Fill a Valid Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form serves as a crucial document for both independent contractors and the businesses that engage their services. This form provides a detailed breakdown of earnings, including the total amount paid for services rendered, any applicable deductions, and the net pay received by the contractor. It often includes essential information such as the contractor’s name, address, and taxpayer identification number, alongside the business's contact details. Additionally, the pay stub may outline the period during which the services were performed, ensuring clarity regarding the timeline of payment. By offering transparency in financial transactions, this form helps to establish a clear record for tax purposes, aiding contractors in their financial planning and compliance with tax obligations. Furthermore, it can serve as a valuable reference in case of disputes over payment or service agreements, reinforcing the importance of maintaining accurate and comprehensive documentation in the independent contracting relationship.

Additional PDF Templates

Western Union Receipt Generator - This form plays a crucial role in making international money transfers a seamless experience.

In addition to its role in providing clarity, the Ohio Operating Agreement form can be easily adapted to meet the unique requirements of each LLC, ensuring that all members are aligned with the established framework. For those seeking a comprehensive resource, All Ohio Forms offers valuable guidance and templates to facilitate the creation of this important document.

Bf Application - Your information is necessary to evaluate boyfriend prospects.

Similar forms

- W-2 Form: This document is issued by employers to report wages paid to employees and the taxes withheld. Like the Independent Contractor Pay Stub, it provides a summary of earnings over a specific period.

- 1099-MISC Form: This form is used to report payments made to independent contractors. It is similar to the Pay Stub in that it details the total amount earned by the contractor during the tax year.

- Trailer Bill of Sale: It is essential to have a formal bill of sale for trailers to document ownership transfer. You can find the document in pdf to facilitate this process.

- Paycheck Stub: Issued to employees, this document outlines earnings, deductions, and net pay for a specific pay period. It serves a similar purpose to the Independent Contractor Pay Stub by providing a breakdown of payments.

- Invoice: Independent contractors often submit invoices to clients for services rendered. Like a Pay Stub, it details the services provided and the total amount due, although it is typically not a record of payments made.

- Expense Report: This document tracks expenses incurred during the course of work. While it differs in focus, it complements the Pay Stub by providing a full picture of a contractor’s earnings and expenses.

- Payment Receipt: A receipt confirms that payment has been made for services. It is similar to the Pay Stub in that it provides proof of income but does not detail the breakdown of earnings.

- Contract Agreement: This document outlines the terms of the working relationship between a contractor and a client. It is similar in that it establishes the basis for payment and services, which is reflected in the Pay Stub.

- Timesheet: Used to record hours worked, a timesheet helps determine how much a contractor should be paid. It is similar to the Pay Stub as it is a record of work performed and compensation owed.

- Payroll Summary: This document summarizes all payroll transactions for a specific period. It shares similarities with the Pay Stub in that it provides a comprehensive view of earnings and deductions.

- Financial Statement: This document provides an overview of a contractor's financial performance. While broader in scope, it can include earnings similar to those detailed in the Pay Stub.

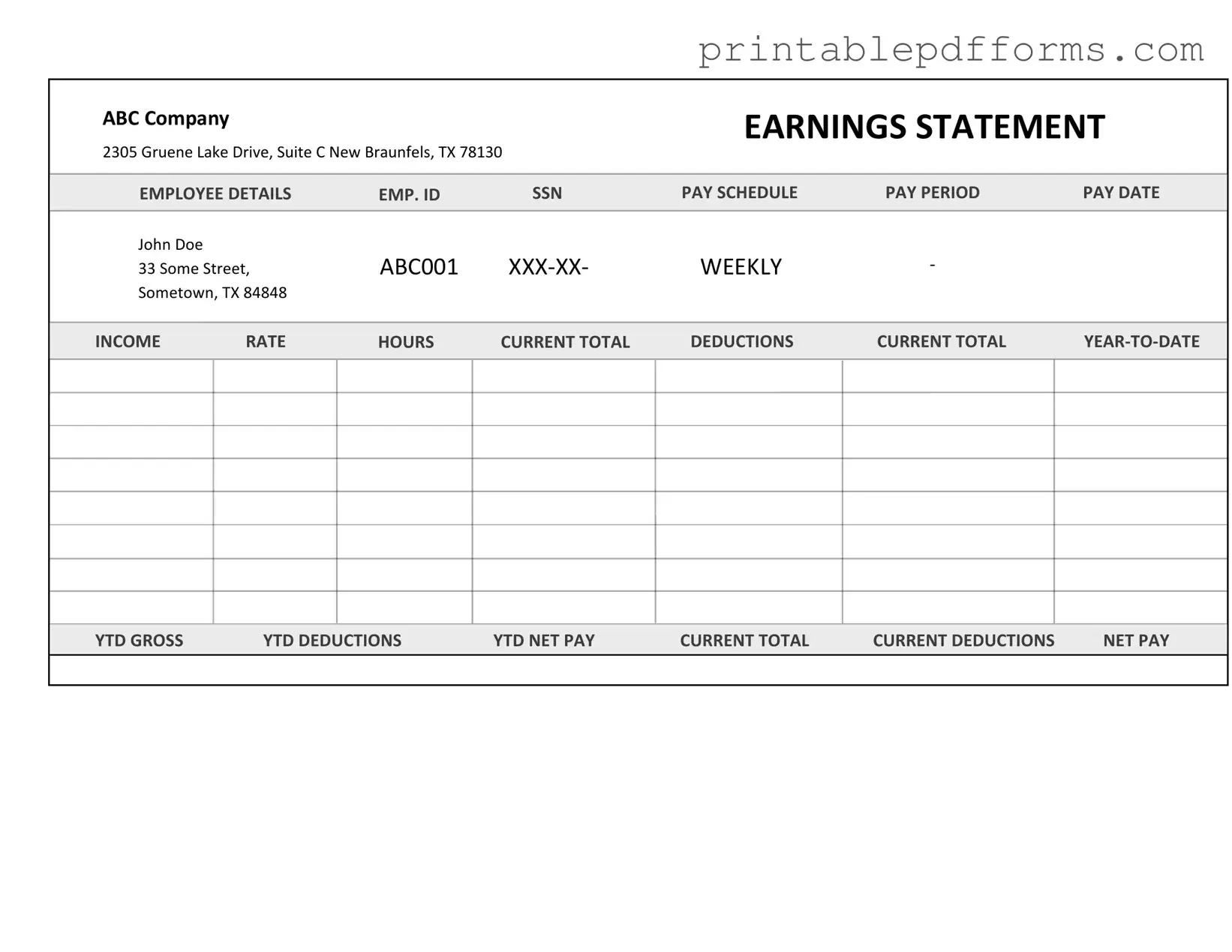

Document Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Form Specs

| Fact Name | Description |

|---|---|

| Definition | The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. It serves as a record of payment for services rendered. |

| Legal Requirement | In many states, providing a pay stub to independent contractors is not legally required. However, it is considered a best practice to maintain transparency in financial transactions. |

| Components | A typical pay stub for independent contractors includes the contractor's name, payment period, total earnings, deductions (if any), and net payment amount. |

| State-Specific Regulations | Some states, such as California, have specific laws regarding independent contractor payments. Under California law, contractors must receive a written statement detailing their earnings. |

| Tax Implications | Independent contractors are responsible for reporting their income and paying self-employment taxes. Pay stubs can assist in tracking income for tax purposes. |

Crucial Questions on This Form

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the payment details for independent contractors. Unlike traditional employees, independent contractors are not on a regular payroll system, so this pay stub serves as a record of earnings for services rendered. It typically includes information such as the contractor's name, payment period, total earnings, and any deductions or taxes withheld, if applicable.

Why do I need a Pay Stub as an Independent Contractor?

Having a pay stub is essential for several reasons. First, it provides a clear record of your income, which is crucial for tax purposes. When tax season arrives, you will need to report your earnings accurately. Additionally, a pay stub can serve as proof of income when applying for loans, renting property, or even negotiating future contracts.

What information is included in a Pay Stub?

A typical Independent Contractor Pay Stub includes the following details:

- Contractor's Name: Your full name as the contractor.

- Payment Period: The specific dates during which the services were provided.

- Total Earnings: The gross amount earned for the period.

- Deductions: Any amounts withheld for taxes or other purposes, if applicable.

- Net Pay: The amount you take home after deductions.

How do I create a Pay Stub?

Creating a pay stub is straightforward. You can use various templates available online or software designed for this purpose. When creating your pay stub, ensure you include all necessary information accurately. If you're unsure, consider consulting with a tax professional to ensure compliance with any local regulations.

Are there legal requirements for issuing a Pay Stub?

While independent contractors are not subject to the same payroll laws as employees, it's still good practice to provide a pay stub. Some states may have specific requirements regarding pay documentation, so it's wise to check local laws. Providing a pay stub can help clarify payment terms and protect both parties in the event of a dispute.

Can I use a Pay Stub for tax purposes?

Yes, you can use your Independent Contractor Pay Stub for tax purposes. It serves as a record of your earnings, which you will need to report on your tax return. Keep your pay stubs organized and accessible, as they will help you track your income and any deductions you may be eligible for.

What if I don’t receive a Pay Stub?

If you do not receive a pay stub from a client, it is advisable to request one. As an independent contractor, you have the right to documentation of your earnings. If your client is unwilling to provide a pay stub, consider keeping your own records of payments received. This will help you maintain an accurate account of your income for tax purposes.

Documents used along the form

The Independent Contractor Pay Stub form is an essential document for tracking payments made to independent contractors. However, it is often used in conjunction with several other forms and documents that help clarify the relationship between the contractor and the hiring entity. Below is a list of other commonly utilized documents that complement the Independent Contractor Pay Stub.

- Independent Contractor Agreement: This document outlines the terms and conditions of the working relationship, including payment rates, project scope, and deadlines. It serves as a formal contract between the contractor and the hiring party.

- W-9 Form: This form is used by independent contractors to provide their taxpayer identification number to the hiring entity. It is essential for tax reporting purposes and ensures compliance with IRS regulations.

- Invoice: Contractors typically submit invoices to request payment for their services. This document details the work completed, the amount due, and payment terms, ensuring clarity in financial transactions.

- 1099-MISC Form: At the end of the tax year, this form is issued to independent contractors who have earned $600 or more. It reports the total payments made and is crucial for the contractor’s tax filings.

- Time Sheet: A time sheet records the hours worked by the contractor on specific projects. This document can be used to verify hours billed and ensure accurate payment based on agreed-upon rates.

- Bill of Sale Form: Essential for documenting the transfer of ownership of personal property, this form provides legal protection for both parties involved in the transaction. More details can be found at https://nypdfforms.com/bill-of-sale-form/.

- Project Scope Document: This outlines the specific tasks and deliverables expected from the contractor. It helps both parties understand the project requirements and can prevent misunderstandings.

- Confidentiality Agreement: Also known as a non-disclosure agreement (NDA), this document protects sensitive information shared during the course of the project. It ensures that proprietary information remains confidential.

- Termination Letter: If the working relationship needs to be ended, a termination letter formalizes the conclusion of the contract. It can outline any final payments and the reasons for termination.

- Payment Receipt: This document serves as proof of payment made to the contractor. It can be useful for both parties for record-keeping and tax purposes.

Understanding these documents can significantly enhance the clarity and efficiency of the working relationship between independent contractors and their clients. Each form plays a vital role in ensuring compliance, protecting rights, and facilitating smooth transactions.

Misconceptions

Misconceptions about the Independent Contractor Pay Stub form can lead to confusion for both contractors and businesses. Here are eight common misunderstandings:

- Independent contractors do not need pay stubs. Many believe that since contractors are not employees, they don't require pay stubs. However, pay stubs can help track earnings and taxes for independent contractors.

- All pay stubs look the same. Some think that all pay stubs follow a uniform format. In reality, pay stubs can vary significantly in design and information provided, depending on the company or service used.

- Pay stubs are only for tax purposes. While tax reporting is a primary reason for pay stubs, they also serve as proof of income for loans, leases, and other financial transactions.

- Independent contractors are exempt from tax reporting. It's a common belief that contractors do not need to report their earnings. In fact, independent contractors must report their income and may need to pay estimated taxes throughout the year.

- Pay stubs must include specific information. Some assume that there are strict legal requirements for what must be included on a pay stub. While certain details are recommended, requirements can vary by state.

- Only large companies provide pay stubs. Many think that only larger businesses issue pay stubs. However, even small businesses or sole proprietors can and should provide them for transparency.

- Pay stubs are not necessary for short-term contracts. Some believe that short-term or freelance jobs do not require pay stubs. Regardless of the duration of the work, providing a pay stub can still be beneficial for record-keeping.

- Independent contractors receive the same benefits as employees. There is a misconception that contractors have access to the same benefits as employees, such as health insurance and retirement plans. In reality, contractors typically do not receive these benefits unless arranged independently.

Understanding these misconceptions can help clarify the role and importance of pay stubs for independent contractors.