Fill a Valid Intent To Lien Florida Form

The Intent to Lien Florida form serves as a crucial notification for property owners regarding potential claims against their property. This document is typically issued by contractors or suppliers who have provided labor, materials, or services but have not received payment. The form outlines essential details, including the date of the notice, the names and addresses of the property owner and general contractor, and a description of the property involved. It also specifies the amount owed and emphasizes the importance of prompt payment. Under Florida law, this notice must be sent at least 45 days before a lien can be officially recorded. If the property owner fails to respond within 30 days, they risk having a lien placed on their property, which could lead to foreclosure and additional costs. The form also includes a certificate of service, ensuring that the notice was delivered to the appropriate parties. Overall, this document is designed to protect the rights of those who have contributed to property improvements while providing property owners with a clear understanding of their obligations.

Additional PDF Templates

Corrective Deed California - A Scrivener's Affidavit is a document used to affirm the accuracy of a written record.

Gf Applications - Show how you would enrich a partnership.

An Ohio Non-disclosure Agreement form is a legally binding document that individuals or businesses use to protect sensitive information. It serves to ensure that confidential details are not disclosed to unauthorized parties. This form plays a crucial role in various professional and commercial contexts, safeguarding trade secrets, client information, and other critical data. For more information, visit All Ohio Forms.

Act of Donation Form Louisiana - This document can be used for various types of property, including real estate, personal belongings, and financial assets.

Similar forms

- Notice of Lien: This document formally establishes a claim against a property due to unpaid debts. Like the Intent to Lien, it serves to notify property owners of potential legal action regarding payment issues.

- Power of Attorney: This legal document enables an individual to designate someone else to make financial or legal decisions on their behalf, especially crucial in situations where the principal may be unable to act. Understanding this form can be pivotal for effective estate planning and for ensuring wishes are honored. More information can be found at freebusinessforms.org/.

- Claim of Lien: This is the official document that is recorded with the county clerk. It follows the Intent to Lien and solidifies the creditor's right to seek payment through the property, similar to how the Intent serves as a warning.

- Notice of Non-Payment: This document informs the property owner of non-payment for services rendered. It shares the purpose of alerting the owner before further legal steps are taken, much like the Intent to Lien.

- Demand for Payment: A formal request for payment can precede the Intent to Lien. This document outlines the amount owed and the urgency of payment, similar in tone and purpose to the Intent.

- Notice of Default: This notice indicates that a party has failed to meet contractual obligations. It serves as a precursor to more severe actions, paralleling the Intent to Lien in its warning nature.

- Notice of Foreclosure: This document is issued when a property is at risk of foreclosure due to unpaid debts. It is similar in that it alerts the property owner to serious consequences of non-payment.

- Pre-Lien Notice: This notice is sent before filing a lien, notifying the property owner of the impending claim. It serves a similar purpose to the Intent to Lien by providing advance notice of potential legal actions.

- Waiver of Lien Rights: Although this document serves to relinquish lien rights, it is similar in context. It is often exchanged in negotiations to ensure that all parties understand their rights and obligations regarding payment.

Document Example

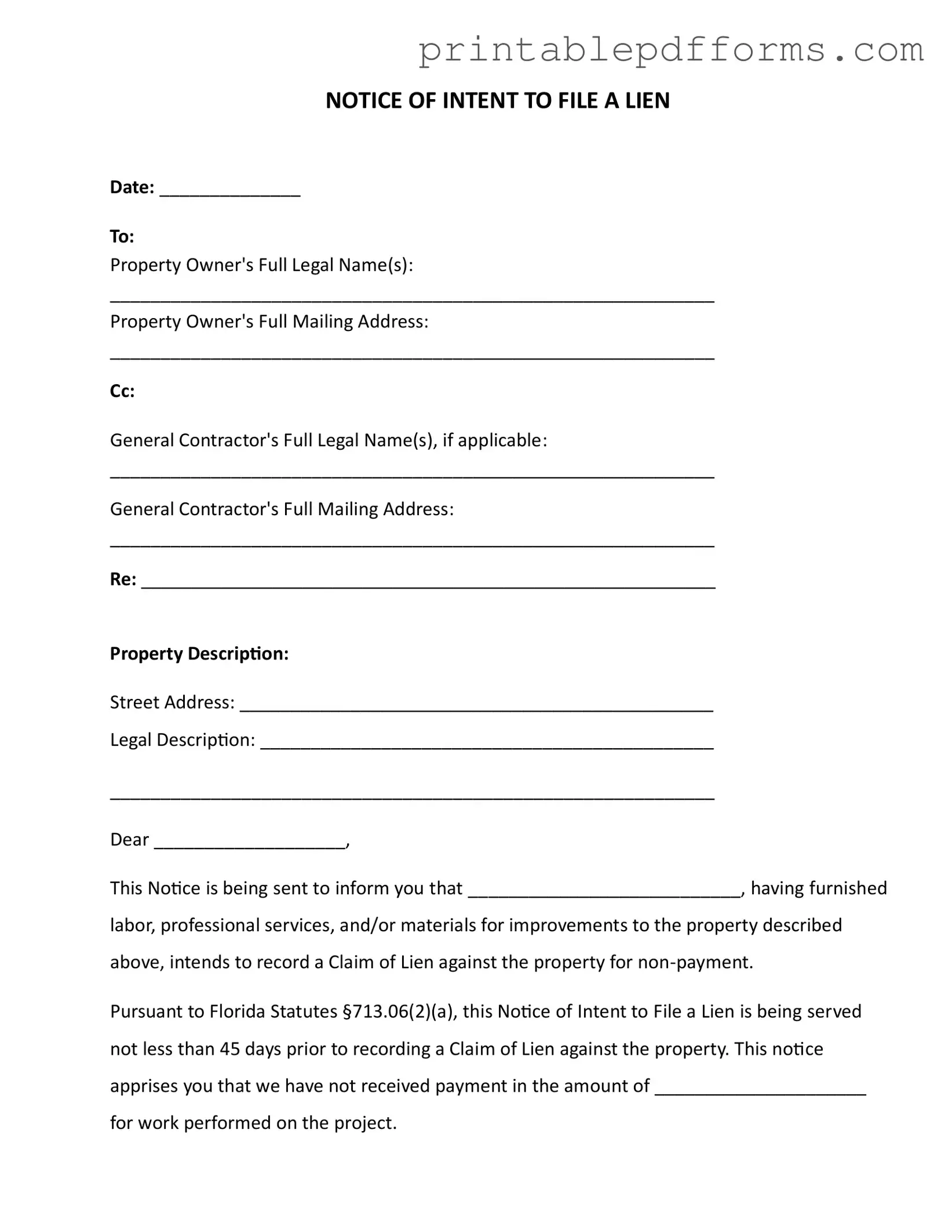

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Intent to Lien form serves as a formal notice to property owners that a lien may be filed due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien in the state. |

| Notice Period | According to Florida law, the notice must be sent at least 45 days before recording a Claim of Lien. |

| Response Time | Property owners have 30 days to respond to the notice before a lien can be recorded. |

| Consequences of Non-Payment | If payment is not made, the property may face foreclosure proceedings, and the owner could incur attorney fees and court costs. |

| Certification of Service | The form includes a section for certifying that the notice was delivered to the property owner, ensuring proper notification. |

| Delivery Methods | Notices can be served through various methods, including certified mail, hand delivery, or through a process server. |

| Importance of Accurate Information | Providing accurate names and addresses for both the property owner and contractor is crucial for the validity of the notice. |

| No Waivers | The form states that no waivers or releases of lien have been received, which is important for maintaining the validity of the lien claim. |

| Encouragement for Communication | The notice encourages property owners to contact the service provider to resolve payment issues and avoid further legal action. |

Crucial Questions on This Form

What is the Intent to Lien Florida form?

The Intent to Lien Florida form is a legal document that notifies property owners of an impending lien against their property due to non-payment for labor, services, or materials. It serves as a formal warning that a claim of lien will be recorded if payment is not received within a specified timeframe. This notice is required by Florida law to provide property owners an opportunity to address the outstanding payment before further legal action is taken.

Who should receive the Intent to Lien notice?

The notice should be sent to the property owner's full legal name and mailing address. If applicable, it should also be sent to the general contractor involved in the project. Ensuring that the correct parties receive this notice is crucial for compliance with Florida statutes and for protecting the rights of the lien claimant.

What happens if I do not respond to the Intent to Lien notice?

If you do not respond to the Intent to Lien notice within 30 days, the claimant may proceed to record a lien against your property. This can lead to serious consequences, including potential foreclosure proceedings. Additionally, you may become responsible for associated costs, such as attorney fees and court expenses. It is essential to address the notice promptly to avoid these outcomes.

How can I resolve the issue before a lien is filed?

To resolve the issue before a lien is filed, contact the claimant as soon as possible. Discuss the outstanding payment and any concerns you may have. Often, open communication can lead to a resolution that satisfies both parties. It may be helpful to propose a payment plan or negotiate a settlement if full payment cannot be made immediately.

Is there a specific timeframe for filing the Intent to Lien?

Yes, Florida law requires that the Intent to Lien notice be served at least 45 days before filing a Claim of Lien. This timeframe allows property owners an opportunity to respond and settle the payment issue. After the notice is served, if payment is not received or a satisfactory response is not provided within 30 days, the claimant may proceed with recording the lien.

Documents used along the form

The Intent to Lien form is an important document in the construction industry, particularly in Florida. It serves as a formal notification to property owners that a contractor or supplier intends to file a lien due to non-payment. In addition to this form, several other documents are often used in conjunction with it to ensure proper communication and legal compliance. Below is a list of these documents along with brief descriptions of each.

- Claim of Lien: This document is filed with the county clerk to formally assert a lien against the property for unpaid work or materials. It provides the legal basis for claiming payment and can lead to foreclosure if not resolved.

- Trailer Bill of Sale: This legal document is essential for parties involved in the sale of a trailer in Georgia, ensuring proper ownership transfer and protection; for more details, visit https://georgiapdf.com/trailer-bill-of-sale/.

- Notice of Non-Payment: This notice is sent to inform the property owner that payment has not been received. It serves as an additional reminder before further legal actions are taken.

- Waiver of Lien: This document is used by contractors or suppliers to relinquish their right to file a lien once they have been paid. It protects the property owner from future claims related to that payment.

- Release of Lien: After payment is made, this document is filed to officially remove the lien from the property records, clearing the title for the owner.

- Notice to Owner: This is a notification sent to the property owner by subcontractors or suppliers to inform them of their involvement in the project and their right to file a lien if not paid.

- Contractor’s Affidavit: This affidavit confirms that all subcontractors and suppliers have been paid. It is often required before final payment is made to the contractor.

- Final Payment Application: This document is submitted by the contractor to request final payment for completed work. It may include a summary of work done and any outstanding issues.

- Construction Contract: This is the original agreement between the property owner and the contractor detailing the scope of work, payment terms, and other essential conditions.

- Subcontractor Agreements: These agreements outline the terms between the contractor and any subcontractors involved in the project, detailing their responsibilities and payment terms.

- Project Completion Certificate: This document certifies that the construction project has been completed according to the agreed-upon terms and conditions, often required for final payments.

Understanding these documents and their purposes can help property owners and contractors navigate the complexities of construction projects and ensure that all parties are protected. Proper use of these forms can prevent disputes and facilitate smoother transactions in the construction process.

Misconceptions

- Misconception 1: The Intent to Lien form is the same as a lien itself.

- Misconception 2: Sending the Intent to Lien guarantees payment.

- Misconception 3: The Intent to Lien must be sent only after work is completed.

- Misconception 4: All contractors must file an Intent to Lien.

This is a common misunderstanding. The Intent to Lien is merely a notice that indicates a party intends to file a lien if payment is not received. It serves as a warning, rather than an actual claim against the property.

While this notice can prompt property owners to settle their debts, it does not guarantee that payment will be made. It is a step in the process but does not ensure that the lien will be avoided.

This is not accurate. The notice can be sent at any point during the project, as long as the payment terms are not being met. It serves to inform the property owner of potential legal action if payments are not made.

Not every contractor is required to send this notice. It primarily applies to those who wish to protect their rights to payment under Florida's lien laws. Depending on the circumstances, some may choose to file a lien directly without sending an intent notice first.