefits while supporting a charitable organization.

Additional PDF Templates

Is It Too Late to Vaccinate My Cat - All information collected is for the pet's health and safety.

This informative guide on the Tractor Bill of Sale document is vital for anyone engaging in a tractor transaction, ensuring all necessary details are properly recorded. For your convenience, you can find a helpful template at this essential Tractor Bill of Sale resource.

Hub Certification Texas - Utilizing this form may promote transparency among members.

Similar forms

Charitable Donation Receipt: This document serves a similar purpose by providing a record of donations made to a charitable organization. It typically includes details such as the donor's name, the amount donated, and the date of the donation.

Tax Deduction Receipt: This receipt allows donors to claim tax deductions for their contributions. It includes necessary information like the donor's identification and the value of the donated items, just as the Goodwill receipt does.

Fedex Shipment Release Form: To ensure timely delivery of your packages, it's essential to complete the Fedex Shipment Release form. This allows FedEx to leave your package securely at a designated location in your absence, helping prevent delivery hassles.

In-Kind Donation Form: This form records non-cash contributions, such as clothing or furniture. Like the Goodwill donation receipt, it details the items donated and their estimated value.

Donation Acknowledgment Letter: Charitable organizations often send these letters to thank donors. They confirm the donation amount and date, similar to what is provided in a Goodwill donation receipt.

Nonprofit Donation Agreement: This document outlines the terms of a donation between a donor and a nonprofit organization. It may include specifics about the donation type and value, akin to the details found in a Goodwill receipt.

Gift Receipt: This receipt is used for gifts made to individuals or organizations. It typically includes the donor's information and the value of the gift, mirroring the structure of the Goodwill donation receipt.

Document Example

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

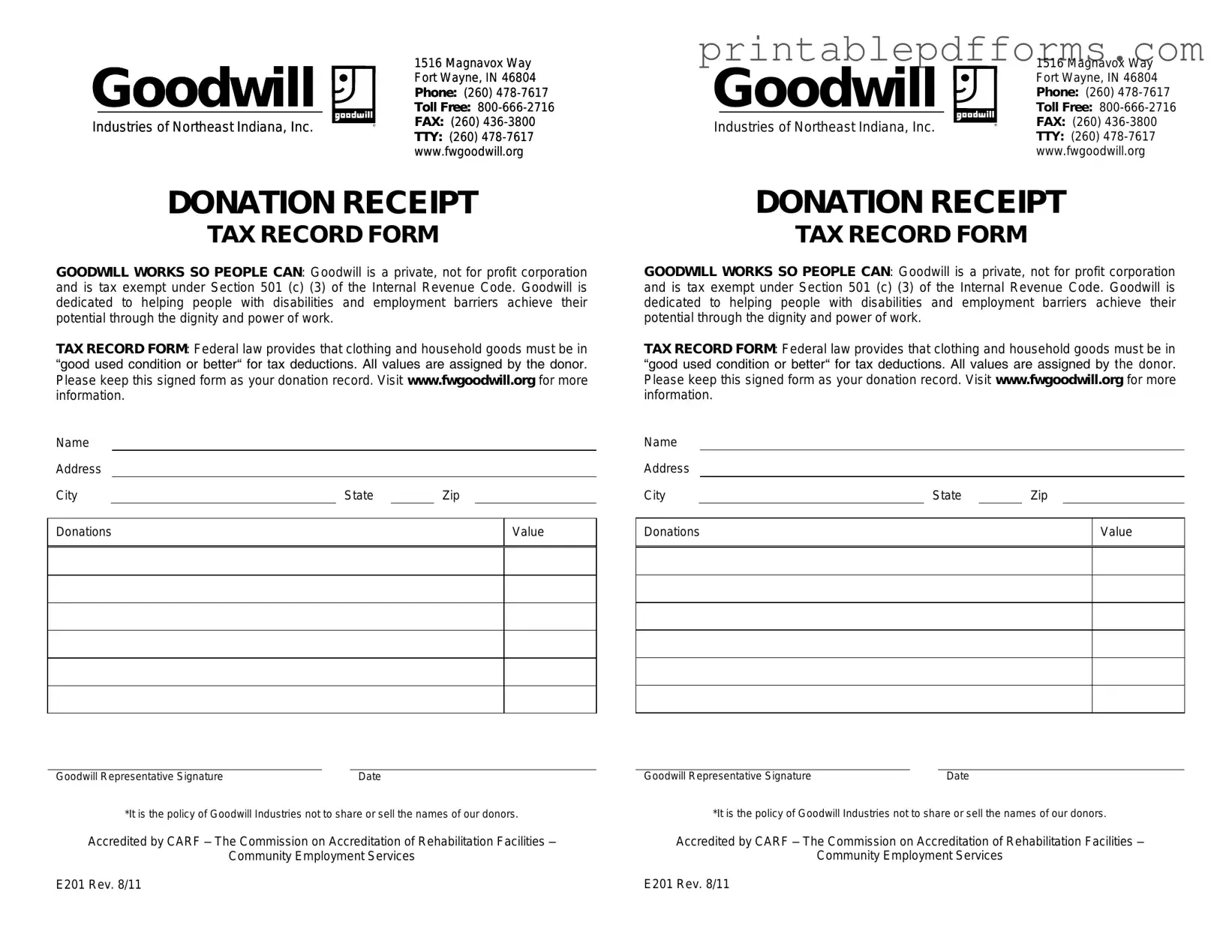

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Form Specs

| Fact Name | Description |

|---|---|

| Purpose of the Receipt | The Goodwill donation receipt serves as proof of donation for tax purposes, allowing donors to claim deductions on their income tax returns. |

| Itemized List | Donors should receive an itemized list of the donated goods, which helps in accurately reporting the value of the items for tax deductions. |

| Fair Market Value | Donors are responsible for determining the fair market value of their donated items, as this value will be used for tax deduction calculations. |

| State-Specific Forms | Some states may have specific requirements for donation receipts. For example, California law requires that receipts include the date of the donation and a description of the items. |

| Retention of Receipts | Donors should keep their receipts for at least three years, as the IRS may request documentation for any deductions claimed. |

Crucial Questions on This Form

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided by Goodwill Industries to donors who contribute items to their stores. This form serves as proof of your donation and can be used for tax purposes.

How do I obtain a Goodwill donation receipt?

You can obtain a Goodwill donation receipt by simply asking for one when you drop off your items at a Goodwill location. The staff will provide you with a receipt detailing your donations. If you are donating through a pickup service, the receipt will typically be mailed to you after the donation is collected.

What information is included on the receipt?

A Goodwill donation receipt generally includes the following information:

- Your name and address

- The date of the donation

- A description of the donated items

- The estimated value of the items (if applicable)

Keep this receipt for your records, especially if you plan to claim a tax deduction.

Can I claim a tax deduction for my donation?

Yes, you can claim a tax deduction for your donation to Goodwill. The IRS allows taxpayers to deduct the fair market value of donated items. Be sure to keep your receipt and document the items you donated for accurate reporting on your tax return.

How do I determine the value of my donated items?

To determine the value of your donated items, consider their fair market value, which is the price that items would sell for in a thrift store. Goodwill provides valuation guides on their website to help you assess the worth of common items.

What types of items can I donate?

Goodwill accepts a wide variety of items, including:

- Clothing and shoes

- Household goods

- Electronics

- Furniture

- Toys and games

However, there are some restrictions. Items that are damaged, hazardous, or not in good working condition may not be accepted.

What should I do if I lose my receipt?

If you lose your Goodwill donation receipt, you can visit the location where you made your donation and request a duplicate. While they may not be able to provide an exact copy, they can often help you retrieve the information needed for your records.

Is there a limit to how much I can donate?

There is no official limit on how much you can donate to Goodwill. However, large donations may require advance notice, especially if you need a pickup service. It’s a good idea to contact your local Goodwill to discuss any significant contributions.

Can I donate items that I purchased from Goodwill?

Yes, you can donate items that you previously purchased from Goodwill. Once you own an item, you are free to donate it again if you no longer need it. Just remember to request a receipt for your new donation.

Documents used along the form

When donating items to Goodwill or similar organizations, several forms and documents may accompany the Goodwill donation receipt form. These documents serve various purposes, from tracking donations to ensuring tax compliance. Below is a list of commonly used forms that can enhance your donation experience.

- Donation Inventory List: This document provides a detailed account of the items donated. It helps both the donor and the organization keep track of what has been given, which can be essential for tax deductions.

- Charitable Contribution Statement: This statement outlines the total value of donations made over a certain period. It is useful for individuals who wish to summarize their charitable giving for tax purposes.

- Florida Trailer Bill of Sale: For those looking to transfer ownership of a trailer in Florida, it is essential to use the correct documentation. To ensure a smooth transaction, get the pdf here for the official form.

- Tax Deduction Worksheet: This worksheet assists donors in calculating potential tax deductions based on the fair market value of the donated items. It simplifies the process of reporting donations on tax returns.

- Receipt for Non-Cash Contributions: This form is often required by the IRS for reporting non-cash donations. It provides proof of the donation and can be necessary for individuals claiming deductions on their taxes.

Utilizing these forms alongside the Goodwill donation receipt can streamline the donation process and ensure proper documentation for tax purposes. Keeping organized records is crucial for maximizing potential benefits and maintaining transparency in charitable giving.

Misconceptions

Many people have misunderstandings about the Goodwill donation receipt form. Here are four common misconceptions:

-

Misconception 1: The receipt is only for tax purposes.

While the receipt can be used for tax deductions, it also serves as proof of your charitable contribution. This acknowledgment can be important for personal records and community support.

-

Misconception 2: The receipt must list every item donated.

It is not necessary to itemize each item on the receipt. A general description of the donated goods is sufficient. However, keeping a personal inventory can help when filing taxes.

-

Misconception 3: Donations are only valuable if they are new or in perfect condition.

Goodwill accepts a wide range of items, including gently used items. Donating items that are still usable can greatly benefit those in need.

-

Misconception 4: You cannot receive a receipt for small donations.

Every donation, regardless of size, can receive a receipt. Even small contributions can add up and have a positive impact on the community.