Blank Investment Letter of Intent Form

The Investment Letter of Intent (LOI) serves as a crucial preliminary document in the investment process, outlining the intentions of potential investors and the terms under which they are willing to engage with a business or project. This form typically includes key details such as the amount of investment being considered, the proposed structure of the deal, and any conditions that must be met before final agreements are reached. It often highlights the investor's expectations regarding the timeline for due diligence and the closing of the transaction. Additionally, the LOI may address confidentiality provisions, ensuring that sensitive information shared during negotiations remains protected. By laying out these foundational elements, the Investment Letter of Intent fosters clear communication between parties, paving the way for a more structured and efficient negotiation process. Understanding the components of this form is essential for both investors and businesses, as it helps to establish a mutual understanding and sets the stage for future collaboration.

Popular Investment Letter of Intent Documents:

Intent to Sue Letter Template - Use clear language to outline your concerns and expectations in the letter.

Similar forms

- Term Sheet: This document outlines the basic terms and conditions of an investment. Like the Investment Letter of Intent, it serves as a preliminary agreement, summarizing key elements such as valuation, investment amount, and rights of investors.

- Memorandum of Understanding (MOU): An MOU is similar in that it expresses mutual intentions between parties. It often includes terms of collaboration or partnership, much like how the Investment Letter of Intent indicates the intent to invest.

- Purchase Agreement: This legal document formalizes the sale of an asset or investment. It is similar to the Investment Letter of Intent in that it lays out the specifics of the transaction but is more detailed and binding.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. While the Investment Letter of Intent may not be as focused on confidentiality, both documents establish a framework for trust and information sharing.

- Subscription Agreement: This document is used in securities offerings and outlines the terms under which an investor agrees to purchase shares. Like the Investment Letter of Intent, it is essential for defining the relationship between the investor and the entity.

- Letter of Intent (LOI): A more general form of intent, the LOI can apply to various types of agreements beyond investment. It shares similarities with the Investment Letter of Intent by indicating a commitment to negotiate and finalize terms.

Document Example

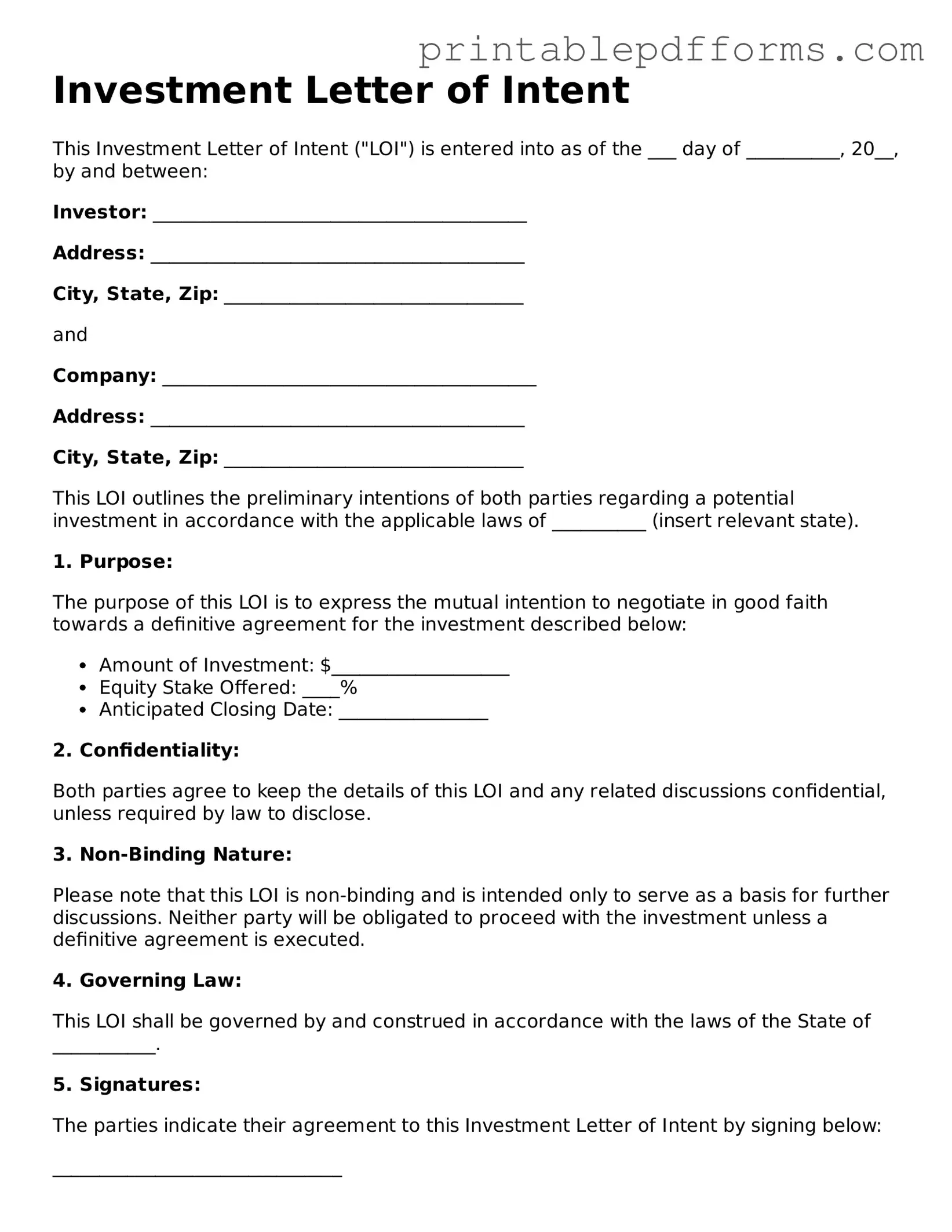

Investment Letter of Intent

This Investment Letter of Intent ("LOI") is entered into as of the ___ day of __________, 20__, by and between:

Investor: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

and

Company: ________________________________________

Address: ________________________________________

City, State, Zip: ________________________________

This LOI outlines the preliminary intentions of both parties regarding a potential investment in accordance with the applicable laws of __________ (insert relevant state).

1. Purpose:

The purpose of this LOI is to express the mutual intention to negotiate in good faith towards a definitive agreement for the investment described below:

- Amount of Investment: $___________________

- Equity Stake Offered: ____%

- Anticipated Closing Date: ________________

2. Confidentiality:

Both parties agree to keep the details of this LOI and any related discussions confidential, unless required by law to disclose.

3. Non-Binding Nature:

Please note that this LOI is non-binding and is intended only to serve as a basis for further discussions. Neither party will be obligated to proceed with the investment unless a definitive agreement is executed.

4. Governing Law:

This LOI shall be governed by and construed in accordance with the laws of the State of ___________.

5. Signatures:

The parties indicate their agreement to this Investment Letter of Intent by signing below:

_______________________________

Investor Signature

Date: ________________

_______________________________

Company Signature

Date: ________________

PDF Form Specs

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent outlines the preliminary agreement between parties interested in a potential investment. |

| Binding Nature | Typically, this document is non-binding, meaning it expresses intent without creating enforceable obligations. |

| Key Components | It usually includes details such as investment amount, terms, and conditions that the parties are considering. |

| Governing Law | For state-specific forms, the governing law may vary. For example, in California, it would be governed by California Civil Code. |

| Importance in Negotiations | This document serves as a foundation for negotiations, helping to clarify the expectations of both parties. |

Crucial Questions on This Form

What is an Investment Letter of Intent?

An Investment Letter of Intent is a document that outlines the preliminary understanding between parties regarding a potential investment. It serves as a non-binding agreement that indicates the intent to proceed with negotiations and outlines key terms that will be further detailed in a formal agreement.

Who should use an Investment Letter of Intent?

This form is typically used by individuals or entities looking to invest in a business or project. It is useful for both investors and companies seeking funding. The letter helps clarify intentions and expectations before entering into more detailed negotiations.

Is the Investment Letter of Intent legally binding?

The Investment Letter of Intent is generally considered non-binding. However, certain provisions within the letter, such as confidentiality or exclusivity clauses, may be legally enforceable. It is important to review the document carefully to understand which parts may be binding.

What information should be included in the Investment Letter of Intent?

Common elements of an Investment Letter of Intent include:

- The names and contact information of the parties involved.

- A description of the investment opportunity.

- Proposed terms, including the amount of investment and ownership percentage.

- Timeline for negotiations and due diligence.

- Confidentiality provisions.

How does an Investment Letter of Intent facilitate negotiations?

This document helps set the stage for negotiations by outlining the key points of interest for both parties. It allows for clarity and transparency, which can expedite the process of reaching a formal agreement. Additionally, it shows commitment from both sides to explore the investment opportunity seriously.

Can an Investment Letter of Intent be modified?

Yes, an Investment Letter of Intent can be modified as negotiations progress. Both parties can agree to changes in terms or conditions. Any modifications should be documented in writing to ensure that both parties are on the same page.

What happens after an Investment Letter of Intent is signed?

After signing the Investment Letter of Intent, both parties typically enter a due diligence phase. This involves further investigation and evaluation of the investment opportunity. Following this phase, a formal agreement may be drafted and signed, which will include the detailed terms of the investment.

Is legal counsel necessary when preparing an Investment Letter of Intent?

How long is the Investment Letter of Intent valid?

The validity period of an Investment Letter of Intent can vary. Typically, it remains effective until a formal agreement is executed or until a specified date mentioned in the letter. It is essential for both parties to agree on the duration of the letter's validity during negotiations.

What should I do if I have further questions about the Investment Letter of Intent?

If you have additional questions, consider reaching out to a legal professional or an investment advisor. They can provide guidance tailored to your specific situation and help clarify any uncertainties regarding the Investment Letter of Intent.

Documents used along the form

The Investment Letter of Intent form is a crucial document in the investment process, outlining the preliminary terms and intentions of the parties involved. Along with this form, several other documents are commonly utilized to ensure clarity and facilitate the investment process. Below is a list of these documents, each serving a specific purpose.

- Confidentiality Agreement: This document protects sensitive information shared between parties. It ensures that any proprietary or confidential information disclosed during negotiations remains secure and is not shared with unauthorized individuals.

- Due Diligence Checklist: This checklist outlines the necessary steps and documentation required for thorough investigation and analysis of the investment opportunity. It helps ensure that all relevant information is considered before finalizing any agreements.

- Term Sheet: The term sheet summarizes the key terms and conditions of the investment. It serves as a preliminary agreement that outlines the expectations and obligations of both parties before a formal contract is drafted.

- Investment Agreement: This formal contract details the final terms of the investment once negotiations are complete. It includes specific obligations, rights, and responsibilities of each party, providing a legal framework for the investment relationship.

These documents work together to create a comprehensive understanding of the investment terms and protect the interests of all parties involved. Proper attention to each of these forms can help ensure a smoother investment process.

Misconceptions

Many people have misunderstandings about the Investment Letter of Intent (LOI) form. Here are four common misconceptions:

- It's a legally binding contract. Some believe that signing an LOI means they are legally obligated to proceed with the investment. In reality, an LOI is typically a preliminary document that outlines the intent to negotiate further. It sets the stage but does not finalize any agreement.

- All terms are fixed once the LOI is signed. Many think that the terms outlined in the LOI cannot be changed later. However, LOIs are often flexible. They serve as a starting point for negotiations, and parties can adjust terms as discussions progress.

- Only large investors use LOIs. There's a misconception that only big companies or wealthy investors utilize LOIs. In truth, anyone looking to make an investment can benefit from this document, regardless of their size or experience.

- The LOI guarantees funding. Some individuals believe that signing an LOI guarantees that funds will be provided. This is not the case. An LOI expresses interest and intent but does not ensure that financing will occur.

Understanding these misconceptions can help individuals navigate the investment process more effectively.